27 October 2024

Coal-based blast furnaces have been core units in steel production for more than 100 years. Now, the industry is looking for ways to cut CO₂ emissions to align with net zero targets from regulators and customers. flow’s Desirée Buchholz reports on how German steel- and technology company Salzgitter AG is leading the way towards decarbonising steel manufacturing

MINUTES min read

Steel demand is usually a good indicator of the global economy’s performance, as both tend to grow in tandem. So the outlook is positive, with global demand for steel forecast to rise from 1.9 billion tonnes in 2022 to reach around 2.06 billion tonnes by 2030.1 This increase is driven by population and economic expansion in India, countries of The Association of South-Eastern Nations (ASEAN) region and Africa.

On the downside, the iron and steel sector is one of the world’s most heavy-emitting industries (next to cement and chemicals) as it accounts for 11% of global carbon emissions.2 In the European Union (EU), the industry is responsible for a hefty 20–25% of industrial CO₂ emissions.3 According to the International Energy Agency (IEA) “efforts in the iron and steel sector need to accelerate significantly to get on track with the Net Zero Emissions by 2050 (NZE) Scenario”.4

Meeting this target is important as steel will remain the backbone of the modern economy. “Despite a strong push on material efficiency strategies, such as vehicle lightweighting or extending the lifetimes of buildings, steel will continue to be an essential input to infrastructure, buildings and mobility systems,” the IEA writes in an April 2023 report.5 Steel also acts as “a critical enabler of the global energy transition”, the report continues as it is needed, for example, to build wind turbines.

Market demand for low emission steel increases

Given the essential role of steel in global value chains, decarbonising the sector has been a priority of policy makers to meet climate objectives. In October 2023, the EU introduced its Carbon Border Adjustment Mechanism (CBAM), which will gradually impose a levy on steel imports from countries without equivalent carbon price mechanisms. This will be done from 2026 to 2034. In parallel, the EU will also gradually end free Emissions Trading System (ETS) allowances for steel producers. This regulation aims to address carbon leakage, by avoiding incentivising firms to relocate parts of their production to countries with less stringent climate policies.6

“The steel sector is a crucial decarbonisation enabler for multiple industries”

Added to regulatory pressure, there is also a growing market demand from customers for low- or net-zero-emission steel. As part of their net-zero transformation strategy, the construction sector – which accounts for more than half of global steel demand – along with the automotive industry and mechanical engineering firms are increasingly looking to reduce their Scope 3 emissions, i.e. emissions that stem from the value chain. “The steel sector is a crucial decarbonisation enabler for multiple industries, as utilizing green steel reduces upstream Scope 3 emissions of corporates relying on steel, a factor particularly relevant for the German economy,” says Lavinia Bauerochse, Global Head of ESG, Deutsche Bank Corporate Bank.

