4 July 2024

Instant payments adoption, digital currencies, correspondent banking consolidation and rising fraud – the payment industry is not short of innovation and challenges. The flow team explores some of the highlights of EBAday 2024 in Lisbon

MINUTES min read

Widely known as the city of seven hills, Portugal’s capital Lisbon has now been afforded a second title: “the unicorn capital of Europe”. This is thanks to the city’s ascending financial services and technology sector, which saw it named as the 2024 European Capital of Innovation by the European Commission. With this embrace of digital transformation and disruptive technologies, it was fitting that Lisbon played host to this year’s EBAday, the Euro Banking Association’s (EBA) annual summit for the leading payments and transaction banking executives which saw a record 1,300 delegates.

As delegates arrived on day one, with coffees and pastel de nata in hand, the event kicked off with an opening address from Wolfgang Ehrmann, EBA chairman, who outlined what to expect from the two days. “As we look to take instant payments and digital transformation into the next stage of its evolution, this year’s agenda reflects the issues and questions that are accompanying us into this new era,” he explained. flow reports on five takeaways related to this theme and the topics explored at the conference.

The EBAday 2024 exhibition floor

1. New technologies and new players in payments

In its Global Payments Report 2023, Boston Consulting Group (BCG) reveals that the global payments industry revenue pool grew by 8.3% between 2017 and 2022 to reach US$1.6trn. BCG estimates that this growth will continue – albeit more slowly – between now and 2027, with an expected compound annual growth rate (CAGR) of 6.2%.1

Speaking on the first strategic roundtable at EBAday, “The future of payments: digital, instant, profitable?”, Tsvetanka Nankova, Global Head of Sales, Institutional Cash & Trade Finance at Deutsche Bank reflected on why the payment industry remains so resilient. “We've gone through a pandemic, geopolitical tensions, shifts in supply chains and an energy crisis, but the world continues to source, produce and trade – and to facilitate this we need efficient payment systems and networks.”

Amid this growth, new technologies, such as AI, blockchain, and cloud, as well as revolving regulatory agendas, related to digital currencies, instant payments, and the G20 Roadmap, are reshaping the market’s future. With so many developments ongoing, new entrants are emerging that focus on a niche area of payments to service a targeted customer base. These companies tend to be fast and agile – placing a growing pressure on incumbent players to keep pace. “The competition is not sleeping and is not shy, so we need to become much more efficient and effective to stay competitive and in business,” suggested Nankova.

Tsvetanka Nankova talks to Finextra TV about building the Bank of Tomorrow

Provided banks can step up to this challenge, Nankova was asked how the landscape might look in five years? Taking out her crystal ball, she outlined one key obstacle that lies ahead. “I believe fragmentation will remain a key challenge for a while longer. We have over 80 real-time payment systems at local and regional levels, but at an international level these remain islands. To really resolve these frictions, we need a unified international payments network,” she said.

“I believe fragmentation will remain a key challenge for a while longer”

Deutsche Bank’s Tsvetanka Nankova speaking during the “The future of payments: digital, instant, profitable?” strategic roundtable at EBAday 2024

For many, ISO 20022 is the foundational piece of the puzzle. The new global standard, which is being adopted by high-value payment systems worldwide – as well as by Swift for cross-border payments – promises not only greater interoperability between various settlement networks but should mean improved information flows.

“The rich, structured data provided within ISO 20022 messages is going to allow us to better leverage data and analytics for our clients,ʺ explained Nankova. ʺIn this sense, it’s not just about the new standard, it’s about how we can use it in combination with technologies like AI to understand client behaviour and tailor our product offering to customers.”

