19 November 2020

Having warded off the pandemic’s full impact, the world’s second-largest economy can focus on achieving technological self-sufficiency and developing its central bank digital currency, reports flow’s Graham Buck

China, thought to have been the first country to enter the Covid-19 pandemic, has also been one of the most successful in limiting its impact. As of 17 November1, its recorded number of coronavirus cases was around 86,361 resulting in 4,634 deaths – figures a fraction of those incurred in other major economies.

As hopes of a V-shaped recovery fade elsewhere, Deutsche Bank Research is increasingly bullish on China’s prospects. In its report China Macro: October activity: revising up GDP forecast, issued on 16 November, Deutsche Bank Chief Economist Yi Xiong wrote, “We revise up our China real GDP forecast to 6.0% y/y in Q4 2020 (from 5.5%), and 2021 GDP forecast to 9.5% (from 9.0%).”

Figure 1: Deutsche Bank Research’s China Real GDP Growth Forecast

Source: China Macro: October activity: revising up GDP forecast (16 November 2020)

Deutsche Bank Corporate Bank China’s November Webinar, held on 10 November and chaired by Dirk Lubig, Head of Global Transaction Banking China, shared insights into China’s economic prospects, its digital currency development and opportunities created by the simplified cross-border trade payment scheme.

The webinar took place days before the 15 November announcement of the formation of the Regional Comprehensive Economic Partnership (RCEP), constituting the world’s largest trading bloc with the 10 Association of Southeast Asian Nations (ASEAN) countries and South Korea, China, Japan, Australia and New Zealand as members. As the BBC’s report noted “the pact is seen as an extension of China’s influence in the region” and the Partnership is examined in more detail in a separate flow article.

The return to normal

At the webinar, China’s macroeconomic outlook for 2021 and beyond was provided by Linan Liu, Greater China Rates Strategist at Deutsche Bank.

She noted that the world economy had suffered its worst contraction since the Second World War because of Covid-19, yet proved more resilient than expected. At the end of Q3, global GDP had recouped around half of its post-Covid losses, raising hopes of a return to pre-pandemic levels by H2 2021.

Much of this rebound was due to the world’s two biggest economies. The US and China posted strong Q3 recoveries, although the pace would slow in coming months due to a combination of Covid-19’s second wave of infections, winter weather and an expected pause before the US launches a further fiscal stimulus.

The 9 November announcement by Pfizer and BioNTech that their coronavirus vaccine trial results were highly encouraging provided a “positive surprise” said Liu – although no less than 15 billion doses of the vaccine will be required to ensure global herd immunity to the pandemic2. So the most likely scenario is for a steady return to post-Covid normalisation in H2 2021 and extending into 2022 and 2023, with society learning to live with the virus as the programme to eradicate it continues.

The pace of normalisation should be helped by Joe Biden succeeding Donald Trump as US president, but the election has triggered several uncertainties – examined by flow in the recent articles All change on Capitol Hill and Changing course on Capitol Hill?. As the Democrats’ return to power falls far short of a ‘blue sweep’ it’s likely that the Republicans will retain control of the Senate, while Congress will see a division of power between the parties that casts uncertainty over the size and timing of the next US fiscal stimulus package.

Three big unknowns

After a projected -4% contraction for the world economy in 2020, with China’s expected 2% growth contrasting with sharp downturns elsewhere, a strong rebound is in prospect next year. Current projections range from 1.7% expansion in Japan, 3.3% for the US and 9%+ for China to give an average global growth figure of 5.6%. Assuming vaccines lessen the pandemic’s impact, in 2022 global economic growth should slow but again be strong at 4.2% with China’s contribution closer to – although still above – the mean at 5.6%.

Liu singled out three issues casting uncertainty over the global macro outlook:

The US election: With Joe Biden emerging as clear winner, US fiscal policy will again be in focus, with an expected further fiscal package of US$1trn-1.5trn – possibly more modest than some have anticipated. The Biden administration will continue a policy of rebuilding US manufacturing and reshoring back industries that have moved abroad over recent decades. Rather than Trump’s ‘America First’ Biden is likely to encourage a ‘Buy American’ policy and may accompany this with a US$700bn investment in research and development facilities.

