08 August 2024

Know-your-customer procedures, the impact and outcome of T+1 settlement in the Americas, the role of digitalisation in post-trade and future industry talent were top discussion topics at The Network Forum’s (TNF) Annual Meeting 2024 in Warsaw, reports flow

MINUTES min read

Having been forced to switch venues in 2023 from Warsaw to Athens because of the war in neighbouring Ukraine, The Network Forum’s (TNF) Annual Meeting finally returned to the Polish capital in June 2024 for the first time in seven years. Around 400 industry leaders from global custodians, asset managers, agent banks, financial market infrastructures (FMIs) and fintechs descended on Warsaw’s financial district of Mirów. This article provides an economic backdrop to the host country and summarises key themes of discussion.

Poland’s post-Covid recovery

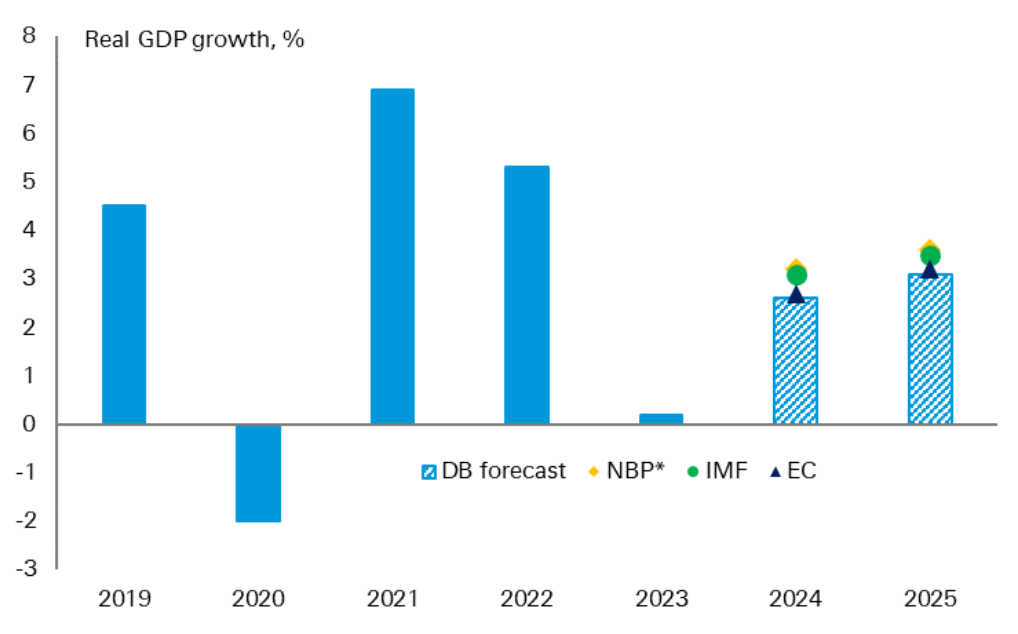

Currently celebrating the 20th anniversary of its EU accession, Poland, according to World Economic Institute analysis, has enjoyed a 40% uplift in GDP over the last two decades, helped by its membership.1 Despite minimal growth in 2023, the European Commission (EC) is projecting that Poland’s GDP will rebound by 2.8% in 2024, before rising to 3.5% in 2025.2 According to the Deutsche Bank Research report, CEEMEA in Pictures - Central & Eastern Europe – April 2024, annual growth is likely to be closer to 2.6% in 2024 and 3.1% in 2025 , up from 0.2% in 2023. See Figure 1.

