10 July 2020

With fears of a pandemic second wave and evidence that the first wave is far from over in much of the world, prospects for recovery must adjust to the reality check report flow’s Clarissa Dann and Graham Buck

As the world enters the second half of the most tumultuous year since 1945, any signs of light at the end of the long Covid-19 tunnel have been welcome, and flow has duly reported on them in our Covid-19 Dossier, with articles such as Exiting the Covid-19 ravine (5 June) and Towards a silver lining (3 April).

But, according to the John Hopkins Resource Centre, new coronavirus case data from the US, Latin America and India, indicates the epi-curve has not been flattened and is heading in a worryingly sharp upward direction1. And this is on top of the cumulative 540,000 deaths and 11.6 million cases recorded around the world so far at the time of writing.

Potential recoveries are examined by analysts by region and by sector, all of which follow a range of different variations on a theme of V and “swoosh” shapes – or more pessimistically L-shapes. Determining factors are the number of countries that have:

- Managed to bring down the infection rate and contain the first wave;

- Continue to register a high growth rate of new daily infections and are still going through the first wave; and

- Are now experiencing a second wave of new infections – either localised or more widespread.

However, a look back at earlier predictions and what the third and fourth quarters of 2020 might bring would suggest that the world may need to get used to a new normal; that of living with the virus while we await the arrival of an effective vaccine. ‘V-shaped recovery’ suggests a return to an earlier position – perhaps this is now wishful thinking?

This article provides an update on earlier Deutsche Bank Research predictions and analysis.

Winter is coming…

In their Credit Outlook for H2 2020 paper issued on 1 July, Deutsche Bank strategist Jim Reid and colleagues suggest that while the increased case numbers threaten to stall US re-openings and impact short-term economic activity and market sentiment, some confidence can be gained from evidence that treatment of the virus is improving and the demographics of who is getting infected are also changing for the better.

“Overall, when you throw everything in the mix, lower fatalities as case numbers rise is a positive even if it leads to some economic set-back,” Reid and his team observe. They explain how both the US and other major economies are in the midst of “a rare recession that has seen personal income soar – albeit mostly due to the government”, but the impact is expected to falter by the final quarter of 2020.

“By Q4 economies will hit a limit well below pre-Covid levels as social distancing prevents normality. At the same time a northern hemisphere winter will likely lead to a more indoor life, more caution, and fears over a resurgence of the virus. So at this stage we think you'll see a reversal of Q3’s gains.”

Noting that some voluntary actions to arrest the pace of re-openings has already occurred, the team also suggest that the next US fiscal stimulus package may now arrive earlier than previously expected.

Overall, given that any launch of a vaccine is looking at least a year away, the team reflect, “It is going to be a confusing picture in the northern hemisphere winter as the global economy tries to work out what the best strategy is. Local break-outs are inevitable and while track and trace should prevent them becoming more widespread, it will be tough to live a normal life and economic activity will likely stall well below pre-Covid peaks even if significantly above the March/April lows.”

The decision that economies face is whether to “return more to normal and live with the virus and have less social distancing”. But the team do not think that this decision is likely to be made before the end of the forthcoming winter.

A long road back

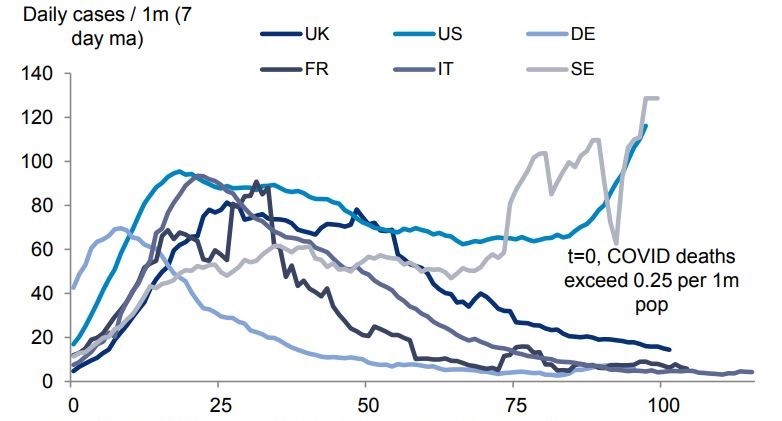

Figure 1: Cases per million have started to see uptick in the US in recent weeks

Source: Deutsche Bank, Bloomberg Finance LP. Note: Data as of June 28th.

