13 April 2022

Central bank digital currencies (CBDCs) are gaining traction – but some corporate treasurers are missing a vision for token-based B2B payments, especially in Europe. flow’s Desirée Buchholz hosts a debate on the relevance of digital currencies for companies

MINUTES min read

Central bank digital currencies (CBDCs) are no longer a buzz phrase whose background is familiar only to the well-informed tech and payment communities. Over the past two years, CBDC have found their way into the discussions of corporate treasurers, consumers, and even the broader public. This trend is driven by the fact that by March 2022, 87 countries representing more than 90% of global GDP had started exploring a digital currency. The number has more than doubled since May 2020, according to a CBDC tracker published by the Atlantic Council.1

The tracker also shows that nine countries had launched a digital currency by March 2022 and another 14 were at the pilot stage – including leading economies such as South Korea and China. China’s central bank, the People’s Bank of China (PBOC) even used the Beijing 2022 Winter Olympic and Paralympic Games to globally showcase its digital currency, dubbed e-CNY.2

Against these developments, the four largest central banks managing the world’s most important currencies – in the US, the Euro Area, Japan, and the UK – are lagging behind. The European Central Bank, for example, only launched its investigation into the launch of a digital euro in October 20213, making autumn 2026 the earliest for the concept to become a reality.4

So, what do corporate treasurers think about these developments? Under what conditions would they like to use CBDCs for their payment processes? And what are the chances that current CBDC projects fulfil these wishes? flow set up a debate on these questions among four professionals:

- Britta Döttger, Group Treasurer at Swiss pharma giant Hoffmann-La Roche

- Martin Schlageter, Head of Treasury Operations at Hoffmann-La Roche

- Alexander Bechtel, Head of Digital Assets & Currencies Strategy at Deutsche Bank

- Jochen Siegert, Head of Asset Platforms at Deutsche Bank and Member of the Digital Euro Market Advisory Group of the European Central Bank (ECB)

Alexander, to ensure that we all have a common understanding: What are central bank digital currencies?

Alexander Bechtel: In general, we differentiate two different forms of money: central bank money and commercial bank money. In today’s financial system, the former is available to end users only in the form of cash. Retail CBDCs would be an opportunity for the public to access central bank money in a digital form. This is what the ECB is planning with the digital euro and what China is doing with the e-CNY. However, there is a second version of a CBDC which is called “wholesale CBDC”. Here, the use remains limited to the regulated banking sector – which translates into use cases that would mostly be limited to capital markets.

And what’s the difference between an account-based and a token-based CBDC?

Alexander Bechtel: This differentiation is relevant for retail CBDCs. Put simply, if a digital currency is token-based the user can settle a payment without any intermediary. You could compare this with physical cash, where the payment is completed once the money is handed over. With account-based CBDCs an intermediary has to verify the account holder’s identity.

“We still need several intermediaries to conduct a cross-border payment, which makes the process slow, costly and fraud-prone. If central banks were to introduce token-based CBDCs, this could change”

Britta, on a different occasion you revealed that you wished for CBDCs to become reality soon. Why is this the case and what form of CBDC were you thinking about?

Britta Döttger: With over 90% of central banks investigating CBDCs, the introduction feels tangible, and China is front running. What’s the purpose of a central bank? Ultimately, it is ensuring the well-being of the society – be it by controlling inflation, by ensuring financial stability and thereby supporting the economy. For me, the latter also encompasses facilitating digital business models. As Roche and other companies are increasingly transforming product and financial business activities to deliver greater value, existing payment systems no longer meet our needs. We still need several intermediaries to conduct a cross-border payment, which makes the process slow, costly and fraud-prone. If central banks were to introduce token-based CBDCs, this could change. Central banks should play a key role in reshaping the future of money.

Jochen, you are a member of the Digital Euro Market Advisory Group of the ECB. Do you feel that a rethink is taking place at the ECB?

