11 October 2023

Trade and supply chain finance is gathering traction as a decarbonisation incentive. Economist Rebecca Harding demonstrates how recent ITFA research finds that global trade participants want further collaboration between banks, regulators and standards bodies to help it fulfil its potential

MINUTES min read

Defining the impact of world trade on sustainability is at best a challenge and at worst impossible. On one level, between 20% and 30% of global CO2 emissions are associated with international trade making it a major contributor to the environmental challenges the world faces.1

On another level, almost by definition, international trade enables goods and services to move around the world that contribution positively to climate transition – for example, exports of environmental goods represented some 8.1% of all exports globally in 2021 according to the IMF,2 while its role in creating better jobs and economic growth is a mantra of the World Bank,3 the World Trade Organisation4 and the International Chamber of Commerce (ICC).5

Impact of economic development

In short, the more trade grows, the more likely it is to have negative climate impacts in the short term but to enable transition to more sustainable business models, create jobs and enable economic growth and development over a longer period. Indeed, those countries where the negative contribution of trade to sustainable development goals are the greatest are in countries with higher levels of economic development, stronger consumption of consumer goods and lower overall contributions to carbon emissions.6

This conundrum will present a problem for those of us who advocate the long-term benefits of international trade until a mechanism has been found to transition to more sustainable business models; most importantly, these models must include social as well as environmental metrics.

There is more resource globally being committed to reducing emissions and helping communities adapt to climate change, but even if every country in the world delivers on its current climate pledges, the International Panel on Climate Change calculates that the world will still not avoid levels of warming about the critical 1.5°C above pre-industrial levels to mitigate the worst impacts of climate change,7 including destruction of jobs, environmental-related migration and conflict.8 For example, in 2022 alone, climate disasters displaced some 32.6m people around the world9 with inevitable consequences for human rights, and equitable economic development.10 In effect, climate change is creating a major foreign policy challenge.11 This will itself undermine the social priorities that are so central to the future sustainability of world trade and supply chains, especially in emerging economies.

Climate change and financial risk

Clearly this is a problem that is too big for the world’s policy makers, regulators, corporates and financial institutions to fail.

The “too big to fail” phrase is often associated with the rescue of systemic banks during the global financial crisis. Arguably this is precisely the basis of moves now to regulate the global financial institutions so that its financial stability is assured even if there is a climate disaster. In short, the broad frameworks accept that there are difficulties assessing the link between climate events and financial risk, not least because the rate of climate change itself is uncertain but is likely to grow over time.12 The goal therefore is to protect the financial system from systemic risk exposure rather than to regulate for the causes of climate change.13

“Regulators… are becoming more stringent in their assessment of the adequacy of sustainability reporting”

Considered against the existential threat to the world represented by climate change, this may seem an inadequate response. However, regulators, especially in the EU and the UK, are becoming more stringent in their assessment of the adequacy of sustainability reporting and risk mitigation with the US following swiftly behind.14

US$32trn

Value of global trade 2022

Moving ahead on the basis of a precautionary principle to “do no harm” and understand and mitigate risk reflects the “we have to start somewhere” approach that is so frequently articulated in trade finance circles and was reflected in the recent ITFA report focused on the challenges of regulatory reporting.15

Where does trade and supply chain fit into this?

Trade and supply chain finance has a unique position in the process of moving towards more sustainable business models. Trade finance and insurance constitutes around 80% of the value of world trade and banks finance around 40% of global trade according to a 2021 McKinsey report.16 In 2022, World trade was estimated to be some US$32trn.17 This is some US$25.6trn in total finance, and US$12.8trn of bank intermediate trade finance that could help move the world’s supply chains to more sustainable business models over time. At present it is estimated that just US$1 in every US$5 of trade finance contributes positively to sustainable development goals18 – this is an opportunity for trade finance to make a real difference to the sustainability agenda.

