14 August 2020

With a potential five-year trek back to near-normal economic health, the Deutsche Bank Research new World Outlook report has revised upwards projections of three months ago – but much is contingent on good news in 2021 about a vaccine. flow’s Graham Buck and Clarissa Dann report

As the first reported cases of coronavirus at the start of 2020 swiftly escalated into a worldwide pandemic, the global economy was effectively mugged and left it lying in the gutter. As it staggers to its feet and dusts itself down, what is the current prognosis for the victim’s recovery?

Better than expected

The good news from analysts at Deutsche Bank Research in their 5 August report: World outlook: Interim update and longer term projections is that in many countries the recovery from the “Covid-induced plunge in global economic activity” has progressed faster over the summer than the team predicted in their previous report, World Outlook Update: Turning Gloomier (7 May).

In his follow-up video, the Bank’s Global Head of Economic Research, Peter Hooper explains that the update follows Q2 data releases around the world “and some important developments on the vaccine front”.1

“Across most areas of the globe recovery from historic economic disruptions have been progressing somewhat faster than we had anticipated in our last report,” he reflects, highlighting Asia and some parts of Europe where “management of the pandemic has proceeded better than anticipated and supportive fiscal policies exceeded our expectations”.

While the US is “an exception to the improving trend” because of the continued spread of the virus and heightened uncertainty about the “ultimate size of the next US fiscal package”, the setbacks to its economic activity, he adds “have not been a severe as feared”.

The 5 August World outlook revises upwards the May forecasts for 2020 growth in many regions of the world. Global growth is now seen at -4-1/2% this year, about 1-1/2%pts stronger than projected three months ago.

The downside of a quicker recovery this year, explains the team, is that it “takes some steam out of our projection for growth in the first half of 2021” and they also stress that a recent resurgence of new Covid-19 cases in several countries underline the near-term challenges ahead, particularly over the winter months when social activity moves indoors.

On a more positive note, the team has also become more hopeful on expectations for mass vaccinations against Covid-19, which it now believes could be well underway by the middle of 2021 to give “the second half of the year a lift and leaves global growth for the year about in line with our earlier projection in the vicinity of 5-1/2%.”

"We see world growth gradually slowing at above trend rates as unemployment gradually returns to pre-virus norms by 2024−25"

