9 June 2022

Managing cross-border payments and cash in Asia-Pacific presents its own specific challenges. How can CBDCs and AI help to remove frictions? flow summarises the four key learning points from a recent Economist Impact webinar supported by Deutsche Bank

MINUTES min read

As geopolitical risks increase and what were black swan events become more frequent, cash concentration is gaining importance for companies around the world. Access to liquidity has become essential, so treasurers are seeking solutions to avoid the problem of trapped cash. However, implementing fully automated cross border pooling structures is not easy in jurisdictions with cross-border lending requirements and restricting FX regulations – of which Asia-Pacific has many.

So how do new technologies such as artificial intelligence (AI) and application programming interfaces (APIs) help to improve cash and risk management in the region? What role could central bank digital currencies (CBDCs) play towards easing frictions in the cross-border payment space? And how should corporate treasurers prepare for a future when CBDCs might outstrip incumbent digital payment methods?

These questions were discussed in a recent webinar titled “Maximising new-age technology and regulatory developments around CBDCs in APAC”, hosted by The Economist and supported by Deutsche Bank. This article summarises the four key takeaways from the webinar shared by the following speakers:

- Sophie Yang, Regional Treasurer APAC, Henkel

- Xuelin Chen, Director, Group Treasury, Trip.com Group

- Chintan Shah, Managing Director, Head of Cash Management – APAC, Deutsche Bank; and

- Lane Silverman, Treasury Consultant (Moderator)

Sophie Yang, Lane Silverman, Xuelin Chen and Chintan Shah during the webinar (clockwise from upper left)

1. China is ahead of the CBDC curve with companies already testing the eCNY

The past two years have been marked by major steps forward in the development of CBDCs. Between May 2020 and May 2022, the number of countries exploring a digital currency has more than doubled and 87 jurisdictions worldwide are considering the possible introduction of a CBDC.1

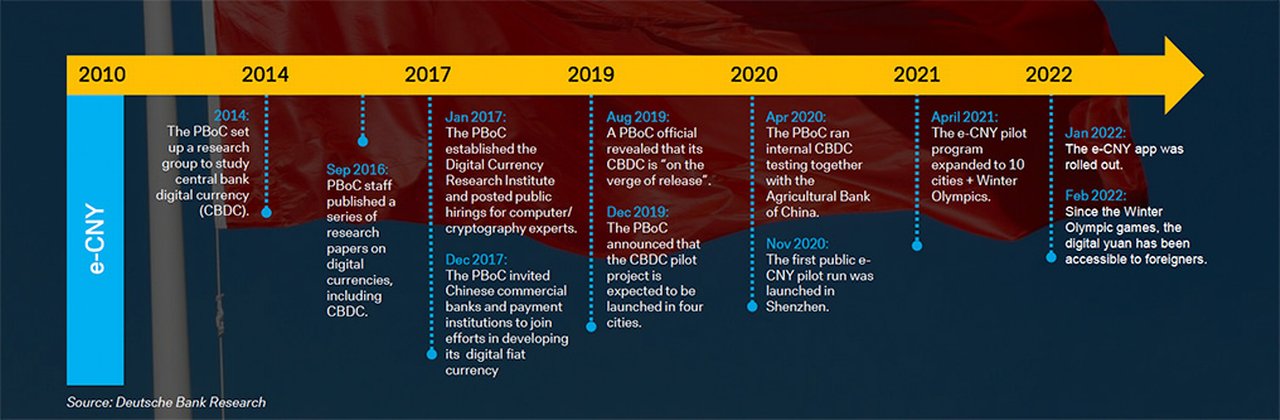

China is undisputedly a frontrunner as the country’s central bank – the People’s Bank of China (PBoC) – started piloting its eCNY back in April 2020 (see Figure 1). At that time, the European Central Bank had yet to begin investigating the launch of digital euro – only in October 2021 did its review finally get underway.2

Figure 1: The digital yuan has been in pilot stage for two years

Source: Deutsche Bank Research, The Future of Money by Marion Laboure, March 2022

China’s leading role in the field of CBDCs was in evidence during the webinar: Trip.com Group – one of the world’s largest online travel agencies operating platforms for booking flights, hotels, trains, car rentals and attraction tickets – already offers its clients the option to pay via digital yuan (eCNY).

The Shanghai-based company was among the corporates chosen by the PBoC to test how the digital currency works in practice, Trip’s head of treasury Xuelin Chen shared during the webinar: “The central bank has made it very clear that the eCNY will, in a first stage, only replace physical cash and coins,” she reported. “Therefore, they were interested in testing it for small purchases like buying tickets for amusement parks.” The cap on eCNY transactions means it is not yet possible for the company’s customers to use eCNY to pay for an entire holiday on Trip.com platforms. So, the digital currency currently accounts for less than 1% of travel agencies’ payment volume.