Figure 1: Expected growth recovery in 2024

Source: National sources, NBP, IMF, EC, Haver Analytics, DB Global Markets Research *based on scenario of withdrawal of the anti-inflation shielding measures on food and energy prices

Deutsche Bank CEE Economist Twisha Roy adds that while Poland’s growth recovery is indeed “underway”, this is primarily demand-led. “High wage growth, and elevated fiscal spending, especially on the social sector, is expected to support a faster recovery in demand. Investment growth is also to remain supportive. Contribution of net exports is likely to be negative due to faster improvement in import demand,” she reported in April 2024.3

Her update also notes that the EC has approved the release of €137bn in previously blocked Cohesion Policy and Recovery and Resilience (RRF) funds (Poland being the third largest beneficiary of this post-Covid support after Italy and Spain). Although this package has yet to be ratified by member states, the report explains that the first three tranches of the RRF will total €18bn of payments in 2024 – corresponding to 2.4% of Poland’s GDP.

Reverse KYCs become more entrenched

Turning to agenda at this year’s TNF discussions in Warsaw, agent banks have, for some time, complained about repeated alterations being made by network managers to the Association for Financial Markets in Europe’s (AFME) Due Diligence Questionnaire (DDQ), a standardised due diligence template used in the service provider selection and monitoring process.4

“The reverse KYC is an intense process and almost like a due diligence in itself”

Speaking to flow at TNF in Warsaw, Sharon Hunt, Global Head of Network Management, at Deutsche Bank, said local regulations and international sanctions against Russia are the main contributors to the uptick in increasingly detailed reverse KYCs.

“The reverse KYC is an intense process and almost like a due diligence in itself. Requests include attestations concerning prohibited activities, the banks approach to economic sanctions and anti-money laundering (AML). In addition, the documents also ask us for a lot of information about our cyber-security policies and procedures,” said Hunt.

Several network managers at TNF Warsaw noted that agent banks in certain markets are demanding the personal identification details (i.e. photocopies of passports, etc.) of their group CEOs and executive directors. Not only did network managers question whether agent banks really need this sort of sensitive information, but many are also pushing back against such requests, citing domestic data protection laws.

A further challenge is that many of the reverse KYCs are not standardised, adding to network manager workloads. While most network managers concede that standardising reverse KYCs – even on an individual market basis – is not feasible, global custodians need to devise a solution.

Hunt said that Deutsche Bank has created an internal, centralised repository full of KYC information, which can be easily accessed by network managers and then repurposed for different agent banks’ reverse KYCs. “If an agent bank asks us a question, we can look for it in our KYC repository, and potentially re-use that information,” she explained.

Others believe the industry should start using centralised KYC platforms. On a panel titled ‘Network Manager Day Feedback to General Audience’ featuring network managers from RBC Investor Services, Brown Brothers Harriman (BBH) and J.P. Morgan, a speaker suggested that the industry could potentially leverage the Swift KYC registry, a platform that can help standardise and streamline the KYC data collection process.5

Another network manager urged agent banks to engage with their home regulators on making the KYC requirements for global custodians more palatable and less intrusive, highlighting the importance of market advocacy, an issue which flow addressed in ‘The Future of Custody – a paradigm shift’.

T+1 – North America’s frictionless transition

Panel: ‘T+1: Global Scorecard & Report – and where does it all leave Europe?’

Left to right: Sachin Mohindra, Executive Director at Goldman Sachs; Philip Brown, CEO at Clearstream Banking; Camille Papillard, Head of FI&C, Client Line, at BNP Paribas Securities Services; Jesus Benito, Head of Domestic Custody and TR Operations at SIX; Gareth Jones, Director, Product Management at Euroclear

With TNF 2024 held just two weeks after T+1 went live across North and parts of Central and South America, experts shared their insights into how the transition has so far fared, and what the future holds for shorter settlements. The good news is that the initial transition to T+1 sparked no major upsets, settlement fails did not spike and affirmation rates even hit 95%, according to the Depository Trust and Clearing Corporation (DTCC) report on 30 May.6 That T+1’s introduction was so frictionless is a reflection of the industry’s preparedness and the extensive dummy run which took place in the DTCC’s dedicated T+1 testing facilities ahead of May 2024,7 a theme discussed during the panel ‘T+1: Global Scorecard & Report – and where does it all leave Europe?’ (pictured above).

