TRADE FINANCE

Trade finance and lending, Macro and markets

Dawn of Europe’s new trade order? Dawn of Europe’s new trade order?

At Sibos Frankfurt 2025 improving Europe’s competitiveness in the face of rerouted supply chains and geopolitical shocks was a dominant theme in conference panel sessions. flow reports on ‘where next’ in the last of our post-event articles, and analyses how technology is helping

Trade finance and lending

Copenhagen 2025: export finance’s call to action Copenhagen 2025: export finance’s call to action

As TXF Global brought 1500 export finance sector participants together in Copenhagen, key themes of cooperation to meet security targets, flexibility in approving export content quotas, and the wider ramp-up of clean energy demand and infrastructure investment point to a busy year ahead. flow’s Clarissa Dann reports

Trade finance and lending, Macro and markets {icon-book}

The trillion-dollar ocean The trillion-dollar ocean

Dr Rebecca Harding looks at the issues in – and beneath – the Arctic Circle and its impact on the global economy

Trade finance and lending, Opinion

ECA finance in transition: navigating risk, relevance, and reform ECA finance in transition: navigating risk, relevance, and reform

Once focused primarily on emerging-market trade, ECA finance is now central to infrastructure, defence, security, energy transition and industrial transformation. Meeting these strategic challenges requires closer coordination and a sustained commitment to reform, says Deutsche Bank’s Werner Schmidt in an article first published by the Berne Union

Trade finance and lending

Distributing trade finance – a vital contribution Distributing trade finance – a vital contribution

Origination of trade lending assets and then distributing them to other financial institutions and investors makes the scaling up of financing trade possible. flow’s Clarissa Dann provides key takeaways from panel discussions at the 51st International Trade & Forfaiting Association in Singapore

Trade finance and lending, Macro and markets

All change for trade All change for trade

Tariffs, fragmentation, and the rise of the Global South are reshaping global trade. In a Q3 2025 Deutsche Bank Research webinar, analysts unpacked the core risks and opportunities. flow’s Will Monroe summarises the key takeaways

Trade finance and lending, Technology, Macro and markets {icon-book}

View from the top: Raising the bar View from the top: Raising the bar

Deutsche Bank’s David Lynne gives his views on Europe’s chance to step up to the plate in a new world order, the role financial institutions play in supporting this – and the convergence of financial and platform capabilities

Opinion, Trade finance and lending, Macro and markets, Technology

Poly-crisis is driving trade finance digitalisation Poly-crisis is driving trade finance digitalisation

An era of seemingly continuous economic and geopolitical crises has placed a premium on efficiency, flexibility, and risk mitigation for large companies around the world. Dr Tobias Miarka explains how that dynamic is changing the return-on-investment calculation for global corporates in trade finance and supply chain management

Trade finance and lending

flow update: trade finance for investors flow update: trade finance for investors

The convergence of new technology-first platforms, tokenisation and ongoing efforts to digitalise trade finance are helping lay the foundations for the trade finance securitisation market of the future. flow explores this nexus of trade finance and the capital markets

Trade finance and lending {icon-book}

Pillars of frontier economies Pillars of frontier economies

Multilateral development banks (MDBs) have been working with commercial banks to support crisis-torn economies to get back on their feet for decades. They do this with guarantees and in-country expertise, supporting critical imports and vital GDP-bolstering exports. flow shares insights on these transformational partnerships from three leading trade facilitation providers

Trade finance and lending

Commodities through the looking glass Commodities through the looking glass

In a year that saw commodity prices holding up and traders recording strong profits, a deglobalised world order has intensified the focus on their supply chains. Following a packed two days at TXF’s annual conference in Amsterdam, flow’s Clarissa Dann reports on markets and transaction patterns

Trade finance and lending

ITFA Abu Dhabi 2023: the new distribution landscape ITFA Abu Dhabi 2023: the new distribution landscape

While investors in trade finance assets were on an education journey, panelists at the 49th ITFA Annual Conference in Abu Dhabi discussed what this means for originators and distributors. flow’s Clarissa Dann reports

Trade finance and lending

TRAFIN the trailblazer TRAFIN the trailblazer

When Deutsche Bank launched its trade finance securitisation, TRAFIN 2015-1, it was unveiling one of the largest deals of its kind in the market. Neil Fredrik Jensen talks to Guy Brooks about a landmark that shows the growing appetite for this asset class

Trade finance and lending

Securing raw materials Securing raw materials

As economies seek to make sure they have access to critical commodities in the wake of tariff wars and military escalation, the trading landscape is changing. flow reports key themes from TXF Amsterdam and EIT RawMaterials in Brussels

Trade finance, flow case studies {icon-book}

Building essential infrastructure in West Africa Building essential infrastructure in West Africa

As West African countries have built their economies, it has often been a lack of infrastructure that has held them back. flow’s Clarissa Dann looks at the trading history of Nigeria and Cameroon and shares case studies of how export finance has enabled improved electricity supplies and a vital road

Trade finance, Technology

ITFA Cyprus 2024: update on digitalisation and distribution ITFA Cyprus 2024: update on digitalisation and distribution