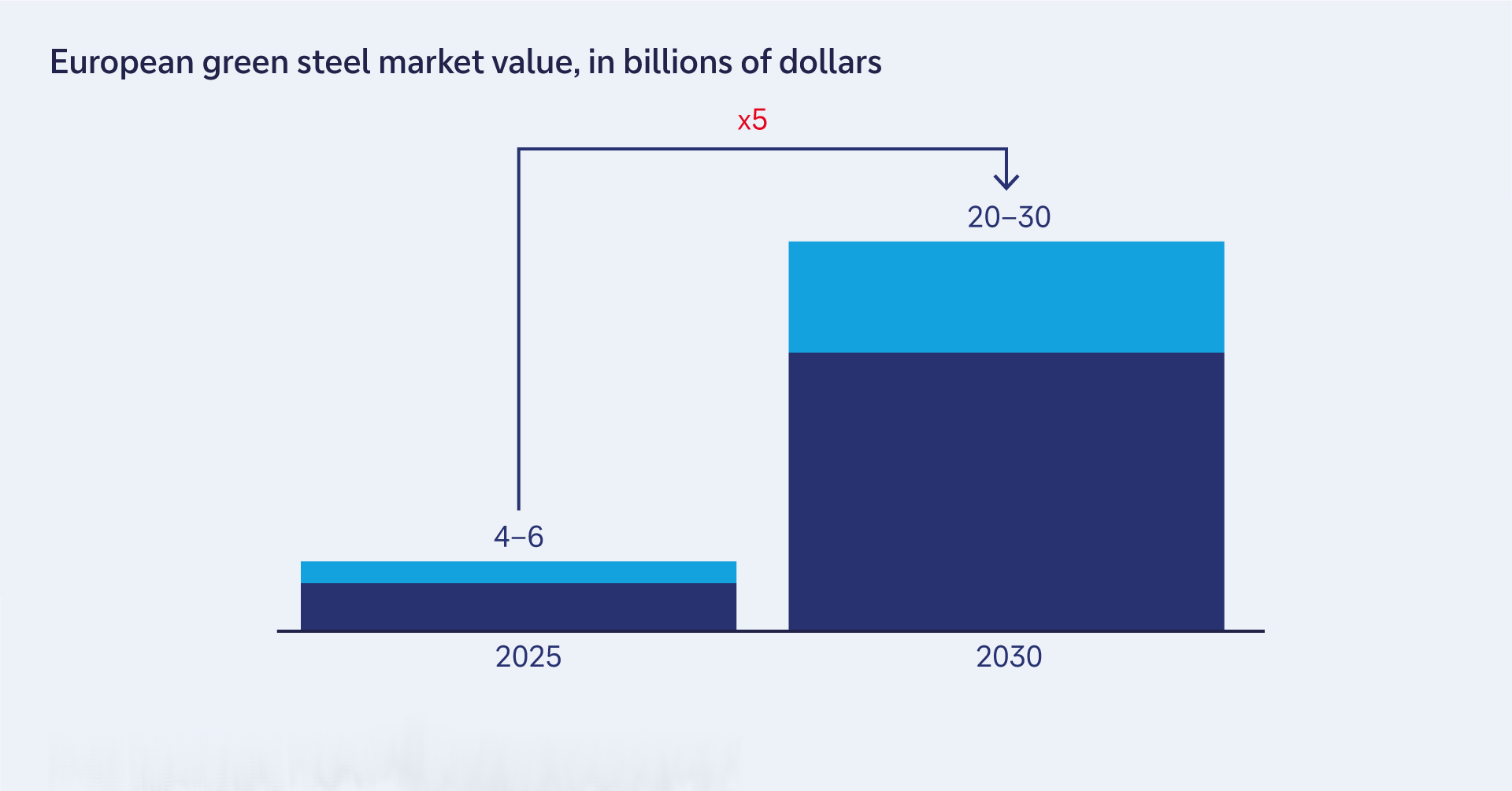

Consulting firm Bain and Company expects between 15% and 25% of European steel production to be low carbon by 2030, which would equal between 25 million to 35 million metric tonnes. Based on expected prices, that volume represents a US$20bn to US$30bn market (see Figure 1).

Figure 1: European green steel market value, in billions of dollars

Sources: Expert interviews: EUROFER; Company announcements; Bain analysis

Salzgitter AG enters a new era with SALCOS®

On the back of these developments, several global steel producers have now embarked on a green steel journey – a necessary but challenging destination, which will require significant investments in process technology, infrastructure, and manufacturing capacities. While there are several alternative pathways to producing low-emission steel, as yet there is no scalable, economically viable alternative to the blast furnace.