Panellists did, however, observe that the industry was on its “best behaviour” and had “allocated a lot of extra staff to manage the process”, but the question remains as to whether settlement fails might rise once ‘business as usual’ resumes.

The panel agreed that the economics of T+1 have yet to be fully understood. “Following T+1’s introduction, DTCC published data showing that no less than US$3.7bn worth of collateral had been released into the market due to the reduced margining requirements for clearing. However, Clearstream Banking CEO Philip Brown reported, ʺForeign investors are pre-funding cash for FX settlement purposes, and we estimate the funding cost of this pre-positioning of dollars could be more costly to foreign investors than the savings related to collateral reduction.”

T+1 and implementation in Europe

While T+1 has gone fairly smoothly for North America, experts at TNF believe its implementation in Europe– a very different regulatory environment – risks being more challenging.

A T+1 consultation published on 21 March 2024 by the European Securities and Markets Authority (ESMA),8 noted that respondents had indicated “the move to T+1 in the EU would be more difficult than in other regions of the world due to the complex and fragmented nature of EU financial markets”. In addition, the respondents “highlighted not only the high number of market infrastructures but also other issues such as the un-harmonised national securities laws”.9 The comparative difficulty is highlighted in Deutsche Bank’s Regulatory Outlook in Securities Services – H2 2024.

While the EU is home to more than 30 national central securities depositaries (CSDs), the US only has one – the DTCC.

“In the US, they have an affirmation model whereby transacting parties affirm a trade and match it before it falls through to settlement,” commented Deutsche Bank’s Mike Clarke, Global Head of Product Management & Head of UK&I Region, Securities Services & ASL, Deutsche Bank, speaking to flow during TNF.

“In the European model, we pass the trade all the way down to the end of the chain to do the matching and then pass any information about, say, mismatches back up the chain. In Europe, we need to think about moving to an affirmation model to shorten the pathway to matching, so we can send trades down the chain pre-matched.”

If these issues stay unresolved in Europe before T+1 takes effect, then there is a greater risk of settlement failure, resulting in firms being hit with penalties under the Central Securities Depositories Regulation (CSDR). See Deutsche Bank’s white paper Breaking the Settlement Failure Chain

European Central Securities Depositories Association Secretary General Anna Kulik reflects on European CSD fragmentation

In a presentation shared at TNF,10 Anna Kulik (pictured above), Secretary General of the European Central Securities Depositories Association, set out the causes of post-trade fragmentation in Europe. In line with the ECSDA Call for Action on Europe’s Capital Markets’ Competitiveness, she outlined the activities that are undertaken by CSDs and measures beyond the CSD reach to be taken by the policy-makers to further strengthen Europe’s capital markets integration and growth from a post-trade perspective.

Beyond the PoCs

Integrating AI into BAU

Propelled by the rapid growth of Generative AI and Large Language Model (LLM) tools, the securities services industry is looking for ways to integrate this technology into its business as usual (BAU) operating model.

Panel: ‘New thinking; reinventing ourselves to stay relevant – What are the issues of tomorrow that we need to face today’

Pictured Left to right: Catherine Dawson, Global Head of Product for Financial Institutions at Brown Brothers Harriman, Mike Clarke, Global Head of Product Management & Head of UK&I Region, Securities Services & ASL, Deutsche Bank; and Rob Ranson, Head of Custody Client Solutions and Client Experiences at Citi

“At Deutsche Bank, we are working on an AI initiative called Project Aggie in partnership with Kodex AI,” said Clarke, who was on the panel examining future relevance of the custody industry (see above). “This is a specially ring-fenced AI model, which through its LLM functionality, allows us to analyse regulatory documents in a local market language while also being searchable in English. It is based on carefully curated information from only validated sources.

“It lets users compare different regulations on, say things like digital assets between different markets,” he added.

