16 November 2023

In the second part of their 2023 three-part series on The Future of Money, Deutsche Bank Research analysts Marion Laboure and Cassidy Ainsworth-Grace revisit the stellar rise of central bank digital currencies (CBDCs). flow’s Clarissa Dann provides a summary of their key findings

MINUTES min read

According to the Deutsche Bank Research dbDIG proprietary survey conducted in September 2023, one in five consumers believe that CBDCs will become mainstream. “We have no doubt: the question is no longer if but when the CBDC economic rocket will take off,” reflect Deutsche Bank Research analysts Marion Laboure and Cassidy Ainsworth-Grace in the second report from their three-part series, The Future of Money, entitled CBDCs: The Economic Rocket Takes Off.

Almost three years ago, the flow article “Digital currencies, differing motives” reported that only around 35 of the world’s central banks had embarked on initiatives to develop their own CBDCs. With the Covid-19 pandemic having added impetus to the trend – that number has now grown to 130, with several countries having already launched a CBDC.

Laboure and Ainsworth-Grace have identified the sea change that saw central banks move to an increasingly positive view of CBDCs occurring towards the end of 2018. Earlier in 2023, in the flow article “Digital currencies: the ultimate soft power?”, the duo considered whether the acceleration of CBDCs over the past five years owed much to their emergence as a soft power tool at a time of geopolitical volatility.

“The question is no longer if but when the CBDC economic rocket will take off”

Current position

Emerging economies are leading the race, with four live retail CBDCs. The Chinese government has also made significant efforts to promote its CBDC. Advanced economies are making progress –in October, the European Central Bank (ECB) has provided the green light to proceed with the next phase of the digital retail euro project, the ‘preparation phase’. While retail CBDC projects are far ahead of wholesale projects, central banks are now speeding up wholesale research – this article provides further information on their progress.

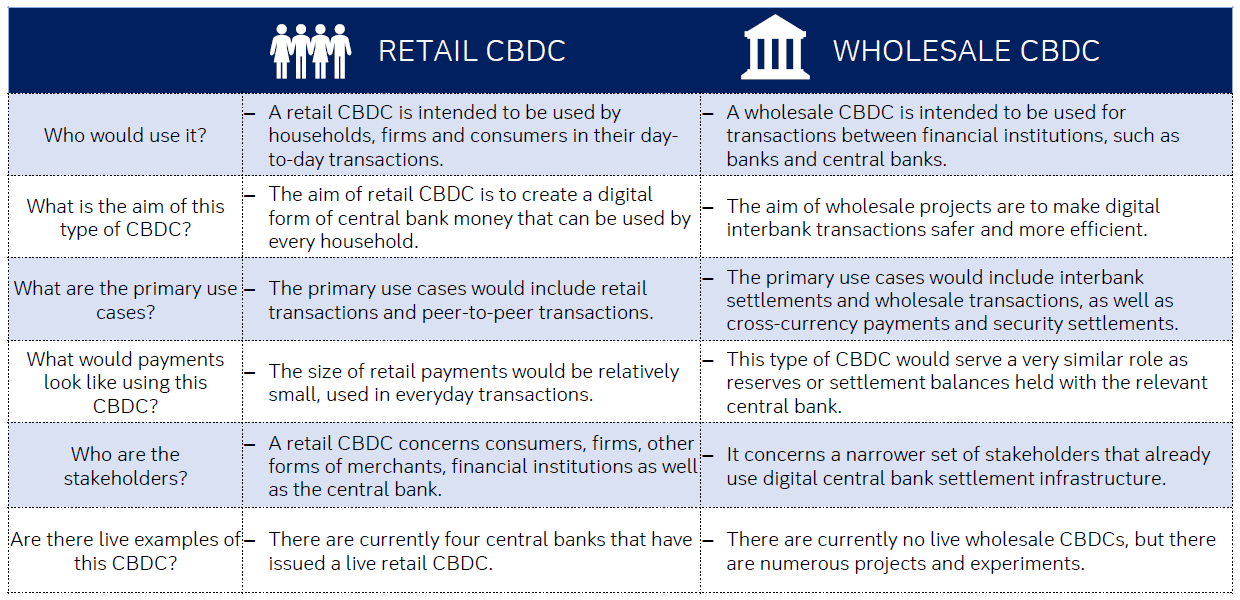

There are two types of CBDC – retail (used by consumers and households in everyday transactions) and wholesale (used by financial institutions and central banks). Figure 1 provides a summary of the main characteristics of each.

