24 March 2025

An era of seemingly continuous economic and geopolitical crises has placed a premium on efficiency, flexibility, and risk mitigation for large companies around the world. Dr Tobias Miarka explains how that dynamic is changing the return-on-investment calculation for global corporates in trade finance and supply chain management

MINUTES min read

A continuous economic and geopolitical ‘poly-crisis’ is creating a powerful incentive for companies around the world to invest in trade finance and supply chain management capabilities. This new focus is accelerating digitisation and opening the door to next-gen solutions with the potential to make these core corporate functions more transparent, flexible and efficient.

Companies use trade and supply chain finance for two main reasons: First, as a form of debt finance where the buyer’s bank assumes the responsibility of paying the seller and takes the risk on the buyer having performed its own due diligence, and second, as a means of managing risk of non-delivery those goods. If a buyer pays up front, there is no leverage if the goods do not arrive. With trade finance, it’s banks that take on this risk – and therefore create a bridge between the seller and the buyer. At the macro level, risk is often triggered by geopolitics while at the micro level it is often prompted by distrust in the counterparty. In both cases it drives corporates’ appetite for trade finance – in addition to the availability and cost of bank loans and capital markets funding.

Hence, just a decade ago, when interest rates and funding costs were still at historic lows, globalisation was on the march and no one had heard of a coronavirus, the reasons for using trade finance were very different than they are today. When CFOs turned their attention to supply chain management, it was mainly to reduce production costs by shifting manufacturing to lower-cost markets and to achieve higher efficiencies by perfecting just-in-time production.

The situation could not be more different today. Large companies face an expanding list of interconnected challenges. ‘Higher for longer’ interest rates are pushing up corporate funding costs. The normalisation of trade flows and supply chains in the wake of the global pandemic has been interrupted by a series of new disruptive events, including wars in the Ukraine and the Middle East, and attacks on shipping in the Red Sea. Geopolitical tensions between China and both the European Union and the United States were disrupting global trade even before the return of Donald Trump to the White House. Since his inauguration in January 2025, the announcement of tariffs and the threat of additional levies have added further barriers to established trade corridors.

In this environment of rising costs and risks, companies see the possibility of a much bigger payoff from any initiative that increases efficiency and flexibility. That dynamic is changing the return on investment (ROI) equation for global corporates on investments in trade finance and supply chain management.

Trade finance as a funding alternative

With uncertainty on the rise, corporate treasury departments are using every tool at their disposal to shore up balance sheets and ensure access to credit. Every year, Crisil Coalition Greenwich asks more than 2,500 CFOs and group treasurers of large corporates around the world to name their departments’ top priorities for the next 12 months. In 2024, participants from North America, Europe and Asia named “financing and refinancing” as their top priority for the coming year by a significant margin.

Corporate borrowers working to refinance existing low-cost debt in today’s higher-rate environment have been hoping for relief from continued central bank rate cuts. Although the European Central Bank as well as the Bank of England appear, at least for now, on track for more easing despite a recent uptick in prices, stubborn inflation data in the US has caused the Federal Reserve to pause, with some economists even seeing the chance for a rate increase in 2025. The upshot – it is much less likely corporate funding costs will drop significantly any time soon.

48%

Trade credit provides a direct source of financing that can help offset high borrowing costs or limited credit availability because a third party in the form of the financier takes the risk on the buyer and seller. This alternative is especially important to companies in Asia where one-third of corporates experienced financing issues in 2024; up 12% from the year before.

Asian companies last year also cited additional concerns, such as FX volatility, payment delays and a lack of credit availability at acceptable terms. These issues seem especially acute in China, where financing has become tougher to secure and more expensive. Companies in China report that, over the past 12 months, foreign banks operating within China – especially European banks – have become more conservative in extending balance sheet.