Liu also expects the Biden era to be marked by multilateralism in several areas, most notably with the US re-joining the World Health Organisation (WHO) and the Paris Agreement on combating climate change. While US-China competition is likely to continue, it should not prevent a de-escalation of tensions with the removal of some tariffs and possibly even some collaboration in areas of potential mutual benefit.

The global pandemic: The recent acceleration in the rate of Covid-19 infections and deaths have persuaded several governments to reintroduce lockdowns, albeit not always as rigidly enforced as in the first wave. Hopes have risen that Pfizer/BioNTech’s vaccine can reach a broader population to help emerging markets. Further good news on other vaccine developments is expected over coming weeks (at the time of writing, US biopharma Moderna’s 94.5% success rate had been announced)3 and the benefits will extend to both developed and emerging economies.

However, the pandemic has created medium and longer-term economic risks from the sheer size of fiscal response packages, amounting to 10% of GDP in Europe and the US. The expected additional stimulus in the US during 2021 – still likely to be a massive US$1trn– US$1.5trn – nonetheless still represents a scaling back. A similar reduction is expected in the size of both the EU and Japan’s fiscal packages; the EU having clearly indicated that its new Recovery Funds will focus on environmental, social and governance (ESG) initiatives along with the digitisation of economies4.

The worldwide response to the pandemic from central banks has been hugely accommodative monetary policy and liquidity support, with at least US$7trn released from their balance sheets (far exceeding the figure provided during the 2008-09 financial crisis), interest rates cut to near-zero or less and the Federal Reserve relaxing its inflation target to an “average” 2%.

While the global monetary system will continue providing plenty of liquidity, Liu noted some attendant risks, such as

- fiscal drag and possible inflation at some later date;

- asset valuations pushed to unsustainable levels and substantial increases in public debt both accompanied by fears about the impact when the stimulus is withdrawn.

China’s FX policy measures, given the increasing case for a weakening USD over the next one to three years as the market “reassesses the dollar’s fundamentals”. Liu expects the Euro to appreciate to €1=$1.20, adding “under Biden the dollar premium will be unwinding, so the currency will weaken”. China’s Renminbi (RMB) has already gained 6% against USD since May, making life difficult for Chinese exporters. While the central bank “doesn’t want to see the RMB appreciate too quickly, particularly with uncertainties surrounding the new US administration” the Peoples’ Bank of China (PBOC) indicates that it is becoming less inclined to actively keep the RMB lower regardless of the impact on exports.

As Liu pointed out, China’s benchmark interest rate stands at 2.2% against the US Federal Reserve’s overnight rate of 0.25%, so the differentials strongly support RMB versus USD. While the Chinese currency advantage is likely to continue in the near term, as other emerging markets recover from Covid-19 and their manufacturing sectors revive, reliance on Chinese exports could lessen.

Five-year and 15-year visions

2021 marks the opening of China’s 14th five-year plan and while Liu said that it has downplayed its quantitative targets, GDP growth of 6-8% is pencilled-in not only for the next five years but also under the separate ‘Vision 2035’ strategy for 2025 to 2035. “Assuming annual inflation of 2%, this gives real growth of 4-6%. While this would be slower than before the pandemic, the structure and sustainability of the Chinese economy should improve.”

China is focused on strengthening the tech sector in its drive towards “scientific and technological independence and self-reliance”. The latest five-year plan will devolve more resources to R&D, both in China’s own universities and tech firms and also globally for collaborative efforts. This bid for dominance in digital technology and AI was charted in flow’s Two contrasting tech battles.

“China has learned from the past few years of trade wars”

Aiming to free itself from dependence on the US and others as providers, Chinese investment will focus most on semiconductors and developing 5G and AI capabilities. “China has learned from the past few years of trade wars and as the US may well continue to impose restrictions on Chinese tech firms it may well seek to become more self-sufficient,” suggested Liu.