Figure 1: The two types of CBDC

Source: Deutsche Bank, Kosse, A. and Mattei, I. (2023), 'Making headway - Results of the 2022 BIS survey on central bank digital currencies and crypto', BIS Papers, No. 136

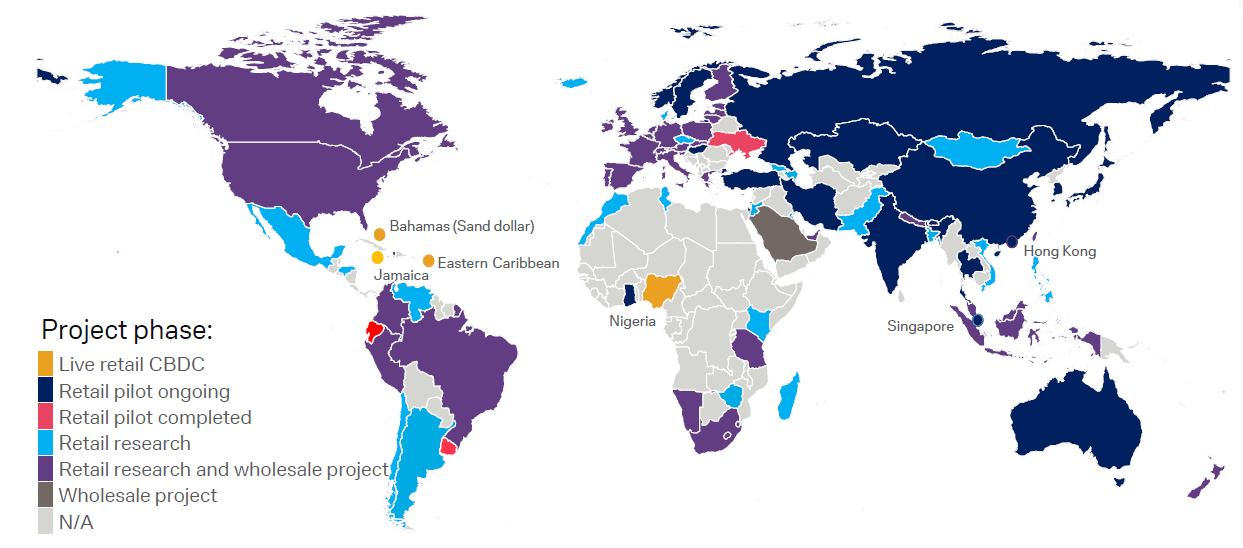

Figure 2 demonstrates how far individual countries have got to with their retail and wholesale CBDC journeys as of July 2023.

Figure 2: CBDC global heatmap

Source: CBDC Tracker, R Auer, G Cornelli and J Frost (2020), "Rise of the central bank digital currencies: drivers, approaches, and technologies", BIS working papers, No 880, August. Updated as of July 2023, latest update by Auer et al (2023)

Retail CBDCs

Rather than the US or Europe blazing the trail, four emerging markets – the Bahamas, Eastern Caribbean, Jamaica, and Nigeria – have been the first to launch live retail CBDCs, helped by these countries’ young demographics, their large unbanked populations, the proliferation of mobile phone usage, and the popularity of peer-to-peer (P2P) payments. But take-up has generally been sluggish. Two years on from Nigeria’s launch of the eNaira, no more than 13 million digital wallets have been opened – an adoption rate of 6% out of a population of 223 million.