Digitalisation of trade finance instruments and tightening prudential regulation could be drivers for trade finance distribution and the quest for new sources of trade finance liquidity. flow’s Desirée Buchholz explores some of the key themes of ITFA’s 50th annual conference in Cyprus

Trade finance and lending {icon-book}

Mining tomorrow’s energy infrastructure Mining tomorrow’s energy infrastructure

The energy transition is suffering from a lack of investment. While an increase from US$1trn to US$1.8trn is an improvement, an orderly transition is going to cost US$4trn a year. With insights from commodities analysts Wood Mackenzie, flow’s Clarissa Dann explores this collective responsibility and what it means for the metals and mining industry

Trade finance and lending, Macro and markets

Taking trade by the horns Taking trade by the horns

As 2024 began, bringing with it slower global trade growth, delegates at the BAFT European Bank-to-Bank Forum in Frankfurt also considered rerouted container shipping traffic in the Red Sea and post-pandemic changes in the supply and demand of goods and services. Yet improved collaboration and long-awaited momentum in digitisation meant the overall mood was upbeat. flow’s Clarissa Dann reports

Trade finance and lending {icon-book}

Project finance explained Project finance explained

flow’s Clarissa Dann explores how project financing supports essential infrastructure and energy projects around the world

Trade finance, Macro and markets

Trump trade – back to the future? Trump trade – back to the future?

Following the decisive election victory for the Republican party on 6 November, what does the win mean for US trade relations and, more widely, for the future of multilateral trade? Independent trade economist Dr Rebecca Harding finds answers in US import and export data

Trade finance, Technology {icon-book}

Data as a building block for digital trade finance Data as a building block for digital trade finance

How can the trade finance industry create a digital ecosystem? Pamela Mar, Managing Director, Digital Standards Initiative, International Chamber of Commerce (ICC) explores how bridging trade and financial flows could be the key

Trade finance and lending {icon-book}

Trade’s choking hazards Trade’s choking hazards

What happens if cargo ships can’t get through ports? Does trade grind to a halt and impact economic growth in surrounding countries? Independent trade economist Rebecca Harding examines supply chain resilience

TRADE FINANCE, MACRO AND MARKETS

World trade in 2024: where will lightning strike next? World trade in 2024: where will lightning strike next?

Trade economist Rebecca Harding reflects on the fracturing of free trade and globalisation and what the ‘new normal’ of future proofing supply chains from geopolitics means for multilateralism as we know it

Trade finance and lending, Macro and markets {icon-book}

Eye of the storm? Eye of the storm?

As uncertainty continues to surround Washington’s trade tariff policy, what does this mean for US manufacturing and appetite for inbound US investment? Ivan Castano Freeman digs deeper into what “wait and see” could mean for America’s economy

Trade finance and lending, Macro and markets {icon-book}

Poland powers on Poland powers on

Following the Polish Presidency of the Council of the European Union for the first half of 2025, flow reports on the country’s meteoric economic growth over the past three decades, its attractiveness to investors, and its diversified merchandise and services trade position

Trade finance, Macro and markets

China’s huge trade surplus – where next? China’s huge trade surplus – where next?

Drawing on a Deutsche Bank Research report examining China’s exports and their destinations, flow’s Clarissa Dann reports on how trade geopolitics are rerouting the country’s trade corridors and what this means for the Global South building its own export capabilities and workforces

Trade finance, Macro and markets

Hello Beijing Hello Beijing

China’s continuing ‘opening up’ of its economy to overseas investors and corporates was very much in evidence at Sibos Beijing 2024, where 7000 delegates met up at the mainland capital's China National Convention Centre for the first time. flow’s Clarissa Dann reflects on the main conference programme insights into cross-border trade and its digitalisation journey

Trade finance and lending

Export finance ancient and modern Export finance ancient and modern

A heatwave across Southern Europe that forced closure of the Acropolis in Athens, occurred mid-June 2024 as delegates gathered at TXF’s Global 2024 Export, Project and Development Finance in the Greek capital to address key export finance developments. Topics included navigating ongoing geopolitical and economic risks, the future of the OECD ‘level playing field’ and supporting the transition to clean energy

Trade finance, flow case studies {icon-book}

Revitalising Tashkent’s water sector Revitalising Tashkent’s water sector

With the damaging effects of climate change and a rapidly rising population putting pressure on Tashkent’s ageing infrastructure, flow’s Clarissa Dann explores how Uzbekistan is modernising its historic capital’s water and sanitation systems.

Trade finance and lending, Macro and markets {icon-book}

Poland powers on Poland powers on

Following the Polish Presidency of the Council of the European Union for the first half of 2025, flow reports on the country’s meteoric economic growth over the past three decades, its attractiveness to investors, and its diversified merchandise and services trade position

Trade finance and lending

Capital markets – a bridge over the trade finance gap? Capital markets – a bridge over the trade finance gap?

