29 March 2023

Home ownership in the United States has a long history of being inaccessible and unequitable for low – and moderate – income communities. flow reports on how Deutsche Bank’s Community Development Finance Group is supporting Blackstar Stability’s efforts to address the challenges

MINUTES min read

Owning a home may be a hallmark of the American Dream, but this dream has not been realised equally by all. While 74.6% of white families own homes, the rate for black Americans currently stands at just 45.2%.1 One of the underlying reasons for this is discriminatory lending practices that had been prevalent in the country for decades. The structural barriers such practices created have been a significant contributor to the racial wealth gap in the US.

One of the financial instruments preventing equitable home ownership is known as a Contract for Deed (CFD). An alternative to traditional mortgages, CFDs are private real estate contracts between a buyer and a seller, in which the buyer sends payment directly to the seller, who holds title to the property until the last payment is made. These are primarily used by members of communities that can’t get access to traditional mortgages – particularly black and low- and moderate-income (LMI) homeowners – and have proven to be extremely exploitative.

Efforts to address these challenges are underway. Blackstar Stability Distressed Debt Fund LLC (Blackstar Stability)— a social impact private equity fund based in Washington, D.C. – is helping by replacing existing CFDs with financial instruments that provide fairer credit terms and help preserve affordable home ownership.

What are CFDs?

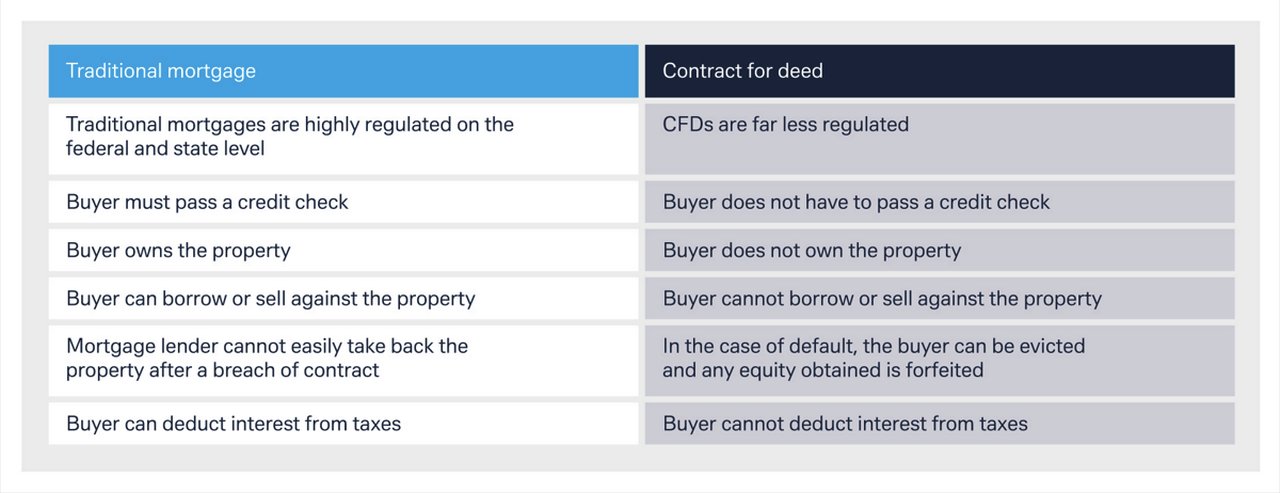

CFD transactions are significantly less regulated than traditional bank-financed mortgages, and almost always include predatory interest rates and valuations that are higher than the actual value of the home.2 Moreover, unlike traditional mortgages, regulation of CFDs are a patchwork, with laws and protections varying significantly from state to state. This often means that the CFD is unduly risky for the buyer, who builds no equity and has a higher risk of being forced out of their residence.

“We're helping to create a more equitable home ownership market in the US”

“The yields or rates on CFDs tend to be extremely predatory in nature,” says George Scott, Principal - Capital Markets/Investor Relations, at Blackstar Stability. “LMI households are often preyed on by those who see this an opportunity to capitalise on those they perceive to have very limited options to secure home ownership,” he continues.

