25 October 2023

ESG was high on the agenda at this year’s Sibos, with over 30 sessions dedicated to the topic. flow reports on this year’s big issue debate, which delved into the need to foster sustainable business practices

MINUTES min read

In an era marked by unprecedented global challenges, the financial services industry finds itself at a key juncture, as calls for sustainability become an imperative that demands the attention of financial institutions worldwide.

This need to promote sustainable business practices has ascended the banking industry’s agenda in recent years – spurred by increasing governmental and regulatory action, as well as growing pressure from consumers. This is, in turn, driving much-needed change for corporate clients around the world, which are at different stages of the sustainability journey depending on the sector and region of operation.

As corporate clients demand more from their banks – and with regulators continuing to catch up as the industry introduces new standards and reporting mandates – can the industry adjust to the new era of sustainable business practices?

Changing business models

In her introduction to the Big Issue Debate session: Are financial services ready to leap into the new era of sustainable business practices? Rosemary Stone, Chief Business Development Officer, Swift, set out the complexities of tackling sustainbility across different global regions.

“In some parts of the world, it's about improving basic infrastructure, and societal advancement. In others, it's about the need for more reliable data, and an increasingly complex regulatory environment,” said Stone. “But what we do know is that in all regions, significant shifts need to be made in the way that our businesses are run.”

“We are in a reality where business models need to transition towards low carbon and sustainable”

This has spurred a move towards sustainable business models, which aim to not only make a positive impact, but also capitalise on the significant business opportunities in the green space. “There are always development stages where businesses need to reinvent themselves,” explained Lavinia Bauerochse, Head of ESG Corporate Bank, Deutsche Bank. “And we are in a reality where business models need to transition towards low carbon and sustainable.”

This trend has forced a shift in the mindset of financial institutions, with environmental, social and governance (ESG) issues and sustainability becoming an imperative. Deutsche Bank, for example, has embedded ESG as a core part of its strategy – and has taken considerable steps to put this into practice, including committing to allocate a cumulative €500bn in sustainable finance by 20251, providing transparencies around interim carbon reduction targets for 2030 and creating a robust sustainable finance framework. Most recently, Deutsche Bank has published its initial Transition Plan which outlines plans to decarbonise its business with clients, its value chain and its own operations by 2050.2

Banks are, as part of this development, looking to support companies on their sustainability journeys, helping them structure their KPIs, coordinate ESG metrics and facilitate investment financing to fund the transition. “We are currently discussing very complex topics where many clients, who do not have the size and scale of a large multinational, struggle to find the capacities and the competencies to deal with these issues themselves,” added Bauerochse.

Panelists during the Big Issue Debate on ESG

In the supply chain financing (SCF) space, for example, Deutsche Bank is helping clients in integrating ESG objectives into their SCF programmes to incentivise suppliers to be more sustainable and transparent (see Greening Henkel’s supply chain).

