5 July 2023

With the Federal Reserve skipping a rate hike at the June 2023 FOMC meeting following the most aggressive round of tightening since Paul Volcker, maintaining the balance between taming inflation and averting recession continues to be the central macro focus for markets, reflect Deutsche Bank Research economists

MINUTES min read

In our 2022 flow US Regional Focus, we noted how Fed rate hikes that spring demonstrated that the monetary policy stance was quickly adjusting to the new reality of persistently high inflation, but “the risk of tipping the US economy into recession” was ever present.

A year later, not much has changed. On 23 June 2023, US Treasury Secretary Janet Yellen said in an interview with Bloomberg News that the US recession risk is “downgraded”.1 However, Deutsche Bank Research has argued over the past two to three years that “the US is heading for its first genuine policy-led boom-bust cycle in at least four decades”. At the time of writing, this remains the house view.

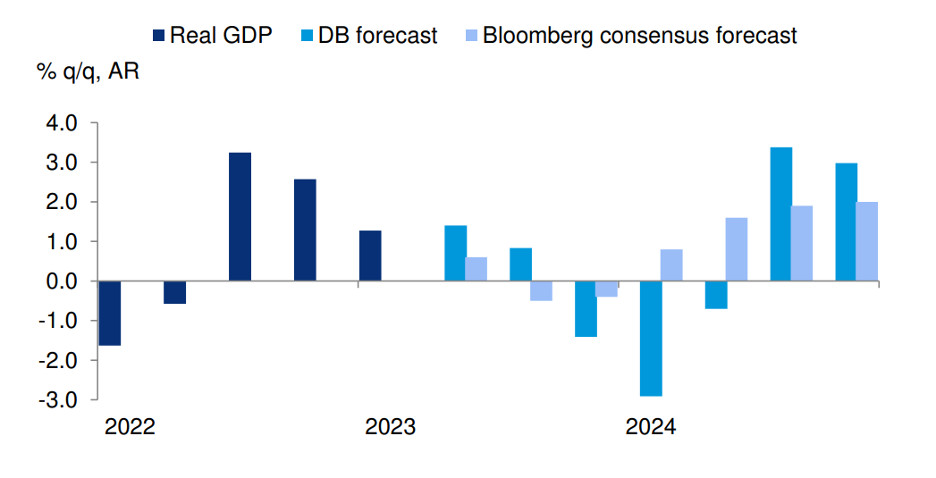

Figure 1: Deutsche Bank continues to see a later and somewhat deeper recession than consensus

Source: BEA, Haver Analytics, Bloomberg Finance LP, Deutsche Bank

In their 5 June World Outlook, Deutsche Bank Head of Global Economics and Thematic Research Jim Reid and Group Chief Economist David Folkerts-Landau point out that this was initially evident in the Fed allowing a surge in the money supply over 2020–21, “which, if you had any monetarist sympathies, was likely to lead to high inflation. Since the strong demand underlying this inflation was induced by expansive fiscal and monetary policy, it seemed inevitable that an aggressive cycle of rate hikes would be needed to deal with it.”

While progress towards lower inflation can be seen in core goods, housing, and repaired supply chains that have helped reduce prices for household furnishing, new vehicles and vehicle parts, it will be “a long time until the Fed has peace of mind”, the Americas Deutsche Bank Research team said in a follow-up report published 16 June 2023.

With recession looming, an increasing focus has been on the timing and extent of future rate cuts. “If the economic outlook evolves as we now anticipate, with the unemployment rate around 4% by Q4 2023 and 4.5% by Q1 2023, we now see the Fed cutting rates in March 2024, one meeting later than our previous expectation. We then see the Fed undertaking 275 basis points (bps) of cuts over the year, coming primarily through 50bps increments,” the team notes.

“The labour market in the US is the tightest it has been”

Tight labour market

“In Q4 of 2019, we had an unemployment rate of 3.5 to 3.8%, but core inflation of 2%,” reflected Brett Ryan, Senior Economist at Deutsche Bank Research, on Trade Finance TV (November 2022).2 “But the pandemic precipitated a huge influx of fiscal stimulus at a time when there was maximum monetary policy. Trillions of dollars given to consumers accounted for all the goods spending in 2021, and brought huge supply chain issues and shipping costs – causing inflation.” He added that “the labour market in the US is the tightest it has been”.

“When you are re-opening an entire economy all at once, with everyone scrambling for the same person – restaurants all trying to hire the same kitchen staff, waiters and bartenders – this bids up the prices for labour,” added Ryan. “While supply chain issues have started to recede, services prices are picking up a lot. This is a problem for central banks, and that’s why we are seeing outsize interest rate moves.”

The June 2023 World Outlook report highlights how the US labour market has “continued to outperform and remains historically tight on many metrics”. The unemployment rate has returned to near five-decade lows, and alternative measures of labour market slack, such as the job openings-unemployed ratio and the quits rate, are generally tighter than they were pre-pandemic, though both have demonstrated progress in correcting.

The imbalances in the labour market are being driven both by elevated demand and constrained supply, mostly among the 55-plus age group, and a lack of immigration, the US Deutsche Bank Research team notes. They add that, while some progress has been made on bringing the labour market into better balance and reducing inflation, both remain far from the Fed’s objectives. “This reality has led to the Fed continuing to raise rates even in the face of banking sector stresses.”The tightrope of taming inflation while avoiding recession looks set to be with us for some time.

Deutsche Bank Research reports referenced

World Outlook: the waiting game (5 June 2023) by Jim Reid and David Folkerts-Landau, with Matthew Luzzetti and the US Deutsche Bank Research team providing the US sections

US Inflation Outlook: Progress is more than a feeling, but a long time until the Fed has peace of mind (16 June 2022) by Justin Weidner, Matthew Luzzetti, Brett Ryan, Amy Yang and Suvir Ranjan, Deutsche Bank Research

Corporate Bank solutions Explore more

Find out more about our Corporate Bank solutions

solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

TRADE FINANCE, MACRO AND MARKETS {icon-book}

Latin America’s resurgence Latin America’s resurgence

Despite political upheavals, Latin America is enjoying renewed growth, as firms shore up supply chains with nearshoring and mitigate currency volatility and inflation. LatAm correspondent Ivan Castano Freeman reports for flow

Trade finance TV

Trade and Inflation Trade and Inflation

Resurgent inflation appears firmly bedded in for now and rising energy and food prices have impacted the cost of living in both developed and emerging economies. What is this doing to trade? How are governments responding?

MACRO AND MARKETS

US economy: timing is all US economy: timing is all

Federal Reserve chair Jerome Powell plans to start tapering off its asset purchase policy as the US economy recovers. But to what extent is the Delta variant of Covid-19 undermining this strategy? flow’s Graham Buck reports