8 September 2025

As artificial intelligence (AI) drives innovation across sectors, it’s not only fuelling technological progress, but also significantly increasing electricity demand. Deutsche Bank’s Lavinia Bauerochse describes how this development is transforming the global energy transition – and why investments in grid expansion and transition finance are taking centre stage

MINUTES min read

AI is revolutionising how industries operate – from optimising engineering to accelerating scientific discovery. In manufacturing, for example, Siemens is deploying AI-powered robotics to enhance automation and improve the usage of data in manufacturing. At its Electronics Factory in Erlangen, the German technology company is working with AI-trained robots that pick and place unsorted parts from crates autonomously. The company reports that this has reduced quality control efforts by up to 95%.1

In pharmaceuticals, AstraZeneca is deploying AI to transform drug development. According to Jim Fox, Vice President Sweden Operations, generative AI (GenAI), machine learning and large language models are already helping to reduce development lead times by 50% and to reduce the use of active pharmaceutical ingredients in experiments by 75%.2

Beyond manufacturing and pharma, AI is also making agriculture more efficient: US-based agricultural machinery manufacturer John Deere has developed AI-equipped robot sprayers that can reduce herbicide usage by only targeting weeds. The company says this helps farmers grow food more efficiently and increases sustainability.3

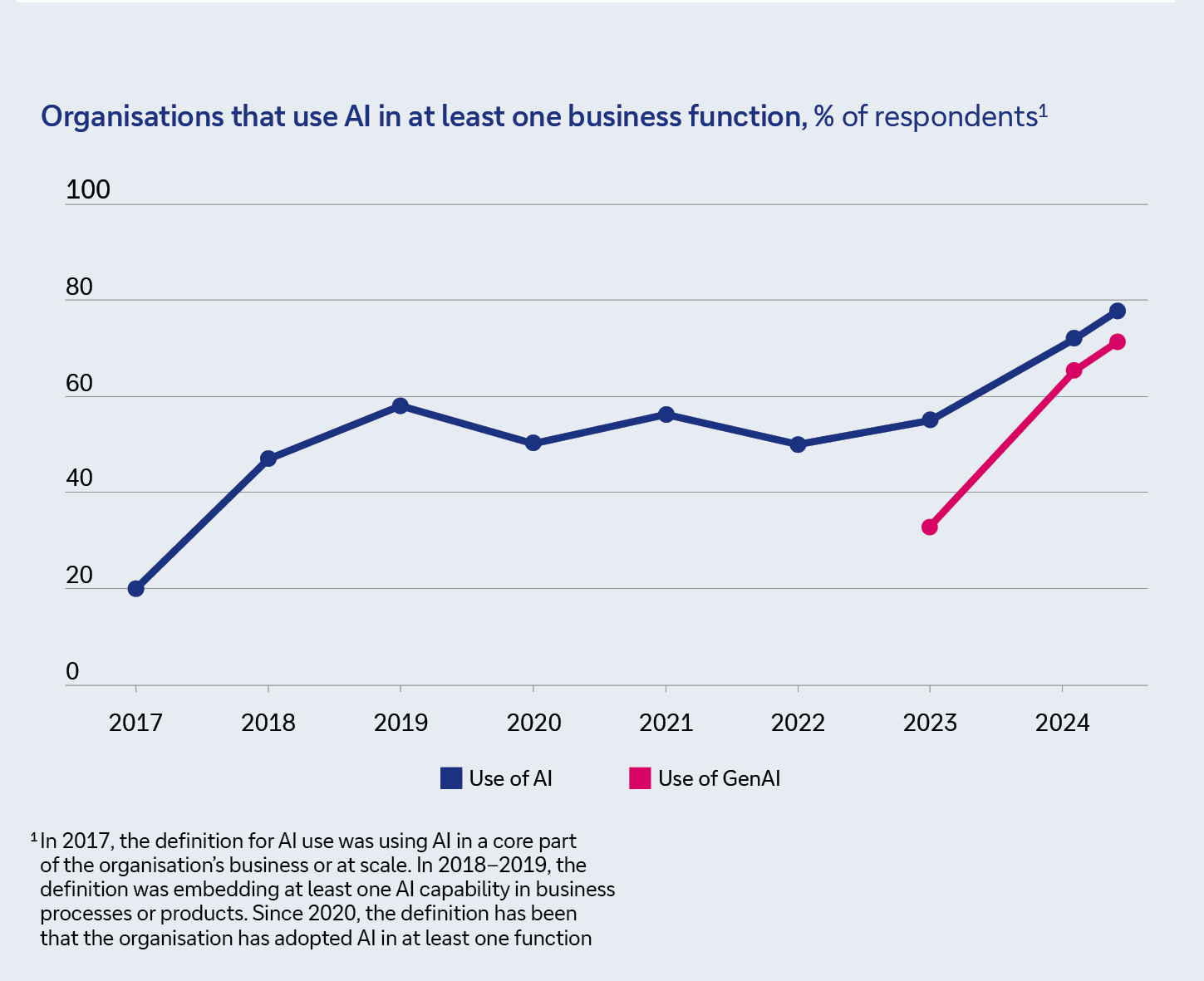

These examples highlight a broader trend: AI is rapidly driving innovation across industries by automating tasks, enhancing decision-making and enabling personalised solutions. While there are still hurdles for corporate adoption, the use of AI continues to build momentum. A McKinsey survey found that 78% of companies are now using AI in at least one business function, with the adoption of GenAI in particular accelerating over the past few months (see Figure 1). Moreover, compared with the previous survey in early 2024, a larger share of respondents report that their organisation’s GenAI use cases have increased revenue within the business units deploying them4 – suggesting that AI is becoming important to competitiveness.

But as the digital transformation picks up speed, a bottleneck is emerging – energy infrastructure.

