7 October 2025

After a strong 2024, many market observers were anticipating a ‘constructive 2025’ as the year got underway. Drawing on Deutsche Bank Research insights, flow’s Clarissa Dann provides an update to a market that has seen increasing new issuance of the asset class nine months into a year characterised by macroeconomic headwinds

MINUTES min read

Collateralised loan obligations (CLOs) ride on top of the leveraged loan market and this complex financial instrument remains popular with investors. As reported in flow’s ‘Collateralised loan obligations explained’, CLO managers buy nearly three-quarters of all leveraged loans issued – more than any single counterparty demographic – and this makes this evolving asset class a vital component of the loan markets.

This article, extracting from published Deutsche Bank Research insights by analysts Jamie Flannick and Conor O’Toole, provides an update on the CLO markets in the US and Europe in three sections:

- Shape and key metrics (such as issuance volumes, pricing, relative value)

- General health of the credit market within which CLOs sit – with the lens of the general macro environment underpinning this broader credit universe

- Innovative and evolving products such as exchange traded funds

“CLO deal activity is still very robust, exceeding last year’s record setting year”

With Q3 2025 over, the themes of Flannick and O’Toole’s reports indicate the following main trends:

- High deal activity and relatively strong credit metrics can be seen across both US and European markets. Flannick notes, “CLO deal activity is still very robust, exceeding last year’s record setting year in both the US and in Europe – and on pace to break last year’s records for new issue and repricings.”

- Weakening economic data in the US (particularly its labour market) has partially led to higher quality loans jumping in price during mid-September compared to CCC-rated loans, which have performed poorly since mid-July, following considerable gains for three months, beginning after April’s sell-off. This points to “cautioning investor sentiment,” Flannick continues. But despite loan defaults remaining elevated across both markets, there remain plenty of reasons to be constructive about CLOs generally, particularly the higher-rated debt and equity tranches of CLO structures.

- The buoyancy in new issuance has led to a deepening investor base, and the continued growth of the CLO ETF market. “CLO ETF inflows are on track to surpass last year’s FY figure”, Flannick confirms.