At present, the regulatory structures, as they are outlined above present an issue for trade finance professionals, however. The International Trade and Forfaiting Association (ITFA) report defines this as a “regulatory paradox” which, simply put, is the result of the risk-based approach that the regulators have taken as their starting point. As stressed above, this is inevitable given the risk-based and precautionary approach that is being taken and, more importantly, the fact that regulators have a responsibility for financial stability of the whole system and not to reduce the impact of the financial system on climate.

What does the industry tell us?

However, trade finance professionals regard the regulations as having created a paradox: by seeking to limit the financial damage from climate change, they are de facto increasing the risk of financial services continuing to contribute to greenhouse gas (GHG) emissions because there is no incentive currently in terms of capital ratios to fund projects with a longer-term renewables, energy transition or more general sustainability focus. The research was based on 40 in-depth interviews with regulated entities and a representative survey of ITFA members; one respondent argued that reporting requirements are “bit of a mess globally with perverse incentives emerging from current capital requirements”.

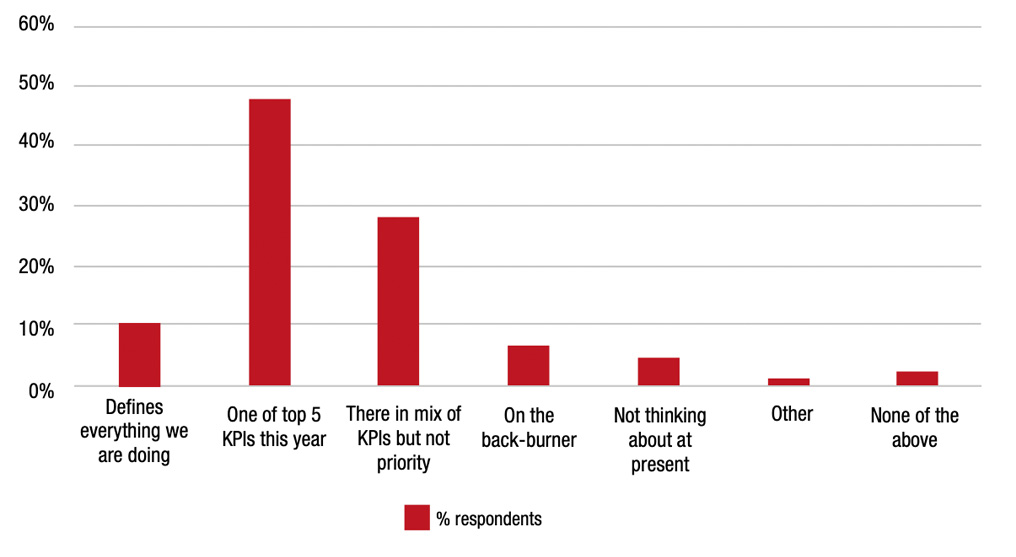

There is little doubt that banks are acutely aware of the need to become more sustainable (Figure 1). Nearly 50% of respondents saw sustainability as one of the top five KPIs for their organisation and a further 10% as defining everything that their organisation did.