With lockdown restrictions lifted and trade volumes recovering, the gap between demand for and supply of trade finance continues to grow. flow’s Clarissa Dann explores how further engagement with capital market players could help bridge this

Trade finance and lending

Outlook for the trade community Outlook for the trade community

As sponsors of Global Trade Review’s annual GTR Directory (now in its 20th year), Deutsche Bank’s Trade Finance & Lending leaders Atul Jain and Oliver Resovac share their insights as the trade finance community comes together to make a positive difference during turbulent times

TRADE FINANCE, MACRO AND MARKETS {icon-book}

Latin America’s resurgence Latin America’s resurgence

Despite political upheavals, Latin America is enjoying renewed growth, as firms shore up supply chains with nearshoring and mitigate currency volatility and inflation. LatAm correspondent Ivan Castano Freeman reports for flow

TRADE FINANCE, MACRO AND MARKETS

When America sneezes… When America sneezes…

America’s sheer size and the dominance of the US dollar as a reserve currency makes it a bellwether of the global economy, explains independent economist Dr Rebecca Harding

TRADE FINANCE, SUSTAINABLE FINANCE {icon-book}

Towards COP27: The financial sector as a key driver of change Towards COP27: The financial sector as a key driver of change

John W. H. Denton, Secretary General of the ICC explains why COP27 must deliver on climate finance and the vital role of the financial sector in achieving the Paris Agreement goals

TRADE FINANCE, SUSTAINABLE FINANCE

Trade’s sustainability challenge Trade’s sustainability challenge

The majority of world trade is unsustainable, and where it is not, it is a symptom of under-development, says trade economist Rebecca Harding. She shares her methodology for a trade sustainablity score and demonstrates why trade policy needs to change

Trade finance and lending, Sustainable finance

New rails for export finance? New rails for export finance?

Export credit agencies, governments, insurers, banks and contractors need to work together to make key net-zero projects happen, particularly in emerging markets

Trade finance and lending

Trade finance funds – where next? Trade finance funds – where next?

Portfolio managers have been eyeing up trade finance funds with interest – particularly in today’s low interest rate yet yield hungry environment. What more can be done to educate investors on the asset class’s risk and rewards? flow’s Clarissa Dann reports on some of the key themes from two International Trade & Forfaiting Association panel discussions

TRADE FINANCE, SUSTAINABLE FINANCE

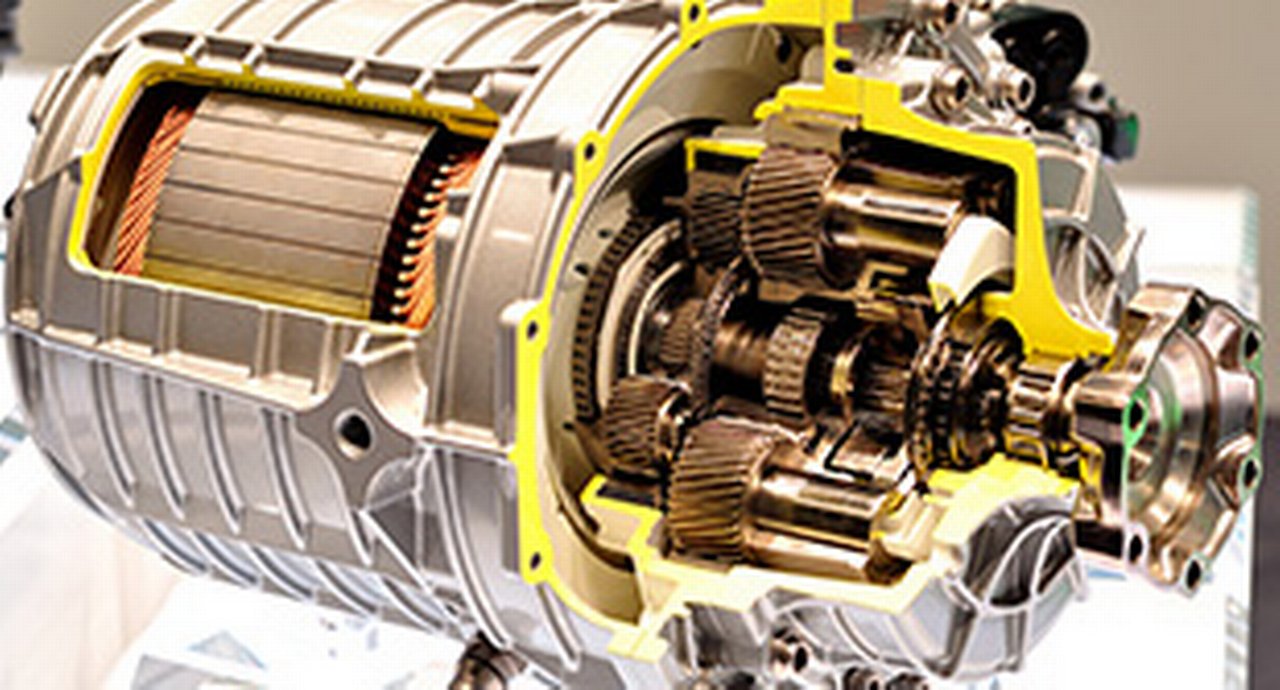

Powering electric vehicles – the commodities impact Powering electric vehicles – the commodities impact

