27 May 2024

Fintechs are revolutionising how consumers pay and invest. While North America and Asia-Pacific are traditionally the largest fintech markets, Europe is catching up. flow’s Desirée Buchholz reviews three key fintech themes in Europe and how they are enabled by the banking sector

MINUTES min read

Fuelled by changing consumer preferences, technological innovation, and regulatory support, fintechs have significantly reshaped financial services over the past decade. As the Boston Consulting Group (BCG) notes in its May 2023 report Reimagining the Future of Finance, fintechs have become mainstream in segments like payments and transaction banking. By 2030, the consultancy expects global fintech revenues to reach US$1.5trn – up sixfold from US$245bn in 2021.1

These are impressive numbers, given that the sector underwent a tough time in 2022 and lost more than half its aggregate market value, BCG writes. As rising interest rates have raised the cost of capital, the supply of zero-priced funding has essentially dried up. For some players this put an abrupt end to high-flying growth plans. Or, as McKinsey puts it in its October 2023 report Fintechs: A new paradigm of growth, “In the new era, a challenged funding environment means fintechs can no longer afford to sprint. To remain competitive, they must run at a slower and steadier pace.”2

Thanks to major inflows from venture capital funds, North America has traditionally been the largest fintech market. Next in size is Asia-Pacific, where a young and tech-savvy population is particularly eager to manage their financials via smartphones and fintechs help to expand financial inclusion.

