21 October 2025

Continuing her report on the securities services themes at Sibos Frankfurt 2025, flow securities services correspondent Janet Du Chenne looks at the wider implications of T+1 in Europe, the adoption of industry standards, and how the digital asset journey is changing the post-trade landscape

MINUTES min read

In Part 1 of this securities services Sibos report we examined Europe’s role in the post-trade financial system, and why its move to T+1 is so much more complex than that experienced by the US in May 2024. This second part of our Sibos update provides more detail on the EU T+1 roadmap before a deep dive into industry standards and the fast-moving evolution of digital assets.

T+1 readiness in Europe

As market participants consider the EU T+1 roadmap (from the EU T+1 Industry Committee)1 in their own impact assessments, the stark reality of the transition is emerging. In an industry session titled ‘Reduced settlement cycles & improved global efficiencies: a reality?’, Tomas Lnenicka, Deputy CEO, Prague CSD, warned of considerable complexity in EU markets outside the Euro, such as the Czech Republic. “T+1 will bring additional complexity to already complex products, like FX, securities lending and repos,” said Lnenicka.

TARGET2-Securities (T2S) is adapting its processes in line with the EU T+1 roadmap, including starting the big delivery-versus-payment cycle around midnight and increasing partial settlement cycles in the nighttime batch. “T2S can settle on any settlement cycle – even T+0, provided the conditions are there, namely the instructions are matched, the inventory is available, and nobody has put a hold on any instructions”, said Karen Ann Birkel, Head of the Market Infrastructure Development Division, European Central Bank (ECB).

T+1 presents banks with a way to streamline matching transactions that are currently matched at a trade level, allocation level and then settled. “Persisting that golden record and enriching the data store could change the way we do things across connecting infrastructures across the industry,” explained Sachin Mohindra, Executive Director at Goldman Sachs. “Standards play a key role, but we need to lean on electronic storage and communication of standard settlement instructions and partial settlement”.

Tobias Pass, Head of Settlement at Berenberg, agreed that process automation to detect downstream issues is key, given T+1 reduces the time for post-trade checks by roughly 83% and missing the overnight settlement cycle and date may incur Central Securities Depositories Regulation (CSDR) penalties or counterparty claims.

‘Reduced settlement cycles & improved global efficiencies: a reality?’ Left to right: Jennie Baisch, Securities Expert, Swift; Karen Ann Birkel, Head of the Market Infrastructure Development Division, ECB; Sachin Mohindra, Executive Director, Goldman Sachs: Tobias Pass, Head of Settlement, Berenberg; and Sonia Paston-Bedingfeld, Managing Director – Group Post Trade & Custody Product, UBS

Interoperable standards

There’s growing adoption of the Unique Transaction Identifier (UTI) for T+1 readiness.2 The tool enables intermediaries in the trade lifecycle to track transactions from trade execution right through to settlement. This allows them to identify potential issues quickly. “Adopting the UTI enables greater automation of your systems ahead of the shift by various markets to T+1,” claimed panelist Kiet Gilliver, Executive Director, Goldman Sachs, in a further session on reduced settlement cycles.

“There are definite operational efficiencies [to the UTI] in the short-term, and those really compound as you persist with the UTI down the stack. If you think about where the industry is at the moment, we are down to single percentages for fails, which is fantastic. Over time, and with greater UTI adoption, we will have far more intelligence to get those remaining kinks out of the system. These long-standing trade tracking issues we experience are essentially preventing us from achieving 24/7 trading and same-day settlement.”

In the conference session ‘From mandate to mindset: can UTI become the DNA of post-trade transformation?’ Gabino Roche, CEO & Founder of Saphyre, compared the UTI to an Apple AirTag. Just as the AirTag enables bag tracking at airports, the UTI does likewise for securities transactions.

“Industry standards are where we get scalability and where we get fungibility”

As market complexity grows, so too does the need for standards. Sibos delegates packed into a Swift standards session, “Why standards matter – a discussion with the ISSA board” to find out more.

Paul Maley, Global Head of Trust and Securities Services at Deutsche Bank and board member of the International Securities Services Association (ISSA), explained that industry standards are “where we get scaleability and where we get fungibility, particularly when you want to move and transfer securities from one part of the market to another. That’s where you drive efficiencies and lower costs for investors”. He highlighted that standards also help in dispute resolution, particularly ISDA master agreements for over-the-counter trades “because when things go wrong, everyone in the chain has the same interpretation of what is going on”.

