23 November 2023

While the demise of banknotes and coins has long been predicted and the pandemic accelerated the decline, Deutsche Bank Research analysts Marion Laboure and Cassidy Ainsworth-Grace contend in their latest research report that news of the death of cash is greatly exaggerated

MINUTES min read

With a growing number of developed world households and businesses using no physical cash at all as payments move to cards and e-wallets, is it just a matter of time before cash is no more?1

In Forget Extinction, Cash the Dinosaur will Survive, the third and final part of report updates in the series The Future of Money, Deutsche Bank Research analysts Marion Laboure and Cassidy Ainsworth-Grace maintain their prediction that cash is unlikely to become extinct in the near term even if the digital age has made it a dinosaur. “Cash remains a popular payment method and over 58% of individuals believe that cash will always be around,” they note. “Cash in circulation has increased over the past 20 years; and Americans, for example, continue to extensively use cash.”

Against this, as flow recently reported in ‘Japan joins the journey to a cashless society’, cash transactions have virtually disappeared in Sweden while Denmark, which has also steadily moved towards a cashless society, recorded not a single bank robbery in 2022 against 221 in 2000 – as criminals transferred their efforts to digital scams. Even countries such as Germany and Japan, where the mantra ‘cash is king’ has traditionally been the strongest, have significantly lessened their reliance on notes and coins over the past few years, with the trend accelerating during the anti- Covid 19 lockdowns “by four to five years”.

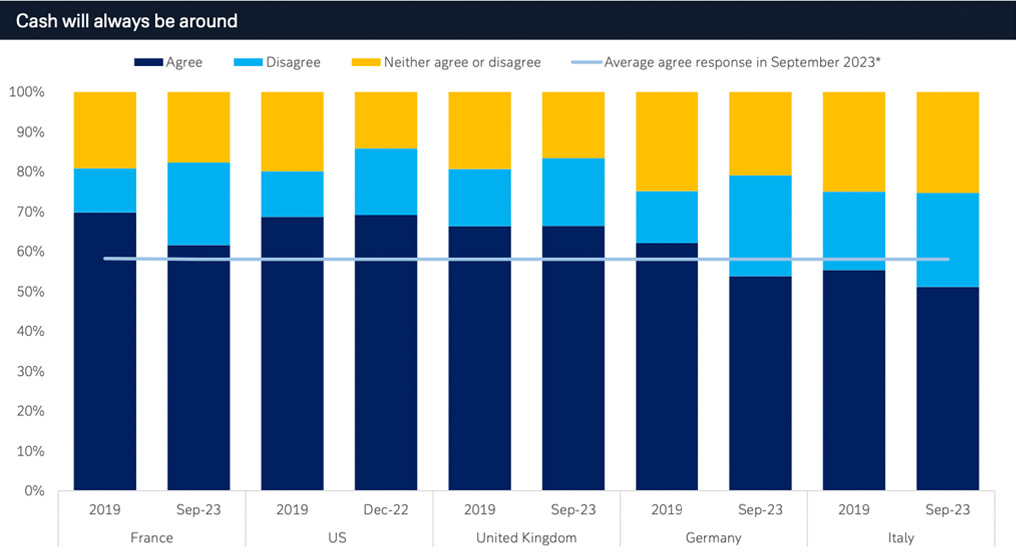

Figure 1 shows the results of the Deutsche Bank Data Innovation Group’s (dbDIG) proprietary survey of 8,250 consumers across the US, UK, France, Germany, and Italy and their recent attitudes towards cash compared with a similar pre-pandemic survey in 2019.

Figure 1: People are not ready for cash to disappear

Source: Deutsche Bank, dbDIG. Note: percentage of respondents who think that cash will always be around. Survey ran September 2023 for all countries except for the US. US survey ran December 2022. *Excludes the US.

While cash has unilaterally fallen as a preferred payment method in the past four years it remains popular, particularly in Europe. In the UK, cash payments increased for the first time in a decade in 2022, after rising 7% year-on-year to reach 6.4bn – despite many British businesses becoming ‘card only’.

