29 July 2025

As TXF Global brought 1,500 export finance sector participants together in Copenhagen, key themes of cooperation to meet security targets, flexibility in approving export content quotas, and the wider ramp-up of clean energy demand and infrastructure investment point to a busy year ahead. flow’s Clarissa Dann reports

MINUTES min read

When Denmark’s King Christian IV built Copenhagen’s new stock exchange building in 1625, complete with 56-metre spire decorated with intertwined dragon tails, this underlined the capital’s position as an epicentre of trade and commerce in Northern Europe.

More recently the headquarters of the Danish Chamber of Commerce, an accident sent the Børsen’s 400 years of history up in flames on 16 April 2024, toppling its spire. But the restoration project following the accidental ‘Notre Dame of Copenhagen’ is well underway with Denmark’s strong trading and manufacturing heritage helped by its geography and neutrality. Home to container shipping giant Maersk, along with Ørsted and Vestas in the renewables space, those sipping a certain Danish lager are reminded of another successful multinational.

It was therefore fitting that Copenhagen hosted around 1,500 attendees at the TXF Global 2025, Export, Agency and Project Finance from 10 to 12 June 2025 – the event a firm fixture in the trade finance year where export credit agencies, financiers, and project managers connect over infrastructure projects. Framing the entire proceedings was the call to action (although the Hague Summit took place two weeks later) from NATO and informal breakout sessions highlighted how this would require ramping up defence spending to 5% of GDP from its partners.1 With 1.5% of that being allocated to “protect our critical infrastructure, defend our networks, ensure our civil preparedness and resilience, unleash innovation, and strengthen our defence industrial base,” this ambition set the tone of the deal conversations.

Market backdrop

The industry landscape featured a geopolitical climate of market instability due to tariff uncertainty, and action plans from governments on defence investment. In addition, government strategies to secure supply chains (especially sources of critical materials) and move towards cleaner energy while ensuring the lights stay on have increased demand for export finance – and its flexibility.

Between January and April 2025, the results of quantitative (440 responses) and qualitative research conducted among banks, export credit agencies (ECAs), exporters and buyers active in export finance were tabled into the Export Finance Research Report 2025. Headline findings that aligned with the key takeaways from the conference were:

- Sentiment is holding steady in the export finance market, but instability is still a factor;

- Corporates appear to be suffering more than banks from macroeconomic conditions;

- The benefits of the updated OECD arrangements2 are still taking time to make an impact;

- The existing drivers of increased export finance activity – developed markets, infrastructure, renewables and defence - continue to dominate;

- The market is looking more closely at solar – while keeping faith with oil and gas; and

- Speed and customer service from banks and ECAs remain more important to borrowers than pricing and expertise.

