14 October 2024

Digitalisation of trade finance instruments and tightening prudential regulation could be drivers for trade finance distribution and the quest for new sources of trade finance liquidity. flow’s Desirée Buchholz explores some of the key themes of ITFA’s 50th annual conference in Cyprus

MINUTES min read

Long beaches, year-round sunshine, historical monuments: Cyprus is a typical holiday destination with tourism accounting for more than 20% of the country’s GDP1. However, with its strategic position at a crossroads of three continents, trade and geopolitical conflicts have always shaped Cyprus’ history. This year, it’s been 50 years since this island in the Mediterranean Sea was divided by a 110-mile-long demilitarised buffer zone monitored by the UN Peacekeeping Force. While the southern Republic of Cyprus is part of the European Union (EU), the Turkish Republic of Northern Cyprus (TRNC) is not.

It is therefore quite fitting that the International Trade & Forfaiting Association (ITFA) chose Cyprus – namely the city of Limassol – to host its 50th Annual Conference. During a time in which the conflict in the Middle East and its escalation into the Red Sea is rerouting supply chains, it fell to Constantinos Petrides, Cyprus’ former Minister of Finance (December 2019 – February 2023), to remind the 400 delegates that although “geopolitical tensions have always been around”, the world is currently “seeing the biggest diversion of trade since the outbreak of the second World War”.

In his keynote speech, Petrides set out four dynamics, which – in his view – are shaping global trade:

- The rise of protectionism: Multilateralism and WTO rules lose its supporters as more and more countries impose trade restrictions and local subsidies.

- Security concerns in Europe: In the light of the Russia/Ukraine war, fiscal sustainability and economic integration becomes more important for the EU.

- Changing demand patterns: The growing importance of high-tech and the necessity for a green transition will “reshuffle playing cards” in favour of countries with most needed resources and commodities which will create new dependencies.

- Threats to the global financial system: The US dollar remains the most dominant currency in world trade, but as Petrides stated, “Sanctions imposed by Western countries may encourage countries like China or Russia” to look for alternatives way to pay and process trade.

Petrides connected his analysis with two central demands: deepening European integration (only as a bloc, the EU will be heard on the table, he believes) and reforming the WTO to revitalise multilateralism.

Constantinos Petrides, former minister of finance Cyprus, during his keynote

As risks in trade finance are increasing, so does the need for risk mitigation and distribution. Clearly, digitalisation is a big lever – the growing importance of electronic documents and fintech applications to speed up processes as well as artificial intelligence (AI) to improve decision-making based on data was discussed in several sessions as well as two follow-up videos.

Regulation aligns with trade technology

In September 2023, the UK Electronic Trade Documents Act 2023 (ETDA) came into granting certain electronic trade documents the same legal validity as their paper equivalents in the UK. More specifically, ETDA allows bills of exchange, promissory notes, bills of lading and warehouse receipts – all of which are used to facilitate payment for goods and services – to be handled digitally.2

With the Act, the UK became the first G7 country to adopt the Model Law on Electronic Transferable Records (MLETR) developed by the United Nation Commission on International Trade Law (UNCITRAL) in 2017. The International Chamber of Commerce (ICC) saw this bill as a “cornerstone to digitalising world trade” as it estimates 80% of all bills of lading to operate under English law3. Further details can be found in flow’s Guide to Digital Trade Finance (updated in July 2024).

Moreover, UK’s legislation has created momentum: As of September 2024, France, Germany and the US have enacted similar legislation according to the MLETR tracker, while other major trading nations such as Japan and China are in advanced stages.4 “As more countries align with MLETR, and the use of electronic transferable records (ETRs) becomes more common, scalable models for data and document transfer will likely emerge”, wrote Pamela Mar, Managing Director, Digital Standards Initiative of the ICC in her flow article Data as a building block for digital trade finance.

Digital Instruments – where are we now and what’s next? Panelists from left to right: Patrik Zekkar (CEO Enigio), Sarah Green (Head of Digital Assets and Trade Finance at D2 Legal Technology), Pierre Courquin (Head of Forfaiting at Société Générale) and Geoffrey Wynne (Partner at Sullivan & Worcester)

In the panel moderated by Geoffrey Wynne, Partner at Sullivan & Worcester, participants discussed what opportunities digitalisation brings, and how its wider implementation could be accelerated.

Professor Sarah Green, Head of Digital Assets and Trade Finance at D2 Legal Technology (and formerly the Law Commissioner for ETDA), admitted that she still sees “doubt and reservations in the industry in terms of implementation”. A key sticking point is the requirement to use of a ‘reliable system’ to provide an electronic trade document with the same treatment as a paper document.

