23 April 2025

As West African countries have built their economies, it has often been a lack of infrastructure that has held them back. flow’s Clarissa Dann looks at the trading history of Nigeria and Cameroon and shares case studies of how export finance has enabled improved electricity supplies and a vital road

MINUTES min read

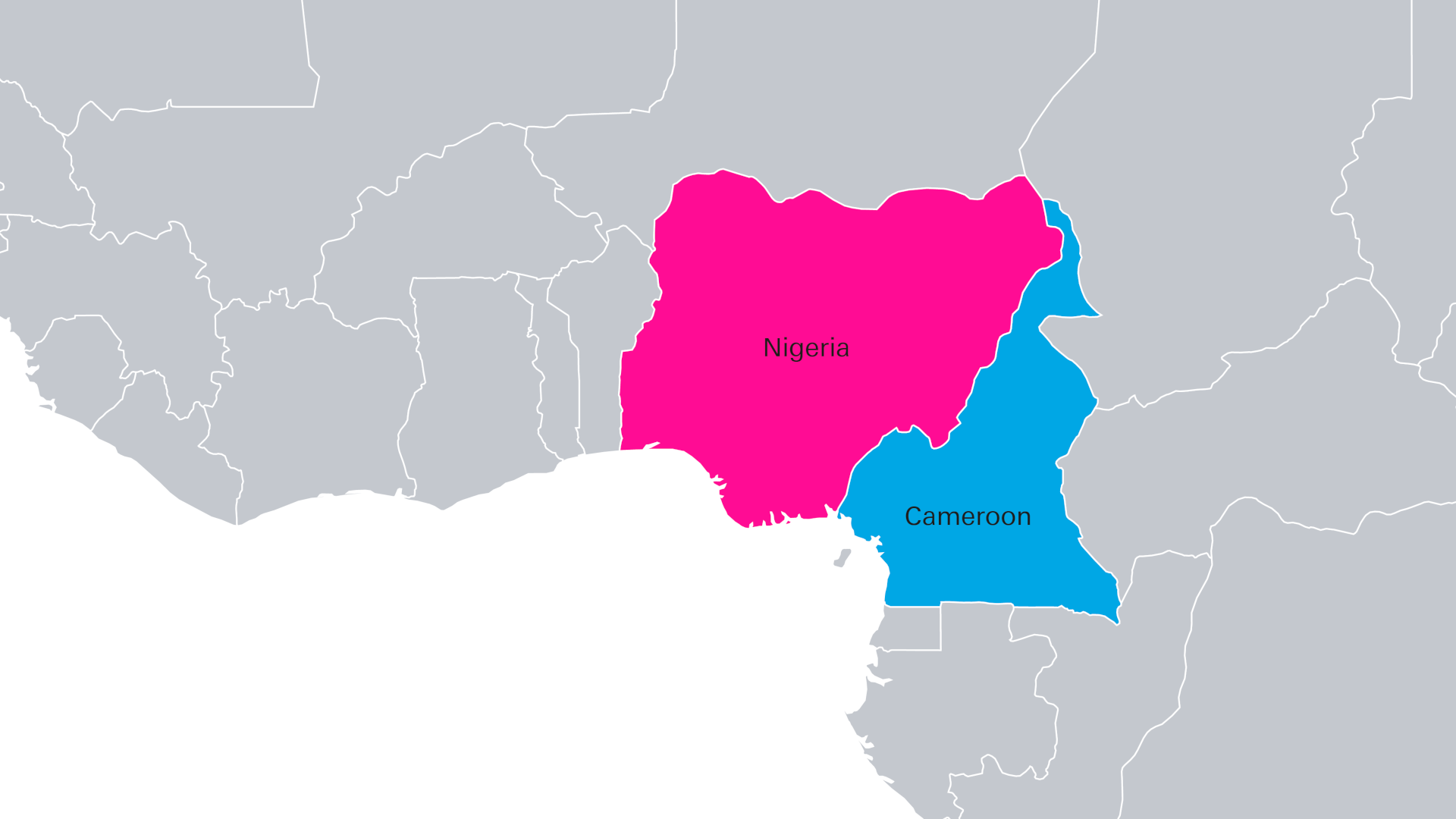

Situated in the crook of the West African coastline, Nigeria and Cameroon share not just a 1,700km border, but also a longstanding economic relationship influenced by historical ties, geographical proximity and economic trends.