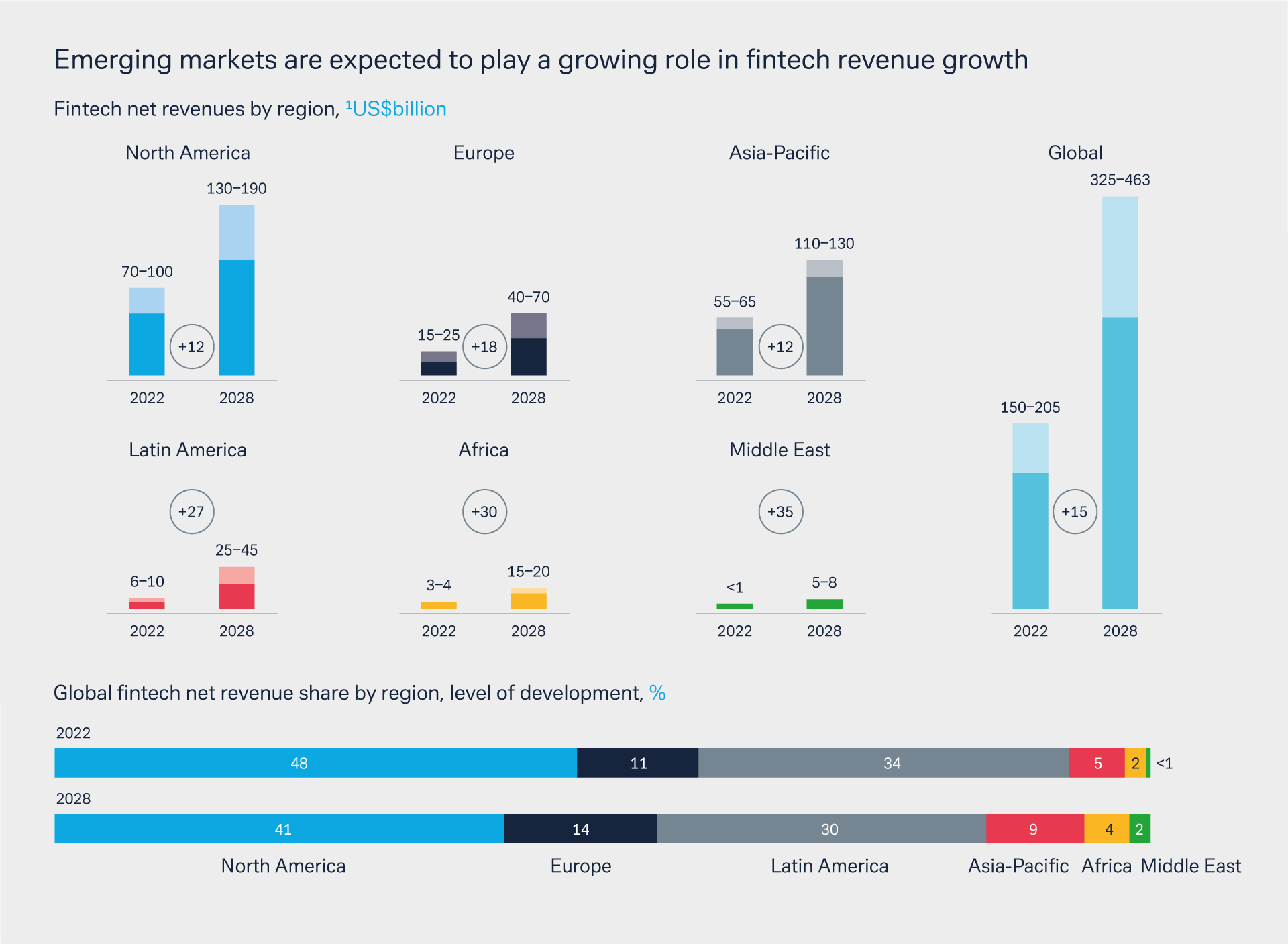

Compared to these regions, Europe was always a laggard. Yet, when it comes to future growth of fintech net revenues, the ‘old continent’ offers much potential, with McKinsey expecting fintech net revenues in Europe to grow faster than in North America and APAC (see Figure 1).

Figure 1: Projection of fintech revenues globally

Source: McKinsey Report Fintechs: A new paradigm of growth (October 2023) fintechs-a-new-paradigm-of-growth.pdf (mckinsey.com)´

Given these projections, what are the macro trends driving fintech growth in Europe? And how do these players cooperate with the banking sector to harness their potential? This article shares insights from Galina Kersten, EMEA Head of Tech & Platform Sales at Deutsche Bank, and Vedran Jankovic, Sales Head Virtual Asset Service Providers at Deutsche Bank, both members of the Global Fintech Coverage Team at Deutsche Bank Corporate Bank.

Kersten and Jankovic identify three emerging fintech themes in Europe:

- Digital payments are on the rise as cash use declines and e-commerce booms;

- Neo brokers are reshaping savings behaviour; and

- Digital assets are fuelled by regulation and technological innovation.