“Our basic principle was to create a future-proof Act which does not restrict technology development”

While the Act provides guidance of factors that could determine a reliable system, it leaves room for interpretation. “If we had spelled how a reliable system should look like in the Act, there is no way the Act would have lasted for more than ten years”, explained Green. “Our basic principle was to create a future-proof Act which does not restrict technology development. So, it now allows the industry to build the system that they want to have provided it achieves the singularity of document.”

This was echoed by Patrik Zekkar, CEO of the Stockholm-based document digitalisation company Enigio confirmed that in his view the law was written “to provide us with a framework to develop a technology that fits into how parties involved in a trade finance transaction are operating today”.

According to him, it needs to be easy and involve minimal changes to existing processes to digitise trade documents. “This means that a new system should not involve onboardings and signing of contracts for all parties”, Zekkar said. “It’s a quite high barrier to ask parties involved in a trade transaction to move it somewhere else. This is why consortiums such as Contour, Tradelens, we.trade, etc failed to digitalise trade.” Enigio uses the PDF format for digital trade documents – everyone recognises, trust and knows what they are.

“We tend to stick with what we know and what works”, added Green. “But if we built a new system to deal with trade finance in the 21st century there is no way that a bill of lading would be done on paper.” A comment from the audience added that the best way to change mentality is to start by digitising “a low-risk product” because “once people see the opportunities suddenly all the barriers go away”. But, added the delegate, “you need that first step”.

It fell to Pierre Courquin, Head of Forfaiting at Société Générale to remind delegates:

- Digitalisation saves time and costs. It’s possible to issue, accept, endorse and discount a bill of exchange within a matter of hours. “Banks will be able to fund the supplier quickly and supplier will be able to improve working capital.”

- It increases security. “The risk of fraud or losing the paper document is mitigated.”

- It improves accessibility for small and mid-sized companies (SMEs). “Large corporates can afford to have dedicated teams for trade finance that have the expertise, but digitalisation will ‘demystify’ the complexity of trade finance for SMEs.”

Fittingly Wynne summed up, “In many sessions we talked about how regulation is making trade finance more expensive. This regulation is the opposite; it makes trade finance cheaper and more accessible.”

Trade finance as an asset class

Merchandise trade enjoying an uptick compared with 2023. The World Trade Organisation (WTO) now forecasts +2.6% in 2024 and +3.3% in 2025.5 The distribution of trade finance assets has always been a key contributor to continued trade growth given that around 80% of global trade financed by some form of trade credit.