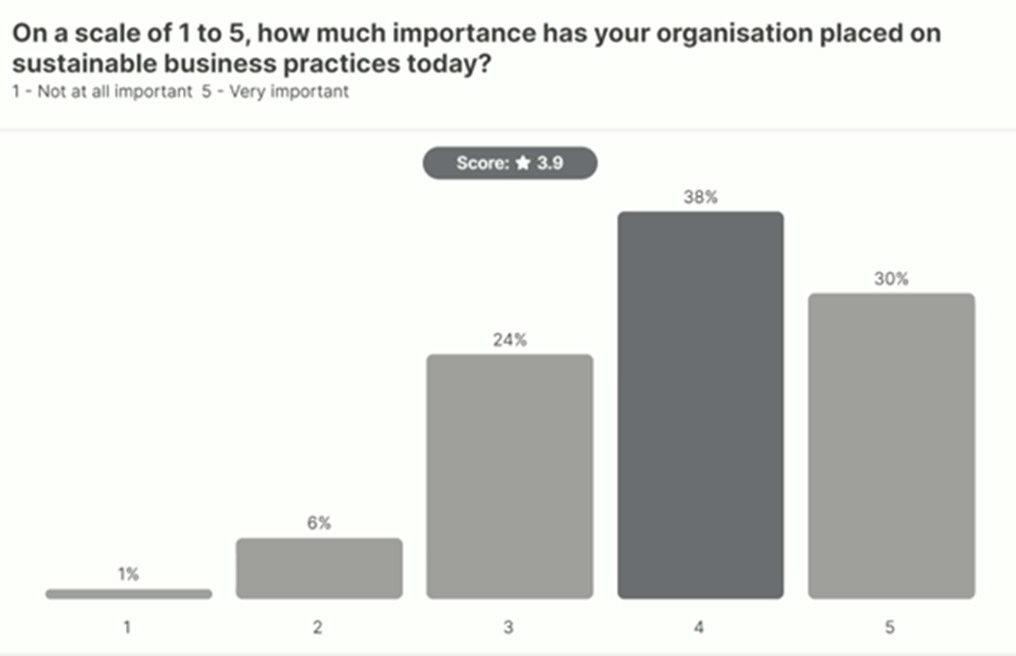

The importance of this transition for the banking community was underlined by a poll during the Sibos session. This asked the audience to rank the importance their organisation places on sustainable business practices, with 68% choosing ‘important’ or ‘very important’.

One panelist reflected that while the result was encouraging, he believed that if the same question was posed to a non- corporate treasury audience the response would be less reassuring and that was one of the fundamental challenges on the road ahead.

The results of the first poll during Big Issue Debate: Are financial services ready to leap into the new era of sustainable business practices?

Collaboration is the order of the day

Asked to select a single word to describe what the key focus for the industry should be, by far the most popular choice for respondents was “collaboration” (see Word Cloud from the session). “Managing the complexity requires a lot of collaboration across the industry and also co creation alongside our clients,” agreed Bauerochse.

The results of the second poll during Big Issue Debate: Are financial services ready to leap into the new era of sustainable business practices?

When it comes to collaboration with clients, Bauerochse stressed the need to remember that while financial insitutions are catalysts for innovation and faciliators of the transition, they are also risk managers. “We need to have a view of how the ESG risk as financial risk are integrated into our risk management processes,” she added.

The focus on risk is an increasing reality not only for banks, but also regulators – with many having conducted, or looking to conduct climate stress tests that have the potential to drive a reallocation of financing. For example, in November 2022, the European Central Bank (ECB) released the results of a thematic assessment of the extent to which 186 banks – with total combined assets of €25trn – were aligning with climate-related and environmental (C&E) risk expectations outlined by the ECB in 2020.3 The ECB’s findings demonstrated that financial services industry is still lagging on this front – and more robust engagement with corporate clients on this topic is needed as it could affect risk premiums and pricing in the longer term (see Decarbonising tomorrow).

“That's an important dialogue to have with our clients, because the availability and allocation of the balance sheet will be considered under ESG criteria for corporates in the future,” said Bauerochse. She added that while the scalability of ESG investment is not yet a problem, as we move forward significant capital expenditure requirements will likely change this – with robust capital markets set to play a key role in mobilising the capital needed to faciliate the energy transition.

One panelist added that solving various challenges that society faces will also require a combination of private and public partnerships. Commercial banks alone are insufficiently equipped to take on long-term risk at the scale needed to finance the transition to a net zero economy. Further collaboration with states and governments will therefore be critical.

Speed and courage needed

To allocate this capital based on ESG criteria inevitably means an ongoing need for clear, robust and usable guidance. “When it comes to standards, we are still in an in a space where everything is evolving – and we are all struggling to adapt to that continuously,” said Bauerochse.

Reflecting on the way forward, Bauerochse returned to the Word Cloud – picking up on the dual need for speed and courage. To achieve this, however, perhaps also demands a shift in mindset. As Bauerochse added, you cannot advocate speed and action and at the same time criticise those that are pioneers in the market. More room and patience is, therefore, needed on this journey as we try, collectively, to understand new standards, adjust to new KPIs and make this transition work.

Sibos 2023 was held at the Metro Toronto Convention Centre (MTCC) in Toronto, Canada from 18 to 21 September 2023

Sources

1 Sustainable financing and investment activities as defined in Deutsche Bank’s Sustainable Finance Framework and related documents, which are published on our website

2 See "Deutsche bank publishes initial transition plan to reach net zero in 2050" at corporates.db.com

3 See bankingsupervision.europa.eu