ISO 20022 is another standard that is progressing in securities. While the end of payments migration is set for November 2025, securities have no firm deadline and at Sibos Beijing in 2024 it was clear that there was no business case to support a global migration of the securities services industry to ISO 20022. Swift enables the use of ISO 20022 and ISO 15022 so that, as Juliette Kennel, Global Head of Standards at Swift said at the time, “the two standards are interoperable and can co-exist”.

‘Why standards matter – a discussion with the ISSA Board’. Left to right: Karen Zeeb, COO and Company Secretary, ISSA; Paul Maley, Global Head of Trust and Securities Services at Deutsche Bank; Margaret Harwood-Jones, Managing Director & Global Head, Financing & Securities Services, Standard Chartered; Brian Steele, President of Clearing & Securities Services, DTCC; and James Fok, CCO, CMU OmniClear

Corporate actions challenge

During an industry session ‘Corporate actions unchained: from manual pain to tokenised gain’, Barnaby Nelson, CEO of the ValueExchange, highlighted research3 which finds the industry is spending US$58bn a year on processing US corporate actions. This is when an event occurs that impacts a company's stakeholders, who include shareholders and bondholders. Dividends, stock splits, mergers, and acquisitions are among the examples.

Corporate actions volumes have gone up 31% per year but automation rates have gone down, with 60% of brokers seeing their automation rates decline. “While there is talk of putting corporate actions on a blockchain network, unless we make corporate action data machine-readable and adopt Swift standards, adopting blockchain may not be feasible,” warned Nelson.

Given the complexity of corporate actions – often involving multiple intermediaries – tokenisation was debated as a solution to make them faster, cheaper and more transparent. “The key thing is that as that acceleration and adoption around distributed ledger technologies [DLTs] increases, we've got to have corporate actions as part of that conversation at the beginning,” insisted Kara Kennedy, Head of Digital Asset Product in the Custody Product Management team at J.P. Morgan.

Digital assets move from talk to action

As DLT moves deeper into the trade lifecycle, the expanding role of digital assets, tokenisation and the growing demand for institutional-grade data, interoperability, and embedded compliance controls were explored in ‘The future of digital assets in financial markets’.