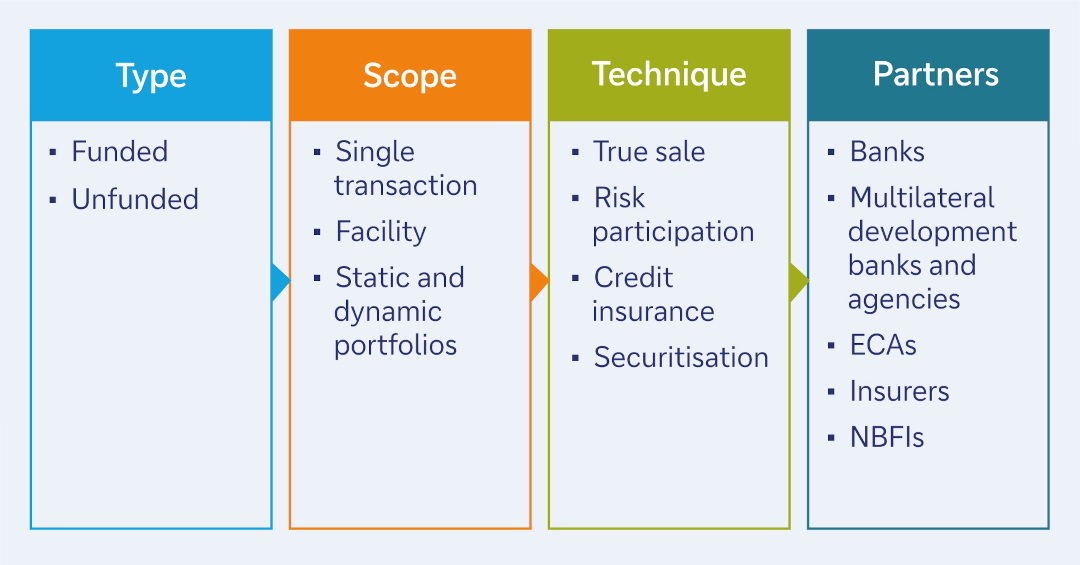

Figure 1: Distribution techniques

Source: ITFA Cyprus 2024 presentation

“We de-risk because it allows us to free limits and do more business with our clients. Moreover, sharing risks in the market is beneficial because it’s the best way to grow the trade finance market”, said Boris Jaquet, Global Head of Trade Finance Distribution at Deutsche Bank on a panel on Distribution techniques. “We use the full toolkit of distribution techniques to be able to sell every single asset that is likely to come on our balance sheet – in case we want to.”

“Sharing risks in the market is beneficial because it’s the best way to grow the trade finance market”

Given the upcoming prudential regulation Basel 4 and the general pressure on bank balance sheets, attention is now on the potential interest from non-bank investors (NBFI) in the asset class to increase overall liquidity. While investors are attracted to alternative asset classes such as trade finance with low volatility and consistent return as well as low correlation against the broader financial market – challenges remain.

The ITFA Trade Finance Investment Ecosystem (ITFIE) Working Group, launched in 2022, had published three key reports ahead of the annual conference6:

- Voice of the Institutional Investors by Suresh Hegde of Goldman Sachs Asset Management and Guy Brooks of Pemberton Asset Management;

- Rules of the Game by Geoff Wynne of Sullivan & Worcester UK Ltd and Paul Coles of Orbian

- Technology and Data by Andre Casterman of Casterman Advisory and Matt Wreford of Demica

The various routes from origination of the trade finance to its various destinations for investors or other risk participants are helpfully set out by Wynne and Coles. “There are several key methods through which an investor can gain access to trade finance asset(s). Note that in general, regardless of structure, most investments in trade finance assets are conducted on an uncommitted basis unless specifically agreed otherwise,” they explain. One of these exceptions is, they continue, “Participations using a Master Participation Agreement (MPA) or similar type of document7, where the seller remains the fronting institution and funder of record and the participant assumes the risk of non-payment of the obligor and the financial benefit of the trade finance assets.”

“Banks and other industry participants have made good progress on mapping and explaining the landscape of broader trade finance, but much of it continues to be less appealing to investors either because of esoteric risk drivers, lack of data transparency and/or low pricing”, write Hegde and Brooks.8

They point out that working capital finance (receivables and payables) is the first sub-asset class of trade finance to find wider recognition and adoption amongst instructional investors. “The nature of the cashflows closely resembles traditional fixed income assets, and it is at least superficially more straightforward to assess credit risk than for more complex trade finance loans whose risk drivers may change in nature as the goods physically move from one place to another.”

Digitalising trade finance distribution

What are banks doing to foster institutional investor demand for trade finance assets? According to one panelist “the old impression that we need to educate them how the trade finance markets works is no longer true”.

While NBFIs “would like to transfer trade finance into more capital markets notes to make these transactions more accessible and liquid”, the panelist also acknowledges willingness to adopt to the requirements of banks. “They are willing to sign master risk participation agreements. It’s not always about portfolio solutions, but we see investors happy to look at individual transactions as well.”

Video 1: Deutsche Bank’s Boris Jaquet about the changing distribution landscape

Boris Jaquet, Global Head of Trade Finance Distribution at Deutsche Bank Corporate Bank, tells flow’s Desiree Buchholz why he believes that digitalisation of trade finance instruments "is a game changer for distribution" and how the industry addresses investor needs

One of the key obstacles keeping institutional investors from purchasing trade finance assets is the comparably low yield. According to Deutsche Bank’s Jaquet there are two levers to address the yield issue: Portfolio solutions and digitalisation. “Digital instruments are a game changer because they allow us to distribute faster, quicker, safer and in bigger volume” he said, adding that the bank has decided to “harmonise the process of distribution wherever possible”.

For example, the bank introduced a unified policy for insurance five years ago that was signed off by more than 55+ insurance partners and can be used from lending project finance down to trade flow business. “That was the way to free up time, reduce operational risk and lower costs,” he said.

The International Trade & Forfaiting Association’s (ITFA) 50th Annual Conference, Cyprus was held 4–6 September 2024

Sources

1 See cyprusprofile.com

2 See ETDA in action

3 See committees.parliament.uk

4 See digitalizetrade.org

5 See wto.org

6 See itfa.org

7 See baft.org

8 See August 2024 report working group report: ITFA – The Voice of Institutional Investors