29 November 2023

While the end of the low interest rate era presents a challenge for ESG investments, there is encouraging momentum in Asia and progress on harmonising sustainability reporting. flow summarises the eight main themes of this year’s Principles for Responsible Investment’s (PRI) annual conference in Tokyo based on a Deutsche Bank Research special report

MINUTES min read

The concept of socially responsible investing (SRI) dates back to the 1750s when the Religious Society of Friends, also known as the Quakers, stipulated that members should avoid involvement in the slave trade. SRI’s modern form gained impetus in the 1960s as issues such as civil rights and equality for women came to the fore, while a steadily growing band of investors opted to avoid placing their money in companies producing alcoholic products, tobacco or weapons.

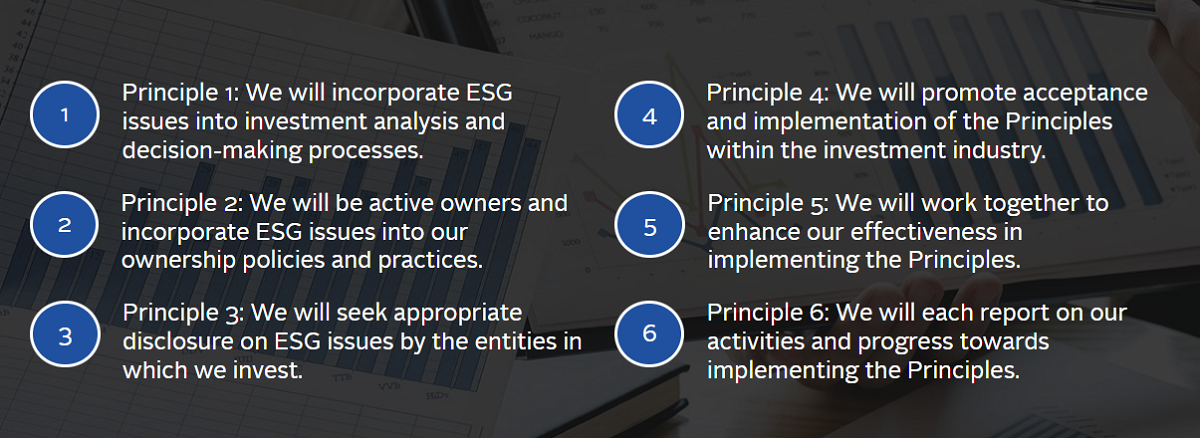

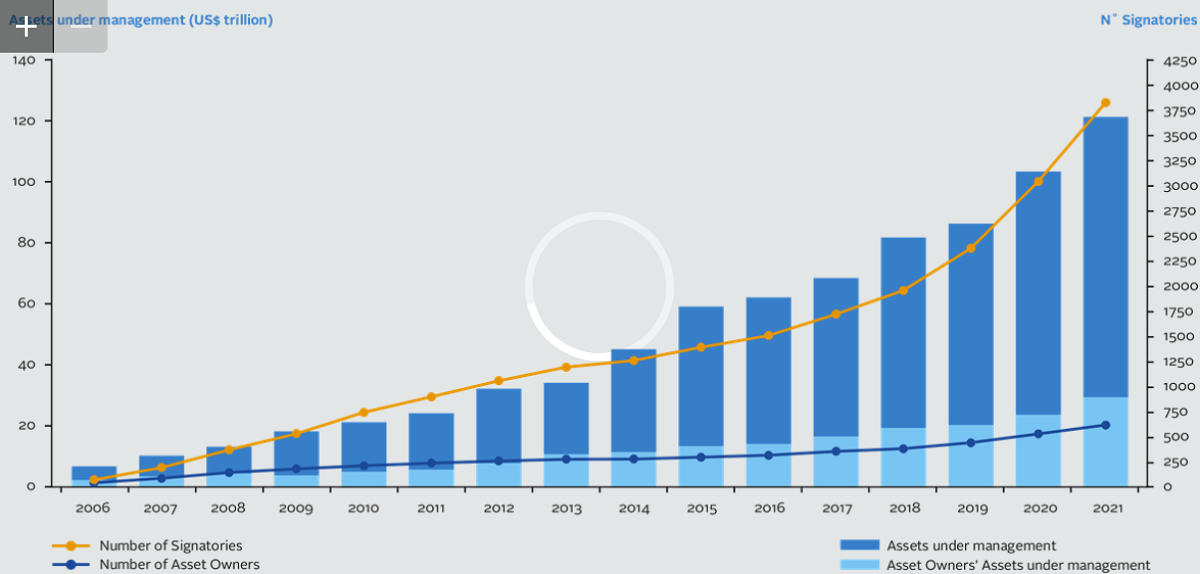

In 2005, United Nations Secretary-General Kofi Annan invited a group of the world’s largest institutional investors to join a process to develop the Principles for Responsible Investment (see Figure 1). What started out by a group of 20 institutional investors from 12 countries, has now grown into an initiative with more than 3,750 signatories globally and approximately US$120bn under management (see Figure 2).1

Figure 1: PRI’s Six Principles for Responsible Investment

Source: PRI https://www.unpri.org/about-us/about-the-pri

Figure 2: PRI growth 2006-2021

Source: PRI https://www.unpri.org/about-us/about-the-pri

The annual PRI conference – this year a three-day event held in Tokyo, Japan in early October – has become one of the world’s leading global sustainability conferences attracting influential asset owners, leading asset managers, regulators and industry professionals.

