10 March 2025

Cross-border payments need to become faster, cheaper, more transparent, and accessible – that’s the homework G20 leaders have given to the financial sector in 2020. Ulrich Bindseil, Director General for Market Infrastructures and Payments at the European Central Bank (ECB), describes collaboration between the private and public actors for achieving these targets – and the scope for further progress

MINUTES min read

Likely consequences of AI deep research

Having tested OpenAI’s deep research, Cox sees three likely consequences:

- Cognitive work will change fast;

- Advanced chips will be in high demand; and

- AI is one step closer to improving itself.

Performance observations

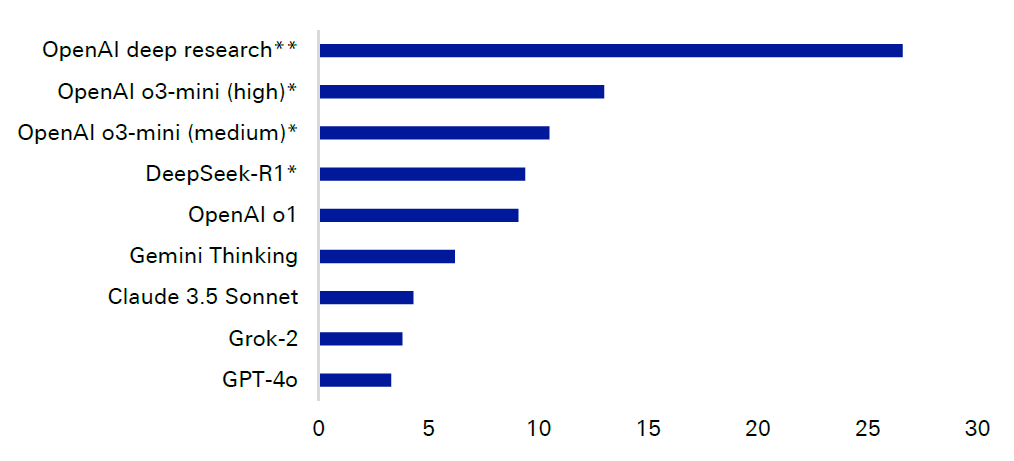

Figure 1: Open AI’s deep research significantly outperforms earlier models

Source: OpenAI "Introducing deep research", Feb 2, 2025, Deutsche Bank

*Model is not multi-modal, evaluated on text-only subset.

**With browsing and Python tools

Figure 1 shows how OpenAI’s deep research significantly outperforms earlier models in the new, tough testing multimodal benchmark Humanity’s Last Exam (HLE), scoring 26.6% – twice that of any predecessor. US business publication Forbes reported on 12 February that the HLE comprises more than 3,000 questions across hundreds of subjects ranging from rocket science to analytic philosophy.5 The test also revealed that just because a task takes a human longer, it does not mean the AI model will find it harder. “The pass rate for OpenAI’s model in internal tests generally declined for more economically valuable tasks but it actually began to slightly improve on tasks that take expert humans longer than three or four hours,” reported Cox, citing company information.

For now, OpenAI deep research is only available to ChatGPT Pro users on a US$200 per month plan in the US, UK, Switzerland, and the EEA, according to OpenAI.

The Deutsche Bank Research test, to produce a report on new US steel and aluminium tariffs in eight minutes, was “not perfect”, concedes Cox, and was not entirely able to shake off the inherent weaknesses of generative AI, such as a lack of context. “In our tariff example, we needed a second attempt to get it to address the most recent round of tariffs,” he adds. It did this successfully.

While it is clearly still early days for deep research tools, these launches early in 2025 suggest that they, together with the underlying LLMs that power them, “will continue to improve”. Cox concludes, “only time will tell how far they will eventually move beyond rehashing other people’s ideas to generating entirely new concepts altogether”.

A brave new world beckons indeed.

Copper has been around for 9,000 years, with ancient civilisations using it to make coins, jewellery, and tools, while several millennia later during the Industrial Revolution entrepreneurs employed it for electrical wiring and machinery.

