29 November 2023

With COP28 approaching, the fight against global warming is back in the headlines. flow’s Desirée Buchholz examines what sustainable business transformation means for German enterprise Melitta Group – and why collaboration with stakeholders such as local coffee farmers and Deutsche Bank is key

MINUTES min read

Over the fortnight of 30 November to 12 December 2023, policymakers, business leaders, scientists and climate change activists will convene in Dubai, UAE, for the 2023 UN Climate Change Conference – also known as COP28. Here, global attention will return to the pressing need to reduce CO₂ emissions.

’Less talk, more action’ will again be the mantra. But how can this be achieved on a corporate level? What are the pre-requisites for a successful business transition towards net zero and how do banks fit into the picture? flow’s Desirée Buchholz discussed these questions with Katharina Roehrig, Managing Director Corporate Communications & Sustainability at Melitta Group – a German family-owned company well known for its coffee, coffee preparation and household brands – and Lavinia Bauerochse, Global Head of ESG Corporate Bank at Deutsche Bank.

Four key takeaways have emerged from this discussion and are set out in detail below – followed by two examples of how Melitta is putting measures around environmental, social and governance (ESG) into action in Brazil and India. These are:

- Sustainable business transformation needs to win hearts and minds.

- Collaboration with all stakeholders is key for individual as well as system-level change.

- Supply chain (Scope 3) emission are the greatest challenge, but solutions are on the horizon.

- Lighthouse projects help to get everybody onboard.

1. Sustainable business transformation needs to win hearts and minds of the people

While achieving net zero remains top of the agenda for many governments, sustainable transition on a corporate level has to take a wider perspective. “For us, business model transformation starts with the question of how to ensure that Melitta Group is ready for its next 150 years,” says Roehrig, referring to the company’s history that dates back to January 1873 when Melitta Bentz was born. It was she who invented the world’s coffee filter with the aid of a brass pot and a piece of blotting paper and, in 1908, went on to found the company which is today known as Melitta Group.1

Based on her simple idea, the company, which is still family-owned, has now grown into a global business generating sales of €2.3bn with roughly 6.000 employees in the 2022.2 While coffee and products around coffee preparation form the heart of the company accounting for approximately two-thirds of Melitta’s turnover, films, foils and bags for food storage as well as household products for vacuum cleaning, waste disposal and clean air at home are also integral components of the firm’s business.3

“Sustainable transformation means holistically rethinking product development, supply chains and – ultimately – the way we work”

The company is well aware of its responsibility to reduce waste, water usage and CO₂ emissions. On the one hand, a significant part of the companies’ product is made from plastic. On the other hand, the farming of coffee beans, their transport, roasting and grinding of the beans, right up to the heating of the water for the coffee and the washing of the cups it is poured in, requires a lot of water and energy. Coffee is second only to oil in the pecking order of most traded commodities.4 According to an analysis published by Canadian scientists, preparing 280ml of traditional filter coffee has a carbon footprint of 172 to 337g CO₂e.5 The main drivers of greenhouse gas (GHG) emissions are coffee cultivation, including the application of agrochemicals, and the preparation of the coffee beverage.

“For us, sustainable transformation means holistically rethinking product development, supply chains and – ultimately – the way we work to enable shifts in culture, strategy, and organisation,” Roehrig states. “Melitta Bentz’ inventive spirit was led by the idea of making people’s lives better, and this visionary thinking is still part of our DNA today.”

Sustainable transition is a highly strategic task, adds Lavinia Bauerochse, Global Head of ESG Corporate Bank at Deutsche Bank. “Looking ahead, sustainability considerations need to be the core of all business models. Sustainability is much more then meeting regulatory ESG requirements. It is about embracing the opportunities that the journey towards net zero provides for our clients – and for us as bank,” she says.

Obviously, top management attention is essential for developing a sustainability strategy. Yet on its own, this is not enough, Roehrig and Bauerochse agree: “Successful transformation requires a joint effort. You need to win the hearts and minds of the employees, break up silos and jointly develop a new strategy for the company.”