Building up home consumption and demand will offset the impact of any future tariffs. The Financial Times reported on 31 October that Huawei will build a massive chip plant in Shanghai without using American technology, to nullify the impact of sanctions.

Sustainability will also be a focus of the new plan, reflecting China’s increased enthusiasm for ecological progress and carbon reduction. However, while the EU aims for carbon neutrality by 2050 – and it seems likely that President Biden’s US will adopt the same target – China is giving itself a further 10 years with a 2060 target.

The plan includes evaluation of Chines industries deemed to represent core manufacturing sectors and identifying them with supply chains most in need of upgrading and modernisation. This will be accompanied by a drive for improved competitiveness in domestic companies and upgrading China’s public services, with spending ramped up on healthcare, care of the elderly and education. Finally, the plan will review ways of encouraging foreign investment and developing new projects under the Belt and Road (BRI) initiative launched in 2013.

Liu also believes that having abandoned its ‘one child’ policy in 2015 and allowing couples to have a second child, further relaxation of the rules is in prospect amid signs that China’s birth rate continues to decline5 .

The digital currency drive

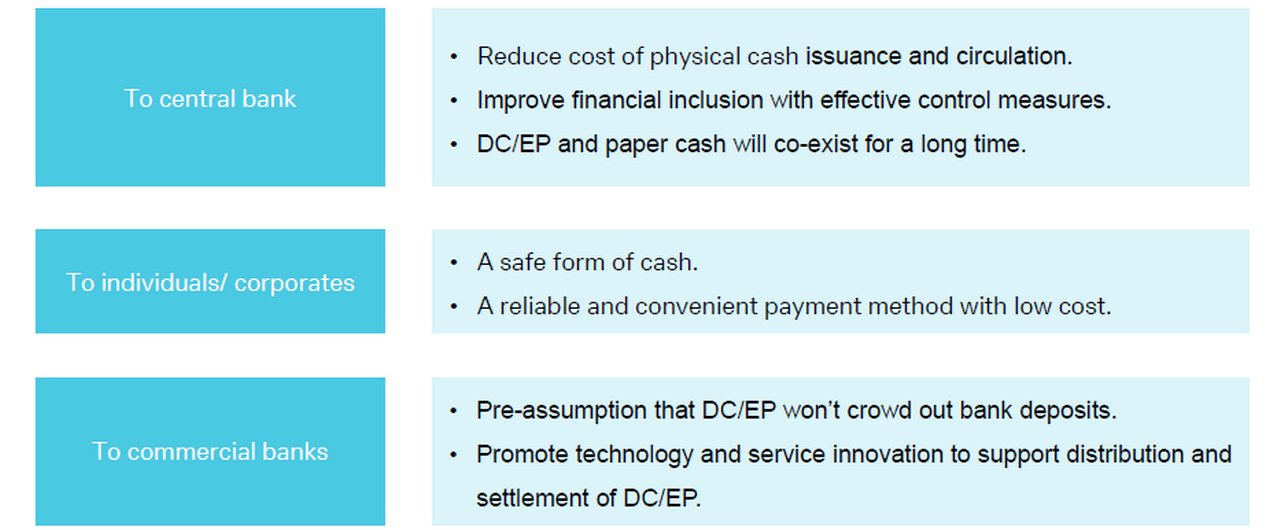

Around 80% of the world’s central banks are actively developing digital currencies (CBDCs) and the People’s Bank of China (PBOC) is introducing Digital Currency Electronic Payment (DC/EP) as part of its drive towards a cashless society, says Alvin Ho, Deutsche Bank’s Head of China Corporate Cash Management.

Having been sanctioned by the government, the PBOC’s digital currency is China’s only legal digital currency and its aims include combating money laundering and other illegal activities, improved monetary and financial supervision and enablement of an offline, low-cost and more inclusive payment system for the population.