However, corporates are already keen for a broader adoption of the eCNY, as Henkel’s Sophie Yang outlined. Over the past two years, the Germany-based company has developed digital marketplaces3 for its beauty care and laundry/home care business units.

“We would like to pilot eCNY collection with one of our core distributors”

“Wholesalers can place orders, track delivery status and pay via credit card, Paypal and other e-wallet solutions which allows for an end-to-end shopping experience,” reported Yang, who heads Henkel’s regional treasury centre for APAC in Shanghai. As part of this digitisation strategy, her team is setting up an eCNY wallet with one of its local distributors, who manages an online beauty shop. She added: “Going forward, we would like to seek more digital currency use cases in operative transactions.”

Henkel and Trip.com are two of the many companies interesting in exploring CBDC use cases in China: According to a March 2022 Deutsche Bank Research report, The Future of Cash: Central Bank Digital Currencies, 10 million corporate accounts had already been created by the publication date. “With more than 1.4 billion inhabitants, China’s CBDC has the potential to advance digital currencies into the mainstream,” notes the report’s author Marion Laboure, Senior Strategist, Deutsche Bank Research.4

2. CBDCs need to provide benefits comparable to digital wallets, and China’s PBoC could easily push adoption

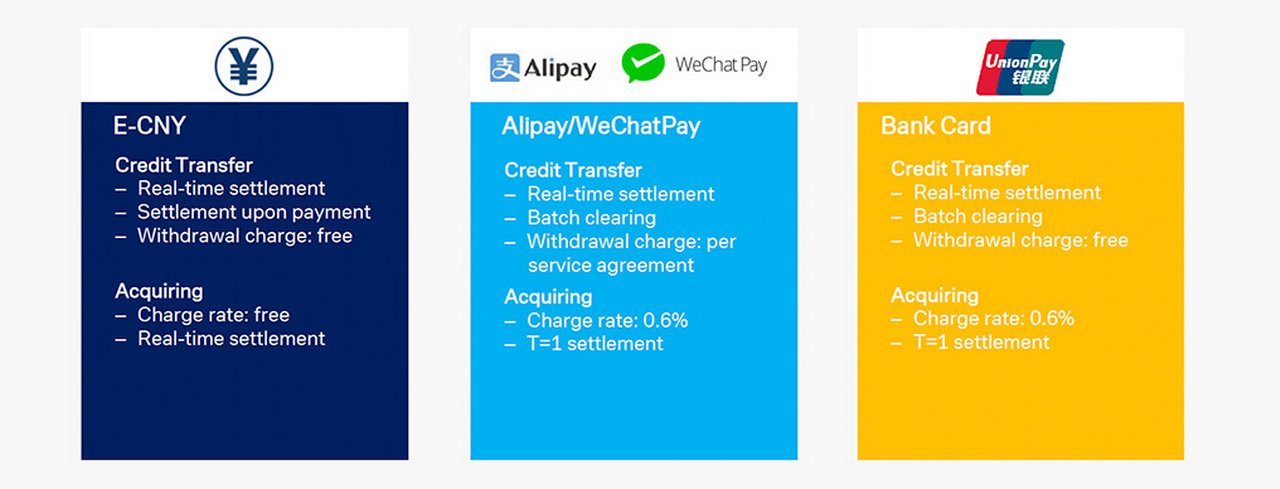

With such a massive pool of potential users, the eCNY could at least partially replace the country’s established payment methods and instruments – principally AliPay, WeChat Pay and the UnionPay bank card. “With the way the eCNY wallet works at the moment, I don’t see any advantage for the consumer to pay with eCNY compared to AliPay, WeChat or any other digital wallet,” said Trip.com’s Xuelin. “But if the PBoC decides to push adoption – which could easily be done by enabling tax or utility bill payments via eCNY – this could change quickly.”

“We believe CBDC could have a network effect in domestic payments much sooner than many people are expecting now”

That developments in Asia can be quick was also noted by Chintan Shah, Head of Cash Management APAC at Deutsche Bank who expects that CBDC could see a “network effect in domestic payments much sooner than many people are expecting now”. He suggested that there are two major benefits in using CBDCs i.e. it combines the safety and stability of fiat money while creating an opportunity to settle real-time 24/7 at a much lower costs than other prevailing retail payment systems.