No old normal

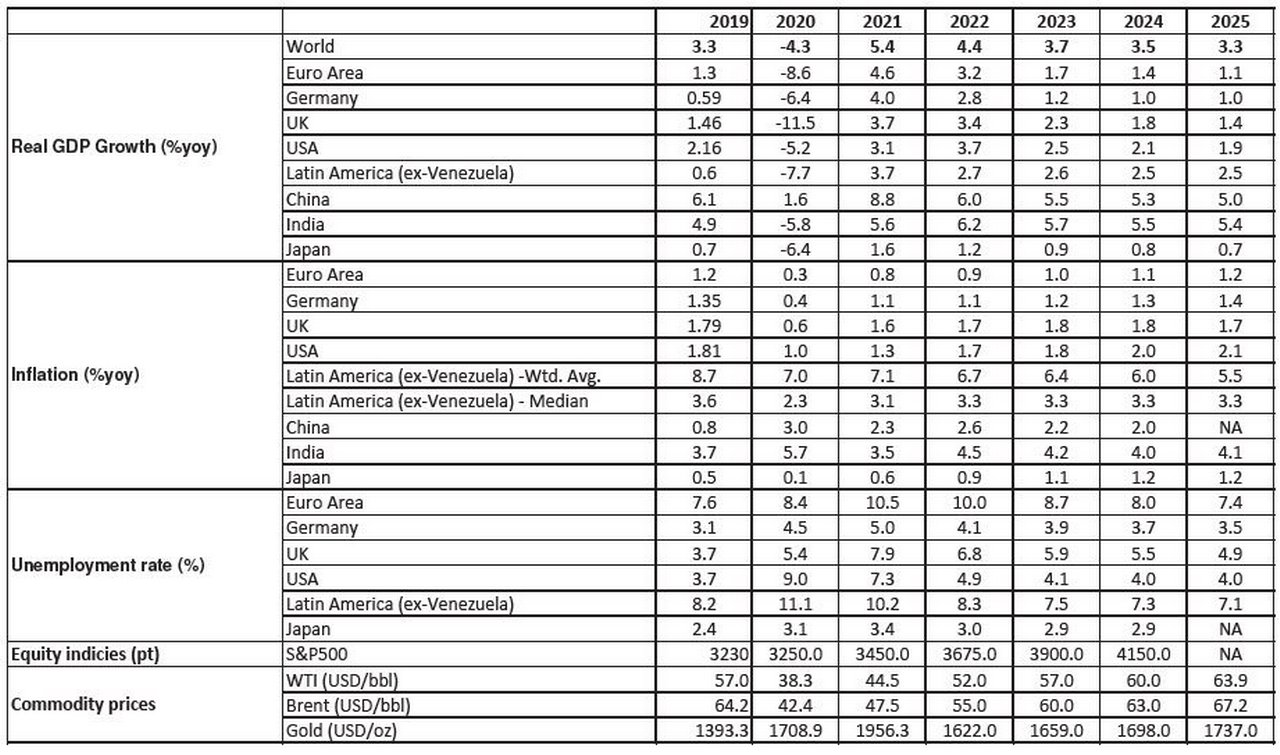

After 2021, the team’s latest prognosis is for world growth gradually slowing, although at above trend rates, as unemployment moves back to pre-pandemic norms by 2024-25. As Figure 1 shows, there is considerable variation in the projected figures from region to region but overall “we expect trend or potential growth rates in out years to be somewhat below pre-virus rates” due to a combination of factors that include:

- Ageing populations and slowing labour force growth as baby boomers continue to retire;

- Fiscal drags as taxes are raised to begin to pay for the fiscal support necessitated by the pandemic;

- The virus causing lasting disruptions to activity in some sectors;

- Likely ongoing disruptions caused by tensions in US-China trade and investment relations, together with the reorientation of global supply chains.

"We see world growth gradually slowing at above trend rates as unemployment gradually returns to pre-virus norms by 2024−25"

Figure 1: Longer-term economic forecasts

Source: Deutsche Bank (Click on table to enlarge)

Europe’s action plan to mitigate the impact of the pandemic has received praise from the World Economic Forum. In its article2 published on 10 August, ‘What we can learn from Europe’s response to the COVID-19 crisis’, the Cologny, Switzerland-based institution commented that after a faltering and uncoordinated initial reaction “Europe came together to save its citizens, businesses and member countries during the COVID-19 pandemic, making it a role model for the world”.

“The EU’s bold monetary and fiscal response demonstrated solidarity and strengthened Europe’s position globally,” added WEF.

Enduring economic scars

So how has this response manifested itself in the numbers? For the Euro Area (EA), in its 5 May World outlook the Deutsche Bank Research team predicted that GDP for the region would recover to about 94% of pre-Covid-19 levels by the end of 2021 but it now raises this percentage to 97%, with activity further improving to 99% by the end of 2022. However, as a legacy of its “later lockdown, followed by a slower lift-off”, the UK is expected to lag behind and not return to its pre-virus levels of output until the second half of 2024, a “record rate of contraction and twice the decline reported over the entire global financial crisis [GFC] period”.

The US, still the world’s biggest economy, gets an upgrade from the team despite the country accounting for more than a quarter of the 20 million-plus reported cases of Covid-19 reported globally. In May they predicted that US growth would contract by -7.1% in 2020 but now revise this figure to -5.2% - a strong recovery in Q3 but followed by a weaker Q4 – with 3.1% growth (versus 2.6% previously) expected for 2021.

Longer-term the outlook for the US is mixed. The team expects growth in the second half of 2021 to “significantly outperform the first half” as the “assumed widespread presence of a vaccine helps to normalise economic activity”, particularly for consumers.

Covid-19 is, however, expected to inflict enduring scars on the economy and they include:

- Greater precautionary savings motives for households;

- Structurally higher unemployment for some time focused on sectors at the epicentre of the coronavirus crisis;

- Inefficiencies emanating from significant closures of businesses (particularly small businesses);

- Softer productivity trends due to significant slack in the US labour market; and

- Lower potential growth due to disruptions to global supply chains over time.

Vaccine progress

In other words, the recovery’s anticipated trajectory is heavily dependent on the current “progress on the vaccine front”.

On 31 July, The World Health Organisation published its Draft Landscape of Covid-19 candidate vaccines, indicating a broad barometer of progress.3

However, it remains to be seen how far the drug development pipeline can really be accelerated despite the urgency. This is a process where compounds move from early laboratory development through to clinical trials on people, which can often take a decade or more. For this reason much of the focus is on drugs that already exist as possible treatments – a point made in the British Pharmacological Society paper, A rational roadmap for SARS‐CoV‐2/COVID‐19 pharmacotherapeutic research and development: IUPHAR Review 29, issued on 1 May.