(1) Key metrics

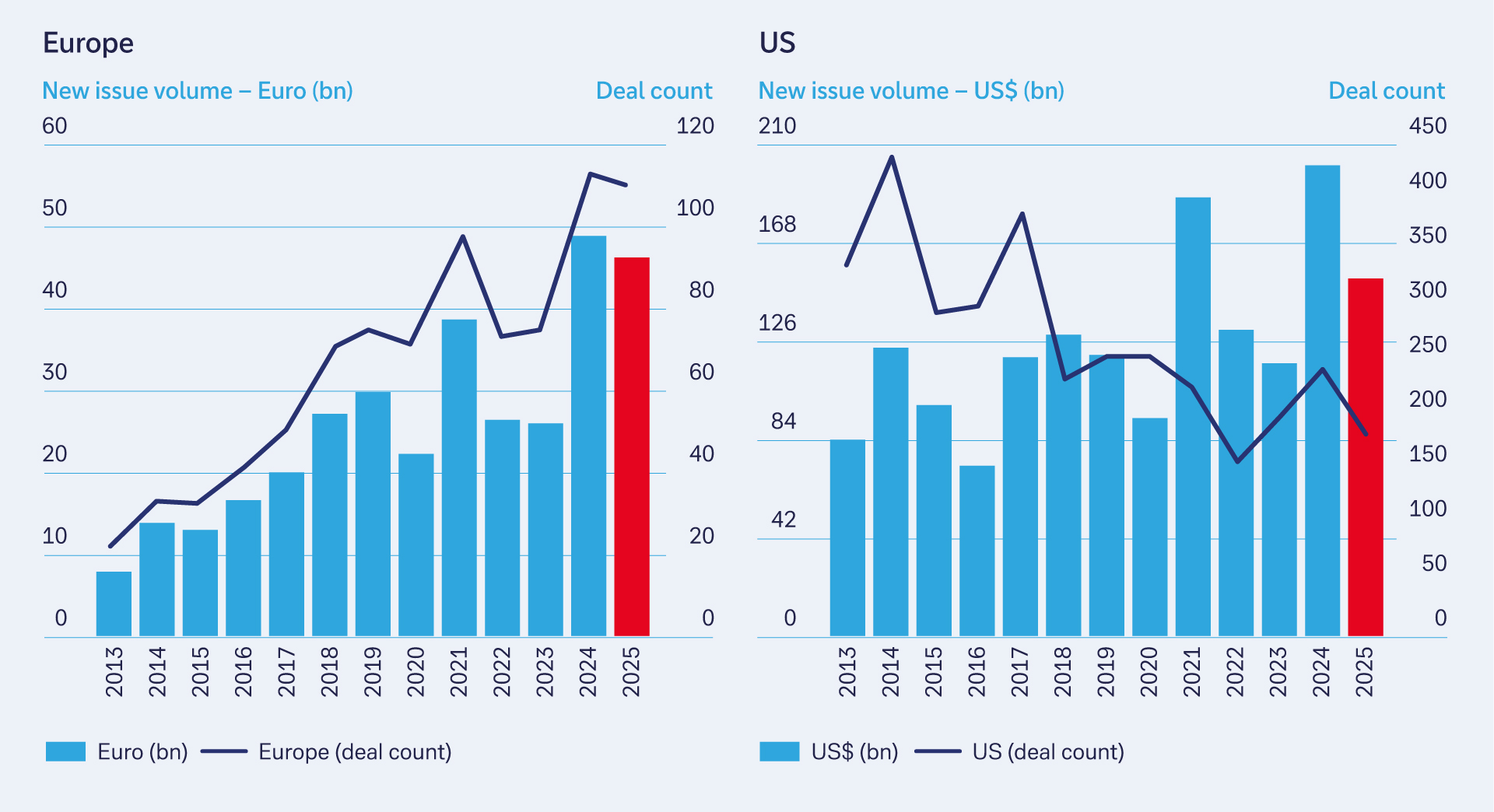

Figure 1: Annual EUR and US CLO new issuance

Sources: PitchBook LCD, Bloomberg Finance LP, Deutsche Bank

In the US, year-to-date (YTD) new issues volume across broadly syndicated loans (BSL) and private credit/mid-market (PC/MM) had reached roughly US$150bn by the middle of September. See Figure 1. This is 10% higher year-over-year, suggesting a year-end figure of US US$205bn, in line with Deutsche Bank Research forecasts. This brisk activity continued throughout the US and European summers.

If August is traditionally a time to take it easy and relax in the sun, the message did not reach the CLO-related departments of issuers, banks, and law firms in the US. In mid-August, new deal volume reached US$3.9bn in one week alone, nearly on par with the average weekly new deal volume of US$4.1bn YTD.

During July and August of 2025, PC/MM CLOs made up roughly 25% of US new deals, and at US$32bn is running at a brisker 18% more compared to this point last year (US$27bn).

Conor O’Toole, Head of European Securitisation Research at Deutsche Bank notes that in Europe “CLO issuance continued unabated – with September issuance in full flow, and moreover with a CLO pipeline which remains robust, with a mid-single-digit number of deals in marketing”. In particular, the “pipeline for debut European CLO managers remains strong”. Three credit investors look set to launch and price deals in the coming weeks. He adds that beyond the new entrants, Brigade, HPS, and Palmer Square priced the first new-issue deals since Capital Four X on 13 August.

Secondary trading volumes – US

Secondary trading volumes were slightly cooler over August but, notes Flannick, are returning to usual levels. Secondary trade activity also reflects a marginal tilt towards higher-rated bonds. Given their nature as an over-the counter (OTC) product, secondary trading of CLOs is recorded by the Trade Reporting and Compliance Engine (TRACE), the FINRA-developed vehicle that facilitates the mandatory reporting of OTC transactions. During periods of market stability, investment grade (IG) trades typically sit around 70% of the total. However, from mid-August to the first week of September 2025, IG trades averaged 82%.

Secondary trading volumes – Europe

Secondary trading volumes did diminish during August but have returned to their typical weekly volumes of just shy of €0.4bn traded. It is worth noting that, of the total BWIC (‘bids wanted in competition’) – i.e. secondary trading – in Europe in this space, while 35% was made up of various CMBS, RMBS, and other ABS trades, the other 65% comprised leveraged loan CLO trades; demonstrating that although the European CLO market is smaller than that of the US, it still offers great variety and liquidity for investors.

Secondary trading – pricing in the US and Europe

Spreads in US CLO secondary trading rallied after the summer, with CLO AAA bonds retracing two basis points (bps) to three-month term SOFR +109 bps and AA CLO bonds coming in six bps to three-month SOFR+153 bps. There has been more modest tightening lower down the capital stack of CLOs, which implies a degree of caution by investors amid some choppy economic data. Incoming inflation and labour market-related data that could well impact investor positioning further. This was seen in Europe too, with secondary trading in September being particularly active for CLO BBs and below.

CLOs and leveraged loans –relative pricing

Bearing in mind that CLO managers assemble their loans with tremendous care, Flannick notes that “US managers remain selective amid ongoing price volatility in loans, which is often a precursor for spread direction across CLO tranches.” He adds that “with relative value more firmly pivoting towards fixed vs. floating rate assets, a question to ask is how much further can spreads compress?”

