31 August 2023

Growth in supply chain finance (SCF) volumes is being backed by increasingly robust reporting requirements, electronic documents legislation and greater collaboration between fintechs and banks. Investors are also showing interest in SCF-based assets. flow reports on the state of play

MINUTES min read

A combination of factors, ranging from globalisation that has lengthened supply chains to regulatory changes impacting on traditional trade, has driven demand for supply chain finance (SCF). According to BCR Publishing’s World Supply Chain Report 2023, global SCF volumes have risen by 21% year-on-year to US$2,184bn and funds in use are up by 20% YoY to US$858bn. This increase is backed by strong growth in Africa and Asia, which have seen volumes improve by 39% and 28% respectively. Growth across other markets – including the Americas and Europe – has maintained a healthy upwards trajectory of 15% to 30%.1

Behind this strong demand, several changes are underway across the SCF industry. New players – who regard SCF as a relatively safe investment in uncertain times – are entering the space. At the same time, updated and more robust reporting requirements are upcoming, and the enhanced transparency could incentivise these recent recruits to stay invested in SCF for the long-term. Driven by changes to UK law and the growing number of fintech-bank collaborations, digitalisation – a longstanding priority for the industry– looks set to finally ramp up.

Taken together, ongoing growth and the slew of changes could further transform the SCF space.

Sustainable growth or bubble?

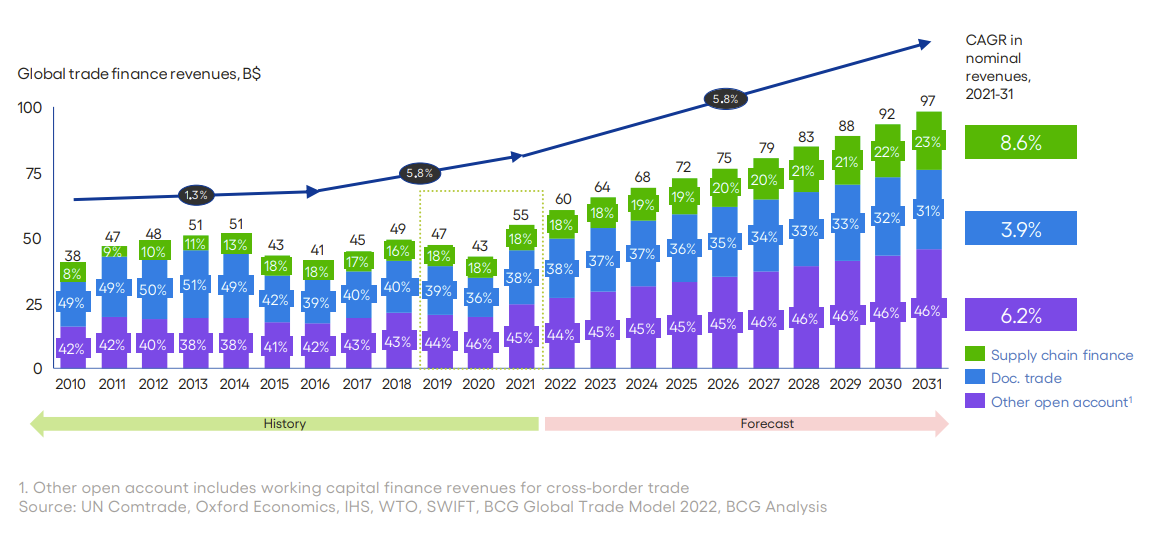

The recent growth of SCF is by no means an anomaly. While there was clearly a peak in 2020 with the impact of Covid-19 affecting trade volumes, the International Chamber of Commerce (ICC) Trade Register/Boston Consulting Group reports that payables finance exposure between 2017 and 2021 has, nevertheless, more than doubled (see Figure 1).2

Figure 1: BCG forecast of trade and supply chain finance revenue pools (2010–2031)

Source: ICC Trade Register Report 2022

In the short to mid-term there should be no issue in maintaining this pace of growth. The current

backdrop of rising interest rates and inflation have encouraged a diverse cast, from large institutional investors and sovereign funds to alternative investors and asset managers, to test the waters.

“These new players see that the SCF business is linked to the real economy and well diversified,” said Eric Balmer, CEO, Global Supply Chain Finance Group while speaking at BCR’s RFiX 2023 event in London.3 “This makes SCF a relative safe haven compared to traditional fixed income markets – and while it does not provide high returns, it does provide decent returns.”

“There is lots of room to continue this growth [of supply chain finance]”

As with any financial market, there are concerns that this unprecedented growth could lead to a bubble. For example, if SCF becomes a “borrowers” market (where demand for financing becomes higher than the offering), further down the road this may lead to lower pricings and spreads, while the risks will remain the same. That could lead to an unmatched risk/return for investors and, were defaults then to occur, could reduce the availability of financing.

Broadening the borrower base could be one way to reduce the potential risk of a bubble bursting, suggested Christian Hausherr, Product Manager, Supply Chain Finance EMEA, Deutsche Bank at the same event. “There is still this infamous long tail, which is not served by supply chain finance, and I believe there are still a lot of companies that are not yet using SCF,” he says. “And there are also all the emerging markets, where the global supply chain finance techniques are not yet that common. So, there is lots of room to continue this growth.”