Key Theme 1: Digital payments are on the rise

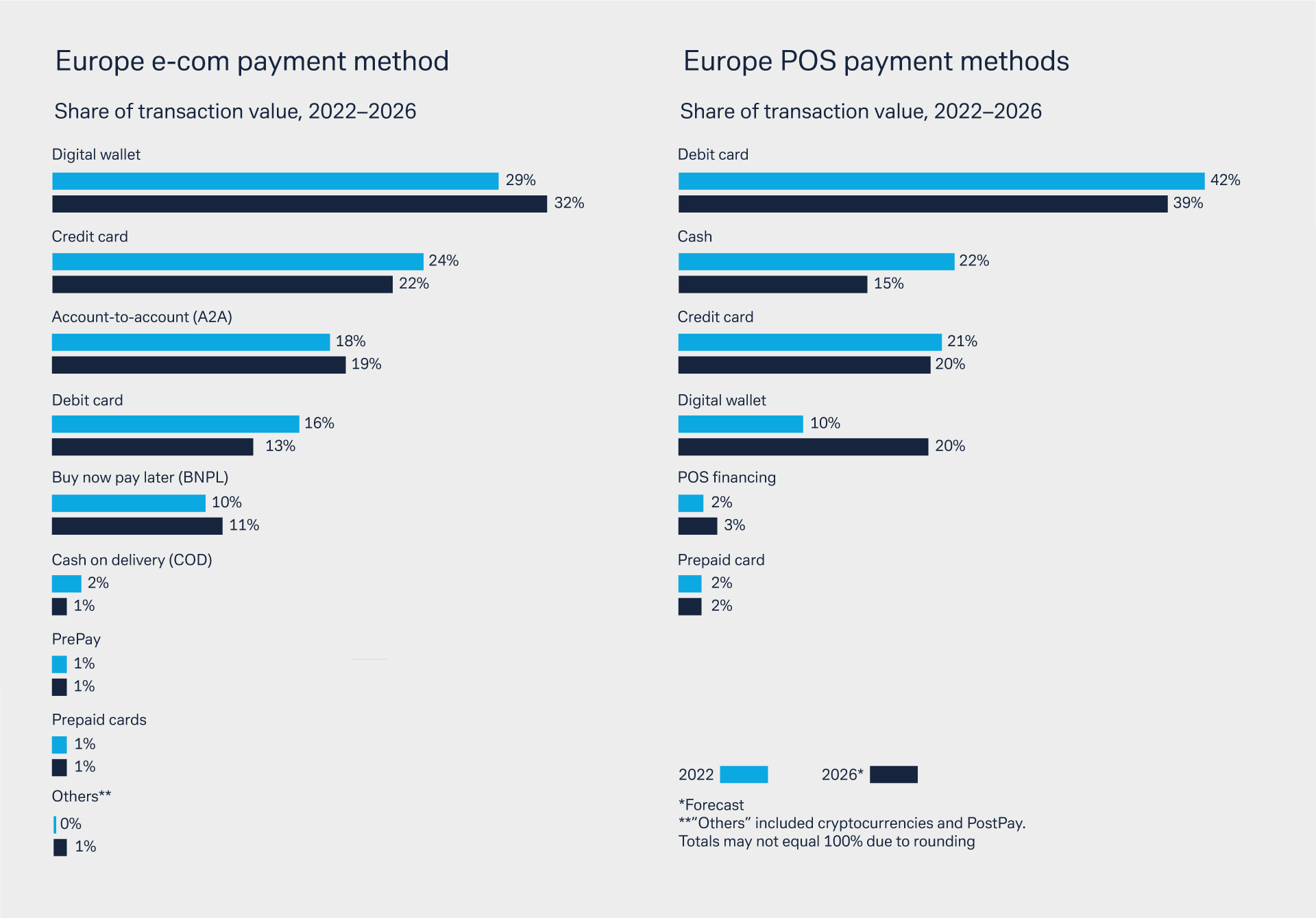

For several years, cash use has steadily declined in Europe: According to data from payment processing provider Worldpay, cash’s share of point of sales (POS) transaction value dropped from 40% in 2019 to 22% in 2022 in Europe. By 2026, that percentage is expected to have fallen to 15%. Even in cash-loving countries like Spain, Germany or Poland – where carrying banknotes is still advisable if you are dining out or hiring a taxi – cash use is shrinking, the report shows (see Figure 2).

Figure 2: Most popular payment methods in Europe

Source: The Global Payments Report 2023, FIS Worldpay (May 2023)

While notes and coins will survive – as many people still want the security and privacy benefits of paying for goods and services in cash, as flow reported in Cash: a dinosaur with longevity? – digital payments appeal to many consumers due to their convenience factor. Online wallets such as Apple Pay, Google Pay and PayPal remove the need to both remember and convey cash, consumers carry fewer items, and finally, it eliminates the need for the consumer to take out their wallet during a transaction, the article explains. Increasingly, it is enough for consumers to have just their smartphone on them rather than the physical wallet.

Moreover, digital payments will naturally grow in importance as e-commerce is booming, having received a boost during the pandemic. According to Deutsche Bank proprietary data dbDIG, the average percentage of spending done online in Germany for example rose from 21% in 2019 to 29% in 2023, in France it increased from 19% to 25%.3 And when it comes to e-commerce payment methods, digital wallets are the first choice of European consumers, followed by credit cards and account-to-account payments, i.e. electronic payments made directly from one bank account to another as for example iDEAL in The Netherlands.

But who is behind digital payments? No doubt the innovation leaders are the largest global wallet providers, who have sustainably changed the way we pay today online or offline. Beyond processing capabilities, payment acceptance at the checkout of an online shop is a battlefield for competition as more and more payments are moving online.