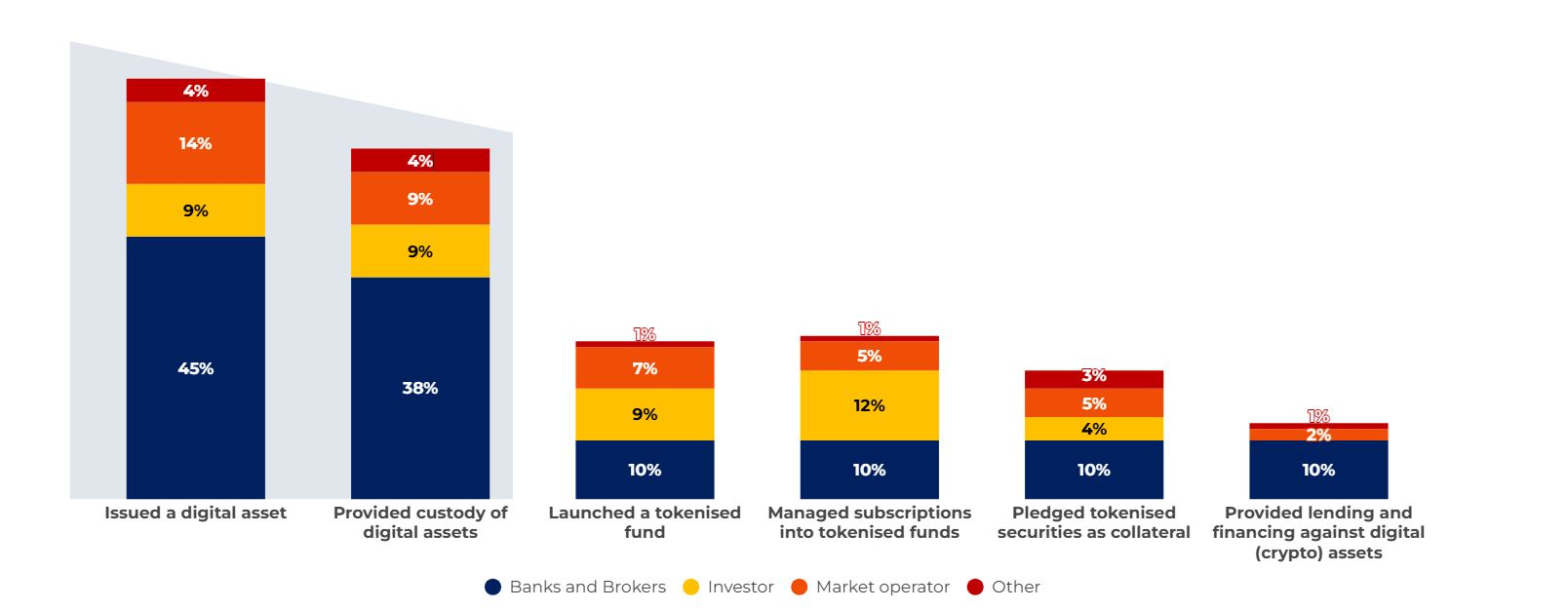

Across all market segments, efforts to pledge tokenised assets as collateral are set to triple, notes a ValueExchange paper4 titled DLT in the real world. The need for intraday liquidity and the ability to mobilise and monetise assets is driving the convergence of digital assets into traditional finance, and banks and brokers intend to provide custody of digital assets in 2026 (see Figure 1).

Figure 1: Actions to be taken by respondents in the next 12 months (% of respondents by segment)

Source: ValueExchange

Banks have sprung into action following the Trump Administration’s repeal last January of SAB 121, which restricted banks’ holding of crypto assets, and the introduction of the CLARITY and GENIUS Acts.5 Many have plans to launch crypto custody solutions in 2026.

Nadine Chakar, Global Head of Digital Assets, DTCC noted the issuance of stablecoins is “all the rage”, as is tokenisation of US Treasuries and money market funds for collateral management purposes. “Those are the three most asked for use cases.”

However, an impatience for solutions must be tempered with caution. Chakar insisted institutions such as the DTCC must approach innovations like digital assets slowly and steadily. If the DTCC makes an error, regulators globally will be demanding answers.

Banks are also proceeding with care. Speaking on the Global regulatory shifts: navigating the new landscape of digital assets session, Anthony Attia, Board Member, Chairman, Euronext, said many innovation initiatives happened because organisations had a fear of missing out (‘FOMO’). “FOMO is not a good reason to invest in speculative business use cases,” he stressed.

Given the crypto markets’ US$4trn in size, securities services providers are focused on building a secure infrastructure to meet regulators’ concerns about the network’s ability to sustain volume and pressure. A panelist claimed, “It’s about assessing what you can do, talking to regulators, doing what you’re allowed and pulling back where you can’t.”

Digital assets standards and regulation

Again, standards, messaging protocols connected to new settlement systems, and security protocols are needed. During the Unlocking digital assets adoption through standards industry session, Thomas Dugauquier, Tokenised Assets Product Lead, Swift, urged a collaborative approach, noting the challenges facing digital assets are similar to those faced by securities markets 40 years ago.

“We need to remain technology agnostic as key to promoting choice”

Clearstream, Euroclear, and DTCC are responding by jointly exploring building a digital asset ecosystem and providing a framework for adoption.6 “Standards are super important, but we need to remain technology agnostic as key to promoting choice,” added Thilo Derenbach, Head of Sales and Business Development, Digital Securities Services, Deutsche Börse. “We do not pretend to be all-knowing about what the standards should be – we are inviting the industry to work with us and define the standards.”

Digital assets also need international standards to address risks. Given the divergence in regimes, including the EU’s Markets in Crypto-Assets framework, the US GENIUS Act for stablecoins, and the UK FCA CP25/14 proposals on stablecoins and crypto custody,7 a lack of standardised regulation could be problematic.

However, there are certain standards that the industry believes may have unintended consequences. This includes the Basel Committee on Banking Supervision’s (BCBS) Crypto Asset Standard (SCO60)8 which sets out risk-weighted asset obligations for crypto assets held at banks. The rules apply a 1,250% risk weighting (meaning they'd need to hold capital equal to the full exposure value) and may drive crypto into the less-regulated markets. In a letter to BCBS, industry associations asked the regulator to pause Q1 2026 implementation and redesign the standard.9

Sabih Behzad, Head of Digital Assets and Currencies Transformation at Deutsche Bank, identified the industry's challenge: interoperability and regulatory certainty are essential for institutions to scale participation, yet “the regulations and interoperability will fall into place once you have a critical mass”.

Sibos Frankfurt 2025 was held at the Frankfurt Messe, Frankfurt, Germany from 29 September to 2 October 2025

Janet Du Chenne is a freelance financial journalist and a former Co-Editor of flow and of Global Custodian

Images: © Swift; Henry Williams

Sources

1 See esma.europa.eu

2 See swift.com

3 See dtcc.com

4 See thevalueexchange.foleon.com

5 See forbes.com

6 See web-assets.bcg.com

7 See fca.org.uk

8 See bis.org

9 See gfma.org