2. Collaboration with all stakeholders is key

When Melitta published its first sustainability report in 2020, this was the result of a four-year process. The company had initiated a bottom-up approach to examine the impact of every value chain on categories such as water usage, electricity consumption, waste etc. “Collecting the relevant data was the most challenging task as each business reported data differently,” Roehrig recalls.

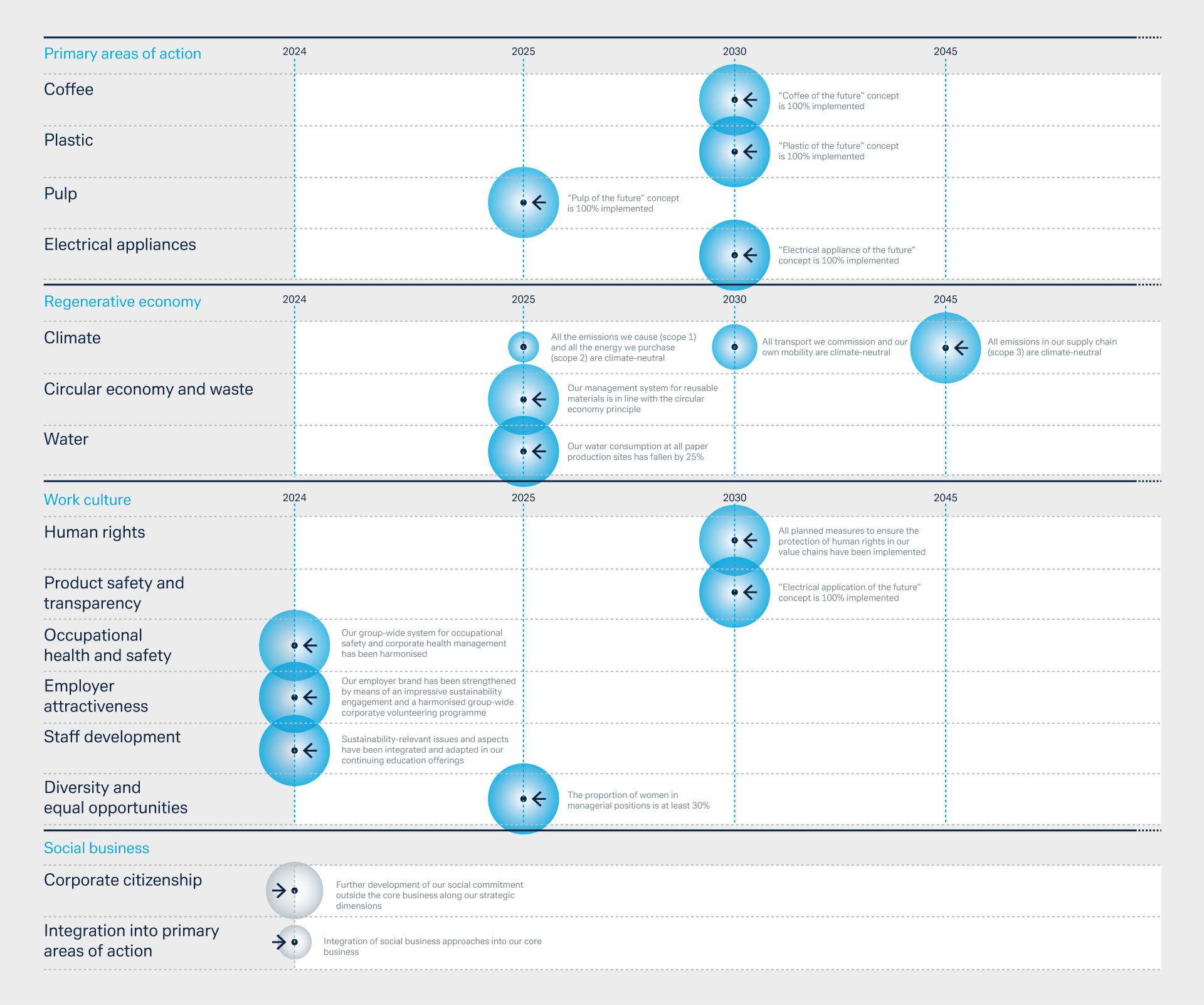

Based on these investigations, the company then derived sustainability targets at group level which were then accompanied by targets for each division (see Figure 1). “We discussed these targets with all our stakeholders – customers, suppliers, banks, NGOs,” she explains. “The feedback we received in these formats were very helpful to learn from each other, exchange experiences and check if we are on the right track.”

Figure 1: Overview over Melitta’s sustainability targets

Source: Melitta Group; more details on the companies’ sustainability targets and its “coffee of the future”, “plastic of the future”, “pulp of the future” and “electrical appliances of the future” concepts can be found in the companies’ sustainability report 2020 and the update sustainability 2021

Collaboration is key, stresses Bauerochse: “Our ambition is to partner with our clients on their decarbonisation journey and to shape the real economy transition to net zero.” In practice this means helping companies to structure their KPIs, coordinate ESG metrics and facilitate investment financing to fund the transition.

“Net zero requires considerable investment and the financial industry has a key role to play as a partner to the real economy in mobilising and directing the necessary capital,” Bauerochse says. This is for example needed when it comes to investing into energy-efficient machinery and the low-carbon transition of operating models. Specifically, she adds, Deutsche Bank has committed to allocate a cumulative €500bn in sustainable finance by 20256 and €5bn accumulated sustainability-linked working capital loans by 2025.7

At the same time, banks are also risk managers. „We need to understand the decarbonisation strategies of our clients in order to finance their transition needs, and similarly to consider climate risks in our risk management and capital allocation,” she explains (see Decarbonising tomorrow). “This is why Deutsche Bank is actively engaging in transition dialogues with its high-emitting clients. Most recently, the bank has also published its initial Transition Plan which outlines the path to net zero with regards to its own operations and value chain, and furthermore the decarbonisation of our business and reduction of financed emissions.”8