Jochen Siegert: The ECB has definitely understood the need to evaluate and most likely introduce a digital euro. In our advisory meetings, central bankers ask a lot of questions. Based on this information, they will decide on the design of the digital euro. Right now, we know that the ECB is thinking about making the digital euro available for retail payments. The ECB is very clear that the digital euro must deliver a perceptible benefit to the consumer compared to the status quo.

Figure 1: Why the ECB wants to introduce a digital euro

Source: ECB

Britta Döttger: If I may jump in. I am a bit worried to hear that B2B payments currently don’t play a role for the ECB. To enable digital business models, improve speed, enhance security, lower cost of, and improve cross-border payments, we need a vision for B2B payments as well. For Europe, introducing a smart, digital euro could be a great foundation of innovation while safeguarding European sovereignty and reducing the dominance of foreign payment service providers.

Jochen Siegert: To clarify, the ECB has not ruled out opening the digital euro for B2B payments. However, it is thinking in phases and will therefore start with retail payments.

“The ECB is very clear that the digital euro must deliver a perceptible benefit to the consumer compared to the status quo”

Why is this the case? Does the ECB believe that the value-add is higher for B2C payments than for B2B?

Alexander Bechtel: I think one important reason for this is that central banks need to limit the risk for the commercial banking system. If consumers hold CBDCs as a direct replacement for physical cash that’s not a problem. But if they withdraw bank deposits and store the money in their central bank account instead, this could become a threat to financial stability. Today, about 90% of the money that is circulating are bank deposits. With the introduction of a retail CBDC this relation could revert – especially if CBDCs will be used for large-scale B2B payments.

“At Roche, our goal is to integrate the physical supply chain with the financial ecosytem where payments are truly made end-to-end”

Martin, over the past few years Roche has spent a lot of time centralising and standardising its payments processes. From your point of view, which incumbent payment systems problems could CBDCs solve?

Martin Schlageter: As a cash manager you are working between two worlds: the physical supply chain where we buy from our suppliers and sell to our customers, and the financial world where payments are made. At Roche, our goal is to integrate these two worlds end-to-end. That’s why we have recently launched a proof of concept together with Deutsche Bank to automate and integrate the order process via smart contracts until the payment to the supplier. Up to now, order intake, checking of invoices, establishing bank data and initiation and approval of payments are sequentially done in different systems. In the future, we want to increase efficiencies in the purchase-to-pay process and eliminate costly and error-prone reconciliation steps. We strongly believe that token-based CBDCs are ultimately the best way to accelerate and improve the last step in this chain; in other words the payment.

But wouldn’t that be possible with incumbent payment systems as well?