Figure 1: Importance of ESG within respondent’s organisations

Source: ITFA survey conducted between April 17th and May 8th 2023

N = 72

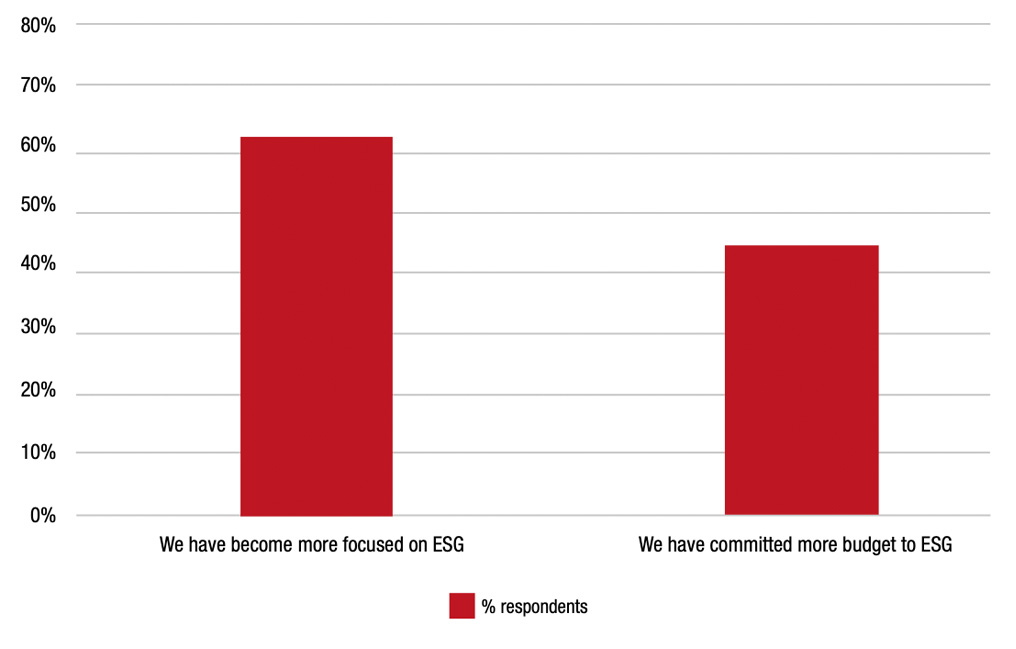

Sustainability has also become more important in the banks and regulated entities participating in the research. 70% said it had become more important in their organisations and 52% said more budget was being allocated to it (Figure 2).

Figure 2: Focus and budget allocation to ESG, % of respondents.

Source: ITFA survey conducted between April 17th and May 8th 2023

N = 72

One of the challenges that banks will face, however, is the sheer multitude of different regulatory standards that there are. Based on a simple piece of web-crawling conducted for this article, there are at least 42 regulatory standards and regulatory authorities around the world, and while some, such as Basel III and Basel IV affect financial institutions everywhere, each national or regional regulatory body has the potential to take the interpretation of international regulations into their national frameworks giving scope for differentiated requirements on the basis of geography. Alongside this, there is a plethora of standards set by various accounting standards bodies such as the International Financial Standards Board (IFSB) with the International Sustainability Standards Board (ISSB) and the Sustainability Accounting Standards Board (SASB) and the Global Reporting Initiative (GRI) which were until recently working independently.

Small wonder, given this volume of standards, that the banks within the interview research conducted for the ITFA research were keen to avoid green-washing accusations by reporting to a minimum requirement while they gain understanding of what the final, auditable standards might be. There is a move to streamline standards via the ISSB that is currently ongoing,19 and the SASB and the GRI have been brought under the IFSB’s umbrella but the alphabet soup that we currently have around various areas of regulation and standards is hard to avoid.