Goodbye paper, hello digital

Digitalisation has been high on the global trade agenda for several years. To this end, blockchain initiatives and technology platforms have come and gone as it became clear that eagerness to adopt and entirely new technology – as opposed to digitalising existing documentation was lacking in the trade finance community. Progress on digitalisation (as opposed to digitisation) has also been hindered by the underlying laws remaining largely unchanged. Even now the operation of many documents important to international trade, including bills of lading and bills of exchange, are still legally premised on their physical possession – meaning digital documents are simply not an option. This legal obstacle to digital trade has proved to be a real challenge and one now being addressed by English law.

The UK’s Electronic Trade Document Bill – based on the model law on electronic transferable records (MLETR) passed in 2017 by the UN International Trade group – gained royal assent on 20th July 2023 and gives electronic trade documents the same legal footing as paperwork in trade and trade finance.4 The impact of the bill is expected to be huge, with McKinsey estimating that an electronic bill of lading could save US$6.5bn in direct costs and enable US$40bn more global trade.5

“Once digital trade documents are properly implemented, so much efficiency will move into the process and I think this will be a game changer,” said John Omoti, Vice President – Supply Chain Finance, Bank of China Limited, London Branch at the BCR RFiX event.

The potential impact of the Bill reaches far beyond the UK. For example, around 80% of bills of lading – and many more trade agreements and transactions – operate using UK law, giving it a global impact. Commenting on 20 July after the Bill’s Royal Assent, Head of Sullivan’s Trade & Export Finance Group and the firm's London office Geoff Wynne said, “This new law removes the physical barriers to the creation and exchange of the documents of trade and trade finance, and will, I have no doubt, deliver a significant uptick in the volume of trade that is financed, globally, in the coming years by both banks and non-bank financial institutions. It will also broaden out the appeal of trade finance assets as viable assets to finance.”6

Inevitably, like all major changes, the implementation of digital documentation will not be straightforward and will involve infrastructure changes across the board. “It is very difficult to actually go from the dream of electronic documents through to the implementation,” explained Justin Parr, Credit Risk Leader at supply chain visibility platform Beacon. “It is not an easy step, especially for smaller businesses – and even large businesses will be very cautious. So, I think definitely an education process needs to happen before we can really make full use of it.”

Robust reporting requirements

New reporting requirements are coming into force to meet concerns from investors that some supplier finance arrangements are not sufficiently visible. In September 2022, for example, the Financial Accounting Standards Board (FASB) released a new standard on disclosure that has the potential to significantly impact SCF programmes. From this year – and for fiscal years beginning on and after December 15, 2022 – corporates that are obliged to report under the U.S. GAAP standards will have to disclose the key details of their SCF programmes, including the terms and size, in their financial statements.7

According to the press release issued by FASB, “A company that uses a supplier finance programme in connection with the purchase of goods or services will be required to disclose sufficient information about the programme to allow a user of financial statements to understand the programme’s nature, activity during the period, changes from period to period, and potential magnitude.”8

In May 2023, the International Accounting Standards Board (IASB) followed suit by announcing new disclosure requirements to enhance the transparency of supplier finance arrangements. The new requirements, which will come into effect for annual reporting periods beginning on or after 1 January 2024, will require companies to disclose: the terms and conditions; the amount of the liabilities that are part of the arrangements; the ranges of payment due dates; and liquidity risk information.9

“This is a push for more qualitative and quantitative disclosures on financials – and I see nothing wrong in this,” commented Omoti. “The result is that these programmes are managed correctly, and investors are aware of the situation and can make the right decision from a credit standpoint.”

The positives are clear: greater transparency could make SCF-based assets a more attractive investment. One downside is that the new requirements will take up additional time and resources for the provider and the auditors.

“Let us step into the shoes of the auditor for a large global corporate that works with multiple vendors,” explained Hausherr. “They will have to put all this information together, which may be a challenge on its own, and they will not only have to receive and consume this information but will also likely have to validate it in the client’s ERP system. If it does not comply, they will have to go back to the vendor and ask them to explain the discrepancy – and imagine this hundreds of times over. It does, therefore, have the potential to be a very painful process.”

From competition to collaboration

The mix of rapid growth, changing laws and new reporting requirements for SCF makes it unsurprising that industry players no longer want to go it alone. There is a growing trend towards collaboration within the industry, particularly between banks and fintechs. This has not always proved a happy marriage, with competition rather than collaboration being the starting point at the start of the relationship.

“When the fintech scene was just getting underway, there were definitely certain start-ups that proclaimed they were part of the SCF revolution and traditional banks were simply not up to the task,” recalled George Koukis, International Business Development Director, Senior Business Consultant, Factoring & SCF at fintech Qualco.

Certainly, in the current landscape of fast evolving client requirements and new business models, the sentiment is not that wide of the mark. Balmer noted that during the early 2000s many banks developed dedicated in-house platforms for their SCF programmes. When looking to develop these platforms, smaller banks tend to be hamstrung when it came to securing the necessary investment – with most of the capital expenditure going towards running the bank itself. This is where fintechs can add real value as a partner.

“Banks should focus on what they do well, i.e. risk assessments, risk taking, funding liquidity, relationship management, while fintechs have the ability to be flexible and bring innovation,” added Balmer. It’s advice that many have already taken onboard.

This article draws on the Receivables Finance International (RFIx23) panel session on 23–24 May 2023: “The SCF market – bigger, better or bubble?”, which was moderated by Deutsche Bank’s Christian Hausherr. Watch the full panel here.

Sources

1 See bcrpub.com

2 See iccwbo.org

3 See bcrpub.com

4 See export.org.uk

5 See mckinsey.com

6 See sullivanlaw.com

7 See fasb.org

8 See fasb.org

9 See ifrs.org