“This solution enables SumUp to pay out merchants instantly on bank working days, weekends and late evenings”

With digital payments on the rise and the strong decline of cash, fintechs are main enablers of this development. SumUp – a leading global financial technology company – was founded in 2012 by a small team with a big idea: a world where every business, regardless of size, has access to affordable and easy-to-use digital payment solutions. Fast forward to today and SumUp is now active in more than 35 markets on three continents and provides payment services that are relied on by four million businesses.4

To support its growth ambitions and win new clients, SumUp needs to maintain top speed in payment innovation – which encompasses the use of instant payments. Handling POS card payment brings certain complexity in the payment flow, as several parties are involved including card schemes, acquirers, fintechs and banks. For the merchant a key criterion is speed of payouts of proceeds to receive timely cash flow. This is where SumUp utilises the power of instant payments.

“With the help of API-based payment initiation in combination with instant payments, SumUp has enabled payouts to merchants also outside the usual banking and bulk payment processing hours, i.e. also over the weekends and late business hours in the evenings. This is a major strategic USP as it enables merchants to have quicker access to funds,” explains Galina Kersten, EMEA Head of FinTech & Platform Sales at Deutsche Bank.

Another example is Online Payment Platform (OPP), a Netherlands-based PSP that specialises in marketplace solutions. Launched in 2013, OPP now processes payment transactions for platforms and marketplaces such as e-Bay Kleinanzeigen, Marktplaats, Naturehouse and Royal FloraHolland.5 The company collects payments from the buyer and then splits the payment to the sellers – thereby providing a secure payment method between private consumers or businesses.

OPP relies on Deutsche Bank to conduct local high-volume (instant) payments and collections for its customers. Moreover, the PSP has implemented an effective liquidity management in different currencies with the help of Deutsche Bank.

In general, the bank supports its PSP clients with integrated solutions - from payment authorisation through risk management up to (instant) payouts.

