18 November 2025

Tariffs, fragmentation, and the rise of the Global South are reshaping global trade. In a Q3 2025 Deutsche Bank Research webinar, analysts unpacked the core risks and opportunities. flow’s Will Monroe summarises the key takeaways

MINUTES min read

Tariffs have dominated the global trade landscape over recent months, ushering in a period of widespread uncertainty. According to the September 2025 UN Trade and Development Global Trade Update, trade policy uncertainty has soared to record levels this year, with the report noting that “policy changes in one country can send shockwaves across the globe, disrupting suppliers, manufacturers and markets”.1

While this uncertainty looks set to persist in the near term, further shifts in global trade patterns are emerging, driven by developments such as:

- The rapid growth of Global South markets;

- EU trade deals and negotiations with both new and established partners; and

- Germany’s ongoing export challenges.

This article outlines several key opportunities and obstacles in global trade arising from these macroeconomic trends, drawing on insights from the Deutsche Bank Research webinar, Shift in global trade patterns: opportunities and challenges from a macroeconomic perspective, featuring insights from analysts Marion Mühlberger and Ursula Walther.

Lothar Meenen, Head of Corporate Coverage EMEA, Deutsche Bank, who presented the webinar, reflected on how the volatile external environment impacts on client needs, noting that “navigating through changing supply chains goes along with changing requirements for hedging and financing in working capital management”.

Tariffs and the EU-US trade deal

The EU-US trade deal agreed at the end of July 2025 restores an element of stability to this vital trade corridor that accounts for an estimated €4.2bn in goods and services crossing the Atlantic daily,2 with the ‘transatlantic relationship’ accounting for nearly one third of global trade.

“Uncertainty is a feature that is going to stay and reverberate in financial markets and corporate actions”

However, Deutsche Bank Research analysts caution that corporate confidence isn’t going to return overnight. During the webinar, Marion Mühlberger, Senior Economist, European Policy Research at Deutsche Bank Research, observed that the US regime shift in respect to trade means uncertainty is a feature that is going to stay and reverberate in financial markets and corporate actions, at least in the near term.

Under the terms of the agreement a baseline tariff of 15% will apply to the vast majority of EU exports to the US. Around US$600bn of private-sector investment from Europe to the US has been earmarked, with the EU also committing US$750bn to strategic purposes including US energy products and microchips.3

Deutsche Bank Research forecasts that the direct cost of the 15% tariffs will vary across EU member states, with Ireland, Slovakia, Germany, and Denmark expected to experience a more significant GDP deviation from the pre-Liberation Day baseline. Approximately US$35bn of German automotive exports are affected by US sectoral tariffs. The section 232 investigation into pharma products is still ongoing.

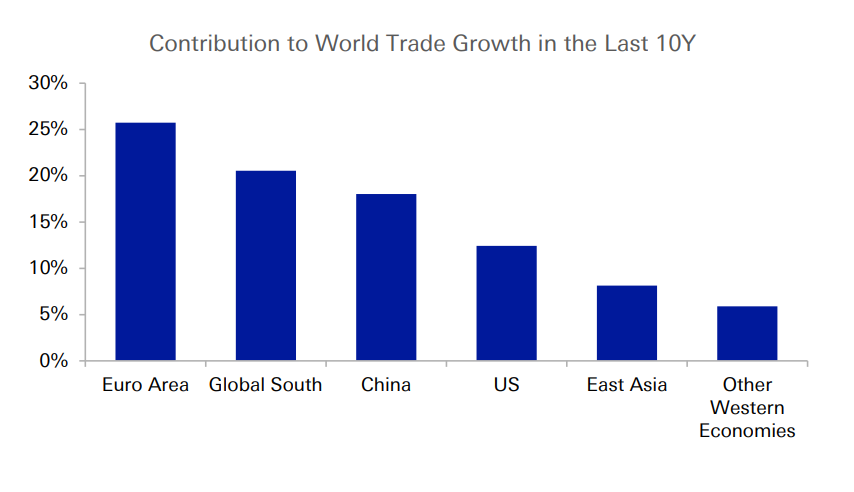

Global South opportunities

The ‘Global South’ – a term with various interpretations but broadly referring to the United Nations G77 countries excluding China – is rapidly emerging as a pivotal force in global trade. According to the Boston Consulting Group (BCG), annual Global South trade is projected to reach US$14trn by 2033, underlining its growing economic clout.4

Trade between emerging markets in the Global South – so-called ‘South to South’ trade – has grown significantly in recent years. BCG forecasts this trend will continue, with South-South trade expected to grow at an annual rate of 3.8% through to 2033, compared to 2% compound annual growth for trade between developed economies in the Global North.

Mühlberger and Walther noted on the webinar that the increasing fragmentation of the global trade landscape opens a window of opportunity for the EU and Germany to strengthen trade ties with high-potential emerging markets. India, Indonesia, Brazil, Mexico and Saudi Arabia are identified as key players in the Global South, with economic size and strategic alignment emerging as differentiators in a fragmented global landscape. For further insights see Deutsche Bank Research’s May 2025 strategic framework for the Global South.