3. Scope 3 emission are the greatest challenge, but solutions are on the horizon

While collaboration with banks is essential to mobilise the capital needed to finance sustainable transition, close interaction with suppliers and customers is at least as important for a company. According to the UK consultancy Carbon Trust, up to 90% of an organisation’s environmental impact lies in its value chain – either upstream (in the supply chain) or downstream (the product use phase).9 These so-called Scope 3 emissions are therefore particularly important when it comes to reducing a company’s carbon footprint. Yet, – by definition – they cannot usually be controlled by that company.

This dilemma is particularly pressing for the coffee sector due to its highly fragmented supply chain. Coffee is cultivated on 12.5 million coffee farms, out of which 85% are smaller than two hectares. According to estimates, these small farmers produce up to 73% of all coffee.10 Adding further complexity, they are largely based in countries of the Global South. Thus, getting access to effectful carbon reduction or removal strategies and corresponding high quality ESG data which are necessary to track Scope 3 emissions and fulfill ESG reporting requirements, is a challenge that the entire sector is facing.

“We need to understand the decarbonisation strategies of our clients in order to finance their transition needs”

“Reducing Scope 1 and 2 emissions is important, but the real benefit will show when we are able to reduce Scope 3 emissions,” says Melitta’s Roehrig. This is why the company has joined an initiative led by SINE Foundation – a non-profit organisation that develops and implements research results in cryptography and economics. The goal of this initiative is to create a Data Commons for Sustainability which enables its members to share ESG data in an inclusive and secure manner with all participants of the network.11 According to her, the initiative is currently creating an easy-to-understand description of challenges and possible solutions as basis of its further expansion, e.g., in the coffee sector.