Figure 1: Increase in organisations’ use of AI

Source: McKinsey global surveys on The State of AI

AI’s growing appetite for energy

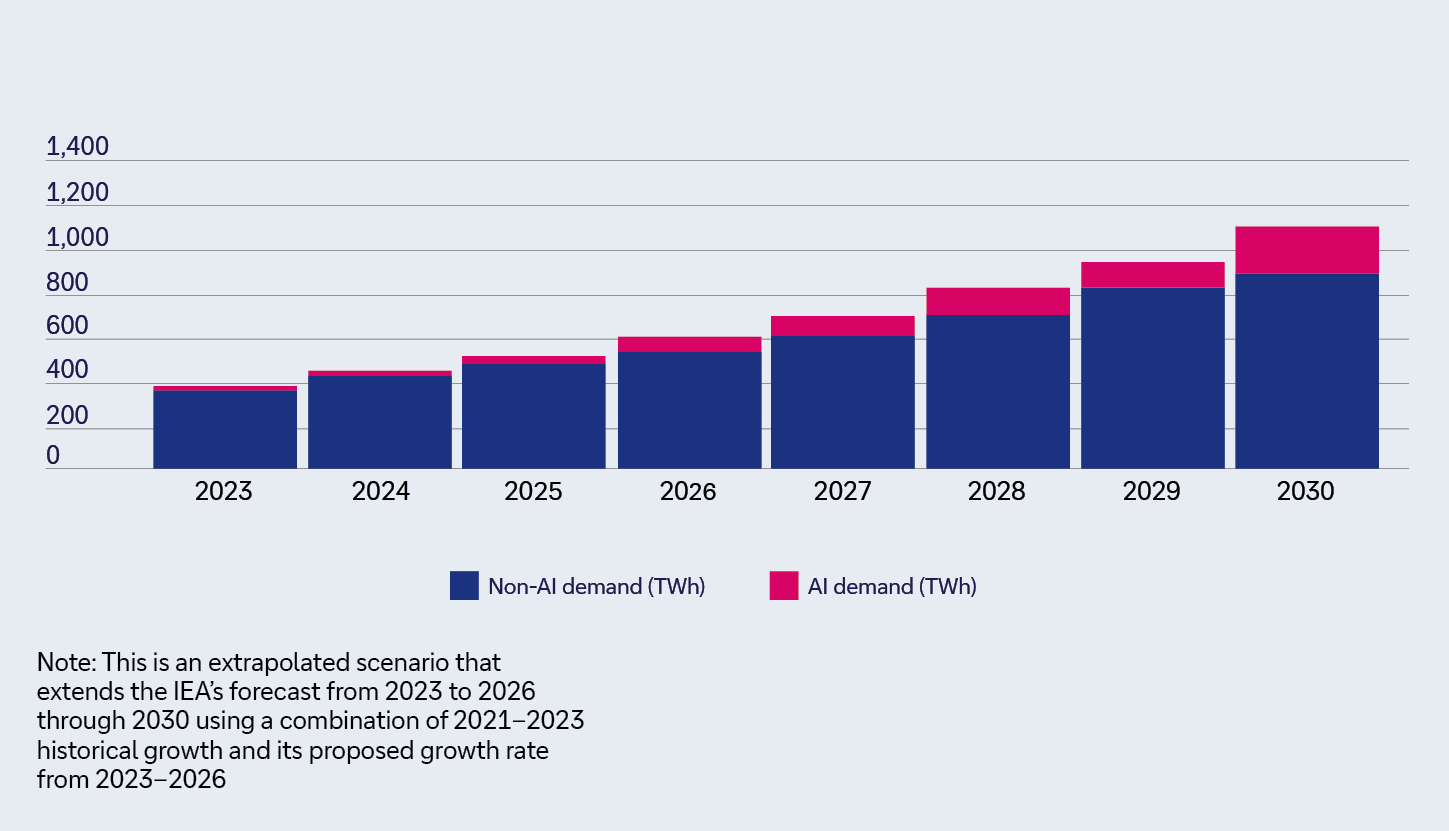

As AI accelerates, so does the demand for energy – and not just any energy. It needs to be available 24/7, clean and affordable. AI applications, particularly generative AI, require substantial computing power and continuous access to electricity. This is driving a sharp increase in demand for data centre capacity and, with it, a surge in electricity demand. One estimate expects data centre-related electricity consumption to grow from approximately 1% of global electricity demand today to over 2% by 2026, potentially reaching 3% by 2030 if forecasted growth continues (see Figure 2). AI-related electricity consumption alone is expected to grow by as much as 50% annually from 2023 to 2030 globally.5

According to the International Energy Agency (IEA), data centres already account for around 2–4% of total electricity consumption in large economies such as the US, China and the European Union. In at least five US states, that share has already surpassed 10%, while in Ireland, data centres now consume more than 20% of national electricity.

