21 October 2025

Post-trade integration in Europe, market infrastructure resilience, T+1, standards and the race to digitalisation were high on the securities services agenda at Sibos 2025 in Germany’s financial capital. In the first of a two-part report from Frankfurt, flow securities services correspondent Janet Du Chenne distils the key takeaways

MINUTES min read

Sibos’s return to Europe this year emphasised the region’s major role in the global financial markets. With North America and Asia already operating on T+1 settlement and clarifying digital asset rules, Europe’s ability to keep pace matters beyond its borders. The region’s deep connectedness with other markets and the complexity of its financial markets mean that a speedier Europe is also good for the rest of the world.

Amid changing investor expectations, speed and efficiency are essential. Digital assets and accelerated settlement have unearthed new ways of connecting with financial institutions and market infrastructures globally. A faster, more efficient Europe creates more opportunities for investors worldwide.

An integrated Europe?

At Sibos 2025, the urgent need for a single market for capital across EU member states to meet these aims was palpable. “We grow so slowly because we invest so little,” stated Piero Cipollone, member of the executive board at the European Central Bank (ECB). In a View from the Top session titled Securing Europe’s financial future: Resilience, autonomy and the global impact, he said further post-trade integration to unlock €35trn in savings to meet Europe’s €750bn annual investment requirement (noted in the Draghi report1) is a priority both for Europe’s competitiveness and global markets.

The integration priority meant market infrastructure resilience, T+1, standards and digital assets were key themes at Sibos Frankfurt, where the convergence noted in the flow article, ‘At the digital money junction’ leapt forward with new types of settlement services.

The ECB reported progress on removing barriers to post-trade integration and harmonising activities under a pan-European rulebook.2 The flow special white paper, Regulatory outlook in securities services 2025, explains these pivotal reform measures. Cipollone emphasised the important role central bank money plays in more integrated and resilient financial market infrastructures, noting digital projects that are moving to production. They include the ECB’s Pontes initiative,3 which will link distributed ledger technology (DLT) platforms and the pan-European TARGET2 Securities (T2S) settlement platform.

‘View from the Top: Securing Europe’s financial future - Resilience, autonomy, and global impact’. Left to right: Marianne Demarchi, Chief Executive EMEA, Swift; Piero Cipollone, Member of the executive board at The European Central Bank; Andrew Bester, Head of ING Wholesale Banking; Bettina Orlopp, Chief Executive Officer, Commerzbank; Stephanie Eckermann, Member of the Executive Board at Deutsche Börse; and Valerie Urbain, CEO, Euroclear

10 years of T2S

While T2S has provided some post-trade integration since the first central securities depository (CSD) migration wave in June 2015,4 fragmentation persists as not all countries have adopted the system’s standards. Panelist Stephanie Eckermann, Member of the Executive Board at Deutsche Börse, referred to it as an underutilised “empty highway” that only 20 CSDs have committed to connecting.

During Sibos week, the Association of Financial Markets Europe (AFME) and the Value Exchange5 quantified T2S’s underuse in a report, which finds settlement costs are well above the targeted €0.15 per instruction. This is because, despite T2S harmonising settlement, CSDs continue to add their own processing fees. AFME recommends expanding T2S’s remit to support further integration in areas such as asset servicing and tax.

Digitalisation and market infrastructure resilience

Europe’s €1trn debt market is another underutilised asset that is attracting attention, with Euroclear and Clearstream cooperating on an industry-wide data standard to facilitate DLT issuance of Eurobonds.6

“There’s a need to deepen liquidity and offer interoperability between different systems”

“Financial market infrastructures are committed to standardising the Eurobond market to lay the foundation to digitise Eurobonds,” said Eckermann during the panel session.

Valerie Urbain, CEO of Euroclear, added that the initiative supports Europe’s unique capital market toolkit. “There’s a need to deepen liquidity and offer interoperability between different systems, to have fungibility between digital and traditional assets, and harmonised frameworks for ease of access for investors. We’re armed to work on stable, resilient and trustworthy capital markets for Europe’s economy.”

Market infrastructure resilience is a precondition for building trust, efficiency and sovereignty in Europe, a theme developed by Urbain in ‘Euroclear and tomorrow’s capital markets trades’. She highlighted Europe’s strengths: “We’ve always defended the rule of law, for example, in sanctions against Russia, we safekeep assets and continue to build on trust and protect the right of ownership and sovereign immunity as that gives trust in capital markets.”

T+1 and beyond

As Europe, the UK and Switzerland prepare for T+1 in October 2027, its role in the future of finance is clear. Andrew Douglas, Chair of the UK’s Accelerated Settlement Taskforce and moderator of an industry session, titled ‘T+1 and beyond: Building the future of global markets’, insisted that it is “not an end destination. It is the stop on the journey to real-time settlement”.7

North America is already seeing the benefits of T+1, with Swift data in the report T+1: one year on a new chapter begins (24 September 2025)8 showing that 80% of equity transactions settled in North America in the first half of 2025 were processed at T+1. For the full year of 2023 (so before the May 2024 migration) this figure was 6%.

While North America’s fail rates have fallen by 7%, Europe has seen a 5% increase. The complexities of a European transition, explained in flow's ‘Europe braces for T+1’, are cause for concern. Cash penalties for late matching and settlement (under Central Securities Depository Regulation) in the new environment could be higher than the €52.8m per month in 2024.