Electric vehicle sales are rising, and progress is underway in finding alternatives to fossil fuel-based vehicle propulsion. What does the transition to EVs mean for the minerals and metals used to reduce emissions, manufacture car batteries and develop fuel cell solutions? Clarissa Dann reports

TRADE FINANCE, MACRO AND MARKETS

Realising West Africa’s promise Realising West Africa’s promise

As the world looks to emerge from the corona virus pandemic but braces for further strains of the virus, how has West Africa been holding up? Better than many regions, is the answer – flow's Clarissa Dann takes a closer look at the economic uptick in Nigeria and Ghana

TRADE FINANCE, SUSTAINABLE FINANCE

New face of trade New face of trade

Trade economist Rebecca Harding examines how Covid-induced patterns of shifting work and consumption have increased supply chain scrutiny and highlighted critical export flows

Trade finance and lending

What’s next for commodities? What’s next for commodities?

Commodities are bouncing back from their Covid-19 lows and some even talk of a supercycle. flow reports on longer term issues facing the industry, such as fraud, digitalisation and ESG transition discussed at the May 2021 TXF Virtual Commodity Finance Conference

TRADE FINANCE, SUSTAINABLE FINANCE, MACRO AND MARKETS {icon-book}

Taiwan’s green energy revolution Taiwan’s green energy revolution

By attracting international corporates and financing with a partnership approach to offshore wind farms, Taiwan is driving renewable energy growth. flow’s Clarissa Dann provides an overview of two large, syndicated export credit agency deals

Trade finance and lending

Biden’s packed agenda Biden’s packed agenda

Now that President Biden and Vice President Harris are installed in the White House, what are their immediate priorities? flow´s Clarissa Dann takes a look at Deutsche Bank Research’s insights, along with other observations on stimulus, infrastructure and tax reform – and responses from the central bank

Trade finance and lending

RCEP launches after eight years’ gestation RCEP launches after eight years’ gestation

Fifteen Asia-Pacific economies sign up to the Regional Comprehensive Economic Partnership (RCEP) Agreement in a move back towards multilateral trade and tariff reduction. flow's Clarissa Dann summarises what this means for trade

TRADE FINANCE, EXPORT FINANCE {icon-book}

Building healthcare Building healthcare

Well before the advent of Covid-19, plans were under way for better healthcare infrastructure in Côte d’Ivoire to support GDP growth momentum. flow reports on a project to build hospitals and additional facilities in the towns of Aboisso and Adzopé

Trade finance and lending {icon-book}

Across the Great Divide Across the Great Divide

Trade economist Dr Rebecca Harding reflects on the US Exim Bank’s annual spring conference compared with the ICC Banking Commission event in Beijing and notes how polarised attitudes to trade have become and that is businesses that trade and not governments

Trade finance and lending {icon-book}

Many rivers to cross Many rivers to cross

As China’s role on the global stage expands, Bank of China’s Yunfei Liu talks to flow about the foundations needed to build bridges in international trade

Trade finance and lending

More Rethinking global supply chains

Supply chain finance (SCF) industry experts gathered virtually for BCR’s 6th Annual Supply Chain Finance Summit to discuss how the industry is recovering from Covid-19 dislocation, embedding ESG into platforms and schemes, and progress on automation and digitalisation. Clarissa Dann reports

Trade finance and lending

What are 2024’s trade megatrends? What are 2024’s trade megatrends?

Trade fragmentation, strategic competition, sustainability and risk – trade economist Rebecca Harding reflects on 2023’s main trends in a year of geopolitical volatility and asks were trade and globalisation put on trial?

TRADE FINANCE, SUSTAINABLE FINANCE

Incentivising ESG transition Incentivising ESG transition

Trade and supply chain finance is gathering traction as a decarbonisation incentive. Economist Rebecca Harding demonstrates how recent ITFA research finds that global trade participants want further collaboration between banks, regulators and standards bodies to help it fulfil its potential

TRADE FINANCE, SUSTAINABLE FINANCE

Export finance gets a full house in Lisbon Export finance gets a full house in Lisbon

After a busy 2022 of export finance deals, the prospect of a new OECD consensus and the continued demand for equipment and infrastructure to support clean energy transition were key themes at the 2023 TXF Global Export and Project Finance event in Lisbon. flow’s Clarissa Dann reports

Trade finance and lending {icon-book}

Fighting trade-related fraud Fighting trade-related fraud

With fraud fast becoming one of the biggest risks for global trade, flow’s Clarissa Dann takes a closer look at the vulnerability of trade finance to criminals and protection measures being deployed

TRADE FINANCE, CASH MANAGEMENT

Five drivers of transaction banking’s direction Five drivers of transaction banking’s direction

How will ISO 20022, sustainability, digital currencies, sanctions and trade digitalisation shape the future of transaction banking? flow summarises the top five takeaways from the Bankers Association for Finance and Trade’s (BAFT) 2023 Europe Bank to Bank Forum

Trade finance and lending

Supply chain finance boosts resilience Supply chain finance boosts resilience

Covid-19 exposed supply chain vulnerabilities as borders closed. With a move to near-shoring, inventory increases, putting pressure on costs prompting an acceleration in demand for payables finance solutions. flow shares insights from Asia’s The Asset featuring Deutsche Bank’s Steven Yu’s observations on the new working capital ecosystem