Figure 2: Digital Yuan in comparison to other payment methods

Source: Deutsche Bank Research, The Future of Money, March 2022

3. Treasurers should familiarise themselves with CBDCs so they can act quickly when development reaches the cross-border B2B payment space

The real challenge to CBDCs however sits in the cross-border payment space. While domestic retail payments can already be managed fast and efficiently by corporate treasurers in APAC, it is in cross-border payments that they would deliver most benefits to companies. This reflects the fact that digital currencies potentially allow for frictionless automation of payment processes – a vision that many treasurers would like to see become reality but that incumbent cross-border payment schemes are not yet able to deliver – despite recent improvements such as SWIFT gpi5 or the upcoming migration to ISO 200226.

“This is why we hope to see more CBDC developments in the B2B cross-border space,” Henkel’s Yang said. Deutsche Bank’s Shah also expects “multilateral CBDC to be a solution for enabling seamless cross-border payments”, however, he added, “multilateral settlement using CBDCs is still in very, very early stages and many design and policy decisions are being discussed by the various authorities.”

“CBDC will become reality for the current generation of corporate treasurers”

Nonetheless, Trip.com’s Xuelin believes that “CBDC will become reality for the current generation of corporate treasurers”, which puts the onus on them to learn about the underlying technology and understand the opportunities and challenges of CBDCs.

4. AI and API technology help companies to automate treasury process end-to-end

While CBDCs are still in their infancy, automating treasury processes needs to be done in a different way – which is why the three panellists turned to the question of how technologies like AI and APIs can help to improve cash and risk management in APAC’s regulated markets.

Yang shared two projects that she is currently working on at Henkel, with her team: One is a new cashflow forecasting tool that the company is developing which is based on AI.

- In a first step, this will incorporate transactions that are already booked in the company’s SAP system and cover a three-month forecasting period.

- The second step will see the cashflow forecast extended to six months via tapping into sales data.

- Third – which is where AI plays a part – Henkel expects to train an algorithm to find patterns in recurring payments like tax, interest and HR to expand the cash flow forecasting to 12 months.

In the other project, Henkel is also enhancing its cross-border cash pool in APAC to repatriate surplus cash to its headquarters in Germany. One example is Korea, a highly regulated market where “we are looking for ways to act within the boundary of the regulation to free up trapped cash”, Yang said. In order to do so, the company is considering a new workflow solution developed by Deutsche Bank, which combines API technology, target balancing and automated FX swaps.

As Deutsche Bank’s Shah shared during the webinar the Henkel project required multiple steps to be taken by the company and the bank:

- Determine which cash position the company wants to hold in a certain regulated country. Every excess amount will then be transferred out of the country to head office or a regional treasury centre.

- Provide the necessary documents to the bank for the purpose of a cross-border payment to be initiated given exchange control regulations.

- Execute Spot FX conversion for the payment.

- Unwind the hedge exposure at HQ level for the underlying payment.

“To reduce friction for such regulated payments, we have introduced an end-to-end workflow solution across liquidity, payments and FX management that can be executed by the bank with a single rule-based execution capability powered by AI and digitisation,” Shah said.

To learn more about how Henkel and Trip.com are embracing AI and APIs in their respective corporate treasury departments, watch the entire webinar here:

Sources

1 See https://bit.ly/3H0PimW at atlanticcouncil.org

2 See https://bit.ly/3xzgpl1 at ecb.europa.eu

3 For more information on how B2B marketplaces change payments and FX flows, read the flow article Digital marketplaces – a gamechanger for payments and treasury

4 For more information on the progress of CBDCs worldwide read the flow article CBDCs: what’s not to love?

5 See https://bit.ly/390vsM3 at flow.db.com

6 See https://bit.ly/3aDgVqj at flow.db.com

Cash management solutions Explore more

Find out more about our Cash management solutions

Stay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

flow case studies, Cash management, Technology

Trip.com’s journey towards a digital treasury Trip.com’s journey towards a digital treasury

The Shanghai-based travel platform Trip.com aims to regain its pre-pandemic growth path. Head of treasury Xuelin Chen tells flow’s Desirée Buchholz about the challenges this creates for her department – and how a project with Deutsche Bank offers both standardisation and digitisation

CASH MANAGEMENT, TECHNOLOGY

Why CBDCs could be a gamechanger for B2B payments Why CBDCs could be a gamechanger for B2B payments

Central bank digital currencies (CBDCs) are gaining traction – but some corporate treasurers are missing a vision for token-based B2B payments, especially in Europe. flow’s Desirée Buchholz hosts a debate on the relevance of digital currencies for companies

CASH MANAGEMENT

Investing strategies in inflationary times Investing strategies in inflationary times

In an Economist Impact webinar supported by Deutsche Bank, two corporate treasurers shared how inflationary pressures are affecting their investment strategies – and why the Covid-19 pandemic is still shaping cash policies. flow summarises the three key learning points