This year’s attendees included a team from Deutsche Bank Research. In their recent dbSustainability Spotlight special report, Takeaways from Principles for Responsible Investment Conference, Debbie Jones, Global Head of ESG and analysts Punyadip Cheema and Luke Templeman highlight their top eight takeaways from the 2023 conference drawn from panel sessions and discussions with other delegates.

1. Momentum in Asia is supportive of environmental, social and governance (ESG) regulation and low carbon policies

According to the team, Asia accounts for approximately 50% of global greenhouse gas (GHG) emissions. While Singapore has led in developing regulation, Japan is accelerating its efforts and Prime minister Fumio Kishida outlined his sustainable growth priorities in the conference’s keynote speech.

Kishida explained that Japan’s government will issue yen (JPY) 20trn (US$134bn) in new “climate transition bonds” in the current fiscal year, investing the proceeds in innovation for renewable energy expansion, hydrogen infrastructure, and low carbon autos, chemical and steel industries. Several Japanese pension funds, collectively representing US$600bn in assets under management (AUM) will be mandated as PRI signatories to oversee them.

Since the end of March, Japan’s listed companies have been required to disclose their human capital related information and February saw the GX: Green Transformation Policy published. This plan outlines an Emissions Trading System (ETS) schedule to launch by 2024 on a voluntary basis and begin operating in 2026. From April 2028, carbon levies will be introduced on fossil fuel importers, giving companies five years to make energy mix adjustments or reduction efforts to mitigate the impact of the tax.

2. Harmonisation of sustainability reporting is on its way, but complete standardisation is “elusive”

Multiple sustainability reporting options are frustrating and confusing for corporates as well as investors, the team states. However, progress has been made in harmonising leading frameworks and standards, the team states, naming two initiatives in particular: The sector specific sustainability metrics developed by the International Sustainability Standards Board’s (ISSB) and the Taskforce on Climate-related Financial Disclosures (TCFD). From 2024, the ISSB assumes responsibility for monitoring the TCFD framework.

The ISSB was set up by the International Financial Reporting Standards (IFRS) Foundation in 2021 during COP26 with a mandate to develop comprehensive global standards for companies’ sustainability-related disclosures.2 In June 2023, it published its inaugural standards—IFRS S1 and IFRS S2 – which “for the first time (…) create a common language for disclosing the effect of climate-related risks and opportunities on a company’s prospects,” the IFRS foundation stated upon publication: “The ISSB Standards are suitable for application around the world, creating a truly global baseline.”3

Yet, complete harmonisation is “elusive”, the Deutsche Bank Research team writes. “Government-mandated disclosure often includes disclosures related to the needs of additional stakeholders and regional objectives, such as those found in Europe's Corporate Sustainability Reporting Directive (CSRD).” Thus, “corporates should focus on the mandated reporting disclosures for their country/region, [while] companies looking to address the investment community’s focus on financial materiality may wish to report against ISSB standards.”

The team also predicts increasing pressure for corporates to provide transition plans to outline accountability for their climate commitments such as Net Zero. The UK’s Transition Plan Taskforce (TPT) issued its disclosure framework4 on 9 October, after the conference ended. While aligned with the TCFD and the ISSB, the framework goes further by asking companies for high level ambitions to mitigate climate change, coupled with short, medium and long-term actions to achieve their goals.

“Solar and wind is the easy stuff. The next wave will be much harder”

3. Anti-ESG movement is expected to get stronger as regulation progresses

As government policies to deliver on net-zero commitments accelerate, growing anti-ESG sentiment already evident in the US is expected to extend to other regions, the team points out: “Legal ramifications for corporates, data quality, debates on fiduciary duty for investors and political backlash are likely to become even bigger challenges. At the same time consumers will also see a financial impact.” And while many net zero commitments assume the use of carbon capture and storage technology, this still requires significant investment deployed to be developed further and accepted.

Moreover, as a conference panelist commented, the recent sharp interest rate hikes by central banks have made the investment returns for solar and wind projects less attractive and new projects less appealing. Shifting infrastructure towards other forms of energy like hydrogen involves more uncertainty and risk, so things will become more difficult.

4. Sustainably managed assets under management (AUM) are expected to continue to grow

A key attraction of the PRI conference is asset managers and asset owners (allocators of capital) can connect. The team notes that this year asset managers reported more sophisticated conversations with asset owners. While some asset owners have long been clear on their sustainability needs, one asset manager the team spoke with suggested that increasing regulation has allowed owners to have a more pointed view about their sustainability requirements.