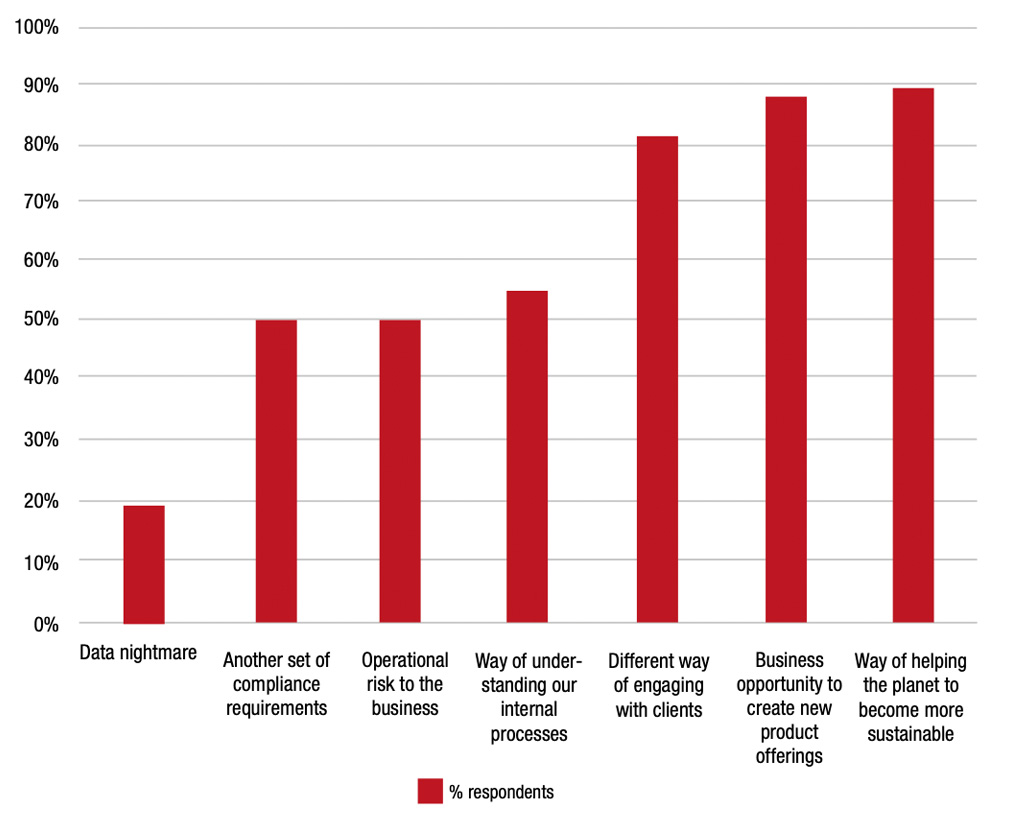

Perhaps for this reason, banks prioritise their sustainability work on the relationship with their clients rather than regulatory frameworks in the first instance (Figure 3).

Figure 3: Views of ESG in respondent’s organisations

Source: ITFA survey conducted between April 17th and May 8th 2023

N = 72

While respondents were clearly focused on helping the planet to become more sustainable, nearly 88% said that this was an opportunity to innovate and create new product offerings and nearly 83% said that they were using it to engage differently with clients. Interestingly, operational risk and compliance requirements were only seen as important by 50% of the respondents.

“Confusion over what to measure and how to measure are creating core challenges in sustainability strategies”