UK Finance also reported that the number of Britons living “largely cashless lives” and seldom or never using notes and coins peaked at 23.1m in 2021 after years of steady increases, but last year the trend reversed, and the figure fell to 21.6m.

“Convenience, anonymity, security and ubiquity are four features that explain why many are unwilling to bid farewell to cash”

“Growing fears about inflation and the rising cost of living have meant some people are making greater use of cash as a way of managing budgets,” explained a UK Finance spokesperson to The Guardian (14 September 2023).2

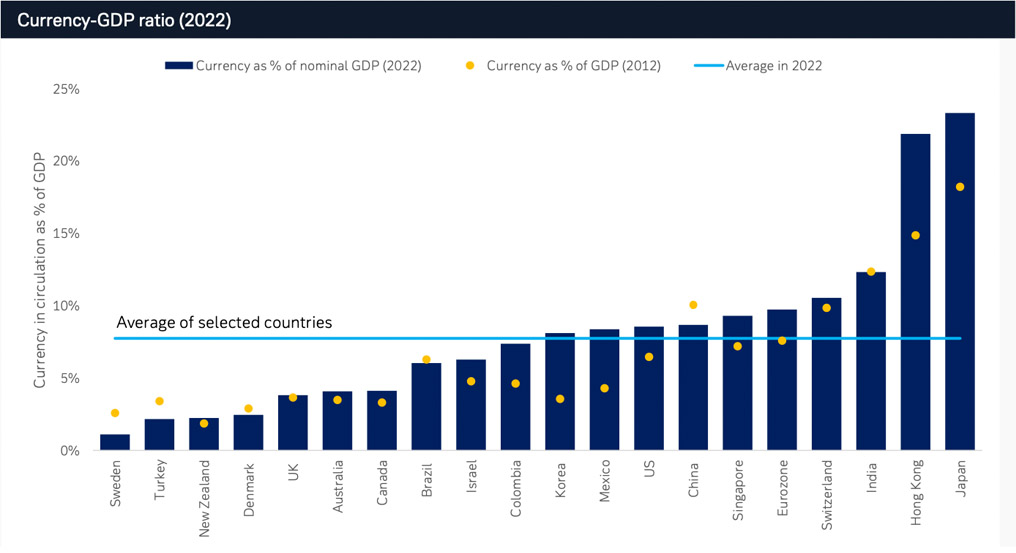

Figure 2: There are some wide disparities across countries in terms of cash in circulation

