19 January 2023

In the first Asia Corporate Newsletter of 2023, Deutsche Bank Research Strategist Mallika Sachdeva reflects on key economic pivots underway in Asia – China’s scrapping of its zero-Covid policy and the Bank of Japan’s initial steps to exiting ultra-easy monetary policy. She also shares insights on the impact of all of this on Deutsche Bank’s currency and commodities views and what this means for corporates’ FX and raw materials hedging strategies

MINUTES min read

In July 2022, Deutsche Bank Research launched the Asia Corporate Newsletter offering our Asia market views for corporates. Presented in the form of a chartbook, the Newsletter identifies the market environment corporates are likely to face in the coming quarter and touches on longer-term themes that could impact their businesses.

As we begin the year, our Q1 2023 Newsletter, entitled From high to long jump, reflects on the global backdrop of resurgent inflation, the economic policy pivots in Asia, a likely sustained downturn in the dollar, and what this means for corporates doing business in the region. This article provides an overview of the key conclusions.

The global backdrop

The path after peak inflation

Developed markets inflation looks set to be peaking – albeit at uncomfortably high levels. This should be supported by prospects of reversal in key global supply shocks as China re-opens from its zero-Covid-19 policy and Europe’s gas supplies improve. However, developed markets central banks are likely to push back against any immediate signs of easing – as this could complicate efforts to restore price stability. Deutsche Bank Research expects the Federal Reserve (the Fed) to take rates to 5.1% and for the European Central Bank (ECB) to peak at 3.25% both in May 2023, with a Fed reversal beginning in Q4 2023 in response to a mid-year recession in the US, with 200bps of cuts through mid-2024.

“China and Japan have surprised us with much faster policy pivots than earlier envisaged”

Although world growth is forecast to slow to around 2% for 2023 (a rate associated with global recession), a shallower recession or one not accompanied by labour market weakness could challenge the anticipated reversal in monetary policy tightening. But despite all this, the global backdrop at present suggests a “friendlier” outcome for Asia than appeared likely in 2022.