Early trade relations between the two countries were limited because of inadequate infrastructure, border security concerns, and divergent economic policies. During the oil boom of the 1970s, Nigeria experienced rapid economic growth, but trade with Cameroon did not increase. “Although there was a slight rise in Cameroon’s dependence on Nigerian imports – primarily due to Nigeria’s dominant industrial sector – high tariffs and existing border tensions hindered deeper economic collaboration,” reflects Yemi Kale, Afreximbank’s Chief Economist.

He continues, “Over time, economic cooperation grew, especially in key sectors such as oil and gas, agriculture, and manufacturing. The Bakassi Peninsula dispute in the 1990s strained relations, but since its resolution, both nations have pursued deeper economic ties.”

Growing trade partnership

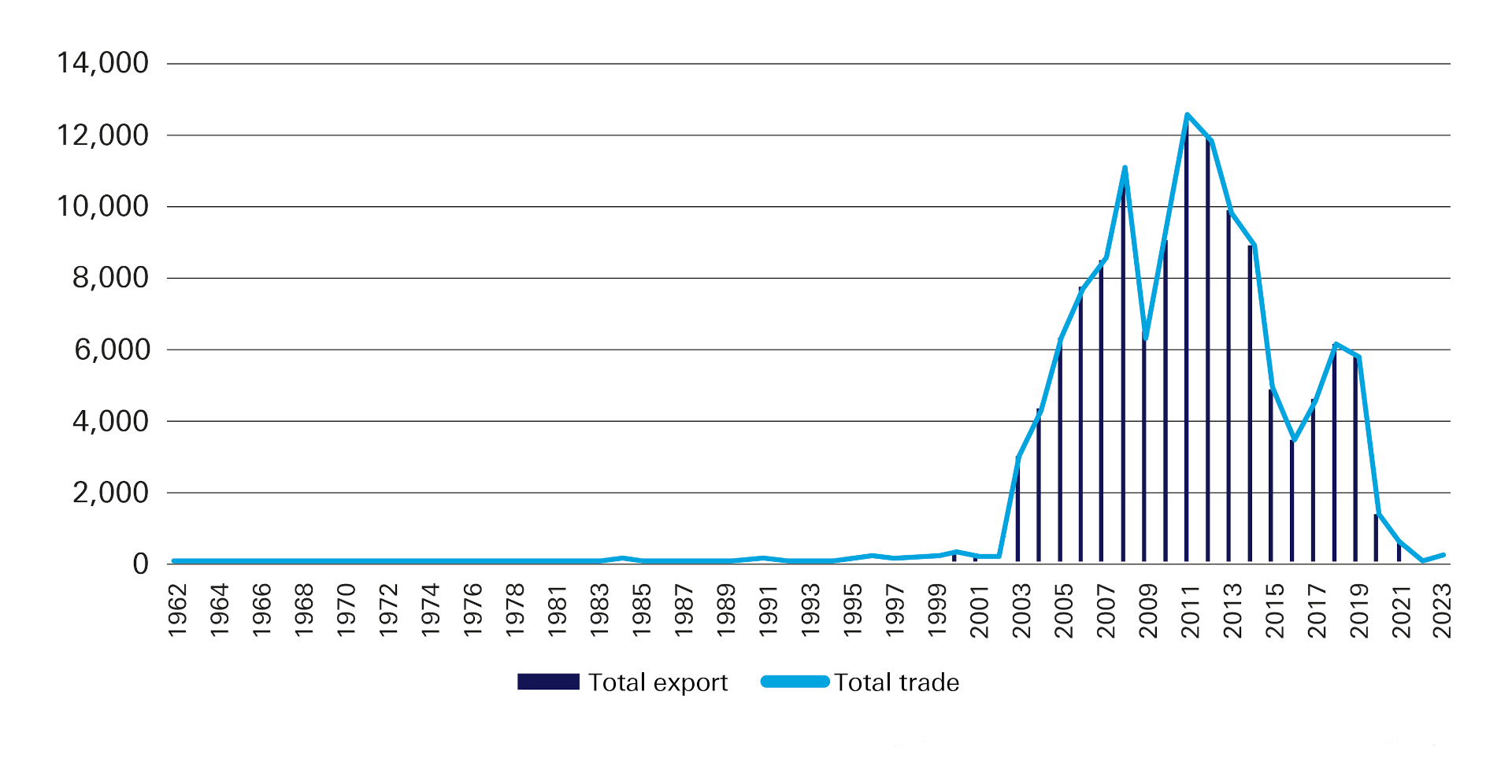

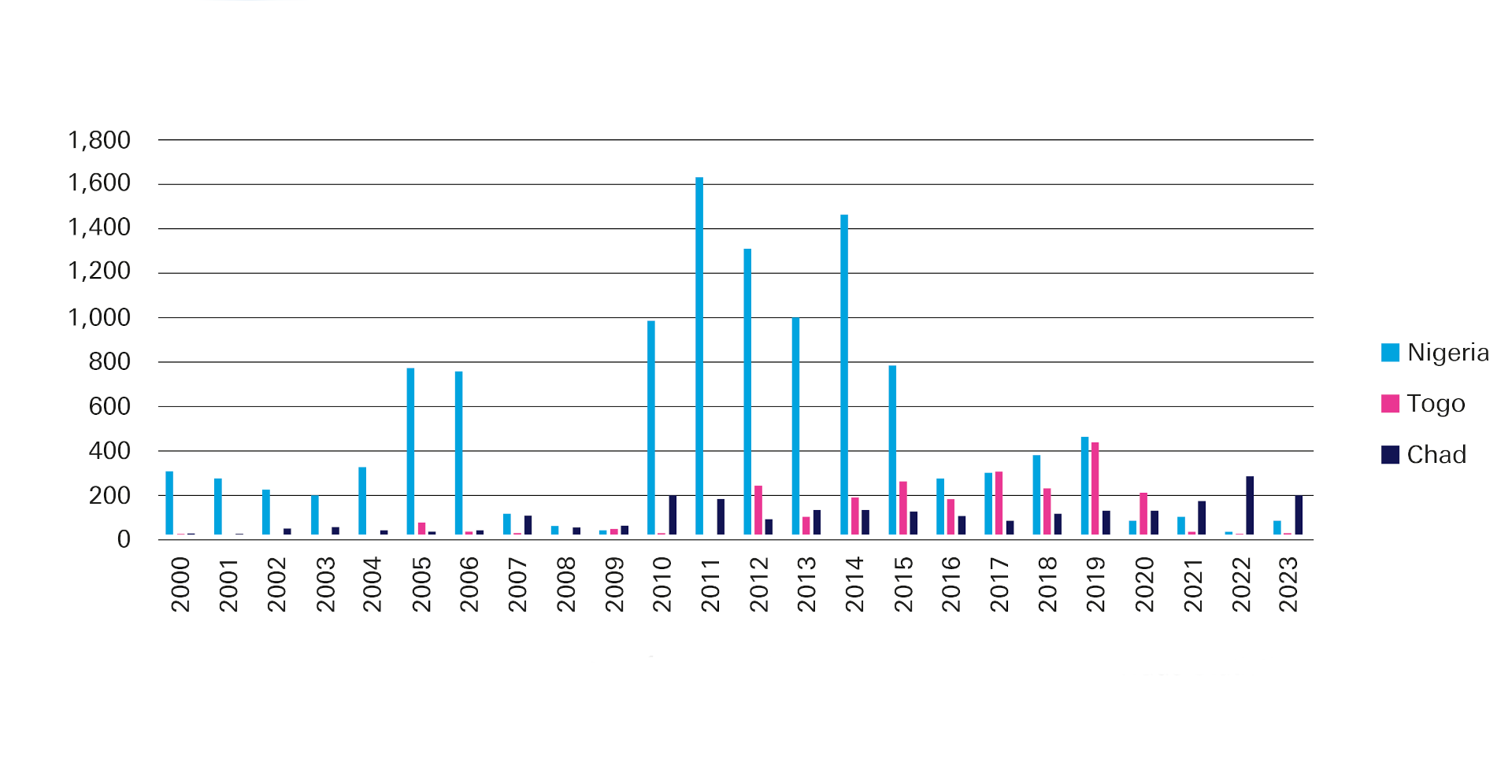

By the mid-2010s, Nigeria’s exports to Cameroon were hitting US$3.3bn a year. This was largely down to petroleum and an increase in manufactured goods, supported by improvements in cross-border infrastructure (see Figures 1 and 2). Flowing the other way, Cameroon’s exports to Nigeria mainly consisted of cocoa, timber and processed goods. Following the economic shocks of the Covid-19 pandemic, and despite the impact of the ongoing Russia/Ukraine conflict, this trade has been recovering since 2023 and stood at US$170.7m at the end of that year. Kale sees potential for these economies to “deepen their economic ties through policy coordination, trade facilitation, and investment collaboration”.

Figure 1: Nigeria’s trade with Cameroon (US$m)