This trend places growing pressure on electricity grids, particularly in regions where AI infrastructure is rapidly expanding. “The growth of data centres could therefore lead to considerable strain on local power networks, exacerbated by the huge mismatch between rapid data centre construction times and the often sluggish pace of expanding and strengthening grids and generation capacity,” warns the IEA.6

Figure 2: Data centre demand: non-AI vs AI

Source: International Energy Agency (IEA); Goldman; Accenture

The grid: backbone of the energy transition

This is placing a new urgency on transforming our electricity infrastructure. Today’s power grids are ill suited to the needs of decentralised renewables and AI-driven digital economies. Currently, our grids are designed for centralised fossil fuel plants and struggling to accommodate the variable and distributed nature of solar and wind energy. Thus, the global energy transition hinges on a significant transformation of our power grids. According to energy providers Siemens Energy and AES, over 400,000km of transmission networks need to be upgraded or newly constructed to alleviate bottlenecks. Currently, nearly 3 terawatts of renewable energy projects are delayed due to grid constraints.7

Here, AI is not just a driver of energy demand – it is also part of the solution. Smart grids powered by AI are helping utilities to optimise electricity flows in real time, reduce transmission losses and manage growing complexity. AI-enhanced forecasting tools analyse weather, consumption and industrial activity to fine-tune the balancing of supply and demand.

