5 December 2023

How is uncertainty impacting corporate FX hedging decisions and what will be the key market drivers in 2024? flow reports on a new Deutsche Bank Research report examining the importance of the cross-currency basis, the case for hedging emerging market FX risk and the role of the dollar as a reserve currency

MINUTES min read

Monetary policy has always been a key driver for FX developments. While this will remain the case in 2024, the underlying influences on monetary policy decisions are changing. As inflationary pressures are decreasing globally, it will now be weakening economic growth rather than inflation that drives the next stage of policy moves, George Saravelos, Global Head of FX Research, Deutsche Bank argues in his report FX Hedging in Focus: “Those central banks with weakening growth are likely to ease first with a weaker currency following.”

In particular, the risks are skewed to the European Central Bank (ECB) cutting rates ahead of the Federal Reserve which may keep the euro weak, but eventually followed by a larger Fed cutting cycle which would lead to a weaker dollar in late 2024 and 2025. Thus, the degree to which the Fed and the ECB easing cycles diverge will be a key driver of FX moves next year.

Additionally, mounting geopolitical risks – ranging from the Russia/Ukraine and Middle East conflicts as well as tensions between China and the US – are set to shape FX markets in the months to come.

The report is part of a new quarterly publication series by Deutsche Bank Research which provides multinational corporates (MNCs) with insights into FX market drivers. The first edition, which was launched on 8 November 2023, examines three key FX hedging themes for the coming quarters:

- The case for hedging emerging market (EM) FX exposure is becoming increasingly strong;

- The cross-currency basis is driving hedging costs; and

- the US dollar’s global status is not diminishing.

How Medtronic and TotalEnergies are dealing with FX hedging challenges

Before looking into these trends in detail, the report features insights from two of Deutsche Bank’s MNC clients on how the current environment is impacting their hedging decisions.

Sheila Quintis, Vice President and Treasurer at US medical technology company Medtronic, and its Senior Treasurer Tim Husnik explain that the company has improved its approach to net investment hedging: “For example, we are now utilising derivatives along with foreign currency debt. We are also more actively adjusting our FX risk management programs, instrument selections, and tenors to achieve more broad risk diversification.”

Alexandre Dubé, Group Treasury at European energy producer TotalEnergies shares the following: “In the follow up of COVID and the Russian’s invasion of Ukraine, and the related disruptions pertaining to numerous markets, amongst them significantly the energy space, it is true that TotalEnergies has had to adapt somehow its risk management practices, be it on the financing front, its liquidity provisions, or the expected volatility of various assets classes.”

Asked to pick the single biggest economic risk that worries him most for 2024, he names “the sustainability and affordability of US debt, amid an important election year. If this were to transform into a debt crisis, it would be the ‘mother of all crises’, in our opinion.”

The case for hedging EM FX exposure is becoming increasingly strong

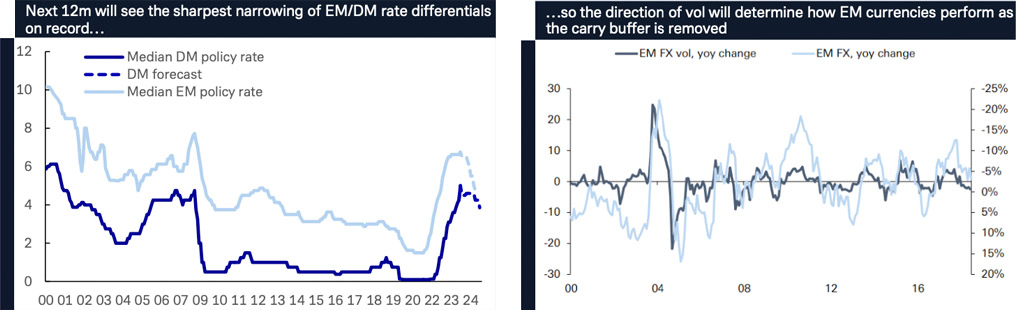

Turning to the first key theme, the Deutsche Bank Research team expects interest rates to fall next year across Central Europe, the Middle East and Africa (CEEMEA) and Latin America. Therefore, interest rate differentials between emerging markets and developed markets “are set to narrow from historically high levels to historically low ones over the next year”, which will lead to a significant fall in hedging costs (see Figure 1).

“There is now a unique opportunity to hedge FX risks”

Moreover – given a weakening global growth outlook and the fact that EM carry returns have been unusually high over the past 18 months – falling rate differentials could even exacerbate FX weakness, the team explains: “This suggests that there is now a unique opportunity to hedge FX risks.” Traditionally, many companies are reluctant to hedge EM FX risks due to the high hedging costs associated with those trades.