Forfeiture clauses are a common element of these contracts, allowing the CFD financer to swiftly take the property after a breach of contract. For example, missing a singular payment can be a breach that results in the contract being cancelled, and the resident being evicted almost immediately. The buyer is also responsible for all property maintenance, taxes, and insurance, but they cannot sell or borrow against the property – they also cannot deduct interest from taxes as with traditional mortgages. So, with a CFD, a buyer has all the expenses associated with home ownership without the benefits of actually owning the home. Individuals and families signing CFDs are frequently unaware that they do not own their homes and typically enter these contracts because they have a low credit score, insufficient cash for a down payment, and/or insufficient income to qualify for a traditional mortgage.

Figure 1: Traditional mortgages vs contract for deeds

CFDs historic roots in discriminatory redlining practices

Redlining is a term used to describe the systemic denial of residential mortgages by government agencies and local banks to residents of certain – predominantly black – neighbourhoods and communities in the 20th century. Many black households were denied access to federally-backed home loans and mortgages due to federal home ownership programmes that discriminated based on race. This manifested itself in the form of higher mortgage interest rates, application rejections or a reliance on CFDs.

The damaging legacy of redlining can be seen in Chicago during the 1950s and 1960s, when CFD financing was often the only option for many black prospective buyers. Between 75% and 95% of the homes sold to black families in the city during these two decades were CFDs.3

Though black home ownership reached a peak in 2004, this soon came crashing down. When the US housing market collapsed in 2008, black homeowners lost their homes to foreclosure at a rate nearly double that of other ethnic groups.4 Post-2008, CFDs saw a revival in popularity. Government Sponsored Enterprises (GSE) such as Fannie Mae sold houses in bulk to corporate and individual buyers, who frequently tripled the price and quickly resold the properties to vulnerable families. These sales were facilitated by CFDs – and most commonly affected neighbourhoods with lower incomes, higher shares of non-white residents, higher rates of vacancy, and less access to traditional forms of credit.5

A way forward for those subject to predatory CFDs

The popularity of CFDs – a market of more than US$200bn – has seen a resurgence in recent years, prompting increased political scrutiny. In response, the enhancement and enforcement of consumer protections have begun, with some Federal and State regulators seeking to legislate against particularly egregious CFD abuse by improving consumer protections.6 Members of the Blackstar Stability management team are working closely with legislators – at both the state and federal level – to advocate these changes, but this will take time. In the meantime, Blackstar Stability is also providing black and LMI communities impacted by CFDs with a much-needed lifeline.

“Owning a home is the primary way that Americans create wealth and build opportunity in the United States,”

In August 2022, Deutsche Bank’s Community Development Finance Group closed an equity investment of up to US$5m in Blackstar Stability. The fund is providing families with predatory CFD financing a pathway to access traditional forms of credit – giving families greater security and control over the ownership of their homes, along with real opportunity for wealth creation.

“Owning a home is the primary way that Americans create wealth and build opportunity in the United States,” said Cheryl Gladstone, Head of the Community Development Finance Group at Deutsche Bank. “Through this investment in Blackstar Stability, Deutsche Bank is supporting the opportunity for wealth creation for communities who have otherwise been marginalised from home ownership.”

Deutsche Bank’s equity investment goes towards the fund that is expected to reach a target close of US$100m and is projected to help more than 10,000 LMI families, while providing risk-adjusted returns to investors. This, coupled with the desire of some CFD issuers to liquidate their holdings in a buyers’ market, has presented a new opportunity to create tangible solutions for black and LMI families.

“We're helping to create a more equitable home ownership market in the US by providing the most vulnerable communities with a fair shot at owning a home. And we mean true home ownership, not the smoke and mirrors or the illusion you get with the CFDs. Investors, such as Deutsche Bank, are patient and understand what this means in practice – both from an institutional investment perspective, as well as a social impact perspective,” adds Scott.

The principals of Blackstar Stability have extensive experience crafting and leading housing policy reform, as well as innovative investment strategies that support black and LMI home ownership. Following the success of its leaders’ previous platforms at the State of Oregon and Further Opportunity LLC,7 the fund was created to target and help black and LMI communities subjected to predatory lending practices.

By converting CFDs into traditional mortgages, Blackstar Stability will create affordable home ownership and wealth creation opportunities in black and LMI communities. The bank’s equity investment will help bring Blackstar Stability closer to achieving this goal.

Sources

1 See census.gov “Quarterly Residential Vacancies and Homeownership, First Quarter 2021.” U.S. Census Bureau, April 27, 2021.

2 See pewtrusts.org

3 See socialequity.duke.edu

4 See responsiblelending.org

5 See jchs.harvard.edu

6 See ncsl.org

7 See blackstarstability.com

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print