2. Bringing together commercial bank and central bank money

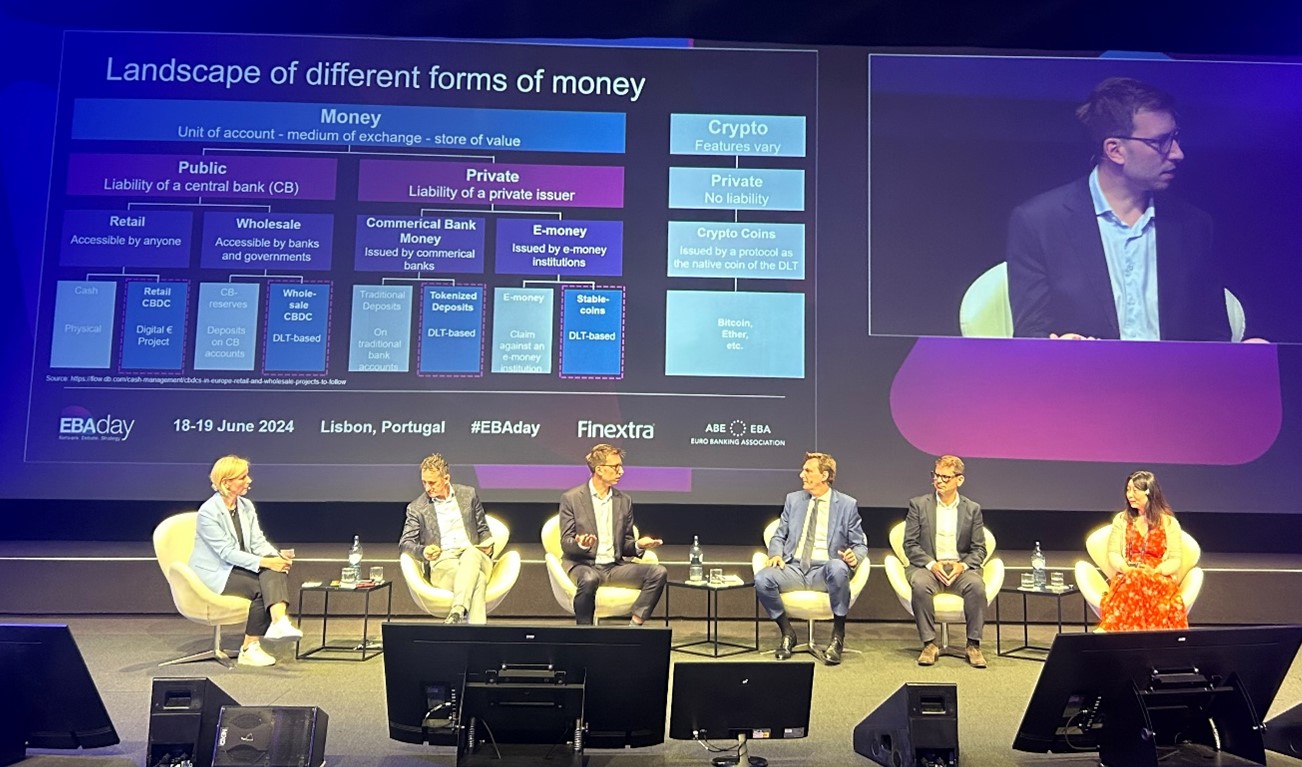

Central bank digital currencies (CBDCs) – digital money issued by a central bank – remains a hot topic, with a recent report by the Bank for International Settlements (BIS) finding that 94% of central banks are now investigating retail or wholesale CBDCs – or both.

The report also finds that the likelihood central banks will issue a wholesale CBDC within the next six years now exceeds that of them issuing a retail CBDC. This trend was reflected by the EBAday session, titled “Challenges and benefits of CBDCs, tokenised deposits and stablecoin adoption”, which focused on wholesale CBDCs, as well as the role played by tokenised deposits.

Speaking on the panel Manuel Klein, Market Management Payments and Digital Currencies at Deutsche Bank Corporate Bank, said, “We have seen many proofs of concepts and pilots testing out different technologies, but outside of tokenised deposit solutions leveraging bank-centric blockchain infrastructure, we haven’t seen much adoption.”

While these tokenised deposit solutions can be used to move money between accounts held with the bank, the money cannot move outside of the bank’s network without the support of traditional payment and settlement rails.

Banks are working on fostering connectivity between the different bank-maintained blockchain networks, but the connection to central bank money, ultimately, remains critical. “The challenge is that anytime you only have commercial banks on the ledger that want to do payments between each other, the missing piece is the settlement leg,” explained Klein.

Deutsche Bank’s Manuel Klein speaking during the “Challenges and benefits of CBDCs, tokenised deposits and stablecoin adoption” panel at EBAday 2024

The blockchains of banks would therefore need to be connected to central bank money in some form – either via traditional real-time gross settlement systems (RTGSs) platforms or a blockchain-based version of central bank money. In the Eurozone, there are three different solutions being tested for wholesale CBDCs that could provide the solution: two ‘trigger solutions’ that connect existing payment platforms – T2 and TIPS – to blockchains, and one solution that would create a new token-based form of central bank money.

