16 November 2023

The European Central Bank (ECB) has decided to continue its retail CBDC project and began its preparations on 1 November 2023. What does this decision mean for the digital money landscape in Europe? And what are the latest developments with respect to wholesale CBDCs? Deutsche Bank’s Manuel Klein shares some insights

MINUTES min read

On 17 October, the Euro Banking Association (EBA) welcomed Manuel Klein, Product Manager Blockchain Solutions and Digital Currencies, Deutsche Bank, back to its Open Forum on Digital Transformation. Klein updated an audience of more than 100 attendees at EBA’s ‘The Future of Payments is a kaleidoscope of opportunity... What's next and is the velocity changing?’ on the latest developments in this field. Kate Pohl, consultant, moderator, and facilitator for the Euro Banking Association, shares his insights for flow in a two-part summary.

This (Part 1) article looks at Klein’s insights on the latest developments on CBDCs in Europe. Part 2, ‘Blockchain-based money from the private sector – an overview’, examines relevant projects around blockchain-based money from the private sector.

Different forms of money in Europe – some background

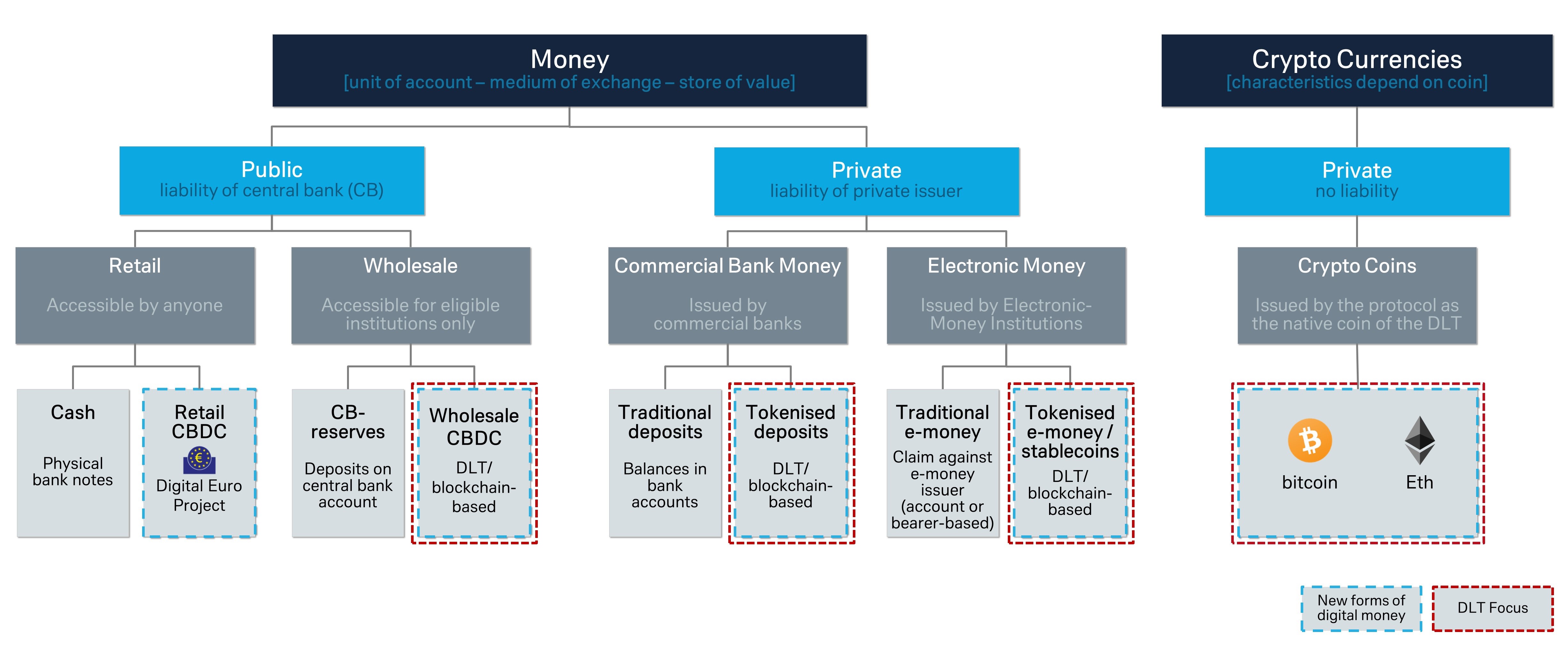

Today’s money can be viewed through a variety of different lenses. The first is differentiating the multiple forms of fiat money vs crypto currencies. Fiat money can be characterised by its features as a unit of account, means of payment and store of value. Crypto currencies do not fulfil these criteria and hence are not a focus of this analysis on the new, digital forms of money.

The second key differentiator is ‘public’ i.e., a liability of the central bank vs ‘private’ money. Private money is again divided into liabilities of private issuers such as banks or electronic money (e-money) institutions or indeed no organisation whatsoever. “Crypto coins are not a liability of any issuer. They can be considered an asset-based form of money,” noted Klein. “These coins, e.g., bitcoin, are issued on the blockchain and should be viewed very differently from fiat currency which always entails a claim against an issuer.” (see Figure 1)

