8 November 2023

Indonesian payment fintech company DOKU is a key enabler for Indonesian and global merchants and consumers in a fragmented payments landscape. This flow case study charts how the company was founded in a digital desert and grew to become today’s powerhouse for 150,000 clients through vision, hard work and favourable demographics

MINUTES min read

Doing business today relies on speed and convenience. Consumer experience shapes business-to-business (B2B) expectations more than ever. Digital natives who grew up in the information age – particularly those born in the late 1990s and 2000s dubbed ‘Generation Z’ – cannot comprehend analogue payment cycles that take weeks: they want instant access to their wages or to payments for goods and services they have provided.

ASEAN’s road to digital payments

Within the 10-nation Association of South-Eastern Nations (ASEAN) bloc, the share of digital natives is particularly high. Its overall demographics comprise 660 million people with an average age of 30. Annual GDP growth rates averaged 9% from 2012–2022. Helped by rapidly improving levels of education, its population enjoys rising income levels coupled with aspirational and discretionary spending: In 2021, the ASEAN Data Management Framework estimated that the ASEAN internet economy had a gross merchandise value of US$72bn in 2018, a figure set to exceed US$240bn by 2025.1

This rise in online spending looks set to be boosted by another trend – embedded finance, which Premdeep Jagdeep Shah, Deutsche Bank’s Head of Fintechs and Platforms coverage for ASEAN defines as the “integration of financial services into non-financial websites or mobile apps, and which are usually deployed at the booking or check-out stage”, for example being offered the opportunity to buy insurance or warranty cover when purchasing electronic goods online. In February 2022, Cornerstone Advisors forecast that global revenue of embedded finance would grow from US$22.5bn in 2020 to US$230bn in 2025, a 10-fold increase.2

These growth perspectives offer great business potential for companies in ASEAN but there are several challenges when selling goods and services online. While the digital journey may be ‘seamless’ for end-users, the transformation - in particular for payments - requires significant hard work by corporate treasury teams and their partners, not least due to the region’s varying payment preferences and regulatory frameworks.

Customer payment habits is one example. Hong Kong and Singapore are largely digital and are heading towards a cashless society, whereas much of Indonesia and Vietnam retains a preference for cash,3 although ATM, bank transfer, and QR are increasingly popular in Indonesia. Central bank the Bank of Indonesia recorded 41% growth in digital payments from 2019 to 2020 and forecasts the total transaction value of such payments will grow from US$82.5bn (93% of it in the Digital Commerce sector) in 2023 to US$131.1bn in 2027.

Given the bloc’s demographics and demand for digital financial services solutions, the rapid success of Jakarta-based DOKU is no surprise. The online payments platform is the first Indonesian-owned provider to offer local payment solutions tailored to address merchants’ online payment needs. This article tells their remarkable story, and shares details of DOKU’s partnership with Deutsche Bank to improve payments flows and cross-country transaction fund collection, which picked up The Asset’s ‘Best New Economy Solution – Payments and Collections for Indonesia’ award in 2023.4

From adversity…

The company was formed in 2007 in response to Bali’s need to attract international tourists after the terror attacks in 20055 sparked a sharp decline in tourism. Alison Jap, DOKU’s Chief International Partnerships Officer, who joined five years later, explains, “The three DOKU founders happened to be working together on a tourism portal for Bali to reintroduce it as a safe holiday destination and found that there was no way for customers to book hotels and attractions.” Discussions with local banks revealed that online payments were still a largely unchartered territory back then. The trio identified the opportunity to set up a new company for online payments to serve businesses who need to collect payments from their customers in Indonesia. But starting-up was tough and meant knocking on many doors. As the pioneer in this industry, DOKU had to work very closely with the banks to mitigate fraud and ensure that the security processes are in place.

However, timing is everything. DOKU’s first big break came when Indonesia’s national carrier Garuda wanted to explore selling tickets online directly to customers and DOKU’s early win of Garuda as its first payment service provider (PSP) client “opened lots of doors” and, Jap adds, helped the team gain critical support from banks and other partners. Initially established and registered as PT Nusa Satu Inti Artha, DOKU was the first Indonesian company to earn the Payment Card Industry Data Security Standards (PCI DSS) Level 1 version 3.2 certification.