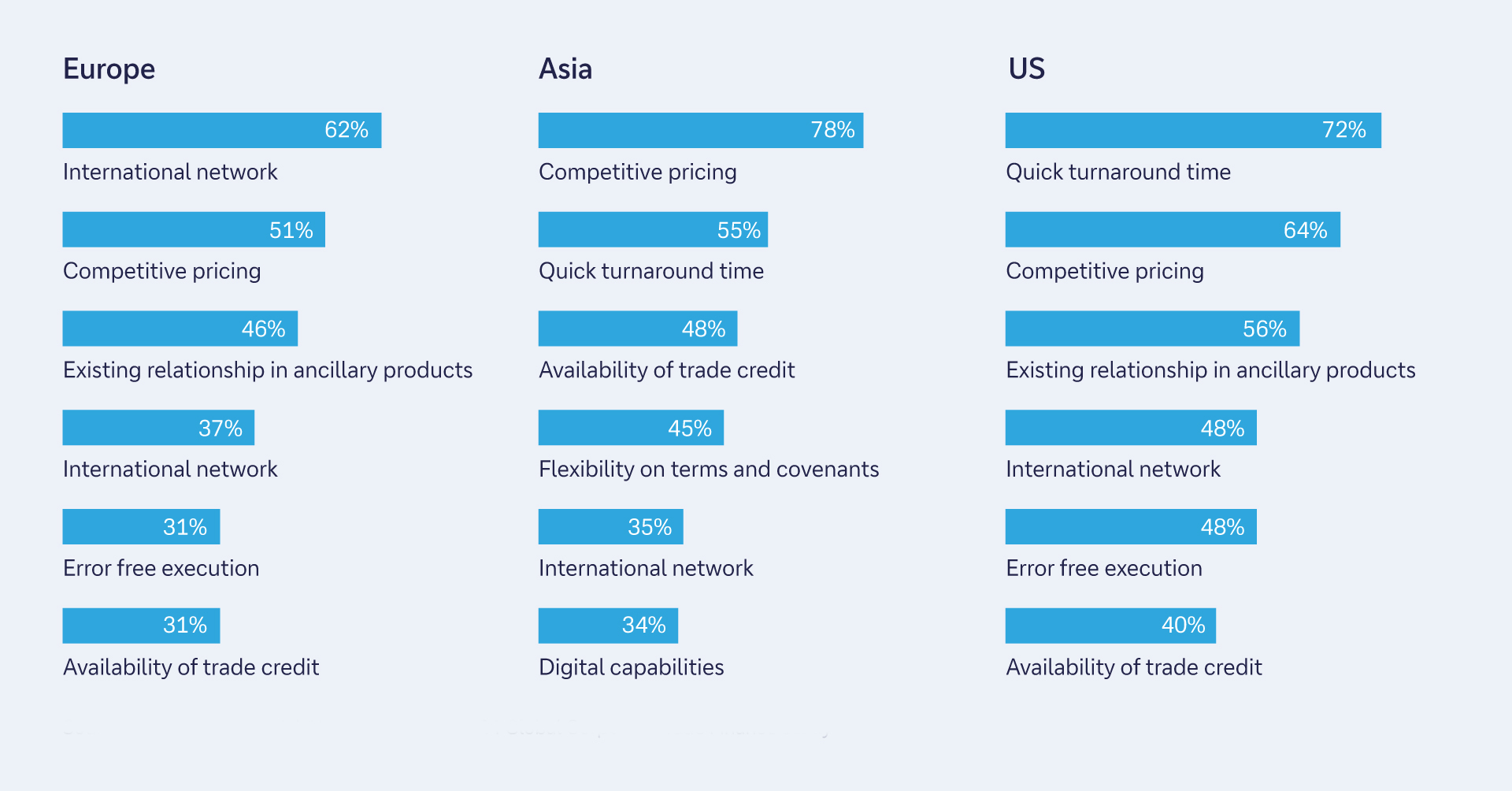

Reflecting that challenging funding environment, roughly half of large corporates across the Asia region now cite “availability of trade credit” as one of the key reasons for choosing a bank for transaction banking services, versus 40% of US corporates and only around 30% of large companies in Europe.

Figure 1: Key selection criteria for overall trade finance providers

Source: Coalition Greenwich Voice of Client – 2024 Global Corporate Trade Finance Study

Enhancing risk management

Growing uncertainty about the macroeconomic and geopolitical situation is also motivating CFOs to ensure that their companies are well-prepared and nimble enough to handle future challenges. Diversification offers one angle to prepare for this: As part of the research, about one in five Asia-based corporates say they are diversifying into Europe, with smaller numbers extending supply chains into other foreign regions. Asia, however, remains the focus, with almost half the companies diversifying their supply chains into countries within the APAC region. Vietnam and India are top destinations, continuing the trend observed in recent years.

“Although diversification can help reduce supply chain risk, it can’t eliminate it entirely, especially in the era of the poly-crisis”

Although diversification can help reduce supply chain risk, it can’t eliminate it entirely, especially in the era of the poly-crisis. Today, even companies with production spread across multiple jurisdictions can run low on inventories due to a lack of steamship capacity in Asian ports or longer than expected ocean-freight transit times caused by Red Sea attacks or delays at the Panama Canal. At the other extreme, companies will often have to manage and finance oversized inventories as they stock up to stay ahead of new tariff announcements, dockworkers strikes or other trade disruptions.