Sources: Afreximbank Research, IMF Direction of Trade Statistics

Figure 2: Cameroon’s top three trade partners in Africa (US$m)

Sources: Afreximbank Research, IMF Direction of Trade Statistics

In short, both countries have navigated high levels of poverty and taken steps to improve bilateral trade, as well as supporting each other to protect their territories from terrorist threats. Given the theme of infrastructure improvement, this article shares details of two transformational export finance deals that have contributed to this – a vital road in Cameroon, and electricity distribution in Nigeria.

Powering Nigeria

Despite being one of the largest economies in Africa, Nigeria faces significant challenges in the power sector, including frequent power cuts, poor grid quality (with more than 100 entire grid collapses in the past 10 years) and limited access to electricity in rural areas. Even in urban areas where electricity is available, supply is often intermittent and unreliable.

“The reliable supply of power remains one of the biggest infrastructure tasks … in Nigeria”

In 2021, about 85 million Nigerians (43% of the population) lacked access to grid electricity, making it the country with the largest energy access deficit in the world, according to the World Bank.1 As Deutsche Bank’s Lagos-based Country Head Andreas Voss reflects, “The reliable supply of power remains one of the biggest infrastructure tasks for the current and all following governments in Nigeria. The next levels of economic diversification will only materialise if country-wide electrification makes significant progress.”