Figure 1: Europe’s Global South trade opportunity

Source: Deutsche Bank Research Institute, The Global South: A strategic approach to the world’s fourth bloc

The EU faces intensifying competition from the US, China and other key players when it comes to tapping into the potential of growing Global South markets, but there is renewed momentum behind the EU’s free trade talks with countries in the region. Mühlberger highlighted that recent US trade policies have “been a catalyst to accelerate policies that wouldn’t have happened at that speed otherwise”, prompting the EU to advance its own trade agenda.

The landmark Partnership Agreement between the EU and four countries from the south American ‘Mercosur’ trade bloc – Argentina, Brazil, Paraguay and Uruguay – is set to be ratified before the end of 2025 and will establish the world’s largest free trade zone, encompassing more than 700 million consumers. It is hoped the deal, which has been 25 years in development, will boost EU annual exports to Mercosur by up to 39% (€49bn).5

Additional progress includes:

- A trade deal with Indonesia, struck in September 2025;

- The EU-Mexico Modernised Global Agreement, set to be ratified shortly, which will build on an earlier trade agreement finalised in 20006 ;

- A pending comprehensive trade agreement with India; and

- Relaunched negotiations with Malaysia and the UAE.

This ramp up in Global South trade agreements and negotiations forms one pillar of a three-pronged strategy that Mühlberger and Walther identify as the key to unlocking untapped export potential in the bloc. The other two factors are strengthening of the EU single market, and enhancing/utilising the ‘trade defence toolbox’ to protect against unfair trade practices. Whether this strategy is enough to address Germany’s lagging export performance remains to be seen.

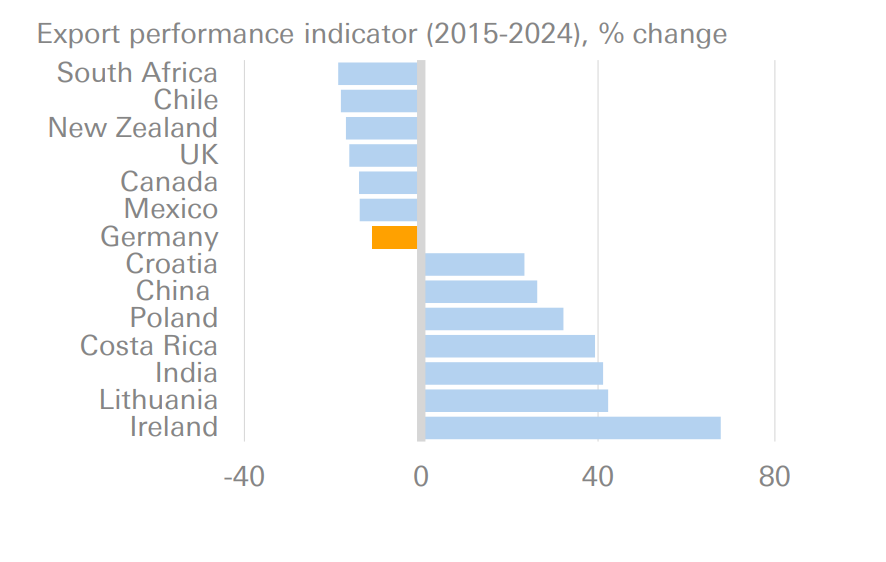

Germany’s export model changes

Germany remains the world’s third-largest economy, behind only China and the US. However, its export-oriented growth model continues to face challenges.

As highlighted in the flow article, ‘Germany at the crossroads’, export competitiveness has been on a downward trajectory since 2015. Rising global trade fragmentation is creating a general headwind, while future trade integration with two key export markets – China and the US – is being constrained by intensifying competition with China and the tariffs environment, among other factors.

Mühlberger and Walther noted that Germany is unlikely to return to its traditional export-led growth model. Instead, a more balanced approach – combining domestic demand stimulation, strategic trade diversification, and structural reform – offers a viable path forward.

One promising avenue is deeper engagement with the emerging economies of the Global South. The EU’s trade agreements with India and Mercosur may unlock substantial new markets for German exports, particularly in sectors such as industrial machinery, and chemical/pharmaceutical products and automotives.

There is also optimism that German exports will benefit from the removal of intra-EU trade barriers in the coming years. The reduction of barriers in sectors including energy, defence, telecommunication, digital, and services is a key priority for the Von der Leyen Commission.7

The cutting of regulatory red tape, noted the analysts, needs to be supplemented by deep structural reforms in labour, tax and energy policy, alongside increased investment in innovation and infrastructure, to ensure growth is sustainable.

Figure 2: Winners and losers in export competitiveness

Source: Shift in global trade patterns: opportunities and challenges from a macroeconomic perspective webinar, Deutsche Bank Research

Deutsche Bank Research reports referenced

Focus Germany: In search of new export markets, 17 July 2025, by Marion Mühlberger and Ursula Walther

The Global South: A strategic approach to the world’s fourth bloc, 6 May 2025, by Mallika Sachdeva and Peter Sidorov (Deutsche Bank Research Institute)

The webinar: Shift in global trade patterns: opportunities and challenges from a macroeconomic perspective, took place on 4 September 2025. Presented by Lothar Meenen, Head of Corporate Coverage EMEA, Deutsche Bank, this featured Marion Mühlberger and Ursula Walther from Deutsche Bank Research

Sources

1 See unctad.org

2 See commission.europa.eu

3 See ft.com

4 See bcg.com

5 See ec.europa.eu

6 See ec.europa.eu

7 See commission.europa.eu