“We believe that the best approach for producing low-emission steel is by a direct avoidance approach”

Among the companies that aim to change this lack of options is Germany’s Salzgitter Group. Based in the town of the same name and with sales of €10.7bn in 20237 Salzgitter is one of the smaller steel players globally, but – according to the Green Steel Tracker published by campaigner The Leadership Group for Industry Transition (LeadIT), among the most ambitious in terms of timing and scope of net-zero ambitions.8

The company’s history dates back to 1858 when the Aktien-Gesellschaft Ilseder Hütte was founded in the small rural town of Groß Ilsede, in what was then the Kingdom of Hanover (northern Germany). Two years later, the company commissioned its first blast furnace, marking the start of its pig iron production.9

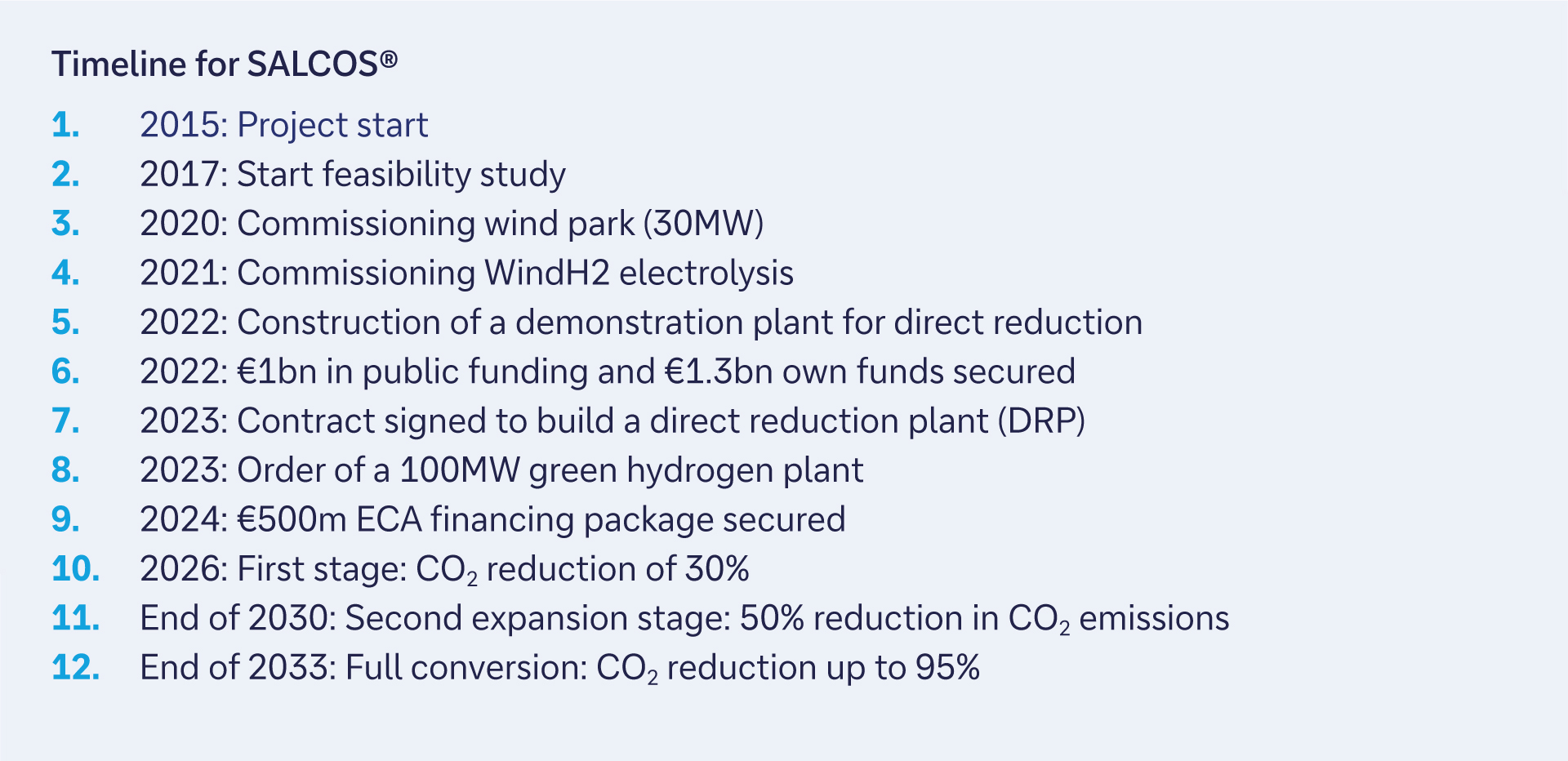

More than 150 years on, in 2015, Salzgitter Group heralded the end of this era with the launch of its programme SALCOS® – or SAlzgitter Low CO₂-Steelmaking. Through this initiative, the company plans to gradually replace blast furnaces by so-called direct reduction plants and electric arc furnaces. The latter uses the direct reduced iron pellets to produce the final steel. The new process will be powered by electricity from renewable sources, such as wind power and green hydrogen. Until hydrogen is available in sufficient quantity, the company will also rely on natural gas for a transition period to operate its direct reduction plant.