Trade finance and lending

Trade finance: A Practitioner’s Guide Trade finance: A Practitioner’s Guide

Legal frameworks and structures underpin trade finance markets and practice, and the right structures and the right documents can make the difference between trade being repaid – and not being repaid. flow shares details of an updated legal guide from Sullivan & Worcester UK LLP’s Geoffrey Wynne, A Practitioner’s Guide to Trade & Commodity Finance

Trade finance and lending

Non-payment insurance in renewables finance Non-payment insurance in renewables finance

While renewables financing is at an all-time high, the demands of the energy transition mean that more is needed. Deutsche Bank’s Sandra Primiero took part in a webinar hosted by infrastructure media and research specialists Proximo, discussing renewables finance and the role that non-payment insurance could play in driving the green revolution

TRADE FINANCE, SUSTAINABLE FINANCE

Sustainable finance – time for action Sustainable finance – time for action

Held just after COP26 in Glasgow, the final day of the Coriolis Technologies Future of Strategy week addressed the issue of transparency in global trade and what this means for sustainability. Dr Rebecca Harding shares some reflections from her “fireside chat” with Deutsche Bank’s Daniel Schmand

Trade finance and lending

Reporting payables finance in financial statements Reporting payables finance in financial statements

Deutsche Bank’s Christian Hausherr and Anil Walia explain why the latest financial reporting recommendation from the International Accounting Standards Board on supply chain finance disclosure is good for the industry

Trade finance and lending

Safeguarding supply chains Safeguarding supply chains

As the world grapples with the impact of its second year of Covid-19 resilience in global value chains can make or break a business and an entire industry. flow reports on discussion points at BCR’s 21st Annual Receivables Finance International Convention (RFiX21)

TRADE FINANCE, NATURAL RESOURCES {icon-book}

Net zero in the North Sea Net zero in the North Sea

As oil exploration and production companies restructure their operations to achieve net zero targets, ESG-aligned commodity finance is supporting them along the way. flow shares the experiences of Lundin Energy and Harbour Energy

TRADE FINANCE, SUSTAINABLE FINANCE

Sustainability and supply chains Sustainability and supply chains

While ESG principles and alignment start at home, they must carry through to supply chains, explain Deutsche Bank’s Anil Walia and Bjoern Goedecke in BCR’s World Supply Chain Finance Report 2021

Sustainable finance, Trade finance and lending, flow case studies

Baby steps Baby steps

When emerging economies build for the future, they need modern and efficient maternity care. flow reports on why the structured export financing of Argentina’s Hospital Provincial Nueva Maternidad Felipe Lucini was a turning point in sustainable finance

Trade finance and lending

It takes trade to tango It takes trade to tango

Having had its recovery interrupted in 2020, Latin America is looking good for 2021, having achieved some herd immunity with an anti-Covid vaccination push in late H2. Ivan Castano Freeman reports on the outlook for trade finance and lending

Trade finance and lending

Trade rides the Covid-19 storm Trade rides the Covid-19 storm

Are corporate treasurers unhappy with the level of support they receive from banks? Can we expect trade to bounce back in the next 12 months? flow reports on these and other pressing issues featured at TXF’s Global Trade 2020 virtual conference

Trade finance and lending

Redefining the supply chain finance landscape Redefining the supply chain finance landscape

As Covid-19 dislocates supply chains in Southeast Asia, corporates are turning to supply chain finance to maintain their liquidity. Chito Santiago of the Asset talks to Zandy Ip and Daniel Tan about how anchor buyers are supporting their suppliers

Trade finance and lending {icon-book}

Trade and the virus Trade and the virus

As Covid-19 dislocates supply chains in Southeast Asia, corporates are turning to supply chain finance to maintain their liquidity. Chito Santiago of the Asset talks to Zandy Ip and Daniel Tan about how anchor buyers are supporting their suppliers

Trade finance and lending

Trade finance funds – where next? Trade finance funds – where next?

Portfolio managers have been eyeing up trade finance funds with interest – particularly in today’s low interest rate yet yield hungry environment. What more can be done to educate investors on the asset class’s risk and rewards? flow’s Clarissa Dann reports on some of the key themes from two International Trade & Forfaiting Association panel discussions

Trade finance, Regulation

How URTEPO can drive trade finance digitalisation How URTEPO can drive trade finance digitalisation

Why are the Uniform Rules for Transferable Electronic Payment Obligations (URTEPO) perfectly positioned to drive forward trade finance digitalisation? Legal expert Geoffrey Wynne explains

TRADE FINANCE, TECHNOLOGY

Sibos 2023: five key trade finance takeaways Sibos 2023: five key trade finance takeaways

Sibos returned to the Metro Toronto Convention Centre (MTCC) for 2023, with fraud prevention, digitalisation and standardisation high on the trade agenda. In the fourth of our post-Sibos reports, flow’s Clarissa Dann summarises how the conference addressed these core trade themes

Trade finance and lending

What is driving the growth of SCF? What is driving the growth of SCF?