“AI is not just a driver of energy demand – it is also part of the solution”

For any region aspiring to become an attractive business location for future technologies and industrial production, access to computing power, i.e. data centres, will be vital. Data centres require access to cheap – ultimately renewable – energy, and thus the relevance of renewable energy goes way beyond sustainability aspects alone: it is determining competitive advantage, attractiveness as a business location, prosperity and economic growth.

In 2024, energy transition investments reached US$2trn8 – and a further renewables uptake is expected. Recognising the urgency of fully realising the potential of renewables, investment in transmission has started to pick up as many countries make grid infrastructure a key priority in their national energy plans. Europe, the US, China, India and parts of Latin America are leading the way, and global investment in power transmission grew by 10% in 2023 to reach US$140bn. Under today’s policy settings, this spending would need to exceed US$200bn per year by the mid-2030s to meet rising needs for electricity, and to reach US$250-300bn in scenarios that achieve national and global emissions goals in full.9

Nuclear renaissance

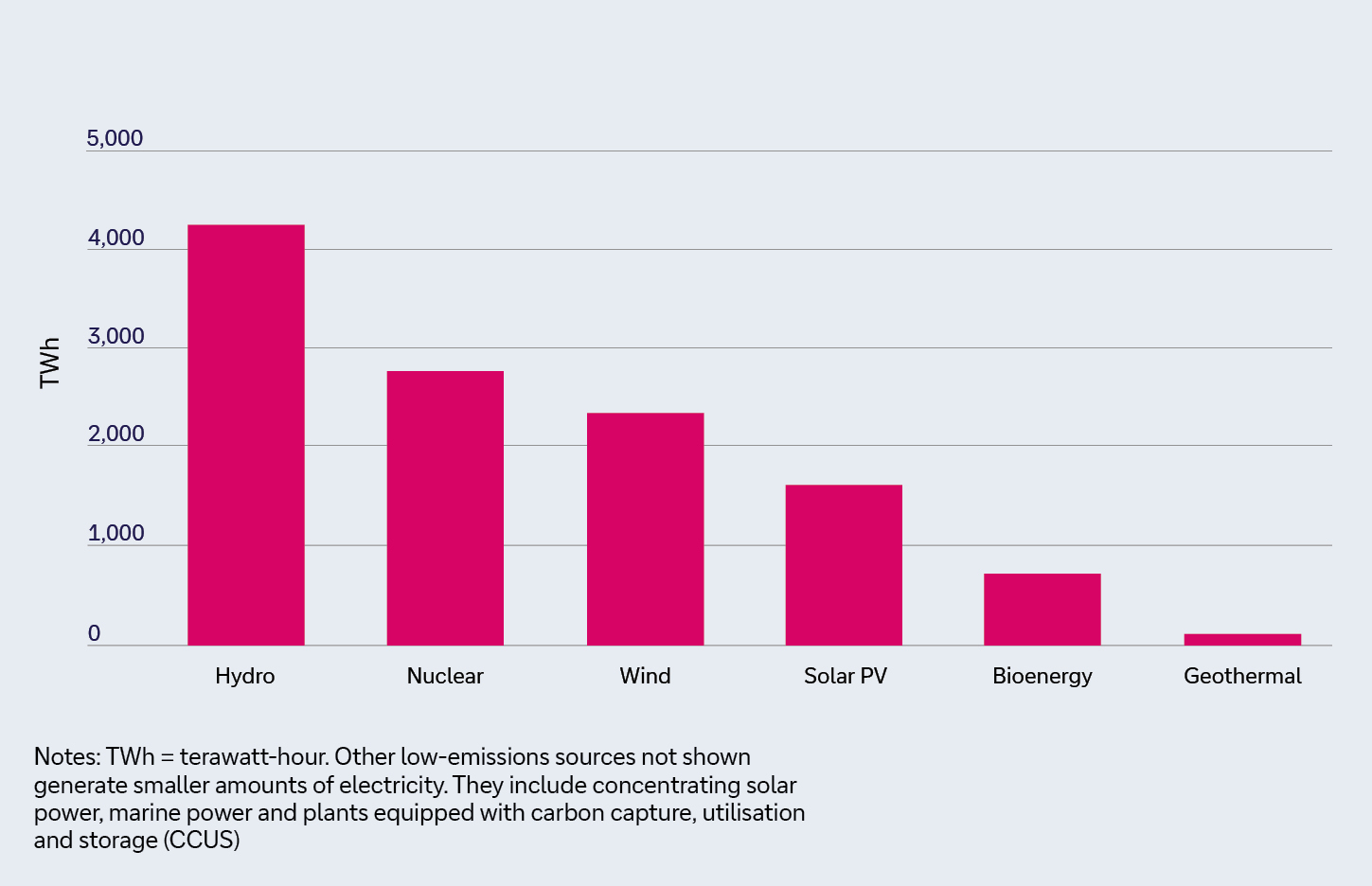

With AI-powered services running around the clock, the appetite for stable baseload power is surging again – and that’s one reason nuclear energy is back on the agenda. Between 2020 and 2023, annual global investment in nuclear – encompassing both new plants and lifetime extensions of existing ones – rose by almost 50%, and now exceeds US$60bn. Today, nearly 420 reactors worldwide provide just under 10% of global power generation, making nuclear the second-largest source of low-emissions electricity today after hydropower (see Figure 3).10

According to the International Atomic Energy Agency (IAEA), nuclear power has prevented around 70 gigatonnes (Gt) of CO₂ emissions over the past five decades and continues to avoid more than 1Gt of CO₂ annually.11

Figure 3: Global low-emissions electricity generation by source, 2023

Source: International Energy Agency (IEA)