Deutsche Bank has contributed to the initiative as well, Bauerochse explains, “Through data commons we hope to get access to better data which allows us and our clients to improve the tracking of ESG performance in global supply chains. This will help to positively incentivise the decarbonisation of supply chains.”

Already today, Deutsche Bank is helping clients in integrating ESG objectives into their supply chain financing (SCF) programmes to incentivise suppliers to be more sustainable and transparent (see Greening Henkel’s supply chain). “Enabling global supply chains is part of Deutsche Bank’s founding principles and an integral part of our Global Housebank strategy,” Bauerochse continues.

4. Lighthouse projects help to get everybody onboard

While it is important to define a proper strategy, putting ESG transformation into action is key. Most importantly as they help to reach the targets, but also in order to keep internal engagement and motivation high. “It’s extremely important to show activities with tangible benefits for the company,” explains Roehrig.

This is why in 2020, Melitta in partnership with Hanns R. Neumann Stiftung and scientists from The University of Lavras, launched a project to implement a circular economy approach in the state of Minas Gerais in Brazil.12 As part of the project “Back to the Roots” smallholder farmers in the region learn about the benefits of reusing coffee pulps, wastewater from the pulping process and organic waste from pruning – waste that might otherwise be disposed incorrectly and that could pollute the environment. It is an example of the general shift towards regenerative practices and nature-based-solutions.

Coffee farmer family Peixoto who are participating in the project “Back to the roots” in Minas Gerais in Brazil

Three years into the project, the results are very promising, explains Roehrig: “Re-using organic waste in coffee production has a number of benefits,” According to her, if used correctly, it helps to reduce soil erosion, improved water infiltration and soil aeration. “Organic waste helps to increase resilience of coffee plants and soil in times of global warming.” Moreover, it enhances the productivity of coffee farms and helps them to reduce the use of agrochemicals thereby protecting natural resources. According to Melitta Group, many of the participating 220 farms (200 smallholders and 20 bigger farms) could record positive impacts after one year already, e.g., a reduction of chemical fertilizer consumption by 30% and a yield improvement of 15%.

Another example where Melitta is trying to improve waste management by implementing a circular economy approach comes from India: In August 2022, the Melitta established a recycling firm in Bangalore which sources plastic waste from selected social enterprises.13 “With this Fair Recycled Plastic initiative, we want to contribute to a better waste management infrastructure in Bangalore and improve working conditions for waste pickers,” Roehrig explains. The recycling company is set up as a social business, which means that the company’s profits are reinvested or used to fund health and education projects for the families of the waste collectors.

Women sorting waste at the Melitta’s recycling company ‘Vishuddh Recycle’ in Bangalore

While this feeds into Melitta’s sustainability goal of improving working conditions in its supply chain, it also pays off for the company: Employees at the plant produce around 2,000t of plastic granulate from LDPE (Low Density Polyethylene) plastic waste every year, which is then used in the companies’ production reducing sourcing costs for the company.

“We see it as our duty to make a contribution to combating plastic pollution of the oceans and soil,” says Roehrig. “Fair Recycled Plastic” addresses concrete environmental and social problems on the ground in Bangalore. But it also aims to act as an “innovative example of sustainable plastic production and recycling, and to inspire other companies and stakeholders to also explore new avenues”, she continues. Because, in the end, a successful sustainable transition is all about rethinking existing structures – and about benefitting from other’s experiences that share the planet.

Note: all images are © The Melitta Group

Sources

1 See melitta-group.com

2 See melitta-group.com

3 See melitta-group.com

4 For more background on the coffee sector, read the client story Barista of treasury on corporates.db.com

5 See theconversation.com

6 Sustainable financing and investment activities as defined in Deutsche Bank’s Sustainable Finance Framework and related documents, which are published on our website

7 See db.com

8 See corporates.db.com

9 See carbontrust.com

10 See international-partnerships.ec.europa.eu

11 See flow article Tackling the lack of ESG data for more information

12 See melitta-group.com

13 See melitta-group.com