‘T+1 and beyond: Building the future of global markets.’ Left to right: Andrew Douglas, Chair of the UK’s Accelerated Settlement Taskforce; Jane Masen Global Head of Custody, HSBC; Gareth Jones, Head of Credit and Liquidity Services Euroclear; Camille Papillard, Head of Banks & Brokers, EMEA, Securities Services BNP Paribas; Marc Bayle de Jessé, CEO, CLS Group; and Michalis Sotiropoulos Head of Government Relations, EMEA, DTCC

As Kelli West, Global Head of Securities and FX Strategy at Swift commented in the report, “To flourish in a T+1 ecosystem, our data clearly shows that greater automation, earlier instruction matching, and better cross-time zone coordination will be needed.”

Douglas declared that “trades are failing because of the same three issues, namely, a lack of inventory, a lack of cash or credit, and instruction problems”. He added that “automation will be key to resolving all of these issues”.

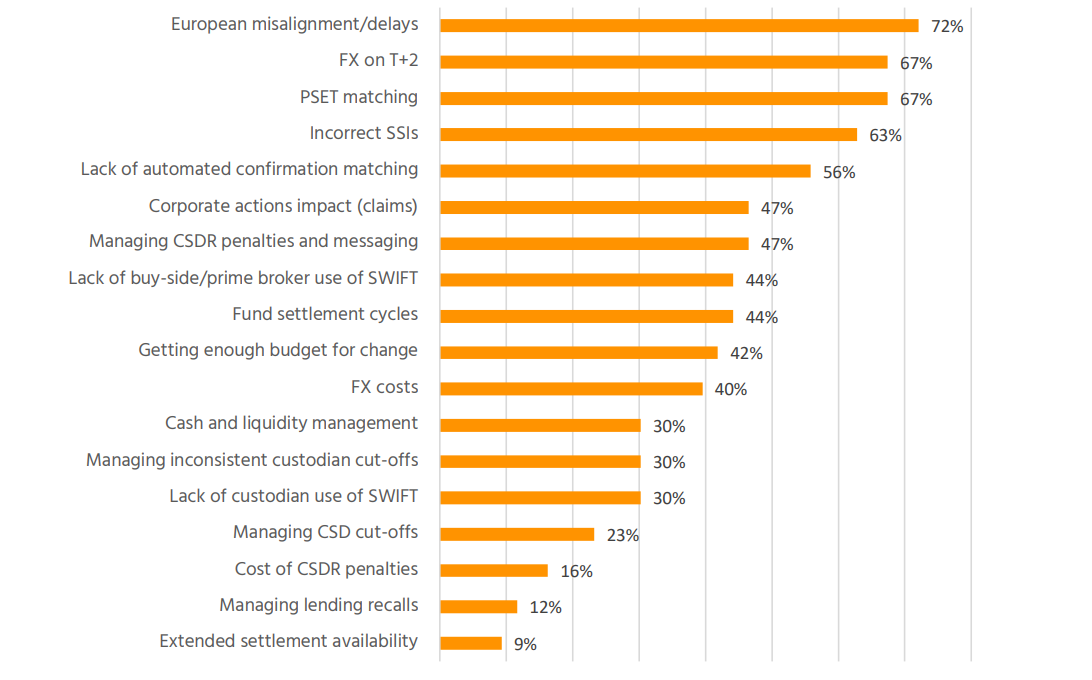

Instruction problems persist despite the Financial Markets Standards Board’s standards for the sharing of Standing Settlement Instructions (SSIs) between market participants.9 Firebrand Research’s Tackling post-trade friction report10 reflects market participants' concerns (see Figure 1) about EU T+1 in the context of the sheer volume of Europe’s 3.5 million fixed income SSIs in the Depository Trust & Clearing Corporation database. A pair of SSIs is only successful if and when they match in the CSD. Matching depends on the quality and accuracy of SSI data – when an instruction is bad, then the trade will likely fail.

One panelist observed that there was no room for complacency just because T+1 had been successful in the US. “It was massive but it’s just one market,” she said, adding that her bank is working closely with clients to prepare them for T+1 in Europe. She reported that the momentum is forcing market infrastructure participants to “go on a journey that makes us more efficient, creates operational resilience and makes interoperability smoother”. Looking forward to a possible T+0 environment, she reflected, “Everyone needs a plan and a budget, and everyone needs to invest”.

Another panelist believed the move in Europe will impact “data, liquidity management, operational tasks, front office and middle office, brokers and asset managers”, adding that the additional costs will ultimately be shared all along the chain. Custodians will need to adapt their messaging and SSI harmonisations and brokers will need to adapt the way they allocate the trades.

Figure 1: Firebrand interviewee greatest concerns around European T+1

Source: Firebrand Research

Digital assets and AI automation will help tackle many of these post-trade problems (for example, by automating trade matching and validation). However, the role of intermediaries remains integral to T+1 and beyond. “The link between traditional systems and new markets increases as we increase fragmentation; the role of a custodian doesn’t go away,” concluded another panelist. “Clients want to speak to people,” she said and servicing digital assets is no different from “what we have been doing for decades – settling trades and asset servicing”.

It was Euroclear’s Gareth Jones who concluded, “Some things are timeless and there are some things that financial markets need to work effectively, safely and with integrity. I am confident that in 10 years market infrastructures will have adapted and will be needed by new markets just as much as they are needed now.”

See also Part 2 of ‘Faster and fitter securities services at Sibos Frankfurt’, which provides further Sibos insights on T+1 in Europe, the adoption of industry standards, and how the digital asset journey is changing the post-trade landscape

Janet Du Chenne is a freelance financial journalist and a former Co-Editor of flow and of Global Custodian

Sibos Frankfurt 2025 was held at the Frankfurt Messe, Frankfurt, Germany from 29 September to 2 October 2025

Images © Swift

Sources

1 See commission.europa.eu

2 See ecb.europa.eu

3 See ecb.europa.eu

4 See bde.es

5 See afme.eu

6 See clearstream.com

7 See nasdaq.com

8 See swift.com

9 See fmsb.com

10 See euroclear.com