Growth in supply chain finance (SCF) volumes is being backed by increasingly robust reporting requirements, electronic documents legislation and greater collaboration between fintechs and banks. Investors are also showing interest in SCF-based assets. flow reports on the state of play

Trade finance and lending, Macro and markets {icon-book}

Angola’s rebound Angola’s rebound

Angola was once top coffee producer and could feed its people but is now dependent on hydrocarbon exports to finance foodstuff imports. flow’s Clarissa Dann reports on how enlightened government reforms are attracting investment and lending to support long-term energy and food security

TRADE FINANCE, MACRO AND MARKETS

Trade in 2023 – navigating the unknown Trade in 2023 – navigating the unknown

Trade economist Dr Rebecca Harding shares her deep dive into the three main drivers shaping trade volumes and values for 2023

Trade finance and lending

Booming Bangladesh Booming Bangladesh

Bangladesh has bounced back from Covid-19 and, with its strong economic fundamentals, infrastructure improvements and digital vision, is growing trade flows and GDP. flow’s Clarissa Dann provides a deep dive into this rapidly evolving economy

Trade finance and lending, Macro and markets

Commodities roller coaster continues Commodities roller coaster continues

The conflict in Ukraine, resurgent inflation and the drop in China’s building sector have all contributed to a volatile first half of 2022 for commodity prices. flow’s Clarissa Dann shares insights from Deutsche Bank Research on their outlook for the months ahead

TRADE FINANCE, SUSTAINABLE FINANCE

Farewell to hydrocarbons Farewell to hydrocarbons

The Ukraine crisis has highlighted Europe’s dependence on Russia for gas while diverting attention from the wider issue of delivering on COP26 net zero pledges. Trade economist Rebecca Harding analyses the trade flows and explains how clean energy supply chains are also highly interconnected

TRADE FINANCE, SUSTAINABLE FINANCE

Driving ESG initiatives through sustainable finance Driving ESG initiatives through sustainable finance

Greening the supply chain is a trend to enhance competitiveness, says Deutsche Bank’s Rachel Chia, Head of Project Finance, Renewables (Asia Pacific) in a recent interview with The Asset’s Chito Santiago. flow shares her insights

TRADE FINANCE, SUSTAINABLE FINANCE

Asia’s ESG balancing act Asia’s ESG balancing act

With Asia proving the most resilient component of the world’s economic engine during the pandemic, can it maintain trade-led growth that accommodates economic, social and governance (ESG) considerations? flow reviews GTR Asia’s recent virtual conference that considered this issue

Trade finance and lending

New frontiers in US trade finance New frontiers in US trade finance

Christina Gnad took up the reins of Deutsche Bank’s Americas trade finance and lending business in August 2021. As the world gets back to business after the Covid-19 economic shock, she talks to trade journalist Ivan Castano Freeman about trade flows, scale, and repairing supply chains

Trade finance and lending

Ghana’s next-generation infrastructure Ghana’s next-generation infrastructure

Over the last decade, Deutsche Bank has arranged over €2bn of financing in Ghana across 20 transactions. The latest such deal – a €150m financing for two critical infrastructure projects in the Southern and Western regions of the country – was announced in February 2021. Clarissa Dann reports on a history of collaboration

Trade finance and lending

Trade re-set? Trade re-set?

Independent economist Rebecca Harding shares three reasons why she believes trade will never be quite the same again

TRADE FINANCE, EXPORT FINANCE {icon-book}

Is just time... out of time? Is just time... out of time?

As corporates revisit their supply chain exposures as a result of Covid-19, could just in time supply chains be replaced by planning ‘just in case’? Treasury specialist Helen Sanders reports on business continuity management strategies

TRADE FINANCE, MACRO AND MARKETS

Covid-19 and commodities Covid-19 and commodities

Covid-19 has shaken up the world’s commodities sector although price volatility is no stranger to its participants. Reduced demand has seen falling prices, lack of investment, and logistics log jams. Clarissa Dann reviews the fundamentals

Trade finance and lending {icon-book}

Sunset to sunrise Sunset to sunrise

Just because the oil majors are withdrawing from the North Sea, that doesn’t mean there is no extraction. Clarissa Dann looks at how reserve-based lending is supporting the smaller independent oil producers that are thriving in the region

Trade finance and lending {icon-book}

A new era for Indian energy A new era for Indian energy

With India’s energy consumption poised to grow at almost 5% annually over the next decade, Clarissa Dann talks to the leadership team at Nayara Energy about realising the potential of its systemically important oil refineries

Trade finance and lending

Deals on the ground Deals on the ground

From proprietary copper extraction technology to lighting up Egypt, flow takes a closer look at four of the Deutsche Bank deals that scooped best deal in the TFR Deals of 2016 awards.

