20 September 2023

Making cross-currency payments from a subsidiary to a central account is often costly and inefficient. flow explores how fashion house Valentino implemented an award-winning accountless solution with an integrated FX workflow to support its growth in South Korea

MINUTES min read

As the most established Italian ‘Maison de Couture’, Valentino is a landmark of “Made in Italy” on the international scene with a presence in prêt-à-porter (ready to wear) sectors including women’s, men’s, couture collections, and in activities with licensed partners in Valentino Eyewear and Valentino Beauty.

Founded in 1960 by Valentino Garavani and Giancarlo Giammetti now Jacopo Venturini, CEO from June 2020, and Pierpaolo Piccioli, sole Creative Director from 2016 are re-signifying the iconic codes leveraging Valentino’s brand heritage in the contemporary world.

Maison Valentino is now present in 163 locations through a strategic distribution network enhanced to date, which involves 221 directly operated boutiques located in key shopping locations around the world and around 1,000 points of sale.

As part of the company’s ongoing global expansion, one area focus for the firm is South Korea, where the rapid growth in purchasing power is making the country an appealing market for the luxury sector. This is, in part, being driven by the global marketability of some of Korea’s top stars. In fact, the growing spotlight on these Korean stars – and the importance of the Korean market for the brand – led Valentino to pair up with Korean musicians and celebrities as part of its new ambassador programme called Di.Vas (short for Different Values) in January 2023.1

SUGA, the South Korean rapper from pop group BTS is a Valentino ‘Ambassador’. Photo © Greg Williams

Valentino’s ongoing marketing efforts in South Korea are being matched by stellar efforts within the treasury function to improve the efficiency of its processes – in particular, the wire transfer and FX conversion between its local subsidiary in Korea and its headquarters in Italy.

A cumbersome payment process

The need to centralise cash resources to drive effective liquidity management remains top of the agenda for treasurers.2 By consolidating cash in a company’s main account, the treasurer can have better visibility and control over the company's overall cash position, making it easier to manage cash flow and allocate funds where they are needed most. Achieving this, however, is not always easy. Companies that maintain operations around the world can face a host of challenges when moving funds from a subsidiary account to a main account – especially when these accounts are held in different currencies. This was the challenge faced by Valentino Korea.

For Valentino’s customers, the retail experience in Korea was simple: they could peruse Valentino’s expansive fashion offering – in person or online – and seamlessly make their purchase. Behind the scenes, however, the treasury operations that facilitated these purchases was not as straightforward.

At the start of the retail process, Valentino Korea acquires goods from the Valentino headquarters in Italy to sell onshore in Korea. Naturally, Valentino Korea sells in Korean Won and, in turn, pays back to Valentino’s headquarters in Euros. The underlying FX process used to facilitate these international payments was – until recently – inefficient and time-consuming.

When Valentino Korea needed to pay the invoices from its headquarters in Italy for the goods it sold locally, it first had to manually exchange the Korean Won for Euros, such that it could send a wire transfer to Italy. This process involved getting in contact with the bank, sending over the relevant documentation, and negotiating an exchange rate using spot. All of this had to be completed before Valentino Korea could even start preparing the transfer.

Driving efficiencies through virtualisation

Valentino, with the help of Deutsche Bank, transformed its FX operations in Korea by implementing a new workflow solution. This involved setting up a virtual account in Korea for its headquarters – eradicating the need for a manual transfer between Korea and Italy.