"Covid-19 has affected financial markets across every asset class"

In The long road to recovery (30 June), Reid and colleagues Marion Laboure and Henry Allen spell out the depth of the contraction. “Covid-19 has affected financial markets across every asset class and future performance will depend on the path of the pandemic, with downside risks prevalent if a second wave led to further economic turmoil,” they reflect. In particular, they note:

- The global economy is in a severe recession and the team now sees global GDP remaining below its pre-virus levels through most of 2021.

- The US will experience a major contraction – shrinking by -7.1% by the end of 2020

- The Eurozone is among the worst performers, with a -12% contraction. This is the largest since the formation of the Euro Area

- However, the Chinese economy will grow by 1.1% in 2020, but in aggregate, “emerging market economies will contract” over the same period.

- Global activity is unlikely to return to the path predicted before the Covid-19 crisis for many years to come, and is likely to leave permanent scars in several ways.

- In the near term, the team sees inflation remaining low as the ongoing shortfall in aggregate demand relative to declining supply has seen little upward pressure on prices in the quarters ahead – a point made in the earlier article, Covid-19 and inflation (19 May). But, adds, the team, “at some point, the continued expansion and monetisation of these debt levels to new heights will begin to test the assumption that inflation will remain low and stable forever.”

While the behaviour of particular US states may not seem entirely relevant to the wider global economy, there are some useful insights to be drawn from the basic relationship between faster coronavirus case growth and economic performance. The team observes, “The US states with faster case growth are now underperforming economically based on measures of small business activity, restaurant bookings and consumer spending. This new inverse relationship between economic activity and Covid cases is particularly acute for several of the states exhibiting the most troubling trends, including Arizona, Florida, South Carolina and Texas. The lesson is that behavioural changes in response to Covid trends can hinder the economic recovery even if states do not re-impose containment measures.”

In his blog, For the economy, cases matter more than deaths (6 July) Deutsche Bank strategist Robin Winkler spells out the collective responsibility to behave in ways that allow a recovery to happen – “government-imposed restrictions are far less important in driving economic activity than people's voluntary decisions”. He underlines the point that “it is evident from the data that economic activity is slowing in response to accelerating cases and irrespective of the death rate”.

"Economic activity is slowing in response to accelerating cases and irrespective of the death rate"

Trade, exports and protectionism

Another of the virus’s lasting legacies is to strengthen a global trend towards greater protectionism, a point also made by Dr Rebecca Harding in flow’s Trade re-set (26 June) where she talks about the “world’s retreat into protectionism and nationalism”.

“The Covid-19 shock is likely to leave permanent scars with a substantial retrenchment of global goods and services trade for years to come,” warn Deutsche Bank’s Reid and colleagues in The long road to recovery. They predict, “Global value chains could become less attractive and will be curtailed in favour of continental value chains. Pure continental production lines should be less prone to any sort of global crisis and are easier to manage in the event of a crisis.”

One development that was more of a surprise has been China’s trade performance in Q2 2020, where “exports have held up exceptionally well, in fact much stronger than in previous downturns,” despite the worst global recession since World War Two. “But Covid-19 has so far had mixed impact on China's exports, including positive effects on some products such as medical supplies and electronics,” the authors note.

However, overall, the outlook for global trade in the short term remains pretty bleak according to Deutsche Bank’s Chief Economist Stefan Schneider and colleagues in the 26 June report Focus Germany: Sounding out the Q2 GDP slump. They cite a variety of “growth dampening effects” and predicts that “more protectionism, the health situation in many emerging markets, the only gradual recovery in developed economies and repeatedly interrupted global value chains will dominate in the short run”.

Referencing the 2008 Global Financial Crisis and its ensuing “wave of protectionism”, Schneider’s team expect the average growth rate of global trade to be similarly impacted by the pandemic. “We think the subdued gradual recovery will continue with a growth rate of 5% in 2022 and then a growth rate which is close to the new normal average growth of 1.7% p.a. for global trade in goods and 3% p.a. for global trade in goods & services. Both growth rates are assumed to be slightly lower than pre-[pandemic]. From 2012 to 2019 they were 2.2% and 3.3% on annual average.”

Wider concern about the future of multilateral trade and trust between economies remains. “For the WTO, trust is a perishable commodity. If there is too much testing by members of the outer limits of existing rules or taking excursions outside of them, trust deteriorates, and the multilateral trading system becomes less reliable,” said the body’s Deputy Director General Alan Wolff on 26 June.2

"“For the WTO, trust is a perishable commodity”"

A more cautious world

In the Deutsche Bank research paper of 29 June Global Macro Outlook: Virus curve flattening, markets stabilising, slow recovery (29 June), the US team reiterate the point that consumer caution is a significant inhibitor of economic growth – a point made in the earlier article, Consumer caution and Covid-19 (30 April). The US, they note, is an exception to the general rule that richer countries tend to have a larger middle class, while many low and middle income households in the US are more likely to feel the impact of Covid-19, which has cost them their jobs.