Trade finance and lending

Trade finance and the blockchain – three essential case studies Trade finance and the blockchain – three essential case studies

What do exports of milk products to the Seychelles, Japanese machinery to Australia, and flowers to Kenya have in common? They were supported by trade finance completed on the blockchain. flow’s Clarissa Dann explains their significance for trade and the outlook for 2018

Trade finance, Regulation

ETDA in action ETDA in action

The Electronic Trade Documents Act 2023 (ETDA) came into force in September 2023, but what does it mean when it comes to facilitating the digitalisation of trade finance? Legal expert Geoffrey Wynne explains

Trade finance and lending, Macro and markets

Rare earths – a powerful attraction Rare earths – a powerful attraction

China has dominated the production of rare earth metals – the vital inputs in the clean energy transition as well as military equipment. But this could be all set to change as Western economies seek greater control of their supply chains and to reduce their dependence on rivals, explains Deutsche Bank’s Marion Laboure

TRADE FINANCE, MACRO AND MARKETS {icon-book}

Supply chains rewired? Supply chains rewired?

Minerals – and their shortages – can make and break supply chains. As nearshoring becomes the preferred strategy for securing essential inputs in times of geopolitical volatility, how does this impact trade flows? Trade economist Rebecca Harding explains

Trade finance and lending

Trade finance funds – a sharpening appetite? Trade finance funds – a sharpening appetite?

Investor understanding of trade finance funds and how they fit into a balanced portfolio has some way to go, agreed panelists at the 2022 ITFA Annual Conference, and the asset class must hold its own against other structured finance asset offerings to gain momentum. Track record, insurance mitigants and good structuring are vital, reports flow’s Clarissa Dann

TRADE FINANCE, TECHNOLOGY

Sibos – unwrapped (Part 3) Sibos – unwrapped (Part 3)

In the final instalment of Deutsche Bank’s post-Sibos reports, flow’s Editor Clarissa Dann turns to trade finance – a resurgent theme in 2022. Digitalising trade finance has moved from “wait and see” to “let’s get this done”. But the balance of regulatory impulsion and industry steering remains unclear

Trade finance and lending, Sustainable finance {icon-book}

Transforming Ghana’s railway infrastructure Transforming Ghana’s railway infrastructure

In many developing economies, growth relies on cross-border trade aided by robust logistics infrastructure. flow’s Clarissa Dann looks at a remarkable collaboration between international banks and export credit agencies to help Ghana improve its rail network and remove freight and passengers from the roads

Trade finance and lending, Macro and markets

Why it’s time for a new look at rare earths Why it’s time for a new look at rare earths

Greater diversity of rare earth metals (REM) supply is essential if the world is to address the dominance of producers such as China and Russia, suggests Dr Rebecca Harding

TRADE FINANCE, MACRO AND MARKETS

Ukraine on the brink Ukraine on the brink

Tensions between Russia and Ukraine having exploded into full-blown war, what are the repercussions for Russian oil and gas exports that escaped the EU and G7 sanctions deep freeze, and the wider risks to neighbouring economies? flow’s Clarissa Dann shares the insights from Deutsche Bank Research

TRADE FINANCE, MACRO AND MARKETS

Transition metals: in the fast lane? Transition metals: in the fast lane?

As the automobile industry shifts up a gear on accelerating average selling prices and electrification, what does this mean for transition metals? In the second article drawing on Deutsche Bank Research’s January 2022 Commodities Outlook Clarissa Dann reports on a copper supply tipping point and what this means for inflation

Trade finance, Dossier Covid-19

Dealing with supply chain disruptions Dealing with supply chain disruptions

Supply chain disruptions are currently the main source of concern for corporate treasurers, research by Economist Impact shows

Dealing with supply chain disruptions MoreTrade finance and lending

More Export credit insurance in crises

With Covid-19 having created the most wide-reaching dislocation of trade and supply chains since the global financial crisis, the role of export credit insurance is again under the spotlight. Vinco David and Jonathan Skovbro Steenberg of the Berne Union explain how their members have been increasing support for exporters and their financiers

TRADE FINANCE, MACRO AND MARKETS

Greening the supercycle Greening the supercycle

Are we heading for another commodities supercycle? One could be forgiven for thinking this was just around the corner given some of the bounce-backs in prices, but ESG priorities and liquidity shortfalls bring different nuances, flow’s Clarissa Dann reports

Trade finance and lending

Financing trade’s recovery Financing trade’s recovery

While Covid-19 has shaken trade and trade finance, the industry has the essentials to ride out the storm. The key is to build on momentum gathered since the outbreak and build out the framework for the industry’s long-term digital evolution, explains Deutsche Bank’s Russell Brown

Trade finance and lending {icon-book}

Merchants of peace Merchants of peace

Celebrating a century of keeping the peace through supporting international trade, International Chamber of Commerce has a new Finance for Development Hub for tackling modern impediments to financial inclusion and trade facilitation. David Meynell reports

Trade finance and lending

After the perfect storm After the perfect storm

flow reports on how a seven-year reserve-based lending solution positioned oil producer Noreco for growth in a two-year turnaround journey

TRADE FINANCE, TECHNOLOGY

Trade and the blockchain – where are we now? Trade and the blockchain – where are we now?