Source: Deutsche Bank, Haver Analytics

Why cash survives

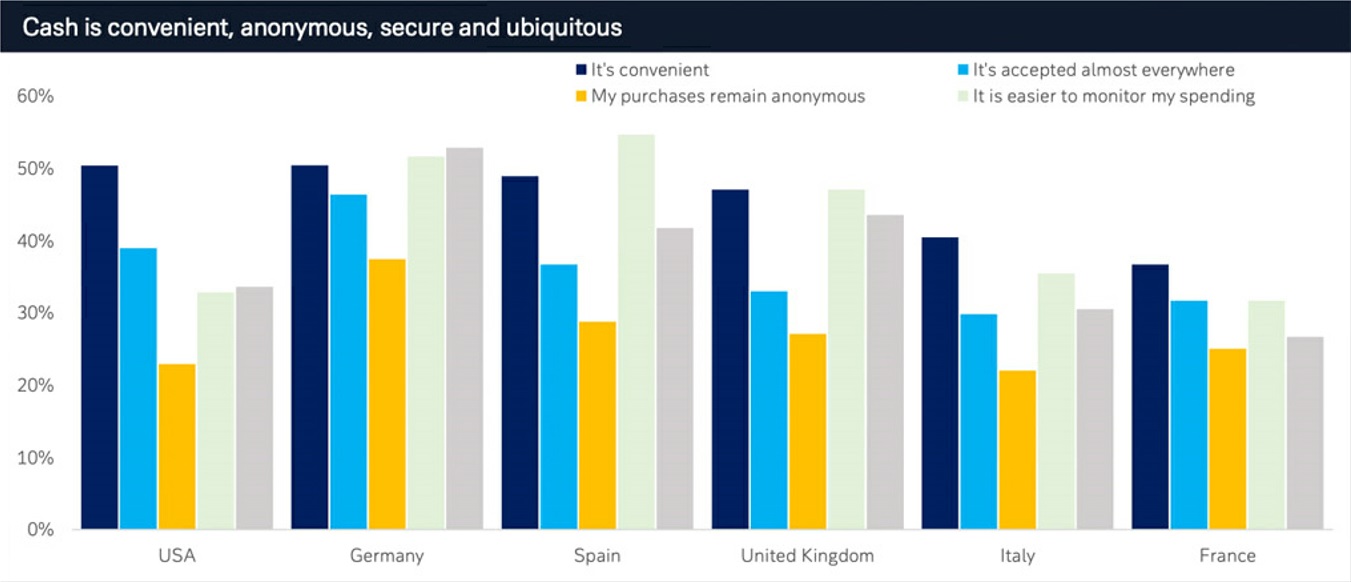

Convenience, anonymity, security and ubiquity are four features that explain why many are unwilling to bid farewell to cash, which (Sweden apart) is still accepted almost everywhere, note the report’s authors. “In the US, 50% of consumers cite this as a key reason for cash being a preferred payment method.”

“Consumers similarly enjoy the security and privacy benefits of paying for goods and services in cash, as it reduces the reliance on third parties and their security practices. These concerns are held most strongly in Germany,” reflect Laboure and Ainsworth-Grace.

Figure 3: Why people still appreciate cash

Source: Deutsche Bank dbDIG. Note: Which, if any, of the following are the main reasons for cash being your most preferred payment method? Please select all that apply. Survey ran August 2023.

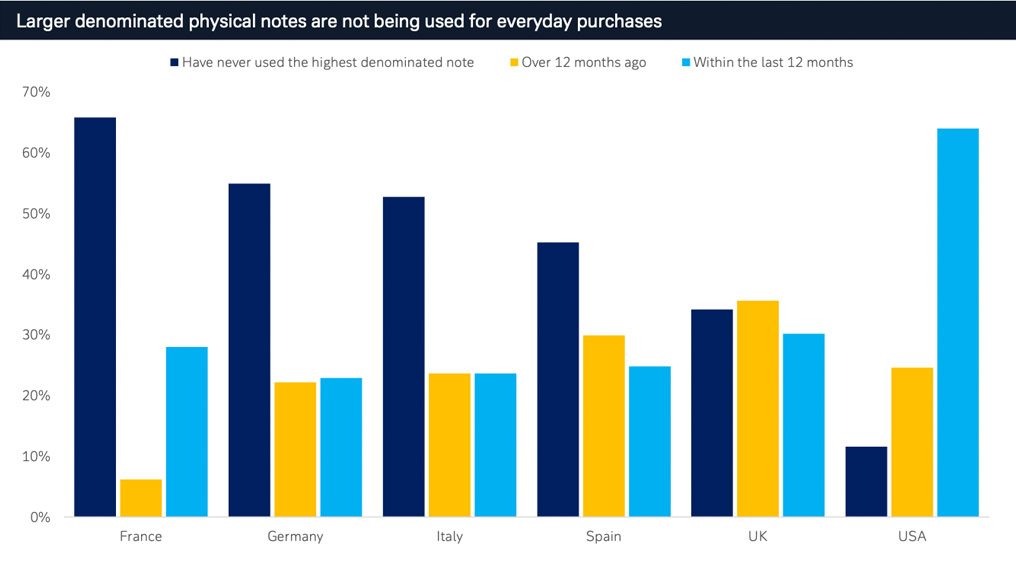

Cash has even survived the withdrawal of high-denomination notes in Europe. Back in 2016 the European Central Bank announced that it would cease production of the €500 banknote due to concerns it “could facilitate illicit activities”.3 More recently, in May the Reserve Bank of India announced that the 2,000-rupee (INR) note would be withdrawn from circulation by the end of September 20234 as part of the Indian government’s ongoing efforts to demonetise the economy.