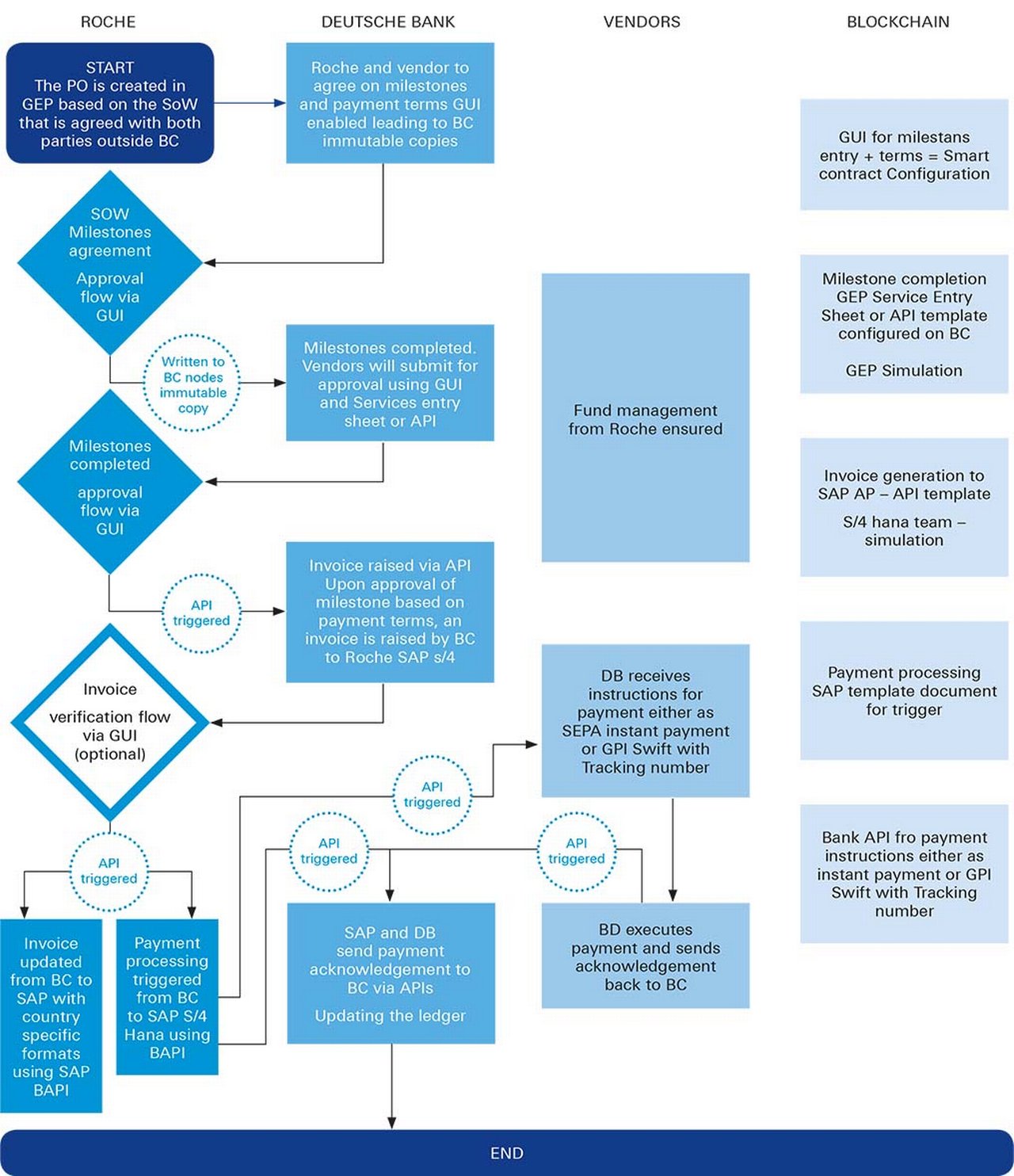

Martin Schlageter: For a start, it could be. In our PoC, we are drawing on so-called payment triggers to connect the blockchain platform that we use to make payments with our existing payment systems. However, this can only be an interim solution. From our treasury perspective we want to strengthen our business models and therefore we need to be as close to business processes as possible. We believe that a programmable CBDC best meets this requirement (see Figure 2).

Figure 2: Smart Contract PoC using Blockchain and Digital Payments (click to enlarge)

Source: Roche

Britta Döttger: Moreover, cash on chain transactions would also help to prevent payment fraud, as payment data originates from the blockchain and could only be changed if all parties agreed to it.

Alexander Bechtel: I agree, CBDCs are the best solution as they allow for frictionless automation. However, from our experience, payment triggers solve about 99% of the blockchain use cases we are currently observing in the corporate spaces. In a nutshell, these triggers are bridging the gap between blockchain platforms and existing payment systems such as SEPA or SWIFT. This allows companies to seamlessly include and automate payments on their trade finance, procurement, billing or Internet of Things platforms. Furthermore, the question is who should put cash on chain: Do we really need central banks or aren’t commercial banks better positioned to offer this service?

And what’s your view on that?

