30 January 2024

While holding the G20 presidency India became both the world’s most populous country and fastest-growing major economy. The Asian superpower is also pushing other boundaries with the Chandrayaan-3 moon landing – only the fourth country to manage this. flow’s Clarissa Dann provides an update on India’s upward growth trajectory and what this means for trade and services

MINUTES min read

On 30 November 2023, India completed its 12-month presidency of the G20. Writing in the UK’s Telegraph newspaper, the country’s Prime Minister Narendra Modi declared this “a moment to reflect, recommit, and rejuvenate the spirit of Vasudhaiva Kutumbakam,” One Earth, One Family, One Future.” Now the country has handed over the G20 presidency to Brazil, this article reminds readers of how it did this through its economic, digital and sustainability achievements, underpinned by strong trading relationships, improved access to finance, and attractiveness to investors.

This article examines India’s economic growth and position as a trading hub, following-up our 2020 update, ‘The five trillion dollar challenge’, which identified the building blocks behind the country’s meteoric rise to economic superstardom. The economic liberalisation that accelerated in the mid-1980s promoted India to a mainstream participant in global trade and foreign direct investment (FDI) flows, all helped by the funding for physical and digital infrastructure. As a result, more than a quarter of a billion Indian citizens were lifted out of poverty in the decade to 2016. It also empowered India’s government in late 2019 to target becoming a US$5trn economic power by the mid-2020s. While the impact of the pandemic set back that accomplishment, India is now the world’s fifth largest economy.1

Beyond US$5trn

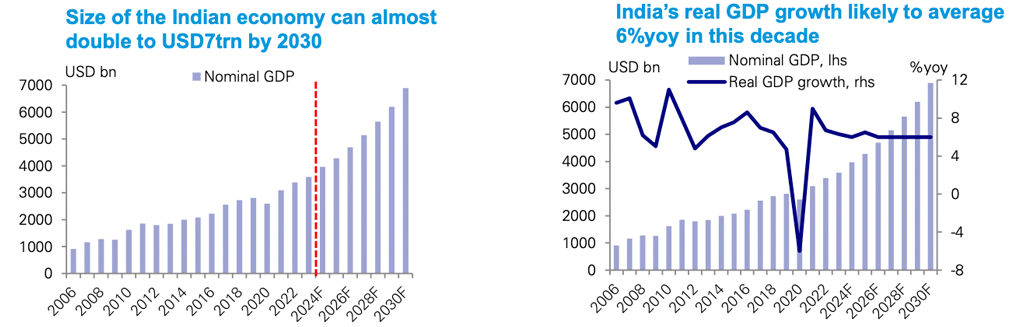

Deutsche Bank Research forecasts show that the Indian economy is set to double to US$7trn by 2030 with per capita income also nearly doubling to US$4,500 over the same period. Kaushik Das – Chief Economist India and South Asia) says, “Even before the end of this decade, India is likely to become the third largest economy by size after the US and China, overtaking Japan and Germany.”2

Figure 1: Economic growth trajectories

India macro outlook for FY 25 and beyond, by Kaushik Das, Deutsche Bank Research

Source: CEIC, Deutsche Bank

The 2022 flow article ‘Gateway to growth’ examined this growth trajectory and its underlying drivers. These include factors such as: India’s resilience, ‘demographic dividend’ and entrepreneurial culture; government efforts promoting privatisation and ‘Smart cities’; and the push for digitalisation and greater financial inclusion. A Deutsche Bank Chief Investment Officer report observed that improved infrastructure has released many women in rural areas from routine tasks, to bring them into the workforce. This, together with the string of reforms that have “increased productivity, reduced subsidy leakage, provided welfare and created opportunities for economic enterprise”, have put India in a position where it will contribute around 22% of the world’s working age population over the next decade “Fingerprinting and iris scanning a billion Indians for the unique national ID card (Aadhaar), linking it to the financially inclusive low-cost bank account (Jan Dhan) and connecting this to a mobile phone number for communication was only the beginning,” says the report.3

Some slowdown in 2025 is anticipated, says Das as momentum moderates from the second half of 2024 because of:

- The lagged impact of monetary policy tightening (through rates, liquidity and macro-prudential norms);

- Intensification of a global growth slowdown;

- The fading of pent-up domestic demand;

- A potential spike in oil prices due to intensifying geo-political concerns; and

- Possible weather-related adverse factors (El Nino remains a key risk).