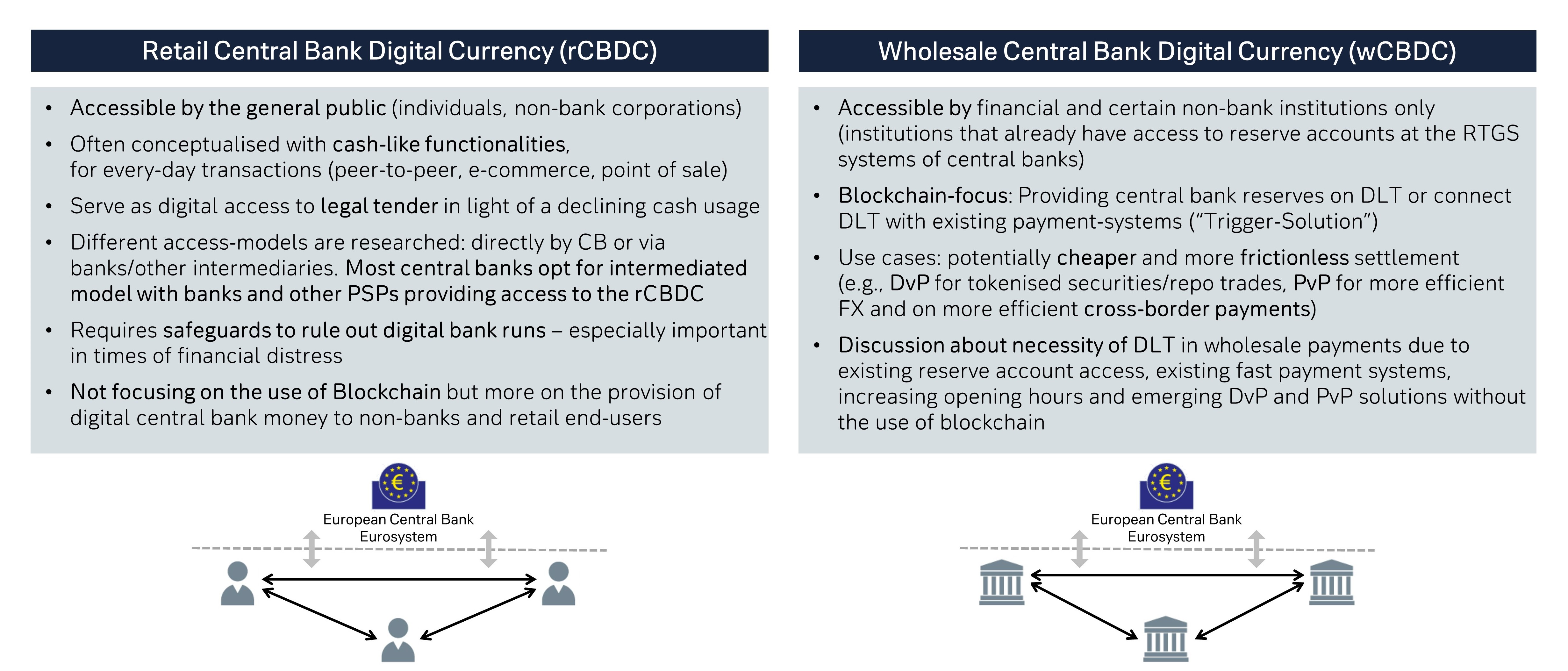

Regarding digital forms of central bank money, Klein explained that “physical cash is a liability of the central bank, that the retail sector uses as a medium of exchange. Retail central bank digital currency (CBDC) is also a liability of the central bank for end-users but can be transferred digitally.” The ECB has been investigating digital forms of the EUR for some time now and on 18 October 2023, announced its intention to continue the digital Euro project and to prepare for the issuance of a retail CBDC.1

Figure 1: New forms of digital money

Source: Deutsche Bank

The ECB also issues money for wholesale transactions in Europe. These account balances are called ‘central bank reserves’ and basically represent deposits held in real-time gross settlement systems (RTGSs) such as TARGET2 (T2) at the ECB. This type of money is only available to eligible institutions that have access to T2. In July 2023, the ECB, together with the Deutsche Bundesbank, Banque de France, and the Bank of Italy, agreed to start a project focusing on the use of distributed ledger (DLT), or blockchain technology for managing wholesale settlements.2

The Eurosystem will provide three solutions i.e., two ‘trigger solutions’ that connect existing payment platforms (T2 and TIPS, a real-time 24/7 settlement system3) to blockchains as well as a tokenised form of central bank money known as ‘wholesale CBDC’. Use cases will include capital market transactions and interbank settlements. A specific example is ‘delivery vs payment’ (DvP), a procedure used for the settlement of tokenised securities.

Commercial bank money and electronic money, which is issued by e-money licensed institutions such as PayPal under the e-money directive4, are liabilities of private entities and already exist today as forms of money. These funds can be held by retail or wholesale clients as bank deposits or balances in a digital e-money wallet. Tokenised deposits at banks or tokenised e-money (the regulated form of stablecoin in the EU) are new forms of digital ‘private money’ using blockchain technology. “Commercial bank deposits equal roughly 85% of the money supply in Europe,” remarked Klein, “and these private sector institutions are actively experimenting with DLT/blockchain-based infrastructures to manage deposits and stablecoins.”