Key Theme 2: Neo brokers are reshaping savings behaviour

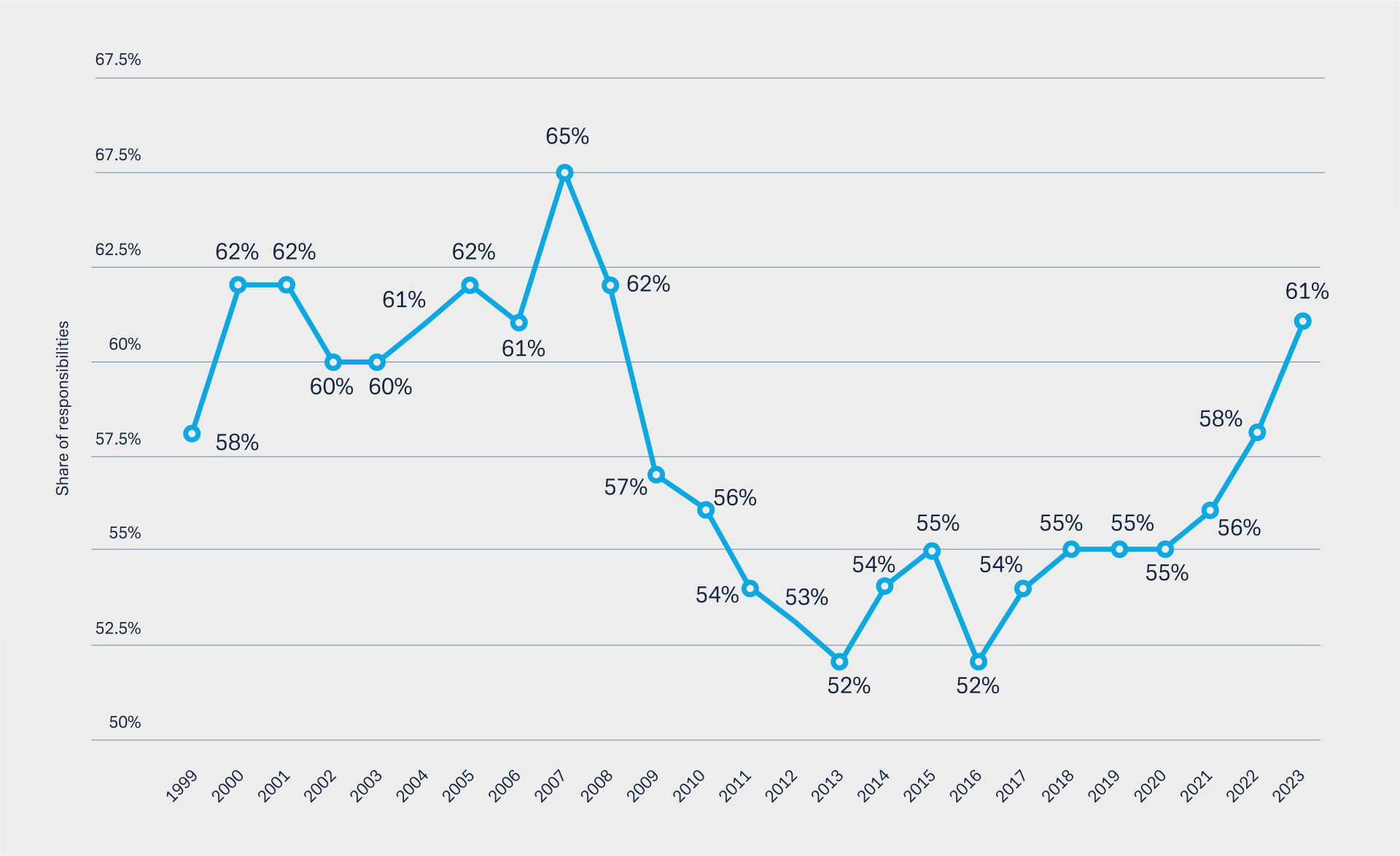

It’s not only payment behaviour that is changing in Europe, saving habits are too. This can be most clearly observed in Germany, where the share of citizens investing in stocks and other equity investments has increased steadily over the past 10 years. According to data from Deutsches Aktieninstitut (DAI) – an organisation of listed German stock corporations – 12.3 million Germans invested in shares and other equity investments in 2023, up from 8.4 million in 2014.6 Still, compared to other EU countries or the US, the share of consumers investing in capital markets is lagging behind (see Figure 3).

Figure 3: Share of adults investing money in the stock market in the United States

As a zero-interest rate environment of several years forced savers to look for alternatives to bank deposits, exchange-traded funds (ETF) became most popular. But even in a higher interest rate environment, consumers are increasingly interested in building up wealth using tools beyond the usual savings accounts. Projections suggest that by the end of 2028, the total volume invested in ETFs by private investors in Continental Europe will more than triple from 2023-levels to over €650bn, a study commissioned by iShares from BlackRock found.7

This untapped opportunity is the sweet spot for so called neo-brokers. Based on a combination of rising consumer interest in capital markets, ETF saving plans starting from a savings rate of one euro and apps that engage with digital natives, neo-brokers have been able to grow significantly. By lowering the entry barriers to tap into capital markets, neo-brokers have been able to engage mass consumers, Kersten explains: “These digital apps make investing and trading more easily accessible to a broader consumer base and are particularly popular among younger people who are investing in capital markets for the first time.”

Take the example of Trade Republic, Europe’s leading and fastest growing neo-broker founded in 2015, which now has €35bn assets under management.8 As of February 2022, nearly 70% of all users were under the age of 35, with the vast majority investing, driven by the lack of other attractive alternatives for savings and building wealth.9 “Deutsche Bank is part of this success story as the bank supports Trade Republic with liquidity solutions, seamless payment services including virtual accounts as well as an application programming interface (API) integration for instant reporting,” she says.