A survey by the American Association of Retired Persons (AARP) and Deutsche Bank Global Research finds that 53% of US households report that they have no emergency savings to fall back on; a figure that increases to 56% for the age group 50-59s and to 59% for those in both the 18−29 and 40−49 age groups. Even for US households with annual income of US$150,000 and above, 25% admit that they have no reserve of emergency savings.

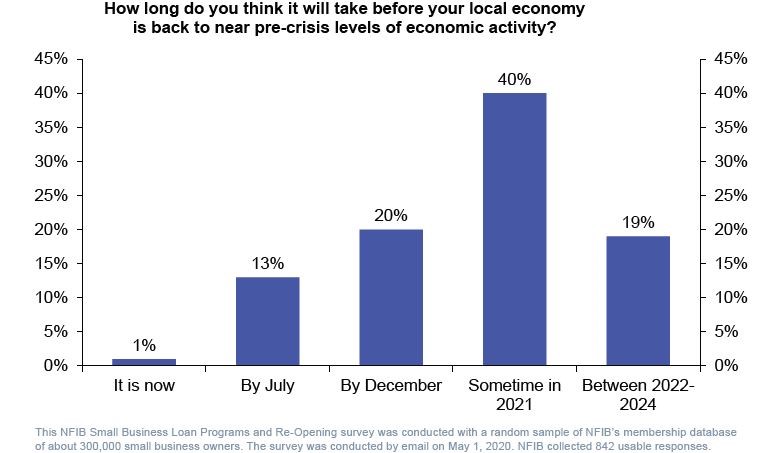

US small businesses are also pessimistic on the prospect of any early return to normal levels of economic activity according to its representative body, the National Federation of Independent Business. As per Figure 2 below, an National Federation of Independent Businesses (NFIB) survey of members at the start of May found two in five firms believe ‘normality’ won’t occur until sometime next year and nearly one in five don’t see it happening before 2022−24.

Figure 2: US small businesses very bearish about the economic outlook

Source: NFIB

Persistent uncertainty

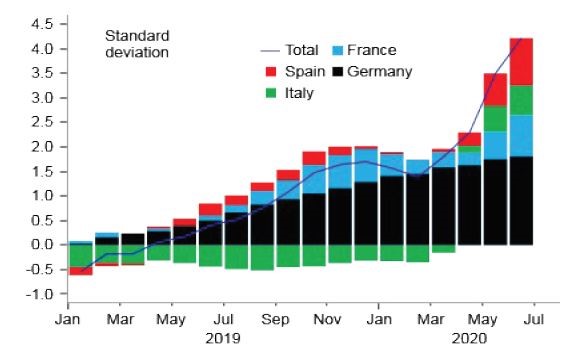

In Europe, the relaxation of lockdown measures in recent weeks has seen a bounce back in economic indicators, note Deutsche Bank Senior Economist Clemente Delucia and Chief Economist Mark Wall in their 2 July Focus Europe paper Uncertainty and the Covid-19 shock, where they measure levels of uncertainty and their correlation with Covid-19.

“Uncertainty is a difficult concept to measure,” they explain. “In the past, we developed our uncertainty indicator, dubbed economy-wide uncertainty indicator, from survey data that capture the dispersion of respondents' opinions on future demand. The more concentrated the responses, the lower the level of uncertainty as respondents tend to have the same expectations for the future.”

The pandemic drove up their economy-wide uncertainty indicators to a record high in May, which suggests that as the Covid-19 shock passes, uncertainty in Europe is set to decline. However, this assumption is undermined by three basic factors:

- Uncertainty is highly persistent. The more it deviates from its long-term average, the longer it takes to return to its pre-shock level. This means that uncertainty could continue to weigh on activity for a while.

- Uncertainty in those sectors that could not operate under stringent social distancing rules — services and retail — is on the rise. With services accounting for 55% of total activity against 17% for manufacturing, where social distancing is less an issue, output could remain subdued for some time.