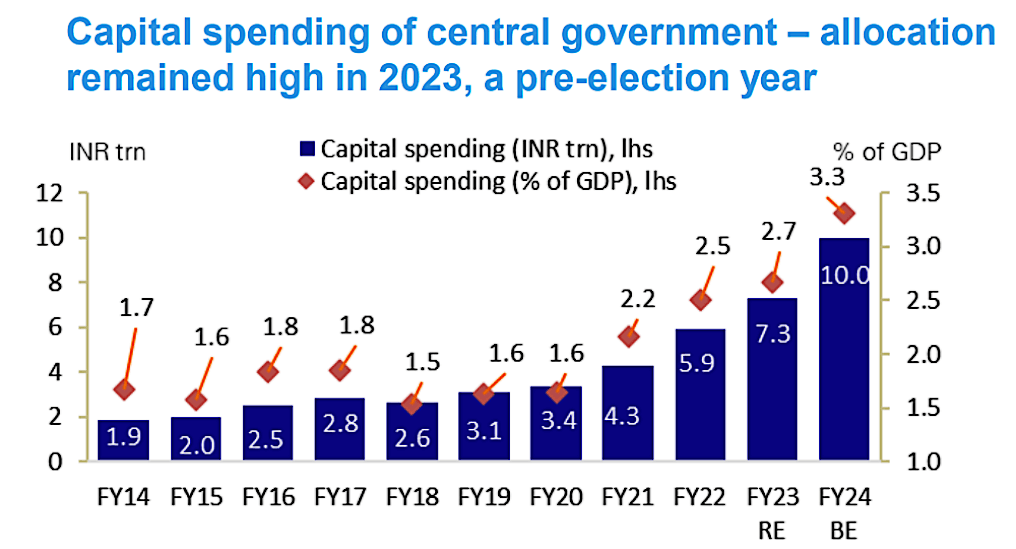

But on the positive side, he adds, the government’s significant push for public investment and any incremental pick-up in private capex investment could help support growth of around 6%. Capital spending remained high in 2023 (see Figure 2).

Figure 2: Central government capital spending

Source: Various budget reports and Deutsche Bank

Key policies and GIFT City

With relative political stability over the short to medium term, - positive for the ongoing reforms agenda and, notes Das, the “structural outlook of the Indian economy” the following government measures are highlighted in his report as being “likely to generate macro dividend over the medium term.”

- Production-linked incentive schemes for the manufacturing sector. This, says India’s Ministry of Commerce and industry, “incentivises domestic production in strategic growth sectors where India has comparative advantage. This includes strengthening domestic manufacturing, forming resilient supply chains, making Indian industries more competitive and boosting the export potential.”4

- Asset monetisation scheme where existing public assets worth Rs.6trn(just over US$80bn) are leased out to private operators for fixed terms. The identified assets are primarily concentrated in roads, railways, power, oil and gas, and telecoms.5

- Insolvency and bankruptcy code. This was enacted in 2016 to consolidate the existing frameworks and guidelines for insolvency and bankruptcy. It aims to resolve the insolvency of corporations, partnerships, and individuals within a certain time period and to balance the interests of creditors and debtors.6

- Goods and services tax (GST). Implemented in July 2017 GST is an indirect tax, which has replaced and simplified the Indian indirect tax regime covering excise duty, VAT, services tax, etc.