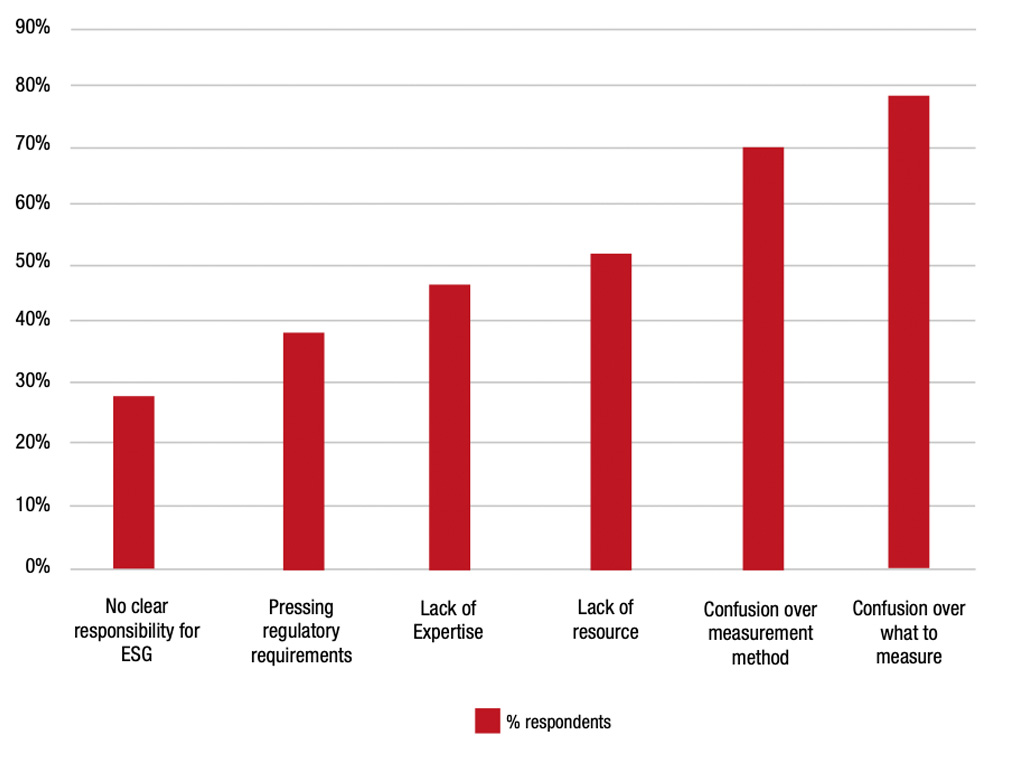

What banks are doing in this space is clearly important too and the results of the research suggested there was no one-size fits all. Sustainability predominantly sat in a cross organisational function, and only 30% said that it was a C-Suite responsibility. More consistently, however, the majority of the banks who responded to the survey argued that confusion over what to measure and how to measure it were creating core challenges in their sustainability strategies at present (Figure 4).

Figure 4: Core challenges for implementing ESG strategies amongst ITFA members

Source: ITFA survey conducted between April 17th and May 8th 2023

N = 72

To summarise: trade finance-focused banks want to focus on sustainability because they take responsibilities seriously but also see it as a means of innovating for and communicating with clients. Accordingly, they are dedicating more resource and time to sustainability but what to measure and how to measure it are key challenges for the industry.

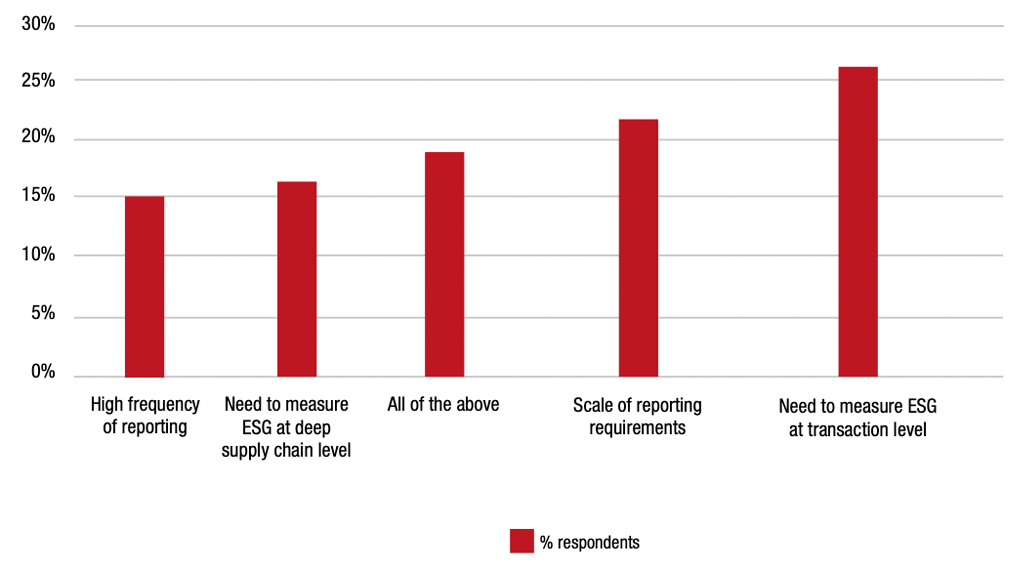

More than this, the responses suggested a major need for regulators and trade finance professionals to work more closely to understand the specific needs of trade and supply chains. 58% of respondents felt that current regulations do not cover the specific requirements of trade finance (Figure 5).