“Despite ESG backlash, we expect sustainable AUM to continue to grow,” the team writes, although this might not always be evident in all regions as some firms have shifted or re-labelled their products due to regulation to avoid greenwashing concerns.

This for example includes a shift from Article 8 to Article 6 funds in Europe. Under the EU’s Sustainable Finance Disclosure Regulation, Article 8 funds promote environmental or social objectives. Article 6 funds need to show how they are addressing sustainability risks in their investment decisions but don’t need to actively pursue ESG strategies. Therefore, in practice, article 6 funds are often those that don’t integrate ESG.

5. Investors are increasingly asked to monitor their portfolio for human rights risk across the value chain

It’s no longer only the “E” but also the “S” in “ESG” which is getting attention from investors. While many conference panels were well attended, the panel session on “managing human rights risk across the value chain” was over capacity, the team recalls. Increasingly, investors are being asked to monitor these risks due to regulation or demands from capital allocators.

One panelist commented that diversity and inclusion (D&I) and health and safety have previously occupied most attention, but asset managers are now being asked to be more diligent on this risk – due in part to increasing regulation such as the German Supply Chain Act5 and the EU’s new deforestation6 regulation , which each address labour and human rights risk.

As part of the session, Nomura Asset Management highlighted its own approach to human rights management, which includes:

- evaluation of human rights policies conforming to international norms

- implementation of human rights due diligence

- surveys of suppliers

- disclosure of supplier survey results

- on-site audits of suppliers, and

- consultation contacts for suppliers to use.

Five key sectors commonly regarded as high risk for human rights issues are: food/agriculture products; autos; information and communication technology (ICT), apparel; and resource related.

6. Biodiversity risk continues to be a hot topic

On 19 September 2023, the Taskforce on Nature-related Financial Disclosures (TNFD) released its disclosure framework. The publication of 14 recommended disclosures and a suite of additional implementation guidance is supposed to help shifting “capital flows to nature-positive outcomes”.7

According to the Deutsche bank Research team, this framework has led to some optimism in the PRI community. This is due to the fact there is a real financial and social impact associated with biodiversity risk, but evaluation remains a challenge – especially for those investors who lack the expertise and/or access to expensive data sets.

A biodiversity-focused panelist at the conference felt that any corporate already undertaking a TCFD report doesn't have much further to go to comply with TNFD as this framework only asks for a few more disclosures. Yet, there are voices in the market that feel this might create extra work and costs for corporates.

Panelists from the session also encouraged investors to continue gathering enough information to engage with corporates; even when sufficient data does not exist. For example, knowing a corporate operates in a region with high deforestation rates should be sufficient to engage.

7. The 2023 conference was marked by a strong focus on stewardship and impact investing

This was evident in this year's slogan of “moving from commitment to impact.” The team adds “this type of investing objective is growing and can be very inspiring” although representing only a small portion of sustainably invested AUM.

Speaking at the conference, Hiroshi Shimuzu, President of Nippon Life, the largest Japanese life insurance company, saw the world entering into a “global boiling phase” and thus managing ESG risk alone is insufficient. Organisations such as the Climate Action 100+ continue to advance their agenda, shifting from a disclosure focus to implementation of climate-related transition plans and are urging members to become more engaged with policy makers. The World Wide Fund for Nature (WWF) also wants investors to support policy and engagement taking on the issues of deforestation and coal use.

The team spoke with investors who said they lack the mandate from clients for stewardship and impact investing. Some also highlighted that private markets are well behind public markets. They are in the early stages of building sustainable risk models but are hampered by a lack of data and internal expertise, especially at SMEs.

8. US representation for the discourse on ESG was notably absent in Tokyo

The team praises Nathan Fabian, the PRI’s Chief Responsible Investment Officer, for his commendable job in outlining concerns during the “understanding the ESG backlash panel”, but conversation could go deeper and examine issues such as the impact of President Biden’s 2022 Inflation Reduction Act (IRA).

Many corporates have immediately responded to its incentives and announced clean-tech investment plans in the US, Deutsche Bank Research points out. “This catalyst for sustainable finance was passed despite more notable opposition to ESG in the US and should be evaluated by those wanting to influence climate policy.”

PRI's 2024 conference in Toronto, Canada, should provide an opportunity to engage more US participants in conversations about the challenges of ESG investing and how to address them, the team concludes.

The 2023 Principles for Responsible Investment (PRI) Conference was held in Tokyo, Japan from October 4-6

DEUTSCHE BANK REPORT REFERENCED:

dbSustainability Spotlight special report: Takeaways from Principles for Responsible Investment Conference by Debbie Jones, Punyadip Cheema and Luke Templeman (9 October 2023)

Sources

1 See unpri.org

2 See ifrs.org

3 See ifrs.org

4 See grantthornton.co.uk

5 See csr-in-deutschland.de

6 See environment.ec.europa.eu

7 See tnfd.global