- The rise in European consumer uncertainty is also a concern. Facing uncertainty regarding the employment outlook and disposable income, households could increase savings rather than spend. In other words, the pent-up demand observed lately could be short-lived – particularly as wage protection schemes and other government measures, such as mortgage holidays, that have helped support household’s disposable income, are approaching their termination dates

Figure 3: Level of euro area economy-wide uncertainty (top four economies)

Source: Deutsche Bank, EC, Macrobond

The report concurs with others that Germany appears to be better managing the Covid-19 shock better than its neighbours. As reflected above in Figure 3 “These results confirm that Spain and Italy are likely to be hardest hit by the pandemic,” it predicts. “France will suffer because its exposure of its economy towards services.”

UK outlook

Finally, in the UK prime minister Boris Johnson recently pledged to “build, build, build” in kick-starting economic recovery, but as Deutsche Bank Research analyst Sanjay Raja noted in his UK Blog of 30 June, the figure of £5bn so far allocated for the task is “underwhelming”. He adds that “the 0.2% of GDP fiscal stimulus pales in comparison to the EU’s Recovery Fund, which is equivalent to around 5% of GDP.”

Raja still believes that “a £10-20bn recovery fund for the remainder of the fiscal year (2020/21) is likely, with our expectations slowly moving to the lower end of our range.” He also paints a brighter picture of the UK deficit for next year as likely to come down from its current post-war highs.

“Positive growth in 2021 will materially bring down the budget deficit (roughly a third of our borrowing downgrade was due to the weaker 2020/21 growth picture).” He makes the point that the UK government plans to unwind most of its most expensive policies as early as October, from the furlough scheme to the self-employed income support scheme (both policies account for more than half of the government's response to tackling Covid-19 at £70bn) as another reason for borrowing to reduce.

“Our current projections have public sector net borrowing (PSNB) dropping to around 7% of GDP next fiscal year, sliding down further to just under 4% by the end of Parliament.”

On 18 June, the Bank of England's Monetary Policy Committee (MPC) left interest rates unchanged at 0.1% and expanded quantitative easing (its bond buying programme) by £100bn to £745bn.3

Living with the virus

While the history of Covid-19 continues to be written, a new normal is evolving and nothing will be quite as it was. As Deutsche Bank’s Jim Reid reflects, “Rapidly rising cases in the US are slowing re-openings (negative) but the death rate is falling (positive). This may eventually give us more faith that we are now better at living with the virus.”

However, this means everyone will need to adapt their day to day behaviour, and The Economist report (4 July)4 ‘The new normal’ sums up the difficulty facing all economies. “Convincing people to change their behaviour in the ways needed to prevent new waves of Covid-19 will rely on people worrying about others as well as themselves.”

New territory indeed.

Summary of Deutsche Bank Research reports referenced

Credit Strategy: IG and HY Strategy – Credit Outlook for H2 2020 (1 July 2020) by Jim Reid, Nick Burns, Michal Jezek, Craig Nicol, Henry Allen and Karthik Nagalingam

For the economy, cases matter more than deaths (6 July 2020) by Robin Winkler

The House View: the long road to recovery (30 June 2020) by Marion Laboure, Henry F. Allen and Jim Reid

Global Macro Outlook: Virus curve flattening, markets stabilizing, slow recovery (29 June 2020) by Torsten Slok

Focus Germany: Sounding out the Q2 GDP slump (26 June 2020) by Stefan Schneider, Sebastian Becker, Barbara Boettcher, Eric Heymann, Kevin Koerner, Jochen Moebert and Marc Schattenberg

Focus Europe: Uncertainty and the Covid-19 shock (2 July 2020) by Clemente Delucia and Mark Wall

UK Blog: Build, build, build: a ‘new deal for investment but bar to disappointment is low (30 June 2020) by Sanjay Raja

Sources

1 See https://bit.ly/2BMaK1Y at jhu.edu

2 See https://bit.ly/3e57f3B at wto.org

3 See https://bit.ly/31UWX3Y at parliament.uk

4 See https://econ.st/300impR at economist.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Macro and markets, Cash management, Trade finance and lending {icon-book}

US-German trade ramps up US-German trade ramps up

As the US overtakes China to become Germany’s top non-European FDI destination, financial journalist Ivan Castano Freeman provides a deep dive into these burgeoning corridors, drawing on insights from Deutsche Bank experts and the German American Chamber of Commerce, Inc. (GACC New York)

Macro and markets, Cash management, Trade finance and lending

Towards a silver lining Towards a silver lining

While the Covid-19 pandemic extends its grip, analysts are already assessing the impact and cost of what could be around US$5trn in fiscal support, and economies taking lessons from the global financial crisis