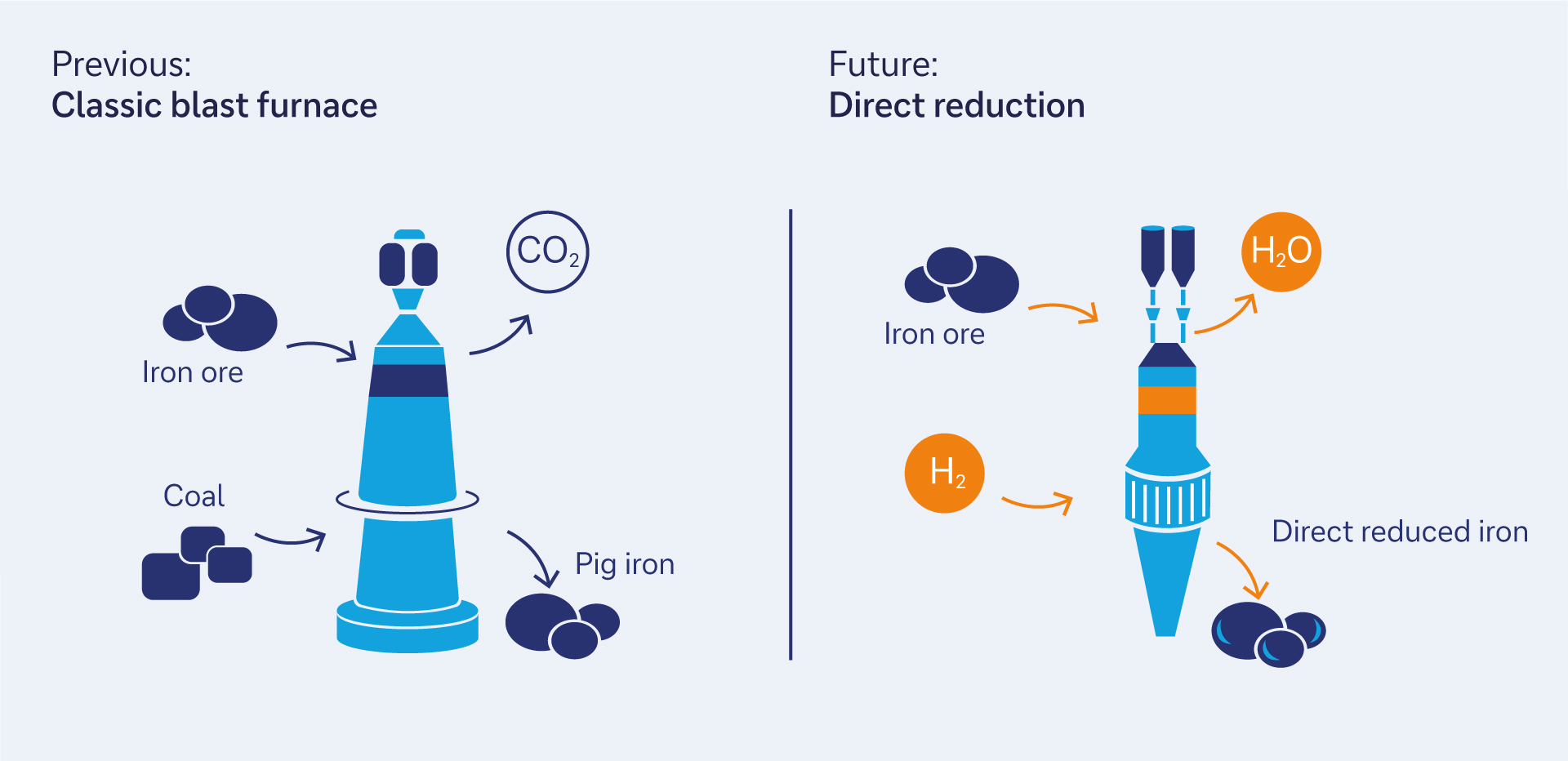

“Going forward, the conventional blast furnaces route – which is heavily reliant on coal to generate the high temperatures necessary to smelt the iron ore – will no longer be economically viable”, says Martin Zappe, Programme Director SALCOS®, who joined Salzgitter in 2021. “And we believe that the best approach for producing low-emission steel is by a direct avoidance approach, in which iron ore is reduced to iron directly in its solid-state using hydrogen.” With this technology, water vapour is emitted instead of CO₂ (see Figure 2).

Figure 2: Green steel manufacturing at Salzgitter

The first stage of the programme, involving an annual capacity of 1.9 million tonnes of crude steel, is scheduled to become operational no later than 2026. Upon completion in 2033, the project is expected to reduce Salzgitter's CO₂ emissions by 95% (see Figure 3) for the full production capacity (4.7 million tonnes/annum) in Salzgitter.

Figure 3: Timeline for SALCOS

Partnering with research, customers, and banks

Originally, SALCOS was not scheduled for full implementation until 2045 – but customer demand, the wish to shape future steel making technology as well as attracting talented personal for the transition – convinced management to substantially accelerate the process in 2022, recalls Zappe: “There are 250 employees involved in the transformation and 2033 is a year that many can relate too, which makes it much easier to get the commitment and engagement needed to make the programme a success.”

Apart from internal commitment, the company also partnered with suppliers to ensure access to the raw materials and engineering capacity needed to ramp up green steel manufacturing. As green steel depends on green energy, Salzgitter group sealed several long-term power purchase agreements (PPA) for fossil-free electricity for example with Iberdrola Germany,10 Vattenfall11 and EnBW.12 The company also joined forces with mining firms to optimise iron ore supplies for direct reduction.

In April 2023, the company contracted a consortium comprising Tenova, Danieli and DSD Steel Group to build a direct reduction plant (DRP) on the site of Salzgitter Flachstahl GmbH (Salzgitter Flat Steel). And last September, Salzgitter ordered a 100MW green hydrogen plant from technology provider Andritz Group.13 This makes the company “the first European steel producer to have taken the investment decision, secured the financing and placed major contracts for its transformation, thus living up to its claim of being a pioneer of sustainable industry”, Salzgitter states on its website.14 “It’s great to see we are moving the industry forward”, says Zappe.

Construction side dated to September 2024

To secure the investment decision, Salzgitter group has already signed contracts with several customers – from automotive to household appliance – which will buy the low-emission steel as of 2026. For example, Volkswagen Group plans to use the low-CO₂ steel in important future projects.15

Financing green steel transition

Being a pioneer in green steel is something Salzgitter group is proud of – particularly as the company is lifting the biggest investment in its history to enable this transition. For SALCOS® Phase 1 alone, the steel maker is providing €2.3bn. As the programme is approved by the European Commission as an Important Project of Common European Interest (IPCEI), it is backed by €1bn in public support funding from the Federal Government and the State of Lower Saxony. The remaining €1.3bn is being sourced by the steel maker directly.