Price dispersion across credit ratings became apparent in Q3. BB and B loans have held up for much of the quarter, but there was visible price softening for CCCs in August, marking a reversal for a cohort of loans that had performed well following April’s market sell-off. As the Deutsche Bank Research analysts commented on 23 September, the drop in CCC prices “may reflect a cautioned tone by investors around credit risk – last week’s sell-off of CCCs parallels the widening of secondary BB CLO spreads and muted investor interest in non-IG bonds in TRACE”. Macro trends, examined below, clearly played a part in this too.

(2) State of the credit market

Borrowers and defaults

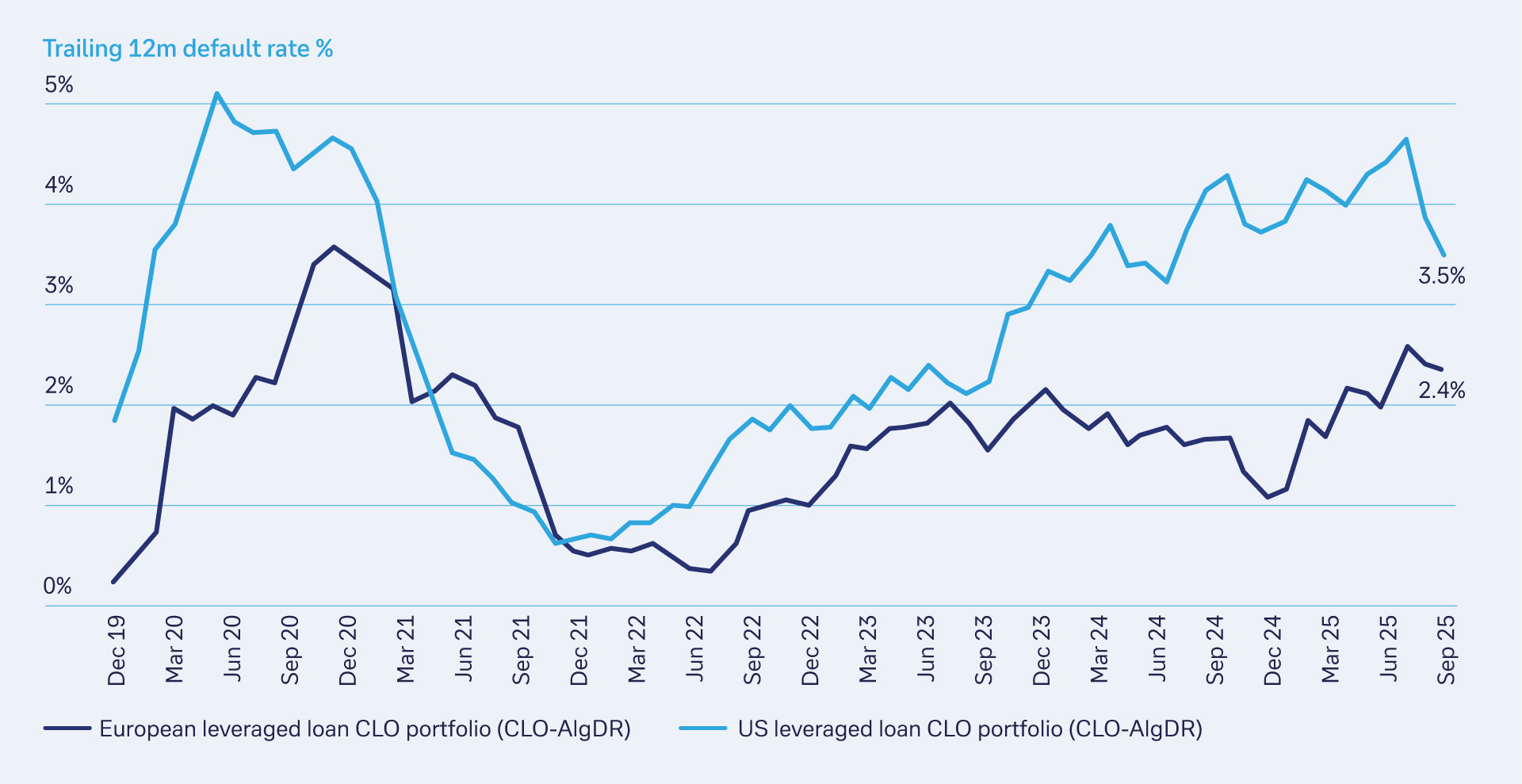

Overall, the number of defaulted borrowers has lately been higher for longer, paralleling the higher interest rates seen in the US and Europe (up from their historic lows driven by zero-interest rate central bank policy). Therefore, the loan defaults within CLOs have also risen in 2025, with the trailing 12-month default rate reaching north of 4.5% in the US and 2.5% in Europe. However, these levels began showing signs of moderation in August and the Deutsche Bank Research strategists are forecasting end of year levels to be lower in both markets.