On a more global level, Project Agorá (Greek for ‘marketplace’) – a collaboration between the BIS, seven central banks and the private sector – is exploring how tokenised commercial bank deposits can be seamlessly integrated with tokenised wholesale central bank money on a unified ledger. BIS claims that the project could help to increase the speed and integrity of international payments, while lowering costs.2

“We need a clear vision, shared by commercial banks and central banks, to leverage an integrated solution to solve some of the key issues we all face, such as the need for more efficient cross-border payments and delivery vs payment to settle tokenised assets/securities,ʺ said Klein. ʺWithout this, these solutions will continue to only be relevant within our own boundaries, and within our own balance sheets.”

3. Taking instant payments international

Several initiatives have converged over recent years to put instant payments firmly at the top of the agenda. The European Commission’s Retail Payment Strategy aims to further leverage on instant payments to modernise and strengthen the role of the European payments market internationally.3 In tandem, there are growing calls for cross-border payments to follow suit, with payment system interoperability and extension a central pillar of the G20 Roadmap (see G20 Roadmap: moving from guidance to action).

With pressure coming from all directions, the question has become: how can the industry best support instant cross-border payments? The answer could lie in leveraging progress made so far. 64% of payment service providers (PSPs) in SEPA already support the SCT Inst scheme,4 with this set to dramatically increase in the wake of the SEPA Instant Payment Regulation.

It will require all PSPs in the euro-zone to be able to receive instant payments from their customers by January 2025. By October 2025, they will also be required to offer their customers to send instant payments. For PSPs in non-eurozone members of the European Economic Area (EEA), the deadline for receiving instant payments is January 2027, for sending it is July 2027.5

A major limitation of the SEPA scheme is that it was not designed to support cross-border payments beyond the SEPA area. In a lunchtime session organised by the European Banking Association (EBA), David Renault, Team Leader SEPA at EBA CLEARING explained that the SEPA scheme lacks important information that would be critical to support cross-border payments beyond the SEPA Area – for example, in SEPA messages users can only choose Euro as the currency.

To overcome these challenges, last November the European Payments Council (EPC) launched the OCT Inst scheme. The scheme unlocks the benefits of SEPA payment schemes for international payments by supporting the processing of incoming and outgoing international instant account-to-account based credit transfers.6

Speaking on a panel focused on this topic, titled ‘The OCT Inst scheme – possibilities and boundaries’, Michael Knetsch, Tribe Lead Instant Payments, Cash Management, Deutsche Bank, explained that adoption would have to be driven by relevant use cases. “Reachability is the key factor for the success of the OCT scheme, as the scheme is optional rather than mandatory, its success will hinge on the value it brings to clients. It is crucial that our efforts are underpinned by relevant use cases – and this will ultimately be the tipping point for banks to invest.”

“Reachability is the key factor for the success of the OCT scheme It is crucial that our efforts are underpinned by relevant use cases to drive reachability”

In Spain, where Iberpay and Santander signed up as first adopters of the OCT Inst Scheme7, Xavier Herrero, Manager Operations Groups, CaixaBank, pointed to the importance of widespread adoption, as well as community-wide collaboration, for the scheme to be a success more broadly. The audience seemingly concurred with this assessment, citing reachability as one of the key success factors.

CaixaBank’s Xavier Herrero and Deutsche Bank’s Michael Knetsch on the “The OCT Inst scheme – possibilities and boundaries” panel at EBAday 2024

4. Addressing de-risking in correspondent banking

Correspondent banking has stood the test of time as a facilitator of cross-border flows globally. Over the past decade, however, the relationships that underpin correspondent banking have seen a steady decline, with banks – cautious of the reputational and financial risks involved – limiting their exposure to perceived high-risk jurisdictions.

Speaking on the EBAday panel, “How to counter the consolidation in correspondent banking relationships?”, Dean Sposito, Head of Institutional Cash & Trade Finance, Western Europe, Deutsche Bank, conceded “the industry has undergone over the last years a clear wave of downsizing correspondent banking relationships leading to financial exclusion. The consequences are very real in terms of economic and societal impact”.