Eastern pivots

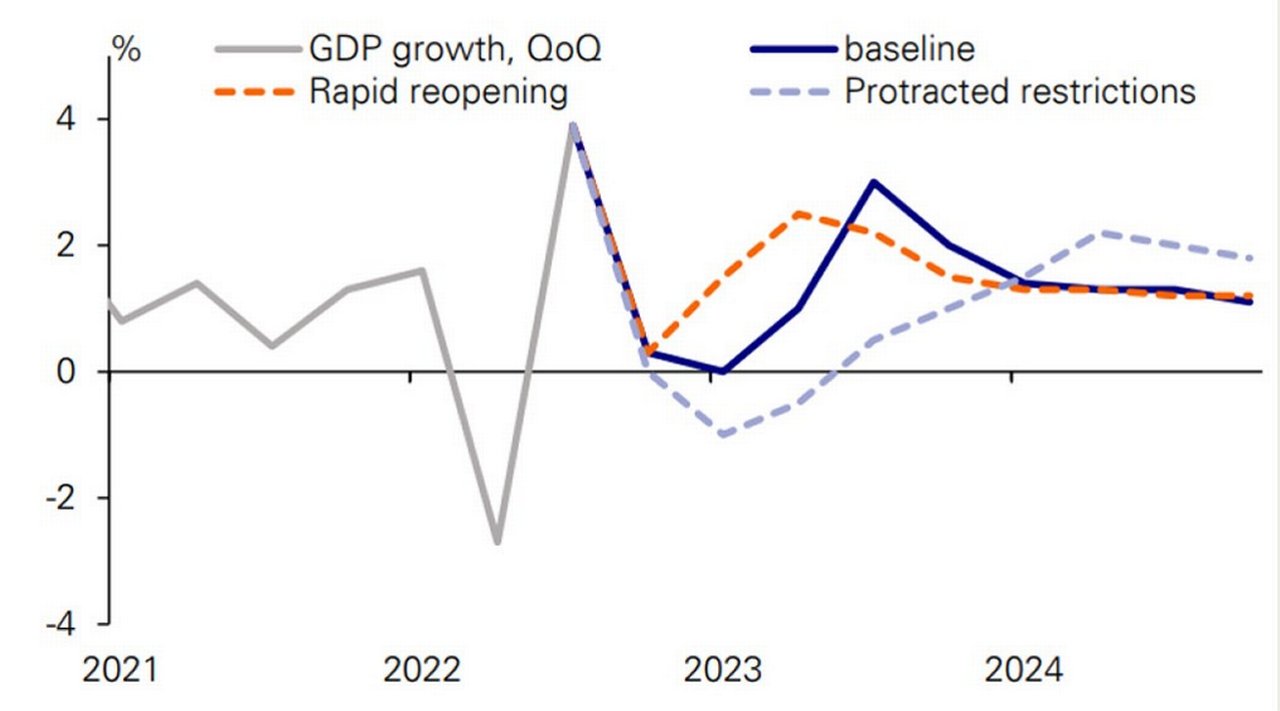

Figure 1: China’s rapid re-opening could see surprise upside growth

Sources: Deutsche Bank, Bloomberg Finance LP, CEIC, Haver Analytics

Although the Fed and the ECB engaged in significant monetary tightening in 2022, China and Japan remained big pillars of monetary easing last year. We believe this contributed to more tentative tightening from other Asian central banks over the past year, and a weakening environment for Asian FX as a result.

But China and Japan have now surprised us with much faster policy pivots than earlier envisaged. China has completely dismantled three years of zero-Covid policies in less than two months (see Figure 1), while in December the Bank of Japan (BoJ) embarked on what could be a first step in exiting from close to a decade of extraordinarily easy monetary policy.

The dollar is heading lower

The combination of China’s re-opening and the improved European energy situation should reduce the safe-haven premium underpinning USD. As confidence grows in the scenario of inflation peaking, we could see EUR/USD rising to 1.15 over the course of 2023. Further tailwinds would come from:

- A narrowing of Fed-ECB rate differentials and a structurally easier fiscal policy in Europe.

- Improvement in Europe’s basic balances given lower energy imports and a drop-off in bond outflows from Europe.

- Beta to China re-opening and global growth cycle (potential volatility and risk).

- Large cash positions in an over-valued dollar.

In addition, we are bullish on the JPY with scope for further adjustment to BoJ policy, a positive outlook on external balances for Japan, with, in our view, plenty of headroom for Japanese investors to raise hedge ratios on their USD asset holdings and to repatriate record levels of USD cash balances.

Recommendation: Currency hedges for USD weakness

Our recommendations to start 2023 have a large focus on FX hedges. Valuation signals advocate holding medium-term short USD hedges as the theme of dollar weakness is likely to remain in focus.

USD/Asia forward points are still historically low, but the closure of valuation gaps should exceed the cost of hedging: we see USD/JPY moving down to 120 by the end of 2023. While the risk-reward has shifted to hedging USD/Asia weakness, we think corporates should consider higher EUR/Asia hedges given our forecasts for significant EUR strength in the long term.

We think the RMB could strengthen further, but gains will be moderated by fundamental and macroprudential constraints. We expect a narrower trade surplus in China as imports rise, a wider tourism deficit as outbound travel resumes, and increased capital outflows to all contain scope for CNY gains. We also expect the removal of the 20% reserve requirement on USD forward purchases onshore.

On the financing side, while the decline in USD rates and credit spreads could revive interest in USD funding, we still see Samurai (JPY) and Panda (CNY) funding as sound options. We also recommend that corporates consider hedges for raw materials costs, particularly base metals. This could be more important to managing costs than FX this year.