The Presidential Power Initiative (PPI) was conceived during a meeting between the President of the Federal Republic of Nigeria, Muhammadu Buhari, and German Chancellor Angela Merkel on 31 August 2018. The PPI aims to enable the power sector to achieve commercial autonomy by facilitating investments in critical infrastructure.

The Federal Government of Nigeria established a special purpose vehicle, the FGN Power Company Limited (‘FGNPC’), to own and execute the PPI. This includes securing funding, coordinating stakeholders, and establishing commercial and contractual agreements to address the country’s infrastructure gaps.

The PPI is being executed in three phases:

- Phase 1: Focus on implementing critical ‘quick win’ measures to increase the system’s end-to-end operational capacity to 9GW.

- Phase 2: Expand the capacity of the transmission and distribution systems to enable the supply of up to 11GW of electricity to end consumers.

- Phase 3: Increase total operational generation and grid capacity to 25 GW through further expansion of the generation, transmission and distribution systems.

It supports the reduction of greenhouse gas emissions and pollution from alternative means of power generation and the facilitation of modern technology to optimise grid performance, in line with the President’s Eight-Point Agenda:

- New lines will bring electricity to agricultural processing facilities and allow for refrigeration of products.

- Improved electricity supply improves standard of living and enhances quality of life.

- Economic growth and job creation.

- Inclusivity and knowledge transfer: a requirement for international contracts is training and transfer of knowledge.