“Initial drug discovery should focus on repurposing licensed drugs, as dosage and safety information are largely to hand,” stated the paper.4

,"Initial drug discovery should focus on repurposing licensed drugs, as dosage and safety information are largely to hand"

The APAC trio

The Deutsche Bank Research team identify two main factors driving the near-term outlook for Asia Pacific’s three largest economies of China, India and Japan: “first, how quickly consumption recovers back to something approximating “normal” and, second, how quickly that happens in key export markets.

China is in a class of its own; the first economy both to enter near-total lockdown and also to emerge from it; hence it has achieved a V-shaped recovery with GDP estimated to have declined by -10.8% in Q1 2020 and rebounding by 12.5% in Q2, while exports (in USD terms) fell by 16% in the first quarter and rebounded by 18% in Q2. “Surging exports of medical equipment was a key factor,” the team notes.

“Such remarkable outperformance is unlikely to be repeated, but the US and Euro Area (EA) outlook for the second half of the year does suggest that export growth in China will likely be higher in the months to come.” However, looming on the horizon is the prospect of renewed conflict with the US on trade issues, not helped by the fact that US exports to China are running below the levels of 2017 rather than above – as China committed to in the Phase 1 deal agreed by the two countries in January this year.

By contrast, Japan is experiencing a second wave of the virus worse than the first wave that hit the country in March. After a sharp decline in Q2 GDP – forecast by the team at -7.5% quarter-on-quarter, they expect only a very weak recovery. “Social distancing is tightening again – mostly voluntarily so far – which is reversing the recovery in activity,” they comment. “Moreover, there simply isn’t the policy space to add more support to the economy that there is perhaps in other large economies.”

Japan is further hampered by a potential growth rate that is among the lowest among the major OECD countries. “Measured by when GDP returns to pre-Covid levels, Japan is expected to experience the slowest recovery among the major economies, achieving that milestone only in 2024.”

India’s story is little better, with its lockdown in March apparently delaying the spread of coronavirus rather than containing it. This is “likely both to have an outsized negative impact on Q2 GDP but also be followed by a relatively weaker recovery as the easing of social distancing restrictions doesn’t actually lead to a significant change in behaviour.”

The team, noting that “the Indian government has very little fiscal space to provide

stimulus to the economy” expect GDP in Q2 to show a -18% quarter-on-quarter decline and for the economy to recoup only about half of that loss in Q3.

Prospects for Germany

The outlook for Europe’s biggest economy, included as a chapter of the 5 August World outlook report, was also the topic of the Deutsche Bank Research note by chief economist Stefan Schneider and colleagues, published 10 August and titled ‘Focus Germany: How strong a Q3 rebound?’

Noting the “unprecedented” 10.1% GDP contraction for the German economy in Q2 the team expects a recovery in the second half with 5% growth in Q3 easing to 2% in Q4, assuming no major change in the country’s Covid-19 data – the recent increase in infection rates in Germany and also elsewhere “is a concern, although not yet alarming”.

This team also anticipates that a vaccine will be widely available by mid-2021, “generating a confidence boost for the back part of that year”. Germany’s GDP is now expected to contract by -6.4% this year (versus -9% predicted in early May) followed by 4% growth in 2021, although the pre-pandemic output level will not be reached before mid-2022.