Figure 2: Headline European and US CLO default rates

Sources: PitchBook LCD, Intex, Bloomberg Finance LP, Deutsche Bank

Macro environment

In the US, persistent inflation remains a macro risk. When the Federal Reserve cut rates by 25 bps on 17 September,1 this was swiftly reflected in loan prices and total returns across fixed income with the high yield (HY) index beginning to outpace investment grade (IG) due to the anticipated tailwind from lower rates for more highly leveraged borrowers.

Relative value is therefore shifting to fixed rate bonds (IG, HY) and away from floating rate, as the Federal Open Market Committee (FOMC) begins what could be a series of rate cuts at its remaining two meetings this year. This is a natural conclusion when looking at interest rate probabilities and relative returns across fixed income indices. If there are further rate cuts, the question market players will be asking themselves is ‘how much further can loans tighten?’

However, with August and September US jobless claims being lower than anticipated and August retail sales being stronger – the case for further rate cuts from the Fed looks less clear cut.

As ever, there are both upside and downside risks to any such macro forecasts as O’Toole and Flannick acknowledge:

- Uncertainty regarding trade and fiscal policies as well as Basel 3 implementation2 could clear, which would provide greater bank latitude in allocation decisions, possibly boosting LBO and M&A activity.

- However, policy uncertainty could persist, which would heighten market volatility, trigger a sell-off in loan prices and spread widening, which would then serve as a dampener to new loan deal activity, all of which could be further affected by negative data regarding economic fundamentals – especially regarding the labour market, inflation, and reduced consumer spending.

- Surprisingly, S&P 500 earnings broadly exceeded earlier market expectations, pointing to strong corporate balance sheets in the US despite the macro headwinds. This resiliency should provide confidence to investors, especially those venturing towards the lower end of the debt spectrum, as well as CLO equity.

(3) New products and growing investor base

In the US, CLO ETFs saw inflows of US$15.2bn in the first nine months of 2025, approaching the 2024 full-year figure of US$16.7bn. Over one week in mid-to-late September, US$125m flowed into US CLO ETF funds, well below the trailing one-month weekly average of US$434m. However, such relatively muted inflows for that week were to be expected, given the Fed’s September rate reduction, since “lower base rates marginally dampen the attractiveness of floating rate bonds” such as ETFs, Flannick explains. Nonetheless, the US CLO ETF market in total has now surpassed US$38bn and, he says, if the trend holds could reach north of US$44bn by the end of the year.

The European CLO ETF market also has significant growth potential, given the first such ETF was listed in September 2024 (four years to the month behind the first US CLO ETF listing), prompting much market interest from European investors. CLO ETFs are attractive for a few reasons, given the relative value of CLOs more broadly. But their accessibility is an additional attractive feature, and just as in the US, the investor base looks set to only grow further in Europe.

“In the high-volume world of CLO and private credit, the real service differentiator lies in the ability to deliver front-to-back efficiencies”

The growth trend continues

Within the CLO and Private Credit Services unit of Deutsche Bank’s Trust and Securities Services (TSS) Group (where trustee and collateral administration services are provided), the team has experienced the volumes of new deals, resets and refinancings. This uptick has coincided with the Group’s focus on new technologies to support and scale the business. Collateral managers are also looking for efficiencies front to back and service providers that can match and integrate with their platforms.

"In the high-volume world of CLO and private credit, the real service differentiator lies in the ability to deliver front-to-back efficiencies and integrate seamlessly – a demand Deutsche Bank’s TSS team is positioning to meet,” says David C West, Global Head of CLOs &Transformation, Trust and Securities Services, Deutsche Bank.

In summary, the CLO markets in both the US and Europe through the first nine months of the year point towards record-setting levels once again. And although macro headwinds remain on the horizon, the market’s resiliency in 2025 should continue to attract more investors in the quarters ahead.

Deutsche Bank Research reports referenced

- Loan defaults in CLOs by Jamie Flannick and Conor O’Toole (6 June 2025)

- A steady market through the dog days of summer by Jamie Flannick and Conor O’Toole (2 September 2025)

- An evolving picture by Jamie Flannick and Conor O’Toole (9 September 2025)

- A few reasons to be constructive on CLO equity by Jamie Flannick and Conor O’Toole (15 September 2025)

- Leveraged loan default cycle – resiliency amidst the uncertainty by Jamie Flannick and Conor O’Toole (23 September 2025)