The Bahamas was the first country to issue a retail CBDC with the late-2019 pilot of the Sand Dollar. According to Laboure and Ainsworth-Grace, the Bahamas is “an interesting case study due to its strong mobile device penetration and that the Bahamian dollar is pegged to the USD”. Four years on there are ongoing efforts to encourage wider merchant adoption, with a focus on QR code payments, merchant training, promotional giveaways and CBDC ‘ambassadors’.

It has, however, been China that has been setting the pace globally. The world’s second-largest economy is “a prime location for a CBDC experiment due to the dominance of mobile payments,” note Laboure and Ainsworth-Grace. In October 2023 it was reported that the city of Shenzhen, a global tech centre in the Guangdong province, is setting up the country’s first business and industrial park to specifically promote China’s CBDC, the digital yuan (eCNY).

But to date the experiment has not quite met expectations. China is increasingly looking to internationalise the renminbi (RMB) against the backdrop of an economic decoupling with the US and efforts to lessen the dominance of the dollar, the report’s authors explain. This has been driven by:

- Necessity, in response to US readiness to use the USD as a sanction tool after the US froze half of Russia’s foreign exchange reserves in February 2022; and

- Growing confidence in the RMB, assisted by its expansion into key export markets, the e-CNY’s development and the ascension in 2016 of the RMB to the IMF’s Special Drawing Rights reserve basket.1

Data shows that e-CNY in circulation was valued at RMB13.61bn, representing only 0.13% of total RMB in circulation. By June this year, that had only increased to 0.16% of total RMB in circulation, although the month saw transactions using the CBDC hit 1.8trn. But average top-up sizes for e-CNY are a mere US$13, compared to US$9,550 for corporates and governments.

Efforts to widen the appeal and use are likely to continue. “The e-CNY has lent confidence that internationalising the RMB may not require sacrificing monetary sovereignty. With control over design and capabilities to trace transactions, Beijing would have confidence future international transactions will not be vulnerable to US sanctions and large transactions could be monitored,” comment Labore and Ainsworth-Grace. But overall, they reflect, “a fully international yuan is unlikely unless China considers greater freedom for its currency and capital markets”.

Figure 3: Selected CBDCs key dates, 2019-2023 YTD

Source: Deutsche Bank, Financial Times, Bloomberg Finance LP, Reuters, ECB, Bank of England, New York Fed, Bosten Fed

By contrast, the US, the UK and the Eurozone are still some distance behind China. In the US, hopes were raised by Project Hamilton, conducted by the Federal Reserve Bank of Boston and MIT, whose team back in February 2022 demonstrated a system capable of processing 1.7 million transactions per second – 99% of transactions were completed in under a second, and the majority in under 0.5 seconds, with the ability to scale linearly with the addition of more servers.

Project Hamilton concluded that a CBDC can provide additional functionalities, such as supporting cryptographic proofs of payment; more complex transfers; and flexible forms of authorisation. Yet

the Boston Fed pulled the plug last December, after cancelling Phase 2 of its project, in reaction to concerns that a digital dollar would be unsuitable for the US economy, which a legislative inquiry upheld.

Separately, in March 2022, President Biden signed an executive order for the ‘highest urgency’ to be placed on CBDC research and development, but the Federal Reserve has still yet to commit to issuing or further researching a CBDC.

Over in the Eurozone, where cash usage in the EU has fallen from 79% of transactions in 2016 to 59% in 2022, the ECB is well-positioned for a digital euro, which promises to harmonise European payment systems, maintain monetary policy stability and respond to the growth in non-cash payments. On 18 October, the ECB announced: “the next phase of the digital euro project - the preparation phase - will start on 1 November 2023 and will initially last two years”.2

Pending this next phase, as well as the development of a complete, high-level design, plans are for the digital euro:

- To be pan-European with a homogenous user experience;

- Not be completely anonymous, with a suggested compromise that the ECB will not be able to access or see personal payments data;

- Subject to an upper limit of €3,000 to €4,000 for digital euro accounts, to meet a target of total digital euro holdings of €1trn to €1.5trn.