The digital euro project for retail CBDC

Cash is the only central bank liability that can be held and used by private citizens today. The retail CBDC project would make it possible for every end-user, i.e., every European citizen, to hold a liability of the central bank that can be transferred electronically. “The aim of the ECB is to provide legal tender in a digital form,” stated Klein. “The ECB will decide in November 2025 whether it will actually issue a digital Euro. However, we don’t, in any case, expect a ‘go live’ before 2028.”

Outlining his views on what a potential digital Euro could look like, Klein said, “it will be a prefunded payment solution. European citizens will be able to hold digital Euros in dedicated wallets up to a carefully analysed, maximum limit.” Amounts such as three thousand euros have been discussed, but there is no decision to date. “The digital currency will be held in a wallet, which will be provided by an intermediary, in other words, a bank or payment service provider (PSP),” Klein continued.

He explained that there will also be an ‘ad hoc’ funding mechanism in place, termed ‘reverse waterfall’ by the ECB. This will allow an individual to make transactions in CBDCs for sums higher than the amount of digital Euros held in their wallet. This will, in fact, even avoid the need to prefund digital Euros altogether.

“This is similar to how most people use PayPal today. The majority of users don’t prefund their accounts. They use a direct debit or a credit card to top-up the wallet if, and when, needed,” pointed out Klein. The reverse will also be true. Every euro that is received in a digital euro wallet that already holds the maximum amount possible, will be defunded back to a client’s commercial bank account. This means that individuals will only be able to hold the predefined limit in their wallets at any time.