What common thread links shipments of dairy products to China, wheat from the United States (US) to Indonesia and sugar cane from Asia to Africa? They were all supported by trade finance completed via blockchain. flow ’s Clarissa Dann provides an update on this technology’s journey towards mainstream adoption

Trade finance and lending

Journey into simplicity Journey into simplicity

How will India’s meet its US$5trn GDP target in the next five years? And what role will financiers, government reform and technology have in making this happen? Clarissa Dann reports on GTR’s one-day conference in Mumbai

TRADE FINANCE, MACRO AND MARKETS

Syntagma Square synergies in trade Syntagma Square synergies in trade

With more than 300 delegates from more than 145 nations gathered in Greece at the EBRD’s Trade Facilitation Programme Trade Finance (TFP) Forum 2019, it was clear that 20 years after the TFP’s foundation, countries lacking in correspondent banking lines need this trade leg-up more than ever. Clarissa Dann reports from Athens

Trade finance and lending {icon-book}

Saving trade Saving trade

As the Covid-19 pandemic wreaks havoc on economies and communities – and ultimately global trade, what is the impact on trade finance and supply chains? Geoffrey Wynne explains

TRADE FINANCE, MACRO AND MARKETS {icon-book}

Germany’s lockdown lending Germany’s lockdown lending

flow talks to KfW’s Ingrid Hengster, who provides insights into the development bank’s partnership with the Germany government and commercial banking sector to support German businesses

Trade finance and lending {icon-book}

Call for capacity Call for capacity

Trade finance shortages remain a barrier to developing world economic growth, as the gap between the perception and actual level of transaction risk widens. Tackling this is an ongoing priority, says the WTO’s Marc Auboin

Trade finance and lending {icon-book}

Market makeover Market makeover

Thanks to some transformational lending, Ghana’s Kumasi Market is undergoing a makeover that is set to transform the Ashanti economy and all it touches. flow tells the story of a project involving three governments, a Brazilian contractor and Deutsche Bank’s Structured Trade & Export Finance team

Trade finance and lending

Farewell to trade barriers? Farewell to trade barriers?

At the close of an extraordinary year, eyes are on growth forecasts for 2021 as economies climb out of Covid-19. But for these to materialise, trade needs to move back towards multilateralism, explains Dr Rebecca Harding

Trade finance and lending {icon-book}

Under the rainbow Under the rainbow

Floods, political upheaval and investor caution have created infrastructure shortfalls in much of Latin America. Ivan Castano Freeman reviews project progress, re-routed trade flows, and opportunities for banks and export credit agencies

Trade finance and lending

A new philosophy for re-building global trade A new philosophy for re-building global trade

Global value chains play a central role in the functioning of the global economy – fostering job creation, prosperity, innovation and investment. But how can they meet the challenges of a post-pandemic world? flow reports from the ICC International Trade and Prosperity Week

Trade finance and lending

Road to trade finance digitalisation Road to trade finance digitalisation

Why is it taking so long to digitalise trade finance? While the rubber stamp underpins all documentary credits and while courts will only accept paper in trade finance disputes, it’s hard to move forward

Trade finance and lending

Beyond the invoice Beyond the invoice

Supply chain finance is growing at 20% a year, with around US$2tn in payables available for financing. But how can this be made safer and more sustainable – and accessible to SMEs? flow reports on key themes at BCR’s 4th Supply Chain Finance Summit in Amsterdam

Shandong Qingyuan, Trade finance and lending {icon-book}

A refined approach A refined approach

Were it not for China’s economic reforms, Ma Zhi Qing would still be running a farm. Today he leads a multi-billion-dollar petrochemical corporate. Clarissa Dann visited the team to hear more about Shandong Qingyuan’s growth story

Trade finance and lending, flow case studies

Sustainable latex from Cameroon Sustainable latex from Cameroon

Allegations related to environmental and social issues in Halcyon Agri’s Cameroon rubber plantations attracted headlines until they were addressed through its Corrie MacColl subsidiary. flow´s Clarissa Dann reports on how sustainable finance helps the firm set

Trade finance and lending

Blue-sky thinking Blue-sky thinking

How can China maintain the war on smog yet ensure steady supplies of home-produced aluminium? flow’s Clarissa Dann investigates how prepayment finance supported Qiya in honing its low-cost, reduced-emissions technology

Trade finance and lending

Back from the brink Back from the brink

As the International Trade & Forfaiting Association met in Budapest for its 46th Annual Conference, flow reports on how heads of trade agree that in times of economic stress, flight to trade finance instruments of trust seems to be on the rise

Trade finance and lending {icon-book}

Frontline economics Frontline economics

In an environment where banking products are becoming increasingly commoditised, providers seek to differentiate their offerings with outstanding client experience. But in a world of self-service and chatbots, how does the personal touch play out? Stefan Hoops shares his perspective

TRADE FINANCE, CASH MANAGEMENT

Bumpy road or motorway? Bumpy road or motorway?

After LIBOR, digitalisation and future proofing were among the “trends to shape a new decade” discussed by delegates at the 2020 BAFT Global Annual Meeting in Frankfurt

Trade finance and lending

Why trade gets paid Why trade gets paid

In light of recent restructurings and regulatory developments, the title of this article is perhaps more optimistic than the result may be. However, some guidance as to how to approach the issues in receivables financings may help to improve the position of the debt holder.