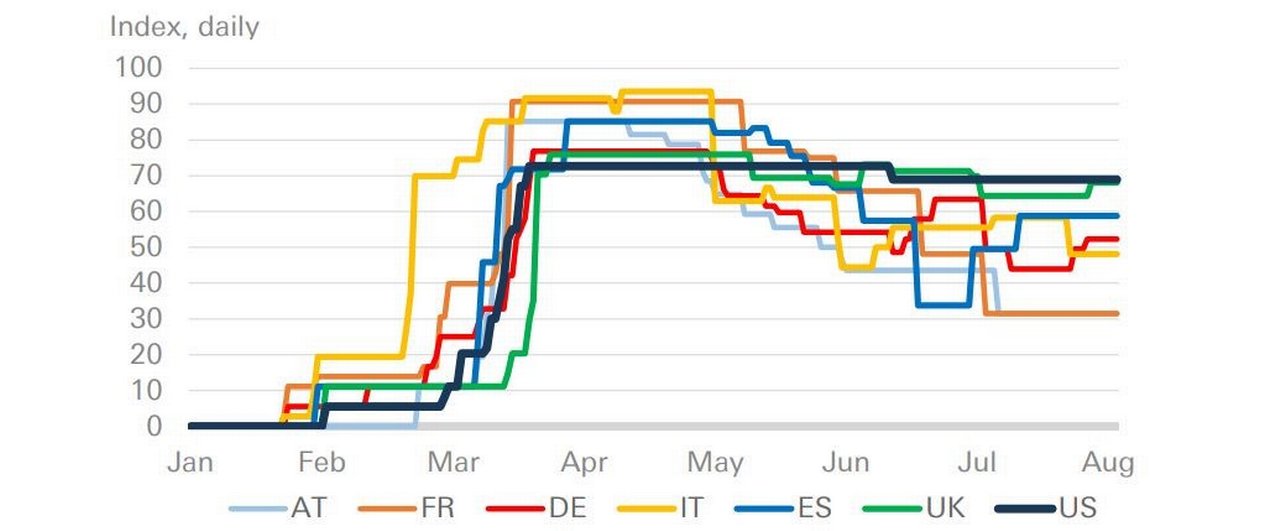

They also consider the legacy of Chancellor Angela Merkel, generally seen as one of the world political leaders whose reputation has been enhanced by their response to the pandemic – although as Figure 2 suggests, the response of the German government has not been noticeably stronger or weaker than those of other major economies.

Figure 2: Covid-19: Government response tracker (100=strictest response)

Source: Oxford COVID-19 Government Response Tracker“Chancellor Merkel leveraged her strong standing and Germany’s economic and political weight to help broker a deal on the EU budget and the Recovery Fund,” the team notes. “She will remain busy steering European affairs during the German EU presidency until the end of December.”

Merkel’s strength might become a burden for her potential successors, they add. “At home, contenders within the conservative camp are stepping up their campaigns for Christian Democratic Union (CDU) leadership and succeeding Merkel as the CDU/[Christian Social Union] CSU’s chancellor candidate ahead of the party convention on 3-5 December.

“The odds seem to have shifted between the candidates based on their performance during the pandemic. A key question will be whether the CDU and its potential new leaders will try to emancipate themselves from Merkel’s legacy.”

The UK’s woes

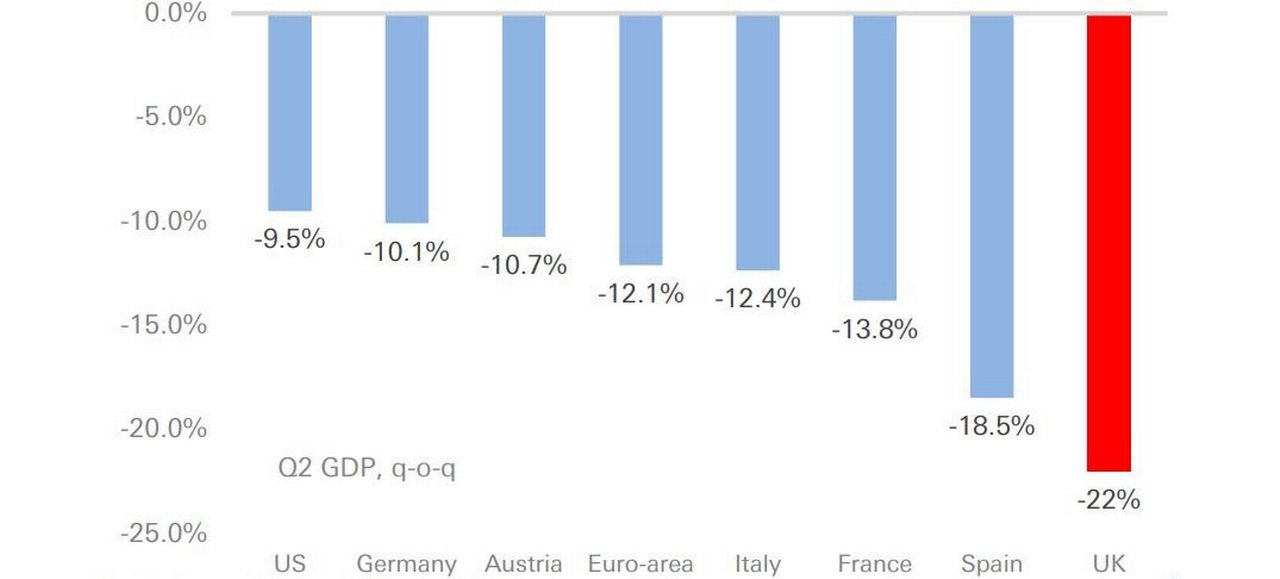

While the Bank of England has attempted to maintain a positive tone, this week’s Q2 GDP data for the UK confirmed that the country had entered recession. Indeed, as predicted by Deutsche Bank Research economist Sanjay Raja in his preview note of 7 August ‘The worst performer in Europe?’, “the UK’s Q2 GDP collapse will be historic”.