Versatility and conductivity

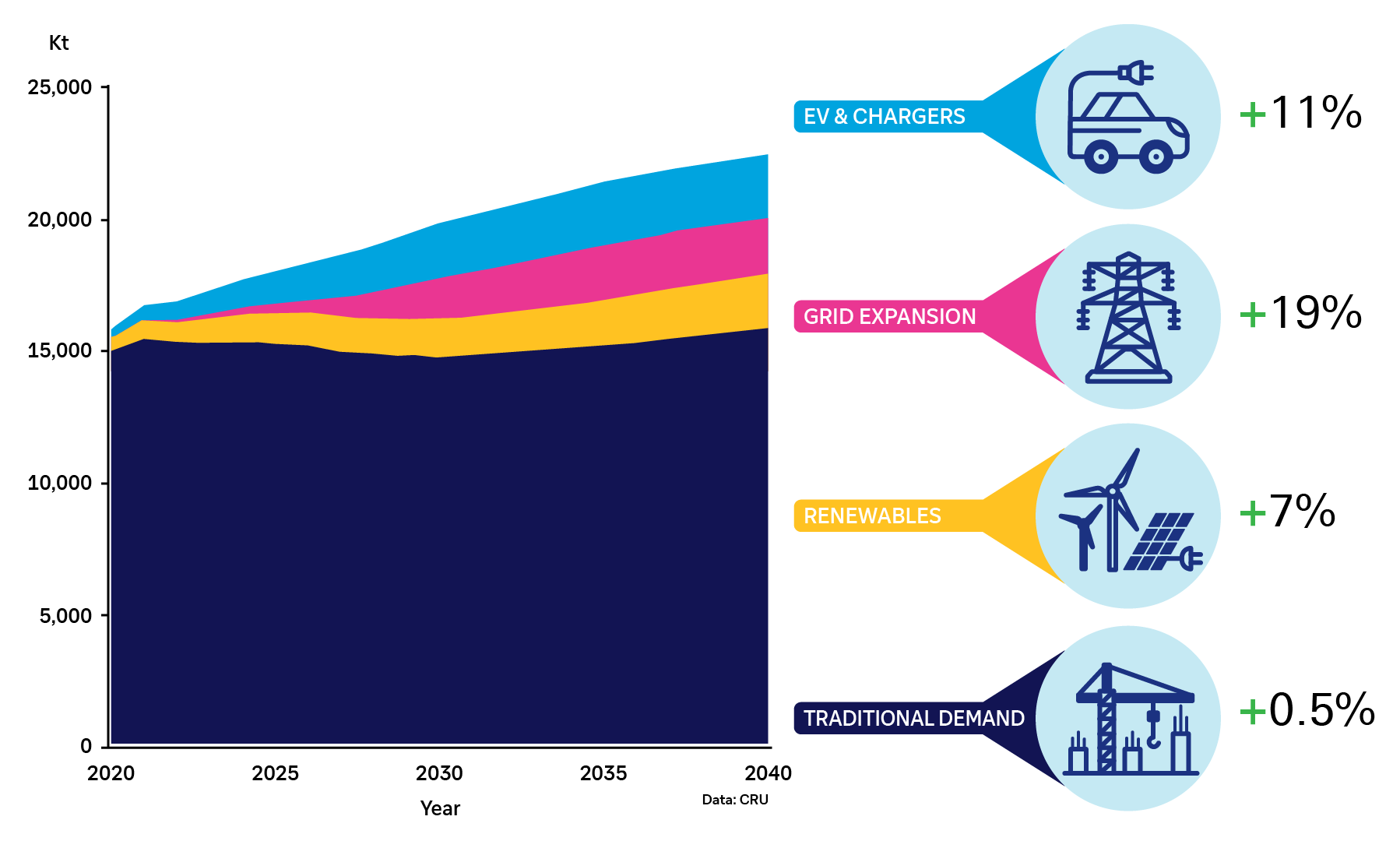

Today, this base metal is the main component powering the digital revolution, energy transition and the advent of AI chatbots. Demand is brisk, with some observers predicting order books will swell up to 30% by 2029 and even double by 2045.1 All of this will happen as more electric vehicles (EVs) hit the roads, new renewable energy infrastructure is installed, and artificial intelligence (AI) data centres continue to dot the planet, sucking up vast amounts of energy.2

Figure 1: Copper cable demand: green vs traditional applications

Source: International Copper Association

Copper is an excellent electricity conductor, which is why it's seeing huge demand from the energy and IT industries. Its soft and malleable qualities make it an essential component of electrical wiring, industrial machinery, electric vehicle (EV) batteries, solar and wind-power infrastructure. Myriad electronic devices benefit from its high conductivity to transfer electronic signals between intricate circuits.

Billed as the third most-used metal globally, after iron and aluminium,3 the world's largest copper mines are in Chile, Peru, Congo, China and the US. Chile and Peru are by far the biggest producers, churning out five million metric tons (mt)4 and 2.5mt respectively, in 2023. China, meanwhile, is the biggest buyer, employing copper in its large property, construction, and automotive industries.

"We know for sure that in the medium term the market will grow a lot," enthuses Pierpaolo Di Fabio, Chief Financial Officer of German-Italian copper processing group KME, which is quickly growing its working capital facilities to gain expansion funding. "In three to five years, we expect at least 20% to 30% growth. And in the next 20 years, worldwide copper demand could double to 50mmt.” That should bode well for the metal, which mainly trades on the London Metals Exchange (LME) and whose price has surged to roughly US$9,000mt from US$6,000mt in 2020.

Targeting electrification

Under another acquisition spree launched in 2019, KME bought full or partial stakes in European rivals such as MKM, Ilnor, Aurubis Zupthen, AML and most recently Germany's Sundwiger.5 Simultaneously, it started unwinding its less profitable copper-for-building franchise that once comprised the lion's share of its business. All of this transformed the company, which was officially named KME (taking the most recognised German subsidiary trade name) in 2006, as a leading European supplier of rolled copper targeting the booming electronics sector.

"We knew the market was trending toward electrification and energy transition, so we began selling our brass rods and tubes business," Di Fabio, who also joined the firm in 2006 as a corporate director of finance and treasury, explains during an interview with flow. "Today, more than 90% of our sales are rolled copper – mainly to customers in EU – and less than 10% is related to building application."

KME sells its products to around 5,000 customers worldwide including leading electronics, digital infrastructure, transportation and aerospace related firms.

In recent years, KME has been working to improve the environmental, social and governance (ESG) profile of its foundries, mainly by boosting copper recycling. In 2023, around 43% of output stemmed from re-used copper, says Di Fabio, adding that KME also moved to streamline its foundries or raw copper processing facilities to achieve its environmental goals. The firm has also significantly reduced water usage and substituted gas furnaces with more environmentally friendly electric ones. According to Di Fabio, KME is on track to achieve its ambitious ESG target by 2030.6