Figure 4: Many consumers have never used their country’s highest-denominated banknote

Source: Deutsche Bank dbDIG. Note: When last, if ever, did you personally use the largest denominated cash note to pay for goods and services? Survey ran September 2023, for all countries except the US. Survey for US ran December 2022.

However, while cash was still growing in 2022 it is now trending downward as the world’s central banks reach the end of their hiking cycle, which has seen interest rates rise swiftly and sharply to levels unseen since before the global financial crisis 15 years ago. Higher interest rates has historically meant there is a stronger incentive to deposit money, thereby reducing cash in circulation.

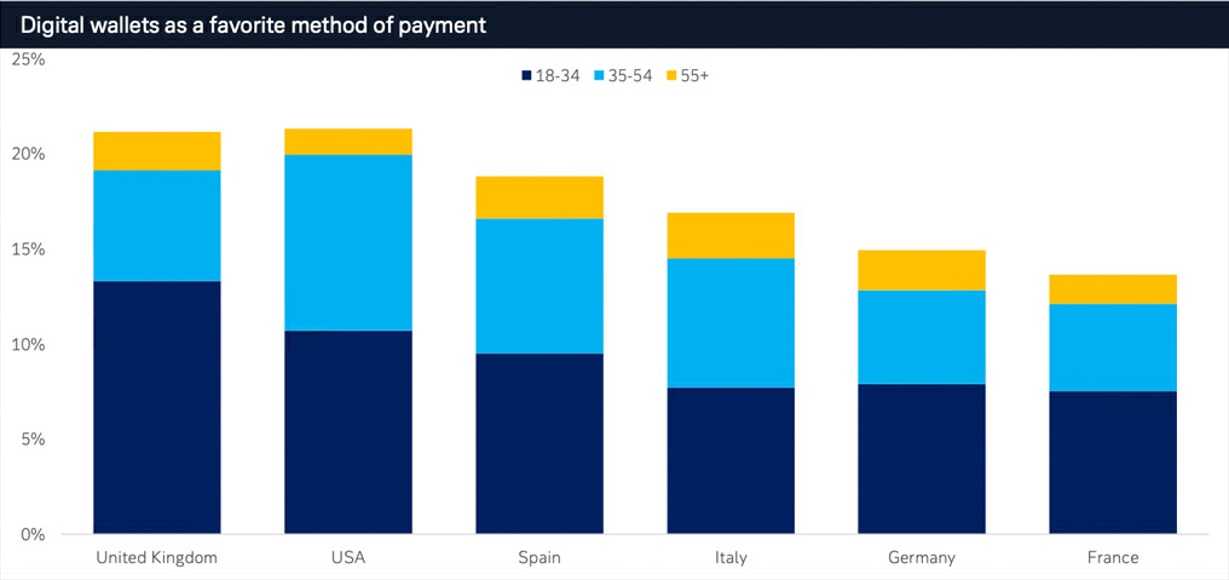

A further legacy of the Covid-19 pandemic was a shift to digital payments. The use of digital wallets as a payment method has increased in both the US and Europe.

As flow reported back in May 2020 in Covid-19’s assault on cash notes and coins were regarded as potential virus transmitters, while many countries raised the maximum limit applicable to a contactless payment. Add to this the fact that many stores were shuttered, and digital payment methods gained significant traction as a result.

“Digital wallets, and smartphone digital wallets in particular, saw significant gains in popularity,” note Laboure and Ainsworth-Grace. “In the US, smartphone digital wallet as a preferred payment method rose from 12% of respondents in 2019 to 16% in 2022. In the UK, there was an increase from 13% to 17% over the same period.”

Digital payments appeal to many consumers due to their convenience factor; 43% of Americans cite convenience as the main reason a digital wallet is their preferred payment method. They remove the need to carry as well as remember cash, consumers are able to carry fewer items, and finally, it eliminates the need for the consumer to take out their wallet during a transaction.