The company now provides a suite of online and offline payment solutions, and most local payment methods, serving more than 150,000 merchants across many industries via payment gateway and transfer services that enable QR, e-commerce, e-Marketplace, e-wallet, super app, and card payments. DOKU is also responsible for AML and KYC obligations from its payments licence from Bank Indonesia. The company services domestic e-wallet and e-commerce platforms, global PSPs as well as domestic and global merchants.

“Anything touching financial services – the trust, reputation, and integrity is so important”

Back in 2007, the team had to build from scratch everything needed to operate up. There was virtually no start-up scene in Indonesia and little infrastructure; “not a unicorn in sight in Indonesia,” recalls Jap. The country’s archipelago structure was not conducive to e-commerce business because the logistic infrastructure was still being built at the time, she explains. “The first 20 companies we had were all ones that did not need shipping. They were not selling physical goods online, so they were airlines, insurance companies etcetera.” However, the need for technology to be built in house with local engineers became part of DOKU’s unique selling point to its partners. “Anything touching financial services – the trust, reputation, and integrity is so important. We work with some of the largest Indonesian and international banks, and they know our risk mitigation and controls are very good. We are also known as the pioneers in this industry in Indonesia and that shows our strong track record and corporate governance,” says Jap.

Banking the unbanked

While the US and UK online markets are easy to navigate for merchants, with most shoppers having Mastercard or Visa cards, only 60% of 270m Indonesians have a bank account and only 5% have credit cards. However, like many emerging economies Indonesia has 100% smartphone penetration. “A lot of people have access to mobile phones and e-commerce but do not have access to the financial instruments to make payments online,” explains Jap. “This has given rise to a very fragmented landscape. It is not unusual in Indonesia when you go to a local online marketplace to shop, when you check out you see 20-30 payment methods being offered – including local convenience stores, so you can go to the local store and make the payment in cash.”

This is where a payments gateway such as DOKU comes in. It is a huge tech ask for a merchant to connect to all these payment channels and the company provides PSP services to traditional companies selling and distributing online, not just e-commerce providers. The company also collects payments locally in rupiah (IDR) from buyers and subscribers, later converting, remitting and settling them with global merchants and PSPs in the requisite foreign currencies. While, for example, a shipping client would have collected payments via bank transfer, with manual checks that payment had arrived, DOKU’s tools automate this and enable real-time notifications. This also helps customers with their reconciliations – another touchpoint of customer loyalty to the merchant. Such B2B transactions constitute most of the company’s business. In 2022, DOKU processed 145 million transactions, a year-on-year increase of 80%, and a similar growth rate is expected for 2023.