The origins of China’s DC/EP efforts go back to 2014, when a research institute was established to focus on digital currencies. Although the PBOC began developing DC/EP in 2017 along with some commercial banks and institutions, progress was initially slow. The pace has noticeably accelerated since June 2019, when Facebook announced plans to develop its own digital currency, Libra, with a consortium of business partners. Shortly after, a PBOC official stated that the bank’s own digital currency would soon be launched6 and issued via a two-tier system, whereby the first tier will be between PBOC and intermediaries such as banks and payment service players including Alipay, Tencent and UnionPay. These intermediaries will then distribute DC/EP to retail participants (second tier).

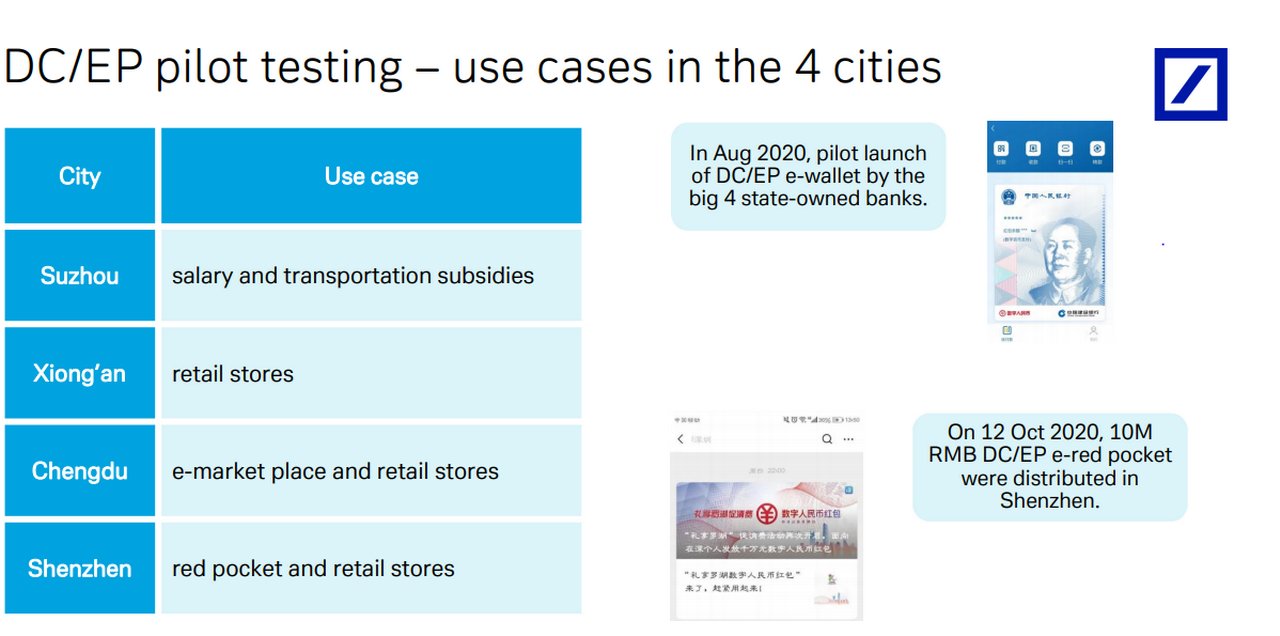

The PBOC has also said that digital currency will be available for the 2022 Winter Olympics games in Beijing, and rolled-out to other regions over time. In April 2020 it announced that it had started testing the new currency in four cities: Xiongan New Area in North China’s Hebei province, Shenzhen in South China’s Guangdong, Suzhou in East China’s Jiangsu and Chengdu in Southwest China’s Sichuan province.