The ECB regards payment service providers (PSPs) are best placed to distribute the digital euro in addition to their current services, note Laboure and Ainsworth-Grace.

In the UK, where cash payments have declined since 2012 from 55% of transactions to 15%, a proposed model for the Bank of England (BoE) digital pound is ready but has not received the green light. It is likely that the digital pound will:

- Not be anonymous, but private;

- Will have the same level of privacy as a bank account;

- Restrict complete access to data to law enforcement only; and

- Be subject to a holding limit of £10,000 to £20,000, so that households can receive income and make larger payments.

A digital pound would also see balances held not with intermediaries, but directly on the BoE ledger so that the central bank is the only institution with access to monies. Users would only have a direct relationship with intermediaries, while digital wallet providers would offer a broader suite of user-friendly features and services and would be required to provide certain minimum functionalities.

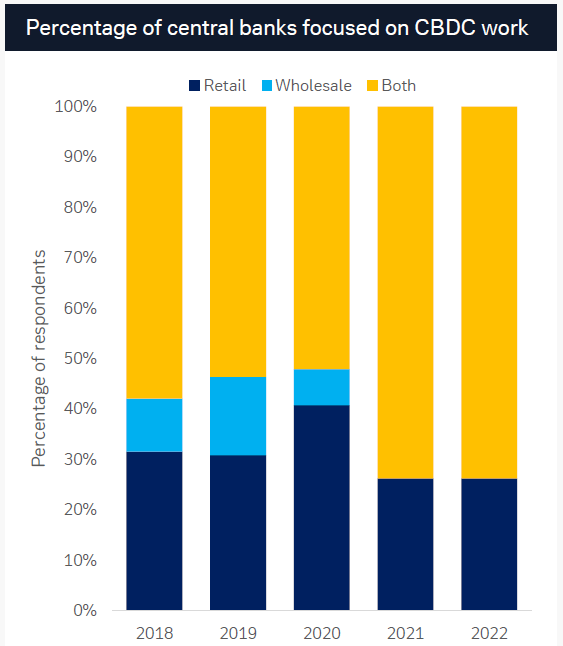

Wholesale CBDCs

While work on retail CBDCs is more advanced than for wholesale CBDCs, more central banks are now focused on developing both, report Laboure and Ainsworth-Grace.

Figure 4: More central banks are focusing on wholesale CBDCs

Source: Deutsche Bank, Federal Reserve Bank of New York and the Monetary Authority of Singapore (2023), 'Project Cedar Phase II x Ubin +', at https://www.newyorkfed.org/medialibrary/media/nyic/project-cedar-phase-two-ubin-report.pdf, Kosse, A, and Mattei, I. (2023), 'Making headway - Results of the 2022 BIS survey on cental bank digital currencies and crypto', BIS Papers, No. 136. How new tech and CBDCs can simplify payments - Deutsche Bank Corporate Flow

Several major experiments to develop a wholesale CBDC are underway. In May 2023, the Federal Reserve Bank of New York and the Monetary Authority of Singapore (MAS) published a joint report on Project Cedar x Ubin+, their wholesale CBDC experiment on cross-border wholesale payments and settlements involving multiple currencies.3

Cedar x Ubin+ tested a multiple wholesale CBDC design, whereby countries and other participants operated their own distinct CBDC network according to their needs. These networks were able to interact due to relying on a shared technical interface/clearing mechanism like an application programming interface (API). It enabled the two central banks to interact and transact with each other without being onboarded to a single network.

This is how it works:

- When a payment leg is initiated, the acting party’s tokens are locked using a hashed secret generated by the other party.

- The second payment leg is initiated on a separate network, similarly locked, and linked to the first.

- The initiating party may then claim the CBDC tokens owed after the secret is revealed – as can the counterparty.

The report findings addressed three pain points: interoperability and autonomy; interlinking of distinct central bank currency ledgers; and providing flexibility in design and operation.