Raw material metal costs on the rise

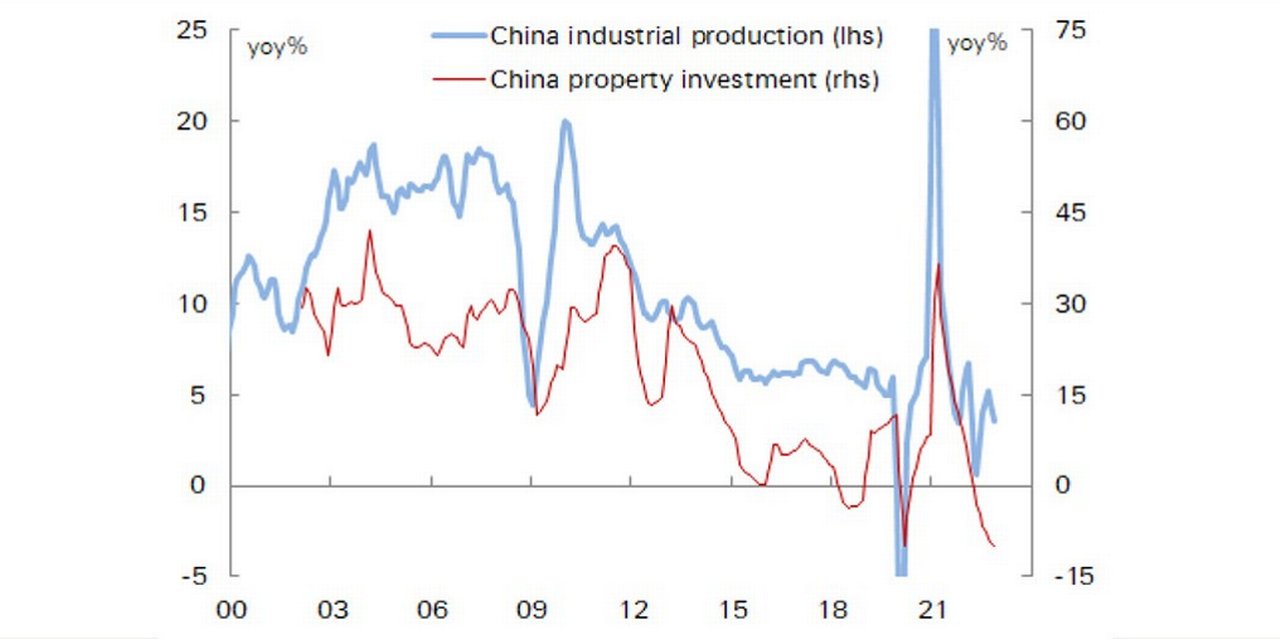

Figure 2: China’s industrial production growth has rarely been so low – a pick up should help metals

Source: Deutsche Bank, Bloomberg Finance LP

A key theme in this Newsletter is the impact of China’s post-Covid-19 re-opening; the government having lifted restrictions much sooner than expected. The recovery in Chinese consumer demand is likely to drive increased inter-Asia trade flow, particularly from countries that export durable goods to China, and also increased tourism spending in Asian economies as Chinese travel resumes. Countries such as South Korea, Thailand and Malaysia could be big beneficiaries.

China’s re-opening is also coming alongside a significant loosening in property market policies, which should revive demand for housing and property investment. This is likely to boost demand for commodities.

China is a huge consumer of metals – taking half or more of global supply for many types. In contrast, energy commodities tend to be driven by US/European developments. While 2022 was about soaring energy costs as the Russia/Ukraine conflict erupted, 2023 could see a rotation towards base metals strength as China re-opening boosts industrial and investment activity from a very low base (see Figure 2).

Corporates may thus find it worthwhile to hedge against higher base metals prices to manage import costs.

Further information on the outlook for industrial metals can be found in Deutsche Bank Research Commodities Outlook, Green shoots for base and precious metals (10 January 2023). The authors note, “With base metals having a higher correlation with China GDP than the OECD, China reopening should be a key support factor, and we assume higher Q2 copper prices before new supply-led price easing in H2. We expect aluminium prices to remain range bound through the early part of this year, followed by a moderate lift in Q2 as demand in China and Europe begins to recover – although a lift in smelter production from around the middle of the year may cap prices through H2.”

Another significant development to watch on the commodities side will be the increased adoption of the RMB for the pricing and settlement of energy and fertilisers trade. We see cross-border settlement in RMB growing at 10–15% over the next five years.

The long jump over the year ahead could, on reflection, prove every bit as challenging as the high jump of 2022.

Deutsche Bank Research reports referenced

Asia Corporate Newsletter Q1 2023: From high to long jump by Mallika Sachdeva, Sameer Goel, Linan Liu, Perry Kojodjojo, Bryant Xu, Time Baker and Joey Chung (January 2023)

Commodities Outlook, Green shoots for base and precious metals by Liam Fitzpatrick, Alan Ruskin, Michael Hseuh, Bastian Synagowitz, Abhi Agarwal, Corinne Blanchard, and Edward Goldsmith (10 January 2023).

Note: These reports are available to Deutsche Bank Research clients

Mallika Sachdeva

Head of Asia Macro Strategy, Deutsche Bank Research

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print