Figure 5: ESG strategy focus of ITFA members

Source: ITFA survey conducted between April 17th and May 8th 2023

N = 72

The most significant reason for trade and supply chain finance needing a different type of treatment in terms of ESG reporting was the need to measure ESG at a transaction level (26%), closely followed by the scale of what needed to be measured (22%). It is also noteworthy that nearly a fifth of respondents answered that all of these factors were important and potentially required ESG approaches in trade finance to have a specific regulatory treatment.

A balanced approach

It is hard to understate the importance of global trade in addressing the urgent need to tackle climate change. Yet this task is fraught with difficulties because, as this article has aimed to demonstrate, one trade flow can be negative in terms of carbon emissions or greenhouse gasses, but positive in terms of its social impact. Trade in mined goods and fossil fuels are good examples of this and the consequence is untold difficulties in measuring the actual impact that trade has on environmental or indeed social sustainability.

That something has to be done on climate change is made clear on a daily basis – temperature records, fires, droughts and floods are the story of our modern era globally and this is already creating a migration crisis that is escalating and has the potential to create political and economic challenges alongside the human catastrophe it already represents.

Banks have the opportunity to take a front and centre role in using the US$12.8trn in trade finance that they intermediate to contribute towards a fair transition to more sustainable economic and business models. The material presented here shows that banks accept that challenge readily and are dedicating resources to doing more with their clients and with their own operations.

However, trade and supply chain finance are a special case – the frequency and complexity of transactions mean that what to measure and how to measure it is amplified as a problem. The current regulatory context, as has been emphasised, is one based entirely on a precautionary principle in the absence of more regulations. Trade and supply chain finance professionals have a unique understanding of the mechanisms of global trade and where the potential is to use the finance that is available to incentivise transition.

It is hard to understate the size of the problem of creating comparable audit standards so that they are consistently applied globally. Many of the trade bodies that represent banks are trying to do this and therein lies a key challenge – there are multiple regulatory frameworks, multiple ways of measuring sustainability and similarly multiple organisations trying to simplify the requirements.

Yet it is equally hard to under-estimate the scale of the sustainability challenges the world faces. The fact that there are so many organisations and entities shows that there is an awareness of this. Now the challenge for the sector is to work together, and with regulators, to make sure that this is addressed with the urgency that the planet deserves. This is, quite simply a problem that is too big for us to fail.

The Regulatory Reporting Reality of Making Trade Sustainable by ESG Committee and Dr Rebecca Harding (published May 2023)

The ITFA research was conducted using an action research approach which aims to investigate and to try and address a problem simultaneously using an iterative feedback loop with practitioners. It was conducted in three stages (the second two in parallel):

- A review of the regulatory literature to identify the principles and the weaknesses of emerging ESG reporting and capital requirements.

- A survey of members to test the responses from semi-structured interviews and establish ITFA members’ attitudes to regulations and ESG.

- A series of semi-structured interviews with 68 individuals from 40 organisations to identify key challenges, current practice in response to regulatory requirements and suggestions for action in the future.

The-Regulatory-Reporting-Reality-of-Making-Trade-Sustainable-May-2023.pdf (itfa.org)

Sources

1 See lse.ac.uk

2 See climatedata.imf.org

3 See worldbank.org

4 See wto.org

5 See iccwbo.org

6 See Trade’s sustainability challenge at flow.db.com

7 See ipcc.ch

8 See unhcr.org

9 See migrationdataportal.org

10 See migrationdataportal.org

11 See cfr.org

12 See bis.org

13 See bankofengland.co.uk

14 See bankofengland.co.uk

15 See itfa.org

16 See mckinsey.com

17 See unctad.org

18 See rebeccanomics.com

19 See ifrs.org