Transactions were only settled if all legs in the cross-currency payment chains were executed successfully, but near real-time settlement was achievable with end-to-end settlement in under 30 seconds. Test simulations resulted in an average of 6.5 payments per second, peaking at 47 payments per second.

In Europe, lead actors are the Banque de France and the European Investment Bank, which have run several wholesale CBDC experiments. France’s central bank reported in July that a CBDC could improve cross-border payments, settlement finality, and security for a vast range of assets. At the start of 2023, the European Investment Bank (EIB) issued its first digital bond in pounds, valued at £50m, via a combination of private and public blockchains.4

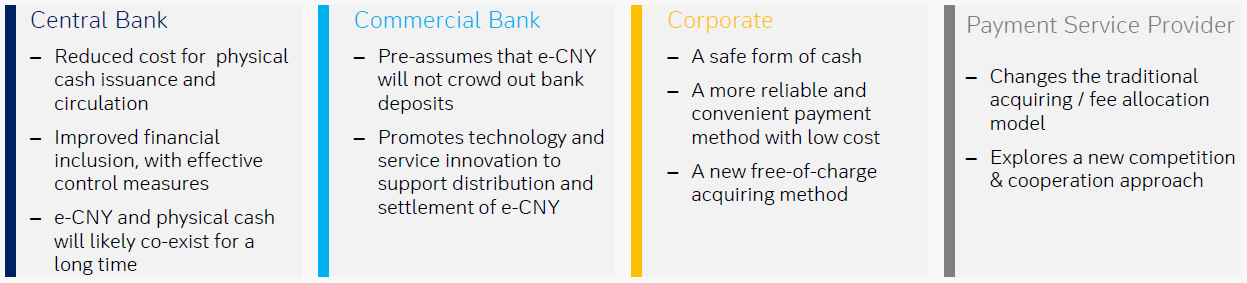

Having decided in only a few years that CBDCs might be a worthwhile concept after all, the authors conclude their report with a synopsis of what the implications are of digital currencies for the banking sector, corporates and payment services providers (see Figures 5 and 6).

Figure 5: Potential implications of digital currencies

Source: Deutsche Bank

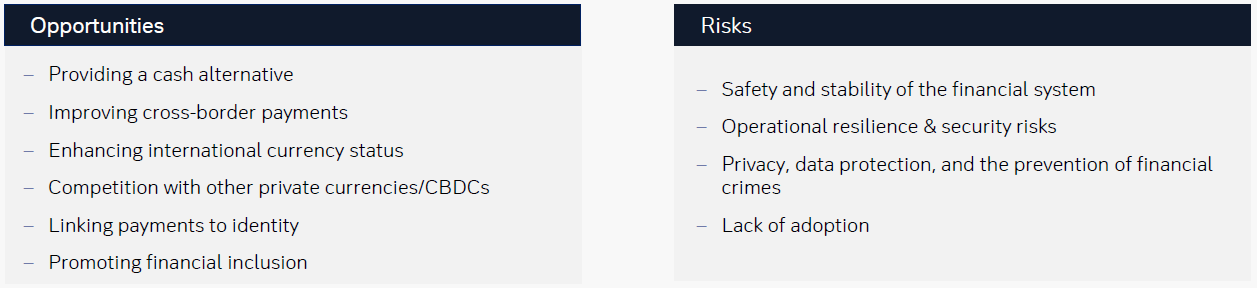

Figure 6: Opportunities and risks of digital currencies

Source: Deutsche Bank

“If CBDCs are designed prudently, they can potentially offer more resilience, more safety, greater availability, and lower costs than private forms of digital money”, said IMF Managing Director Kristalina Georgieva in February 2022.5 Eighteen months later, it is all about adoption and appetite.

Deutsche Bank Research report referenced:

The Future of Money – Part 2. CBDCs: The Economic Rocket Takes Off by Marion Laboure and Cassidy Ainsworth Grace (September 2023)