In a first-of-its-kind for Germany’s steel industry, Salzgitter group signed two export credit agency- (ECA) covered green loan financings to support the decarbonisation of its steel manufacturing operations this April. The financing package consists of a €300m export credit facility covered by SACE, the Italian Export Credit Agency, and a €200m export credit facility covered by the Oesterreichische Kontrollbank AG (OeKB), the Austrian Export Credit Agency. Together, these facilities will help fund a portion of the Phase 1 of SALCOS®.

“Deutsche Bank has been a long-standing partner for us. The bank was very supportive in navigating us through the green loan process”.

In support of the transaction Deutsche Bank acted as joint mandated lead arranger and lender, as well as sole sustainability coordinator, for which the bank ran the green loan classification process. This was backed by a second-party opinion from ISS-Corporate, which assessed and confirmed the alignment of the loans with the Loan Market Association’s Green Loan Principles and EU Taxonomy.

“Deutsche Bank has been a longstanding partner for us. The bank was very supportive and pivotal to navigate us through the green loan process of the export credit agencies particularly with respect to the sustainability angle”, says Jacqueline Jander, Commercial Manager SALCOS®.

“The export finance loans structured under Loan Market Association’s Green Loan Principles underpin Salzgitter’s ambition to act as pioneer in the decarbonisation of the steel industry in Europe,” says Stefan Götzinger, Head of Sales & Structuring Germany, Austria, Switzerland, Central Europe, Structured Trade & Export Finance, Deutsche Bank.

“The use of ECA covered financings in this project is an important reference for future sustainable transition cases,” adds Markus Ohse, Senior Corporate Banker, Deutsche Bank. “It highlights the strong rationale for using ECA financing also in developed markets to support clients’ sustainability objectives while benefiting from an attractive long-term financing solution.”

Availability of green hydrogen is key

While Salzgitter group has started its transforming journey, it’s still early days for the shift to manufacturing CO₂ reduced steel at scale and affordably. The company itself names three conditions which need to be fulfilled for SALCOS® to reach its full decarbonisation potential, and each depends on support from the German government:

- Rapid expansion of renewable energy and hydrogen infrastructure;

- Internationally competitive electricity and hydrogen prices; and

- Establishment of so-called green lead markets.

For SALCOS® phase 1, Salzgitter will need 150,000 tonnes of hydrogen annually. Yet, the on-site 100MW electrolysis plant is expected to only produce 9,000 tonnes of hydrogen, which requires the remaining 141,000 tonnes to be sourced from external suppliers. Salzgitter has now issued tenders for its hydrogen needs, but deliveries can only begin in 2029 once the company is connected to the new hydrogen pipelines the German government is planning to build.

“The availability and the price of hydrogen is a key requirement for producing CO₂ reduced steel and it’s good to see that there is now a commitment for building this infrastructure,” says Zappe.

The idea behind so-called green lead markets is a concept developed by the German government to stimulate demand for CO₂ reduced steel, which is currently significantly more expensive than conventional steel. One possible incentive could be public procurement. While the industry doesn’t want permanent support, as Salzgitter group states, this may be needed until production ramps up and scale effects kick in, which will reduce prices for green steel. An optimistic Zappe says, “I expect to see a competition between green and grey (i.e. high-emission) steel, and – provided market regulation such as CBAM enters into force as planned – I am very confident that the price differential will be competitive.”

Sources

1 See bronk-company.com

2 See weforum.org

3 See greensteelworld.com

4 See iea.org

5 See iea.org

6 See "The price of CO₂" at flow.db.com

7 See salzgitter-ag.com

8 See industrytransition.org

9 See salzgitter-ag.com

10 See salzgitter-ag.com

11 See group.vattenfall.com

12 See salzgitter-ag.com

13 See salzgitter-ag.com

14 See salzgitter-ag.com

15 See salzgitter-ag.com