Data as a service

The importance of having seamless access to data amid today’s worsening geopolitical tensions and market volatility is a priority for network managers at TNF, and a need they believe their agent banks can help them with – something they articulated in flow’s February 2024 article, The future of custody – a paradigm shift. As Dan Hickey (pictured, centre, above), Global Head of Network Management at State Street, reiterated in the panel session, ‘Data Sharing and Efficient Access – What is everyone doing?’ “We see our agent bank network as a seamless extension of State Street. Our objective is to be able to get data to our clients at the same time as it is received at the local CSD level. We want to bring data and information in a rich format straight up the value chain to investors.ʺ

“Digital assets will likely co-exist with traditional securities for a long time”

Digital assets – not game over

At previous TNFs, digital assets such as security tokens featured prominently, but industry disappointment is mounting over an apparent lack of progress. However, some experts believe people need to be more patient about digital assets.

Michael Buzza, Global Head of Network Management & Market Strategy at Northern Trust, reminded delegates, “We won’t see an overnight change to digital assets. Instead, digital assets will likely co-exist with traditional securities for a long time,” speaking on the panel, ‘Consolidation of digital assets: What’s really moving in this space? And when will we reach the next level?’

For digital assets to properly scale, six basic principles need to be met first, according to a recently released white paper by Clearstream, the DTCC and Euroclear. “The six principles that promote the successful adoption of tokenisation and digital asset securities are legal certainty, regulatory compliance, resilience and security, safeguarding customer assets, connectivity and interoperability and operational scalability.”11

Future talent

Panel: ‘How are we addressing recruitment and mentoring?’

Left to right: Anand Rengarajan, Global Head of Sales & Head of Asia Pacific, Securities Services, at Deutsche Bank; Fraser Wikner, CEO at MYRIAD Group Technologies, Rachel Collins, Director, Financial Services People Advisory at EY, Fiona McNally, Global Head of Network Management at BNY Mellon

For the securities services industry to grow, it needs to recruit the right talent and ensure that existing employees can up-skill as digital transformation gathers momentum – a point also made at the Athens event in 2023 by Kamalita Abdool, Deutsche Bank’s Head of Securities Services Americas/Global Custodian Coverage. “Market changes such as T+1 create opportunities for hiring managers to break away from the traditional mould and attract a wider, more diverse talent pool to deliver business outcomes,” she reflected at the time. Anand Rengarajan, Global Head of Sales & Head of Asia Pacific, Securities Services, at Deutsche Bank developed this further in a 2024 follow-up panel reminding delegates that custodians had to compete with tech companies for younger workers. “Within asset servicing, we are seeing the emergence of new technologies like AI, and these will require people to have different skill sets. It is essential firms also up-skill their people, so they are prepared for these changes,” he said.

EY, in its 10 July 2023 paper, How banking on Gen Z talent will make or break the future of banking, stated, “Gen Z will make up 27% of the workforce by 2025. Banks need to attract this vital demographic — but that could require some radical change. From modernising banking jobs to transforming the learning experience, there are six key ways banks can increase their appeal to potential employees.” These are: supporting diversity, equity and inclusion; modernising antiquated jobs; transforming the learning experience; embracing technology and data; building authentic purpose and driving social impact; and energising the culture with wellness, flexibility and transparency.12 These are clearly ongoing areas for the industry to work on.

The Network Forum Annual Meeting took place between 10–12 June 2024 in Warsaw. It reconvenes on 16–18 June 2025 in Madrid, Spain

Sources

1 See trade.gov.pl

2 See economy-finance.ec.europa.eu

3 See CEEMEA in Pictures - Central & Eastern Europe – April 2024 by Deutsche Bank Research

4 See esma.europa.eu

5 See swift.com

6 See dtcc.com

7 See dtcc.com

8 See esma.europa.eu

9 See esma.europa.eu

10 See thenetworkforum.net

11 See euroclear.com

12 See ey.com