“Thanks to this new solution we could gain precious time, increase efficiency and facilitate the whole workflow”

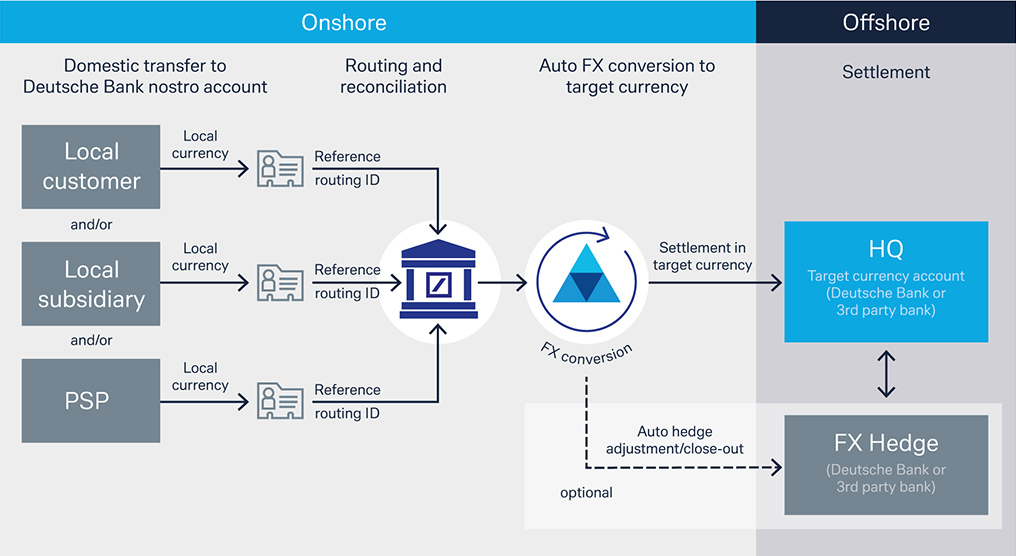

Under the new workflow, Valentino Korea now pays the virtual account in Korean Won, which is then automatically converted into Euros before being sent on to Valentino’s master account in Italy. This means that whenever Valentino Korea needs to send money to its headquarters, it is now classified as a domestic wire transfer, with the payment moving from Valentino Korea’s onshore account to Valentino’s virtual onshore account (see Figure 1).

Figure 1: Valentino’s workflow solution

Source: Deutsche Bank

One of the key benefits of this approach the reduced amount of time spent on the transfer. In the previous model, there were a lot of moving parts – and the new solution has greatly simplified this.

“We were able to implement an accountless solution for Valentino based on a virtual account”

“Adopting an accountless system, with an integrated FX workflow, has allowed us not only to be time efficient regarding negotiations with the bank, but also in terms of submitting documentation,” explains Antonio Deluca, Treasury Manager at Valentino. “The new solution allows the documentation to simply be uploaded via email. Not to mention that, given that the payment is now domestic as opposed to international, the whole solution is far more cost-effective.”

He adds, “Putting together the relevant documentation was a laborious and costly process. Thanks to this new solution we could gain precious time, increase efficiency and facilitate the whole workflow.”

A key aim for treasurers today is also to try and keep the number of current accounts as low as possible. Opening an account requires a lot of effort both in terms of costs and maintenance – with ongoing due diligence, monitoring, auditing, and statements just a few of the many factors to consider.

“To avoid the additional effort involved in setting up and maintaining an onshore account, we were able to implement an accountless solution for Valentino based on a virtual account,” says Gudrun Bieche, Cash Management Sales, Deutsche Bank. “The incorporation of our FX4Cash solution also means that Valentino has a pre-agreed pricing set up for its automatic FX conversion – meaning they no longer rely on converting at spot, which gives them much more certainty and control over costs.”

Going forward, the solution is scalable should Valentino decide to take a similar approach for other restricted currencies in other geographies. Furthermore, if Valentino decides to hedge its projected cash flows in Korea, hedges may automatically be adjusted if the local receipt date and hedge date do not match. This process can be enabled on top of the current one to achieve an operationally efficient end-to-end workflow for a challenging market from a time zone and currency perspective.

Deutsche Bank’s accountless solution won a Highly Commended Best Foreign Exchange Solution Award at the Adam Smith Treasury Awards 2023

Valentino’s Hyundai Pangyo boutique following a relocation reopening. © Valentino

Sources

1 See voguebusiness.com

2 See the flow case studies of Siemens, Roche and home24 where virtual accounts tackled the problem