- Corporate tax cut. Announced in September 2019, when corporate tax rates were cut from 30% to 22% for domestic companies and from 25% to 15% for new domestic manufacturing companies.7

- Various privatisation and disinvestment initiatives such as the US$2.3bn sale of Air India to Tata Group in October 2021.8

- The Gujarat International Finance Tec-City aka GIFT City, India’s first ‘smart’ city.9

As explained in our 2022 flow article, the core aim of GIFT City is to ‘re-shore’ some of India’s offshore flows. The government and Reserve Bank of India (RBI) want GIFT City to help internationalise the rupee – and for it to serve as an India-based competitor to the existing international financial centres for rupee products – especially rupee derivatives (which are among the most traded contracts globally).10

Section 14 of Deutsche Bank’s guide Namaste India provides a detailed explanation of GIFT City’s development and purpose and explains: “GIFT aspires to cater to India’s large financial services potential by offering global firms the world-class infrastructure and facilities. It is positioned as a gateway for inbound and outbound investments in India. It also aims to attract the top talent in the country by providing the finest quality of life.”

FDI flows

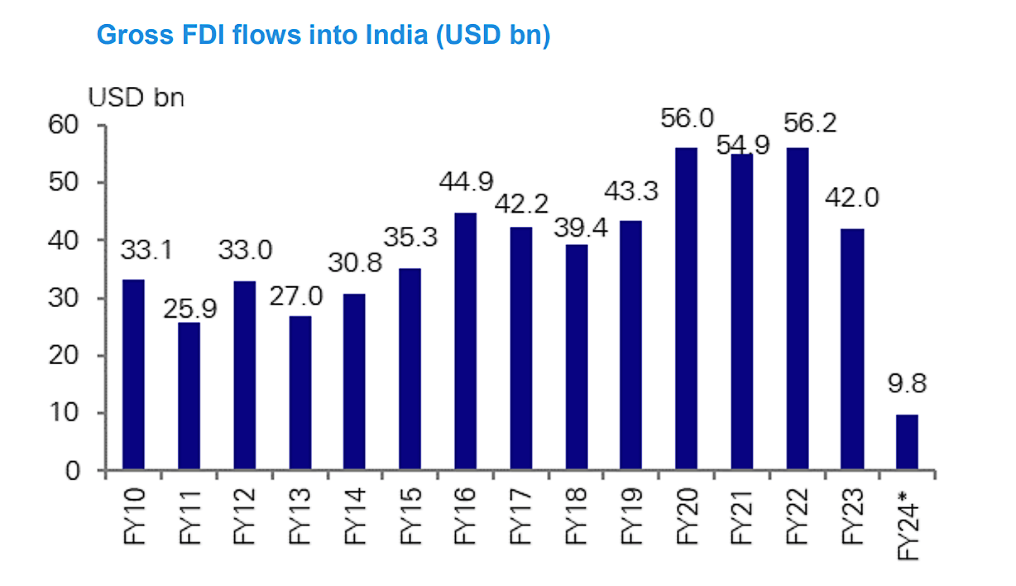

According to the OECD India was the sixth largest recipient of global foreign direct investment (FDI) in 2022 but, while FDI flows have not been impacted by Covid-19 and global markets volatility, momentum eased for FY23 (see Figure 3) with a lacklustre start in 2024. FDI has been (and remains) the key source of financing for India’s current account deficit.

Figure 3: Gross FDI flows into India (US$bn)

Source: RBI, Deutsche Bank. Note 1: Gross FDI flows do not include repatriation / disinvestment proceeds. Note: FY24* refers to Apr-Sep´23.

India’s place in the world

India held the G20’s rotating presidency for the 12 months ended November 2023 and joined the G20 in 1999. Over the year of summits and events in which 15 million Indians had participated, more than 30 Indian cities played host to 100,000 delegates from 125 countries. Prime Minister Narendra Modi’s visits to France and the UAE in July 2023 took his tally to 72 foreign trips since taking office in 2014. Such a focus on putting India on the world’s map has helped most of its citizens believe that their nation’s influence upon the world’s stage has grown.