An even newer kid on the block is lemon.markets, a Berlin-based fintech founded in 2020, which in March 2024 went live with its brokerage-as-a-service platform. lemon.markets’ mission is to provide companies – primarily financial services providers and other fintechs – with the infrastructure allowing them to embed brokerage into their own offerings. This infrastructure comes in the form of an API, which the company offers as a white label solution, meaning that clients using it can do so under their own brand. As a partner of lemon.markets, Deutsche Bank processes the payment transactions between lemon.markets and its customers, which can include holding deposits.10

Key Theme 3: Digital assets are fuelled by regulation and technological innovation

But what if people want to invest in digital assets such as cryptocurrencies, rather than stocks or ETFs? This segment is also becoming increasing popular, with revenue in the cryptocurrencies market alone projected to reach US$14.3bn in Europe in 2025.11

This is where the so-called Virtual Asset Service Provider (VASP) comes into play. A VASP is defined by the Financial Action Task Force (FATF) as a business that conducts one or more of the following actions on behalf of its clients:

- Exchange between virtual assets (a subset of digital assets) and fiat currencies;

- Exchange between one or more forms of virtual assets;

- Transfer of virtual assets;

- Safekeeping and/or administration or virtual assets or instruments enabling control over virtual assets; and

- Participating in and provision of financial services related to an issuer’s offer and/or sale of a virtual asset.12

“It will be a transformative year for investments into virtual assets in Europe,” says Vedran Jankovic, Sales Head Virtual Asset Service Providers at Deutsche Bank. According to him there are two main drivers for this development – one from the regulatory and one from the technological side.

First, the Markets in Crypto-Assets Regulation (MiCAR)13, an EU-harmonised regulatory framework for virtual assets and VASPs, which came into partial effect in June 2024 (full effect from 30 December 2024). “The financial services sector attaches high hopes to this regulation as it has introduced uniform rules for VASPs throughout the entire EU,” he explains. The MiCAR licence, for example, allows VASPs like centralised virtual asset exchanges and stablecoin issuers to offer their services in 27 EU member states. “This framework is unique in the world and makes Europe a pioneer in virtual asset regulation, thereby slowly increasing trust in this segment,” he adds.

“It will be a transformative year for investments into virtual assets in Europe”

Second, the three most prominent Blockchain protocols (Bitcoin, Ethereum and Solana) will embed further inherent technological upgrades throughout 2025 and 2026. “This will, among others, improve efficiency and throughput of these chains which addresses reputational flaws centered around energy consumption and transaction costs,” Jankovic says. “Combined with the impact of interest rate cuts in Europe, these advancements make investment liquidity inflows into blockchain projects and the digital asset market in general quite likely.”

Again, there are several fintechs hoping to benefit from these trends. A prime example is Bitpanda, a regulated multi-asset trading platform offering stocks, ETFs, commodities, as well as cryptocurrencies and crypto indices to retail and institutional investors. Founded in 2014 in Vienna, the fintech now has more than four million users which buy, sell or swap more than 3,000 virtual assets. Moreover, with the Bitpanda VISA card, users are enabled to utilise their asset holdings for e-commerce or offline payments. Bitpanda has a PSD2 payment service provider licence and e-money licence as well as an BaFin-licensed inhouse crypto asset custodian.14

“With their strong regulatory setup Bitpanda is well positioned to benefit from the abovementioned virtual asset-friendly developments in Europe,” Jankovic believes.

The way in which Europe’s consumers pay for their purchases and invest their money changes constantly. While fintechs are an important driver for change by digitising processes, which makes it easier, more convenient and cheaper for consumers to manage their financials, a close partnership with banks is key in order to be able to grow sustainably and reap their full potential. Ultimately, this cooperation benefits everybody – consumers, fintechs and banks.

Sources

1 See web-assets.bcg.com

2 See mckinsey.com

3 See Deutsche Bank Research Report The Future of Money – Part 3: Forget Extinction, Cash the Dinosaur will survive by Marion Laboure and Cassidy Ainsworth-Grace (September 2023)

4 See sumup.com

5 See onlinepaymentplatform.com

6 See dai.de

7 See cdn.extraetf.com

8 See traderepublic.com

9 See diw-econ.de

10 See financemagnates.com

11 See statista.com

12 See mastercard.com

13 See eur-lex.europa.eu

14 See bitpanda.com