The pilot project

Export credit agencies (ECAs) are government institutions that provide financial cover to domestic exporters in order to promote the export of goods and services and enable financing to importers and borrowers. This cover underpins the export transaction, and related financing reduces the financial risk for the loan, which serves the financing of the trade contract.

In December 2021, FGNPC and Siemens Energy of Germany concluded the first export contract concerning the supply and operation of 10 132/33kV mobile substations and 10 132/33kV transformers as part of Phase 1. This is set to swell Nigeria’s transmission sector by an additional 1,300MW, which goes some way towards tackling the country’s electricity shortages.

The loan agreement, whereby Deutsche Bank arranged a €60m 12.5-year loan backed by the German ECA, Euler Hermes, reached financial close in August 2024; the delay was mainly driven by the Nigerian presidential election in 2023 and the approval process. Due to the importance of the project, Siemens Energy and FGNPC agreed to effect deliveries earlier, in 2022–2023. FGNPC made payments under the contract that were reimbursed out of the loan to the borrower upon financial close of the facility. Deutsche Bank acted as sole arranger, facility agent, Euler Hermes’ agent and lender on the transaction.

Jyad BouChrouch, Sales Head, Grid Solutions Western Europe and Africa at Siemens Energy, tells flow: “The ECA financing arrangement and our collaborative approach in this pilot project play a key role in addressing the capacity gap between power generation and transmission in Nigeria.” He continues, “By leveraging Siemens Energy’s grid technologies, we aim to support the development of a more reliable and sustainable power infrastructure. This initiative highlights how strategic partnerships and well-structured financing models can contribute to meaningful improvements in electricity access and support broader economic development.”

Deutsche Bank’s Annette Seip, part of the German Structured Trade and Export Finance (STEF) team who structured the deal, makes the point that these mobile substations “will help reduce power outages, improve voltage stability, and enhance the overall reliability of the power grid”. She expects this to have a cascading effect on Nigeria’s economy, reducing the need for costly diesel generators, lowering electricity prices, and providing businesses with the consistent power they need to grow and create jobs.

Sean Manley (Siemens Energy - Project Director Presidential Power Initiative) and Oladayo Orolu (Siemens Energy - Regional Director for Grid Technologies Sales)

© Siemens Energy

Resurfacing roads in Cameroon

The Cameroon Government’s National Development Strategy 2020–2030 (NDS30)2 set out a road resurfacing plan that, by 2024, had evolved into a commitment to deliver 11,300km of asphalt surfaced roads by 2027.3

“The Olounou-Oveng road project is an important project for Cameroon”