Alexander Bechtel: I believe this is a service that banks should offer their customers. From my point of view, they are more innovative and closer to the corporate world, which allows us to tailor solutions to our clients’ requirements. This is something that central banks wouldn’t be able to do, and it is not their mandate.

Britta Döttger: I agree, and I still see a role for central banks, given that we don’t need different solutions from each bank. With central banks on board, there is an opportunity to develop global standards around cash on chain. Up to now, I see few banks that are as active as Deutsche Bank in this space, which is why I would be reluctant to leave it entirely to the private sector to bring cash on chain.

“We face the challenge that a token-based currency needs to be scalable, fungible and interoperable to deliver benefits. It’s a tough task as it requires close coordination across the banking sector”

Alexander, do you expect progress with respect to getting cash on chain?

Alexander Bechtel: Yes, I think we will see progress over the next months and years. But let me explain why the banking industry isn’t moving quicker when it comes to bringing cash on-chain. We face the challenge that a token-based currency needs to be scalable, fungible and interoperable to deliver benefits. It’s a tough task as it requires close coordination across the banking sector. At the same time, we need to make sure to adhere to new regulation such as the Markets in crypto-assets Regulation (MiCAR). We are working on it – as Deutsche Bank and as an industry.

For cross-border payments via CBDCs coordination is also needed on a global level. Which initiatives should corporates be aware of?

Alexander Bechtel: The Bank for International Settlements (BIS) is working on a wholesale CBDC to increase the efficiency of cross-border payments. The idea is to build a multi-CBDC system which follows a single set of rules, a single technical system and would essentially lead to the creation of a new multilateral payment platform. However, this is a very complex model as it requires solid cooperation among central banks; so we won’t have this up and running any time soon.

But if put in place, what would that mean for SWIFT and the current corresponding banking systems?

Britta Döttger: If this becomes reality, I think it would be an alternative to SWIFT and existing clearing systems. Such a payment platform would not only allow for messaging but also for settlement. From a corporate point of view, it would be great to have such a system.

Advantages of token-based CBDCs for corporates

- Supporting digital business models by enabling payment automation on (blockchain) platforms for trade finance, procurement, Internet of Things etc

- Direct access to central bank money that eliminates counterparty risk

- Speeding up (cross-border) payment processes

- Supporting payment fraud prevention through consensus mechanism

Possible barriers to adoption

- Most CBDC projects are still at an early stage, few are launched yet

- Interoperability: the need to agree on a common global standard for cross-border payment based on CBDCs

- Missing regulation, e.g., how to deal with machine-initiated payments

- Companies need to ramp up internal processes

Sources

1 See https://bit.ly/3KBFjWk at atlanticcouncil.org

2 See https://bit.ly/3E3H5gg at pbc.gov.cn

3 See https://bit.ly/3JMtVG1 at ecb.europa.eu

4 For more information on the latest CBDC developments around the world, see the flow article “CBDCs: what’s not to love?”

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upYou might be interested in

Cash Management, Technology, Trade Finance

What treasurers should know about blockchain payment triggers What treasurers should know about blockchain payment triggers

As companies transfer business processes onto the blockchain, existing payment systems are reaching their limits. Does this mean that corporate treasurers will soon need digital currencies or are payment triggers sufficient? Alex Bechtel, Head of Digital Assets & Currencies Strategy at Deutsche Bank shares his views with flow’s Desirée Buchholz

CASH MANAGEMENT

CBDCs and the impact on cross-border payments CBDCs and the impact on cross-border payments

A growing buzz around central bank digital currencies (CBDCs) is seeing proofs of concept and pilots worked on by many central banks across the world. As these schemes gain traction, Deutsche Bank’s Bradley Lonnen, Alexander Bechtel and Marc Recker outlined in a webinar how CBDCs could transform cross-border payments

Cash Management, Macro & Markets

More March of the digital euro

The European Central Bank’s go-ahead for an investigation phase could see a digital currency for Europe issued before the end of 2026, reports flow’s Graham Buck and Clarissa Dann