Settlement flow to offshore PSPs and merchants

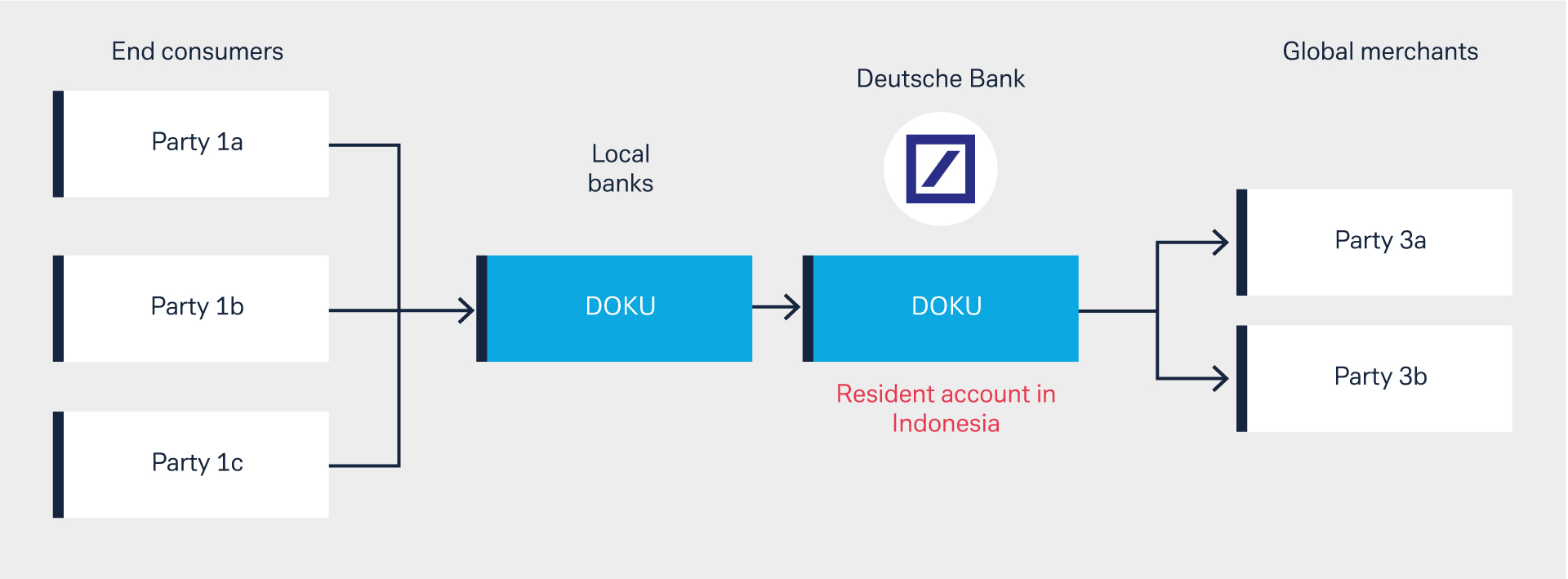

Figure 1: How Deutsche Bank supports DOKU’s settlement flows

Source: Deutsche Bank

DOKU’s rapid growth created several pain points. Average transaction values are around US$20 per ticket size and manual processes to meet the spike in transactions erode profitability. For example, Bank Indonesia regulates FX remittances and requires PSPs such as DOKU to submit FX transactions for approval ahead of a non-negotiable and relentless daily deadline. This left a ‘very short window of time’ for the treasury team to complete the work before the daily FX cut-off. DOKU would batch underlying transactions for approval, such that a six to seven-figure FX trade on any given day is made up of tens of thousands of smaller transactions. Upon collecting IDR payments locally from buyers or subscribers, DOKU had to settle to global merchant and PSPs in the required foreign currency. Deutsche Bank provided a solution to improve their cross-border payments and collections flows, while managing FX risk relating to settlement to overseas merchants and PSPs.

The project commenced with both teams mapping workflows, deadlines, and processes, identifying what could be simplified and automated – a process Jap describes as of “immense value for our operational teams.” It won Deutsche Bank the ‘Best New Economy Solution – Payments and Collections for Indonesia’ at The Asset’s 2023 awards.6

How did this work? Deutsche Bank received IDR funding from DOKU’s local bank account in Indonesia and converted the IDR into the required foreign currencies before remitting funds to the offshore accounts of the global merchants and PSPs (see Figure 1). This helped the company eliminate manual processes – although Jap admits skilled humans are still needed – increase productivity and reduce the operational burden. FX cut-off deadlines are unrelenting – if one is missed DOKU ends up breaching its own client settlement contracts. In other words, efficient scaling up on the back of demand was critical. “This helps us with our accuracy and the operations team – who report to the CFO – are really benefiting because they get to go home on time,” adds Jap.

“It was good to hear how Deutsche Bank’s KYC processes had supported DOKU in benchmarking theirs”

The partnership also helped manage DOKU’s FX risk when settling with overseas merchants and PSPs. Jap confirms the partnership with Deutsche Bank had the added benefit of strengthening its own KYC processes. “It was good to hear how Deutsche Bank’s KYC processes had supported DOKU in benchmarking theirs and evolving them to the global standard. This was a long journey but has absolutely paid off,” reflects Herson Limoa, Deutsche Bank Coverage banker who saw the project through from inception 18 months ago.

The road ahead

With around 450 staff in its Jakarta, Bali, Kuala Lumpur and Singapore offices, DOKU’s focus is now firmly on driving growth of the business by acquiring new clients and also expanding its product offerings. The company received a US$32m capital injection from UK-based private equity fund Apis Growth Fund 11 in 2021. The capital raising supported the subsequent July 2022 acquisition of senangPay, a leading Malaysian online payment gateways for US$7.5m. At the time, DOKU’s Chief Operating Officer Nabilah Alsagoff explained that it marked “the beginning of DOKU's expansion overseas and its efforts to reach a wider business segment, especially SMEs.”

Other regions will doubtless follow…at the right time for DOKU.

Sources

1 See asean.org

2 See synctera.com

3 However, efforts by the Indonesia Payment System Association and partner banks to convert small-scale cash transactions (at street vendors, for example) into QR payments could change this.

4 See wartaekonomi.co.id

5 See news.bbc.co.uk

6 See wartaekonomi.co.id