“The Covid-19 pandemic has accelerated the move to digital payments”

Ho noted that the pandemic has accelerated the move to digital payments. In August 2020, China’s four biggest banks – the Industrial and Commercial Bank of China (ICBC); Agricultural Bank of China (AgBank); Bank of China; and China Construction Bank (CCB) – began testing DC/EP wallets. Transactions can take place between DC/EP wallets without either wallet being associated with a bank account. In the same month China’s Ministry of Commerce announced a pilot of CBDC in three regions: the Guangdong-Hong Kong-Macao Greater Bay Area, the Beijing-Tianjin-Hebei region and the Yangtze River Delta.

This October saw Shenzhen distribute RMB10m of DC/EP to citizens in a giveaway lottery in which 50,000 winners could download a digital RMB app to receive their winnings, to spend at more than 3,000 local retail outlets. All these initiatives, noted Ho, reflect China’s aim of accelerating the development of blockchain technology while discouraging any cryptocurrency that competes with the PBOC’s CBDC.

Figure 2: China’s Digital Currency Electronic Payment pilots

Ho said that DC/EP promises to become a widely-used reliable and low-cost payment method. As a highly centralised system with near-field communication (NFC) base, it can be taken entirely offline and will be available to China’s unbanked communities, enabling them to transfer money without having to use the internet. Further pilots will follow in other cities with participating hotels, supermarkets and US chains such as McDonalds and Starbucks.

Figure 3: Potential implications of DC/EP

Simplified cross-border trade payments

Deutsche Bank recently became the first European bank7 – and one of three foreign banks – to gain approval from China’s State Administration of Foreign Exchange (SAFE) for launching simplified cross border trade payment solution under what is termed Guideline v2.0 (SAFE SH [2020] No.23 ) issued by SAFE Shanghai in May 2020. The Bank completed the first foreign currency payment under the pilot scheme in late September for auto parts technology group Aptiv.

Kevin Liang, Deutsche Bank’s Senior Product Manager of Greater China Corporate Cash Management Products said the result will be to reduce the cross-border trade payment process from one to two days to only minutes. Deutsche Bank can communicate with SAFE to resolve any problems that occur and provide end-to-end life cycle management of cross border trade payments.

Sources

1 See https://bit.ly/3nxXaBG at worldometers.info

2 As confirmed in the 9 November Deutsche Bank Research report, Everything We Know About a Covid-19 Vaccine II (Marion Laboure, Jim Reid)

3 See Climbing out of Covid: Nearly there? at flow.db.com

4 See https://bit.ly/3kMNUrD at ec.europa.eu

5 See https://bit.ly/38OWyTQ at cgtn.com

6 See https://cnb.cx/3nxg3EO at cnbc.com

7 See https://bit.ly/3kAn6L3 at db.com

Go to Corporate Bank EXPLORE MORE

Find out more about products and services

Go to Corporate Bank Go to Corporate BankStay up-to-date with

Sign-up flow newsbites

Choose your preferred banking topics and we will send you updated emails based on your selection

Sign-up Sign-upSubscribe Subscribe to our magazine

flow magazine is published annually and can be read online and delivered to your door in print

You might be interested in

Macro and markets, Trade finance and lending, Securities services {icon-book}

Re-enter the dragon Re-enter the dragon

As China’s Year of the Dragon progresses, its bounce-back following overseas investor nervousness is creating opportunities for corporate banking services. flow examines trade corridors, the turning of the tide in foreign direct investment (FDI), and an agile FX solution as Western economies’ monetary policy gives the RMB (Renminbi) a chance to shine

Macro and markets, Cash management, flow case studies

The rise of Global Capability Centres in APAC The rise of Global Capability Centres in APAC

Formerly, it was mainly back-end functions that were outsourced to Asia-Pacific. Today, these hubs drive technological innovation and enhance organisational efficiency on a global scale. What does this mean, both for the treasury function and for corporate banking services?

Trade finance, Macro and markets

Hello Beijing Hello Beijing

China’s continuing ‘opening up’ of its economy to overseas investors and corporates was very much in evidence at Sibos Beijing 2024, where 7000 delegates met up at the mainland capital's China National Convention Centre for the first time. flow’s Clarissa Dann reflects on the main conference programme insights into cross-border trade and its digitalisation journey