“There has clearly been a wave of de-risking, but this has not been done carefully enough”

When it comes to maintaining these relationships, banks face stringent regulatory requirements, as well as a complex and changing international sanctions regime. The resource- and cost-intensive nature of meeting these obligations means that even lower risk corridors are facing exclusion.

“While it’s clear that we need strong regulation, if the risk vs. reward doesn't make sense, banks are naturally going to look to exit these markets,” added Sposito. “I think we need to work in a partnership approach with the regulatory agencies to show them exactly what we, the correspondent banking community, are doing on our side to try to make the financial system as safe as possible.”

Deutsche Bank’s Dean Sposito speaking during the “How to counter the consolidation in correspondent banking relationships?” panel at EBAday 2024

Correspondent banks are making a concerted effort to improve the resiliency of their operations and flows. Know-your customer (KYC) checks have evolved to also incorporate know-your transaction checks, which take a real-time analytical approach to the data from transactions to better understand the risks. Alongside enhanced internal processes, having a more well-defined risk appetite is also proving critical.

“What we are seeing is that correspondent banks are looking at risk in a way that is very black and white. But if you have better risk controls and strong governance in place, you can manage these risks is a far more dynamic way,” explained Sposito. “I like to use the analogy that if you have a cut on your finger, you don't have to amputate your arm. If a client or jurisdiction is deemed high risk, it doesn’t necessarily mean you can’t provide any services.”

For Sposito, the final piece of the puzzle is the financial institutions that receive banking services from a correspondent bank, known as respondent banks. There is a need for these banks to understand what is expected of them, such that they can implement the right controls, processes, and policies to meet this. To support with this, the Bankers Association for Finance and Trade (BAFT) published Respondent’s Playbook 2.0, which serves as a roadmap for respondent banks on the standards associated with international anti-money laundering and combating the financing of terrorism.

5. The spectre of fraud

As payments become faster, the spectre of fraud continues to loom over the industry. In the EBAday panel, “New approaches to fraud management”, Erwin Kulk, Head of Service Development & Management, EBA CLEARING, revealed that fraud is six times higher in SCT instant payments compared to regular SCT credit transfers.

To combat this, regulators are strengthening regulations. For example, as part of the new EU regulations on instant payments, financial institutions will be mandated to verify the account details of the payee before initiating a transaction. The forthcoming legislative framework under the Third Payment Services Directive (PSD3) and Payment Services Regulation (PSR) also aims to further strengthen anti-fraud requirements.8

Despite regulatory action, fraudsters are achieving access through increasingly sophisticated techniques – and keeping pace with new fraud methods is a constant battle. One such technique explored during the panel was social engineering, whereby fraudsters are leveraging information on employees – from new starters to CEOs – posted on their social media or networking channels to build up a detailed image of the company and its organisational structure, which they can then look to exploit.9 Generative AI and deepfake technologies are also proving a powerful tool for fraudsters. Just recently, a finance worker was duped into paying out US$25m following a video call with a deepfake ‘chief financial officer’.10

Kulk explained that socially engineered fraud is very often outside of the banking estate and is therefore not something that can be defended against; the solution is to begin exchanging this information. But how should data be shared to combat fraud? In an audience poll, 53% agreed that identified fraud patterns and models should be shared, while 24% thought that Banks and PSPs should share payment data.

To the home of the EBA

Collaboration is always the centre piece of EBAday – and 2024 was no exception. Whether leveraging technology and regulation to drive the future of payments, understanding and implementing digital currencies, supporting instant payment adoption, countering correspondent banking consolidation or tackling fraud risks, dialogue within the industry remains critical to move the needle forward.

EBAday 2025 – the 20th edition of the event – will continue to faciliate these conversations, this time at Les Salles du Carrousel, in the heart of Paris – the home of the EBA. The Deutsche Bank team look forward to seeing you there on 27–28 May 2025.

The Euro Banking Association payments conference, EBA Day 2024: Orchestrating the dialogue on payments - The Collaborative Advantage, took place 18 and 19 June 2024 at the Lisbon Congress Centre, Lisbon

Sources

1 See bcg.com

2 See bis.org

3 See europarl.europa.eu

4 See europeanpaymentscouncil.eu

5 See corporates.db.com

6 See europeanpaymentscouncil.eu

7 See europeanpaymentscouncil.eu

8 See eba.europa.eu

9 See A corporate’s guide to payment fraud prevention at corporates.db.com

10 See edition.cnn.com