And while Singapore and Korea lead the way in the number of cashless payments per inhabitant, the

US and the UK are leading with digital payments with Millennials (born between 1981 and 1996) and Generation Z (from 1997 to 2012) the most comfortable with digital wallets as their preferred method of payment. “But we may have a way to go until digital wallets replace physical wallets,” the report cautions.

Figure 5: The US and the UK lead the way in digital payments

Source: Deutsche Bank dbDIG. Note: Demographics account for the percentage population represented in the 18-34, 35-54, and 55+ brackets. This excludes people under the age of 18. Survey ran September 2023.

E-commerce also boosted

According to our Deutsche Bank proprietary data dbDIG, the pandemic also gave a fillip to e-commerce, with the average percentage of spending done online in the US increasing from 23% in 2019 to 32% in 2023. There has been a small drop-off in spending online in the past year across all surveyed countries save France, as the last of pandemic restrictions and behaviours across the world peter out.

The popularity of Buy Now, Pay Later is another key development in e-commerce – see the flow article Cash – the long goodbye (28 June 2023). BNPL is a type of short-term financing offered at the checkout which permits consumers to pay for the product/service they purchase later in future. These products are usually interest free but come at a high cost if the consumer defaults.

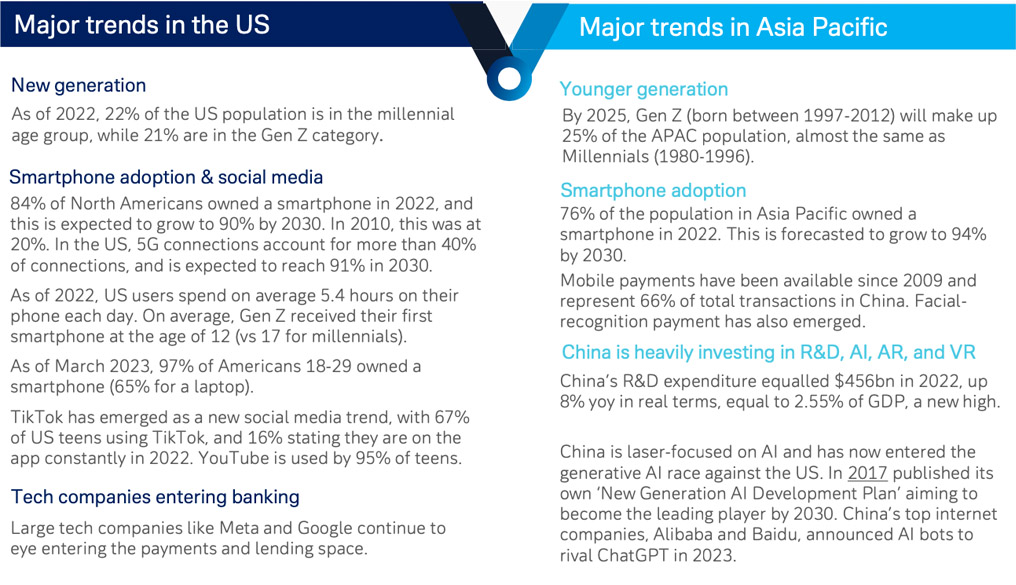

As for the future of cash and payment methods, “consumers are more tech savvy and digitalisation is key” conclude the two analysts, rounding off their report with a summary of key trends in the world’s largest developed economy and its biggest emerging economic region. These are set out in Figure 6.

Figure 6: Trends in the US and Asia Pacific

Source: Deutsche Bank, GSMA, Statista, Insider Intelligence, Grayscale Investments, YPulse, Pew Research Center, Reuters

US novelist Mark Twain famously quipped, “The reports of my death are greatly exaggerated,” after the publication of two premature obituaries. Perhaps the same could be said of cash.

Deutsche Bank Research report referenced:

The Future of Money – Part 3: Forget Extinction, Cash the Dinosaur will survive by Marion Laboure and Cassidy Ainsworth-Grace (September 2023)

Note that that the summary of Part 1: Cryptocurrencies: The return of faith, trust and fairy dust can be found on flow here and Part 2: CBDCs: The Economic Rocket Takes Off is available here