Figure 1: Why EM hedging is attractive

Source: Deutsche Bank Research

The cross-currency basis is driving hedging costs

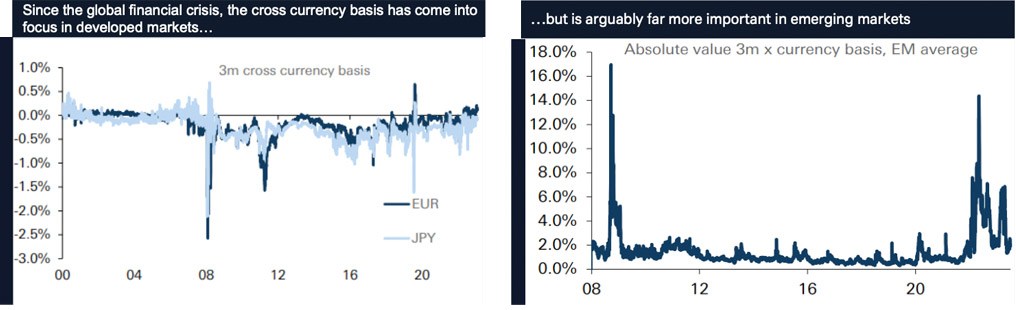

In addition to interest rate differentials there is another important driver for hedging costs, namely the cross-currency basis. It indicates the amount by which the interest paid to borrow one currency by swapping it against another differs from the cost of directly borrowing this currency in the cash market.1

The concept came into focus in developed markets during the 2008-09 financial crisis as acute dollar funding shortages spilt over into FX swaps and forwards markets. Yet Saravelos, Gopal and Rizkallah argue that the cross-currency basis is far more important in emerging markets because it “can be larger, more volatile and affect a wider range of agents in the economy” and thus deserves more focus (see Figure 2).

According to the authors, policy is becoming an increasingly important driver of the basis in EM, as central banks have sought to use the FX forwards and swaps market as an FX intervention tool. “Even with respect to global shocks, which place limits on dealer banks' balance sheets, the impact on individual EM forward and swap markets varies considerably, with one important distinction being the relative effect on deliverable and non- deliverable markets.”

Figure 2: The cross-currency basis forms a 'hidden' part of the hedging costs

Source: Deutsche Bank Research

The US dollar’s global status is not diminishing

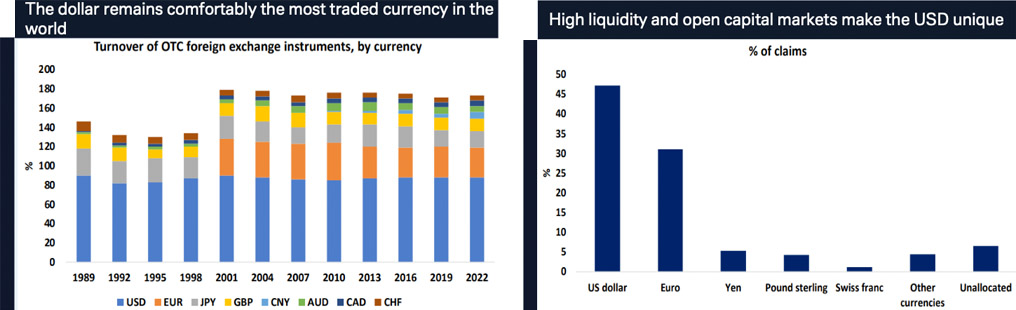

Finally, the team examines whether there is any evidence of the US dollar losing its reserve status. For some time, large emerging economies have been looking for alternatives to the greenback in an attempt to become less dependent on US policy makers’ decisions. At the summit in August 2023 hosted by the five BRICS emerging economies, Brazil's President Luiz Inacio Lula da Silva, proposed to create a common currency for trade and investment between BRICS countries, as a means of reducing their vulnerability to US dollar exchange rate fluctuations.2

“Combined with rising geopolitical risks, large EM economies like China are understandably keen to increase their certainty and capacity to match their prices with costs by invoicing in their own currency,” the team writes. “We, however, think there are good reasons to be sceptical of this narrative.”

First, the team points to the fact that since the euro’s launch back in 1999, the dollar’s share of global reserves has only fallen by 6%. According to the team, high liquidity and open capital markets make the dollar unique – in particular compared with emerging market currencies such as the CNY (see Figure 3).

Second, and more importantly, the vast bulk of cross-border claims and liabilities continue to be denominated in USD and the team sees “no signs” that the dollar will lose its status as pre-eminent currency of choice for these private sector transactions. “Exporter conversion ratios in domestic currency in large EM economies are if anything, declining, with export receipts kept in dollars.”

Figure 3: The US dollar remains the most important currency for trade and central bank reserves

Source: Deutsche Bank Research

Deutsche Bank Research report referenced

FX Hedging in Focus, by George Saravelos, Shreyas Gopal and Soha Rizkallah Deutsche Bank Research, 8 November 2023