"India’s rapidly growing smartphone penetration is being used by the government to deliver public services"

In addition, on 23 August 2023, India made history with its Chandrayaan-3 Moon mission, becoming the first country to land a spacecraft near the lunar south pole – joining an elite club of countries to achieve a soft landing on the Moon after the US, the former USSR and China.11

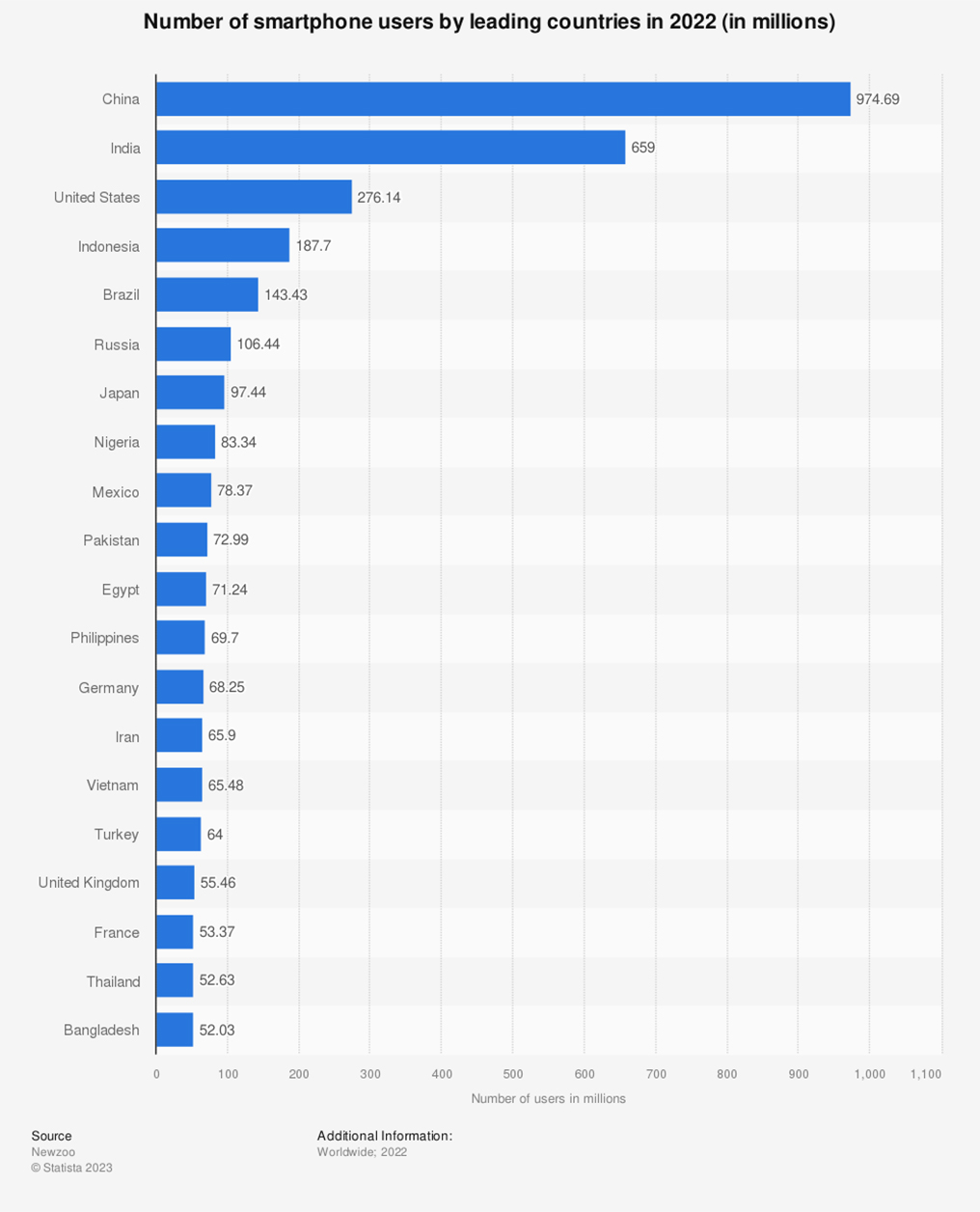

Just as the pace of investment in India’s physical and supply chain infrastructure (both for defensive and growth purposes) has been relentless, so too has that for its digital infrastructure. Rajesh Thakur, Rajesh Thakur, Co-Head of Corporate Bank India and Sri Lanka & Head of Trade Finance, lending & Cash Management, Deutsche Bank, points out that “India’s rapidly growing smartphone penetration is being used by the government to deliver public services and enable digital and financial inclusion” (see Figure 4). Such initiatives leverage payment frameworks such as Unified Payments Interface (UPI) developed by the RBI, and National Payments Corporation of India (NPCI) jointly backed by the RBI and the Indian Banks Association (IBA).

"India’s talented tech-savvy workforce makes scaling digital services easier"

Figure 4: Smartphone adoption in India

In 2023, the penetration rate of smartphone in India reached 71% and was estimated to reach 96% in 2040. In 2022, the volume of smartphone shipments across India was around 144.3 million. And the most popular brand at the end of 2020 was Xiaomi

Source: Statista

“India’s talented tech-savvy workforce makes scaling digital services easier,” notes Shyamal Malhotra, Co-Head of Corporate Bank India and Sri Lanka and Head of Corporate Coverage India, at Deutsche Bank’s Mumbai office. Similar to India’s efforts with GIFT City12 to keep onshore its various FX and other financial flows – Malhotra observes that governments and corporates alike are trying hard to keep onshore the resulting data – the ‘digital gold.’ Recent benefits from this, such as the emergence of embedded finance can be seen in various Deutsche Bank initiatives, such as the development of a QR code-based API-linked real-time incentive system for Bosch’s Indian consumers.

Young man texting a message next to his rickshaw at Jodhpur

Source: istock

Trade flows and sustainability