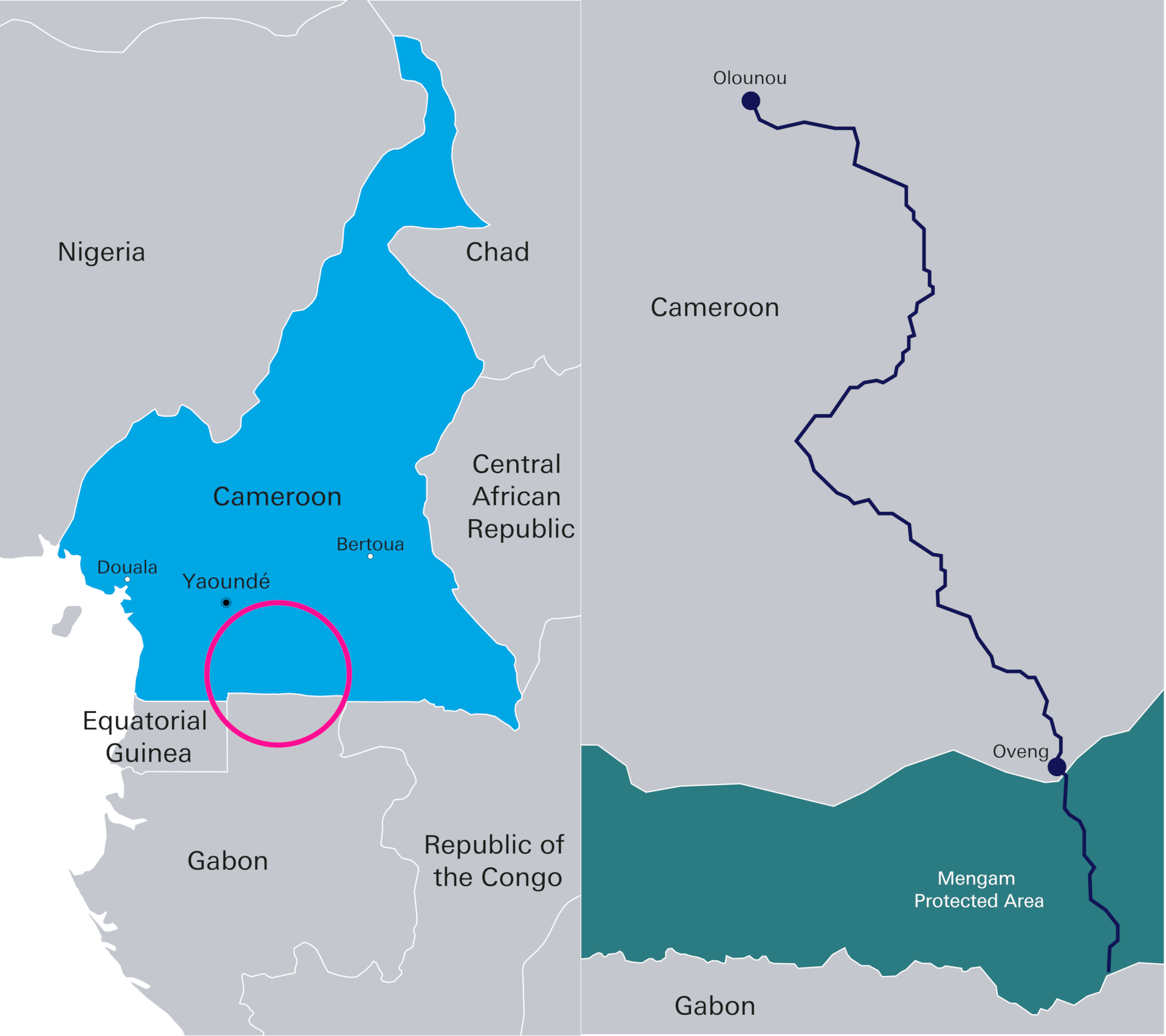

One of the critical highways is the dirt road connecting Olounou and Oveng. Its planned redevelopment includes rehabilitation, modernisation and expansion of the existing route over a construction period of 36 months. According to the feasibility study, once it is completed, the project will improve the lives of millions, boost economic trade, reduce travel time, and curtail air pollution from cars.

Smith Arrey, Deputy Director of Cooperation with Europe at Cameroon’s Ministry of Economy, Planning and Regional Development (MINEPAT), told flow, “The Olounou-Oveng road project is an important project for Cameroon because it will facilitate connection within the national network and between south Cameroon and neighbouring countries such as Congo and Gabon.”

Italian support

A €94.8m ECA facility was arranged by Bluebird Finance & Projects, with Deutsche Bank as sole lender and agent, with a tenor of 13 years; it is backed by SACE (Italy’s export credit agency), with the involvement of various Italian suppliers. SIMEST (the Italian development finance institution) is contributing a subsidy mechanism that allows an attractive fixed rate. Closed in October 2024, the project has now moved into the construction and operation phase. The construction is being carried out by two Italian contractors, Seas and Cosedil. A further 50km is being planned as Phase 2 of this project, to complete the connection of Oveng with the Gabonese border.

The transaction is a good example of how medium-sized Italian enterprises can create huge impact in a key infrastructure project – illustrating that projects like these are not just the domain of the giant engineering, procurement and construction companies.

Ndeye Rivet, part of Deutsche Bank’s STEF team for the Middle East and Africa, explains how “this project of national importance for Cameroon aligns with Deutsche Bank’s strategic focus on supporting infrastructure development in key emerging markets”. She highlights “the significance of the financing structure in enabling long-term sustainable growth while reinforcing Deutsche Bank’s commitment to facilitating cross-border trade and investment in the region”.