At the time of writing he predicted the drop to be -22% quarter-on-quarter (the figure subsequently published on 12 August was -20.4%) − both the worst on record and the worst among the major European economies. Raja explains that the national lockdown imposed on 23 March led to a dramatic fall in spending, a marked rise in involuntary savings and a collapse in business and trade activity.

Figure 3: The worst Q2 economic contraction in Europe*

Source: Deutsche Bank, Haver Analytics LP, *UK projectionThe three months from April to June saw UK households and businesses stuff their cash into savings accounts, while government spending ramped up as automatic stabilisers and increased discretionary spending kicked in, Raja explains. Total fiscal policy aimed squarely at tackling the consequences of Covid-19 is likely to total around £190bn, or 9.5% of GDP. Yet in terms of the national accounts “we think government spending added very little to the consumption and investment numbers in Q2.”

Raja agrees with colleagues, who project a -11.5% contraction for the UK economy in 2020 as a whole, helped by a 13.5% quarter-on-quarter jump in growth in Q3 and slower growth thereafter. “For one, we anticipate more localised lockdowns that would disrupt the UK's recovery. And two, we expect rising unemployment to weigh on household consumption from Q4 onwards.

“Brexit uncertainty should also further dampen business investment, though this will partly be offset by a rise in stockpiling. The result: a weaker Q4 growth print, likely around 1.5% q-o-q. We expect more fiscal and monetary firepower to come in late Q4 to help support activity.”

Oil and gold

The final section of the 5 August World outlook turned to those other bellwethers of economic volatility – oil and gold. “Longer-term forecasts for gold will turn on the withdrawal of accommodative monetary policy at the Fed, which with US growth rebounding to 3.7% in 2022, may be anticipated by the market during the course of that year or possibly earlier,” the team notes. However, they add, “From a physical supply-demand standpoint, factors ameliorating a decline in gold prices would include price-sensitive investment in bars and coins, as well as a contraction in recycled supply”.

“While oil markets are now struggling to digest a very high overhang of surplus inventory” the team doesn’t anticipate significant further supply growth, given that US companies are cutting back on investment and prioritising profitability. “Altogether this means it is reasonable to expect longer term oil prices to recover towards USD 60/bbl, although we see overshoots as relatively unlikely given the potential for significant OPEC spare capacity to be deployed, with a tail risk of upside supply surprise in Iran and Venezuela.”

Key uncertainties

While much remains uncertain, Hooper did point out in his video interview that another potential growth factor could be “the next generation of tech companies that should be up and running in our five-year growth target”. “Stay tuned,” he advises, as the team will be back in September when they will be taking “a more comprehensive look after key uncertainties are resolved on the US fiscal front".

Summary of Deutsche Bank Research reports referenced

Special Report: World outlook: Interim update and longer term projections (5 August 2020) by Peter Hooper, Michael Spencer, Mark Wall, Matthew Luzzetti, Stefan Schneider, Sanjay Raja, Yi Xiong, Kentaro Koyama, Kaushik Das, Drausio Giacomelli, Sebastian A. Brown, Michael Hsueh and Parag Thatte

Focus Germany: How strong a Q3 rebound? (10 August 2020) by Stefan Schneider, Barbara Boettcher, Kevin Koerner and Marc Schattenberg

UK economic notes: Q2 GDP Preview: the worst performer in Europe? (7 August 2020) by Sanja Raja

Sources

1 See https://bit.ly/2Ck8i2W at dbresearch.com

2 See https://bit.ly/33W0dgf at weforum.org

3 See https://bit.ly/2E0ACaU at who.int

4 See https://bit.ly/2PKmSUx at wiley.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

MACRO AND MARKETS {icon-book}

Matters of the mind Matters of the mind

Covid-19 has inflicted the greatest change upon the global population since World War II and highlighted the importance of wellbeing. Michael Morley tells flow how an informed approach to employee wellness could play a meaningful role in a sustainable recovery

MACRO AND MARKETS

Covid-19 and inflation Covid-19 and inflation

As economies move along their pandemic exit trajectories, and the cost of economic stimulus raises the spectre of galloping inflation, flow's Clarissa Dann reviews Deutsche Bank Research analysis on whether this scenario is likely given the current central bank grip on markets

MACRO AND MARKETS, TECHNOLOGY

China focuses on post-Covid goals China focuses on post-Covid goals

Having warded off the pandemic’s full impact, the world’s second-largest economy can focus on achieving technological self-sufficiency and developing its central bank digital currency, reports flow’s Graham Buck