This focus on being ‘open for business’ has in recent years seen India conclude trade agreements with countries ranging from Argentina and Colombia through to the UAE.13 India is also in the process of inking further deals, including with the UK. Even where India has declined to be a party to a trade deal or association – for example it declined to join the Regional Comprehensive Economic Partnership (RCEP) signed in November 2020 by Asia’s other major economic powers – it has done so to foster import substitution, which has boosted FDI.

Five key items – petroleum products, precious stones, drugs, iron & steel, and telecom instruments – account for almost 37% of India’s total exports, with USA, UAE and China being key export destinations. India's key imports include crude oil, coal, gold, electronic goods, precious stones, and chemicals (these six items account for 51% of its total imports), some of which are used as intermediary products for re-exports, while others are used as finished goods for capital intensive investment. Again, China, UAE and the US are the key countries from which India imports.

Deutsche Bank Research’s Das observes in his Special report: focus on trade relationships (14 September 2023), “The US, Europe and China together constitute 45% of India's total exports while India imports 35% of its total requirement from these three destinations currently. Strikingly, China's trade interlinkage with India has increased significantly over the last two decades. In 2001, India's exports to China were only 1.9% of its total exports vs. about 5.0% currently, while India's imports from China have increased to about 14.0-15.0% vs. 3.0% of total imports in 2001.” The report notes that India’s top five import items sourced mainly from China include:

- Electronic components;

- Computer hardware/peripherals;

- Telecom instruments;

- Organic chemicals; and

- Industrial machinery for dairy, etc.

Several schemes have been announced to reduce India’s dependence on China – albeit Middle Kingdom is an important trading partner as India moves towards developed world status. As Das reflects: “It remains to be seen how much more the import dependency can reduce over the next few years, and more importantly even if India manages to reduce imports from China significantly by way of targeted policy measures, whether other countries would be able to substitute for the reduced quantity within a relatively short period of time.” Thakur adds that “reducing concentration risk is important to India alongside its trading relationship with China – and our trade finance business supports this – as well as the Indo-China corridor trade.” In addition to new trade linkages with Taiwan and the Middle East, many multinational companies (MNCs) are opting for India and Vietnam as their next manufacturing pit stop.