At COP28 in Dubai in December 2023, more than 20 countries – including the US, Japan, the UK and France – pledged to triple nuclear capacity by 2050. Since then, the number has grown to 31 countries.12 In March 2025, big tech companies such as Amazon, Google and Meta joined the initiative, recognising nuclear’s role in powering digital infrastructure sustainably – with the pledge expected to gain more support in the coming months from industries such as maritime, aviation, and oil and gas.13 As of early 2025, according to the IEA, 63 reactors are under construction globally, representing more than 70 gigawatts of new capacity, one of the highest levels seen since 1990.14 But despite all this, the long-term viability of nuclear power remains challenged by the unresolved issue of final repository solutions for radioactive waste.

Transition finance: enabling the shift

Powering the AI era sustainably requires more than just technology – it requires capital. The energy transition is not only an environmental challenge, but also a massive economic shift which requires large amounts of private capital to be mobilised. Industries face significant capital expenditure as they adapt business models to a new energy and regulatory landscape. Transition finance is about enabling corporates to adapt to these fundamental shifts that are driven by digitalisation, geopolitics and regulation.

Closing the capital gap to decarbonise high-emitting sectors such as steel, chemicals – and, increasingly, IT – requires a gradual transformation. We need to think about and approach transition more broadly. Transition goes beyond the dark green assets captured by Green Finance. Transition Finance supports the adoption of business models in the form of a transition plan or transitional economic activities. It is essential for closing the capital gap and achieving a successful transition of economies.

AI is poised to be one of the defining forces of the 21st century, but its benefits will only be fully realised if the underlying infrastructure keeps pace. That means investing not just in AI, but also in grids, clean power, storage – and financial mechanisms that ensure industries can evolve.

Lavinia Bauerochse is Global Head of Sustainable Finance Corporate Bank, Deutsche Bank

Sources

1 See siemens.com

2 See weforum.org

3 See nvidia.com

4 See The state of AI: How organizations are rewiring to capture value

5 See reports.weforum.org

6 See iea.org

7 See weforum.org

8 See about.bnef.com

9 See iea.blob.core.windows.net

10 See iea.blob.core.windows.net

11 See iaea.org

12 See power-technology.com

13 See reuters.com

14 See iea.blob.core.windows.net