“We don’t expect a digital euro to go live before 2028”

Klein also noted that the ECB does not want to engage in end-customer contact, leaving this to payment service providers such as banks. These intermediaries will also be responsible for performing KYC on individual users and AML checks for each transaction. Klein said that privacy vis-à-vis the Eurosystem would be maintained, because the ECB is aiming not ‘know’ the debtor or creditor in the settlement process.

“The ECB has made it clear, that as they will provide the ledger, they want to do the settlement for all types of retail CBDC transactions. This includes person-to-person, P2P (C2C), point of sale, e-commerce and government transactions,” Klein emphasised. No decision has yet been made as to what back-end system will be used to support retail CBDC. Whether it will be TIPS, or perhaps a new, more innovative platform, using digital tokens, is still open.

The investigation phase has revealed that a potential retail CBDC will be based on a centralised infrastructure, hosted by the ECB, therefore Blockchain technology will most likely not be used. The Eurosystem has, however, experimented with an innovative token-based backend infrastructure which could allow digital Euros to be token-based and hence similar to physical cash which is also not account-based. The ECB has stated that transactions must be free for end-users. It will, however, be possible for intermediaries who process transactions to generate revenue. This will be achieved through merchant fees for the acquirer and interchange fees for the issuing bank.

Once a retail CBDC transaction is settled, the money will be credited, up to the maximum holding amount set by the ECB, to a recipient’s wallet. To prevent large liquidity outflows from the banking system, merchant wallets will always have a zero intraday and overnight holding capacity. Enterprises that accept digital euro transactions, will therefore immediately and automatically, have these funds ‘defunded’ to their regular bank accounts at a commercial bank. “The digital euro cannot be held and used as a form of payment for corporates and merchants,” Klein emphasised.

Klein made it clear that he welcomed the decision to go ahead with the digital euro preparation phase. “The digital euro is a logical development in the overall digitisation of the economy and the money system, especially if cash usage continues to decline. In the next two years, important fundamentals of a potential digital euro will be developed. This will include a rulebook and a minimum viable product of the digital euro ecosystem. Close cooperation with the private sector in terms of front-end innovation and rulebook design will be fundamental for success. Combining the strength of the private and public sectors is a prerequisite for creating an attractive product for Europe.”

Wholesale CBDC – What’s next?

As mentioned above, the ECB, in cooperation with the Bank of Italy, Bundesbank and Banque de France, has formed a separate working group that focusses on interbank settlement of blockchain-based transactions. This is independent from the digital retail euro project. The Eurosystem has defined three different approaches to provide blockchain-based central bank money for wholesale settlement. However, it will at this time, only allow trials and experiments that fall into the bucket of the ‘interoperability approach.’

- The Integration Approach means that a central bank would provide a blockchain-based infrastructure that combines money and securities on one platform, similar to T2S (Target2-Securties). A central bank blockchain is created where securities and wholesale CBDC are tokenised.

- The Distribution Approach means that the central bank would issue their wholesale CBDC as tokens on various market blockchains where assets reside. This is somewhat similar to stablecoin issuance e.g., USDT (Tether) who issue smart contracts and therefore their tokens on various blockchains.

- The Interoperability Approach means that infrastructures supporting the movement of money on a blockchain, or existing payment system platforms, are connected to other blockchains where e.g., digital assets such as tokenised securities are issued.

In total, three different interoperability solutions may be tested in 2024. Two of them can be labelled ‘trigger solutions’ which connect a payment system e.g., TARGET2 or TIPS to a blockchain where tokenised securities are issued. The third solution can allow the Banque de France to connect its blockchain - on which wholesale CBDC tokens are issued – to market distributed ledger technologies (DLTs). The key use case for all three interoperability solutions is a delivery vs payment transaction to settle tokenised assets/securities.

Figure 2: Retail vs wholesale CBDC

Source: Deutsche Bank

At the end of 2024, a decision is expected from the governing council of the ECB regarding which – if any – of the solutions for wholesale CBDC will be introduced into the market. The testing phase from April to November 2024 will allow experiments (simulation only) and pilot transactions where real money is involved. The ECB and the national European central banks want to understand if blockchain settlement should be supported by the Eurosystem. “It will be up to the market to convince the Eurosystem that blockchain technology provides real added value,” Klein emphasised.