Another area of dependency drawing attention is India’s oil imports from Russia which, Das notes, “have increased sharply due to the steep discount offered.” That aside, he continues, there has been an impact from the “global spillovers of the Russia-Ukraine conflict through the channel of elevated oil prices and sharp interest rate hikes by the Federal Reserve.”14

Sustainability is an opportunity, says Anand Jha, Global Head of Trade Finance Financial Institutions at Deutsche Bank. “According to market research data, securing effective decarbonisation would require India to spend US$7.2trn on green initiatives. This is an enormous sum, but it also implies enormous potential. About 75% of industrial capacity that will exist in India by 2050 is not yet constructed, which offers the chance to build sustainably from the start.” This, he adds, makes it possible for Indian businesses to become global leaders in areas such as green steel, hydrogen, electric mobility, and clean tech, as these are all nascent industries. India is a major exporter of two- and three- wheeled vehicles, so “it could use this position to change to EVs, particularly in markets similar to its own such as Africa, Latin America and Southeast Asia.”

The new supply chain linkages should help India see new capital spending opportunities in private capex space across many industry segments. Roads, renewables, railways, electronics, crude oil, base metals, power & telecom, chemicals, healthcare, logistics and cements are clear leaders in driving this growth. Deutsche Bank, points out Jha, is supporting India’s infrastructure development by “directly financing many corporates and also financing the non-bank financial institutions that lend to this segment.”

Shared service centres and regional treasury hubs

India is the preferred global location for shared services hubs, according to the findings of the Deloitte 2023 Global Shared Services and Outsourcing Survey issued last August. Saurabh Mathur, Partner, Deloitte Touche Tohmatsu India LLP observes, “According to WTO estimates, India is also amongst the world's top exporters of services, doubling its share in global services trade to over 4% in 2022 from 2% percent in 2005. This, backed by survey findings, showcases that shared service centres (SSCs) are going to be at the core of India strengthening its position on the global map, and achieving the country’s services exports target of US$400bn for the current fiscal year.”15

Flows of FDI from MNCs have boosted job creation and upskilling in India, and fostered a wider business ecosystem that drives services-sector growth. Companies such as NTT Data, CMA CGM, and indeed Deutsche Bank itself are among those that have set-up SSCs in India for their global groups.

In addition, Deutsche Bank has been supporting both international and domestic clients including Merck KGaA with FX solutions. As explained in the flow article, Boosting treasury in India, Deutsche Bank worked with Merck to streamline and automate cross-border flows, integrating FX execution and automatic hedging adjustments. The result was a new process which saves the group time, effort, and provides further cost savings through competitive FX rates thanks to a new rule-based automated workflow. It also provided Merck with further data visibility and management capabilities on its cash balances, customs, hedges, and reconciliation.

After the moon

In 2023, India’s moon landing and G20 presidency drew the world’s attention to the investments the government, corporates and their partners have been making. The velocity of its upwards journey will keep all eyes on India both over the coming year and also longer term.

Deutsche Bank reports referenced

India macro outlook for FY25 and beyond, by Kaushik Das, Chief Economist, India, Deutsche Bank Research (4 December 2023)

Namaste India by Deutsche Bank’s Securities Services team. This captures key securities market and regulatory updates in an annual publication

Sources

1 See forbesindia.com

2 See India macro outlook for FY25 and beyond, by Kaushik Das, Deutsche Bank Research, 4 December 2023

3 See deutschewealth.com

4 See pib.gov.in

5 See reuters.com

6 See unacademy.com

7 See bbc.co.uk

8 See livemint.com

9 See giftsez.com

10 See rbi.org.in

11 See bbc.co.uk

12 See Namaste India at corporates.db.com

13 See commerce.gov.in

14 See India macro outlook for FY25 and beyond (see note 2)

15 See deloitte.com