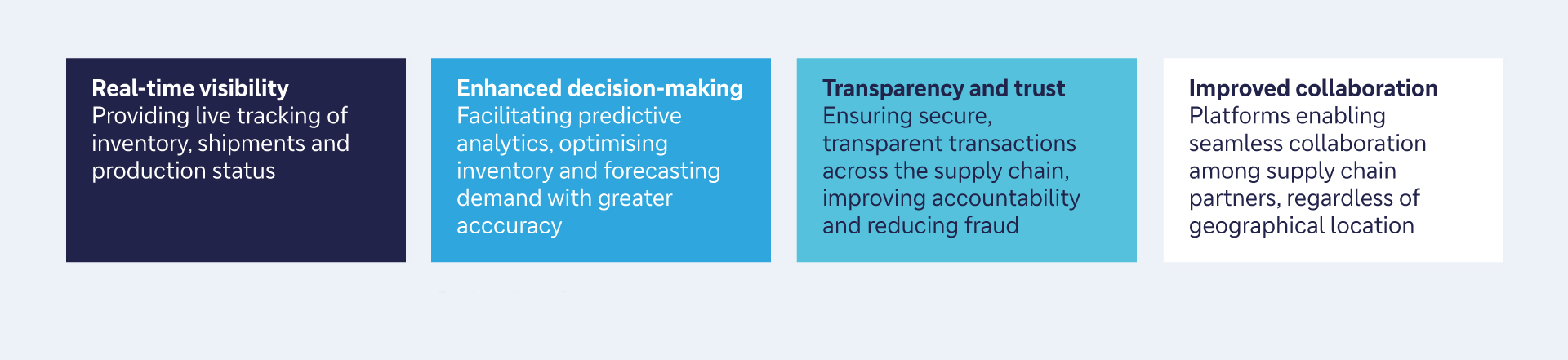

Another angle for corporates to improve risk management is by adopting new technology solutions. Data analytics, automation and emerging artificial intelligence applications can streamline operations, optimise inventory management and make supply chains more visible and efficient. These advancements enable faster decision-making and reaction times. Companies can use real-time tracking systems, advanced analytics and blockchain technology to identify potential bottlenecks early and take measures to avoid them. For companies that integrate these technologies, the results can be lower costs, improved transparency and a heightened ability to respond effectively to changing conditions and crises.

Figure 2: Impact of digital technologies on supply chain management

Source: Coalition Greenwich 2025 Digital Banking Transformation Study

These potential benefits are speeding up the digitisation of trade finance. While the industry has been working hard to achieve a digital solution, as pointed out in Deutsche Bank’s Guide to Digital Trade Finance, it is hard to align all the large number of parties involved – from port authorities, customs to financiers and corporates. For many smaller players, manual, paper-based processes worked well, and the costs and headaches of switching to digital platforms just didn’t seem worth it.

This has all changed. Today, digital supply chain management platforms are proliferating amongst companies in all regions. Most large corporates now conduct at least a portion of trade finance business through digital channels and the focus on digitisation is also driving selection criteria when looking for a banking partner: 46% of respondents in Europe, 51% in the US, and 54% in Asia mention digital banking capabilities is one of their key selection criteria. Therefore, securing this capability is a firm top five requirement among all criteria in consideration.

How can banks help?

Banks can help companies modernise trade finance and supply chain management by expanding and upgrading their digital offerings, and by ramping up marketing and education efforts that inform companies about solutions that are available, and teaching treasury staff how to use them.

As banks build out their digital trade finance platforms, they should focus on the following ‘wish list’ of attributes from the hundreds of companies participating in the Crisil Coalition Greenwich study this year. Broadly speaking, companies want:

A seamless digital journey

- No manual intervention; digital from end-to-end

- Fewer physical documents and submissions

- User-friendly and intuitive process

More trade finance products available online

- Documentary trade (letter of credit, bank guarantee, etc.)

- Supply chain finance

- Integration with other systems (cash, FX, etc.)

A new era of innovation

Based on feedback from companies participating in our global research, we believe the changes we are seeing today are just the beginning, and we are about to enter a new phase of innovation and investment. Companies will not be looking to just digitise their existing process. Rather, they will experiment with using digital tools to reengineer trade finance and supply chain management, and in the process create new solutions efficient and flexible enough for an era of continuous poly-crises.

About the author

Dr. Tobias Miarka is leading Coalition Greenwich’s Corporate Banking research globally and advises international as well as domestic banks on strategic client service and product issues that result in profit enhancing and sustainable solutions. He is also affiliated with the ESCP Business School where he teaches banking and fintech related subjects as part of the school’s Master in Management programme