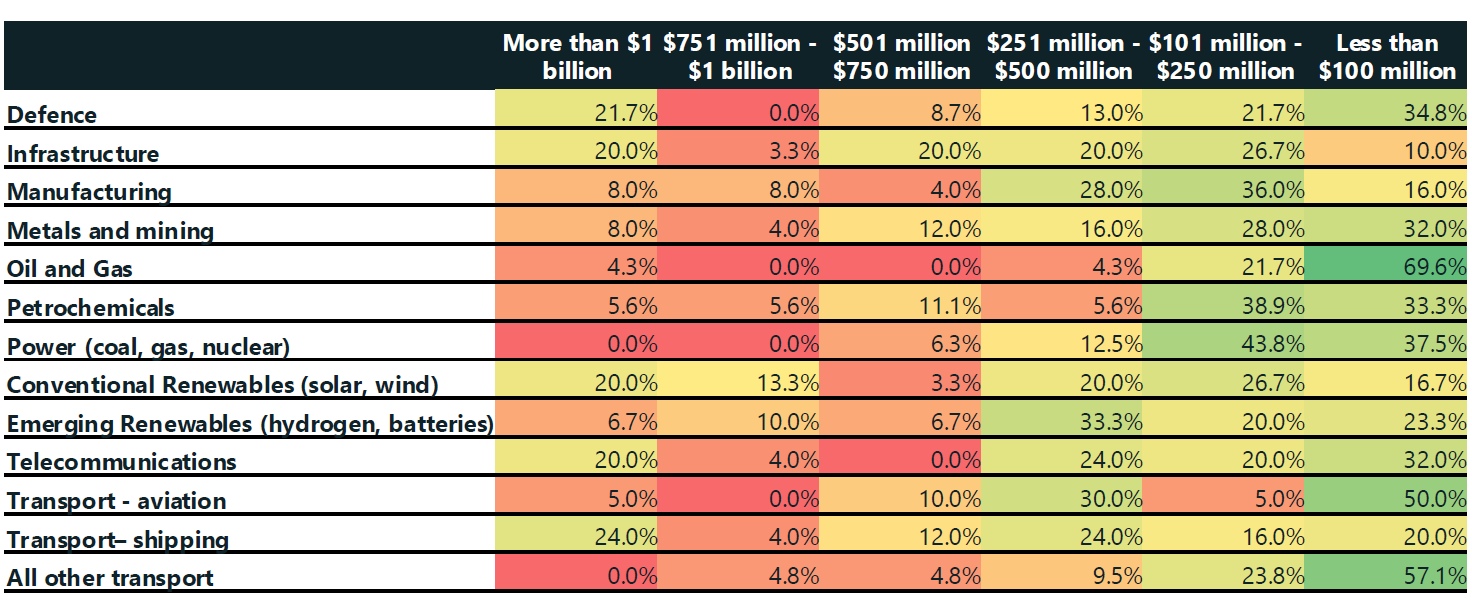

When banks were asked how much capital they planned to invest across given sectors over the next 12 months, defence headed the table for US$1bn+ allocations.

Figure 1: Capital banks plan to invest over 12 months from Q1 2025

Source: TXF Export Finance Research Report 2025

Reflections from ECA leaders

Delegates at the Copenhagen event heard from 11 ECA heads, sharing their reflections on how transactions continue to be shaped by the clean energy transition, a nationalistic geopolitical landscape and, more recently, the requirement to boost national security infrastructures. This article shares key reflections from five of them.

Export and Investment Fund of Denmark (EIFO)

Peder Lundquist from the host ECA was the first to take the floor, and reminded delegates how the largest business area for the Danish ECA remains wind power infrastructure, although “we still want to develop other business areas”. Given the plethora of data centres and the increased demand for energy, the world, he said, “needs a lot more wind power – both on and offshore”. One example of EIFO’s commitment in action is the ECA’s €800m participation in the €2.6bn financing package for the Polish Baltica 2 offshore wind farm, alongside EBRD, EIB and a consortium of international banks.3 Baltica 2 is developed by Ørsted and PGE.

SACE (Italy)

SACE CEO Alessandra Ricci explained to delegates how the Italian ECA had identified 13 ‘GATE’ countries where “the potential for the Italian economy had not yet been exploited”. GATE is an acronym for Growth, Advanced, Transformation and Entrepreneurial and, according to SACE’s Doing Export Report 2024,4 the opportunities in these countries represent around €80bn, rising to €95bn by 2027. The countries are, Saudi Arabia, the United Arab Emirates, Brazil, Turkey, Serbia, Egypt, Morocco, South Africa, India, China, Vietnam and Singapore.

Alessandra Ricci, CEO of SACE, shares details of the ECA’s 13 GATE countries

She went on to explain how SACE had launched its new Growth Guarantee Scheme on 1 April 2025, to make it faster and easier for Italian enterprises to access the credit system.5 Provided specified criteria are met, the guarantee can be issued in 24 hours. Ricci added that while technology investment can deliver organisational agility, the key is changing mindsets of those that operate it to “achieve speed of service” with the client at the centre of the organisation.

“We as ECAs are taking risk commercial banks will not take without our involvement”

UK Export Finance (UK)

Asked how he assessed and mitigated risk, Tim Reid, CEO of UK Export Finance (UKEF) responded, “We are in the business of taking risk – by definition, we as ECAs are taking risk commercial banks will not take without our involvement. So, it is critical we assess it well, and by doing a good job on risk management and analysis we retain the confidence of our ministers, our board and other stakeholders.”

He confirmed that a huge amount of analysis takes place, which comprises “what we hear on the ground, working with our colleagues across governments”. This, continued Reid, is how UKEF determines credit ratings and risk appetite from a portfolio perspective. The vigilance must be ongoing, “with stress testing so you understand what might happen”, he added. Like SACE’s Ricci, the human interpretation of what technology and models are showing is vital so that “we can make a decision on whether a transaction can be supported or not”.

As for supporting defence exports, while the UK ECA has always done so, Reid said that now this had “never been more important from a geopolitical risk perspective”. Working with other ECAs on some of the larger transactions helps reduce concentration risk, and he reassured delegates that UKEF has increased capacity from £60bn to £80bn6 to ensure that while the UK ECA continues to support defence this is not at the expense of other transformational projects such as infrastructure improvements in Africa. In the financial year ending March 2025, UKEF had provided £14.5bn to support 667 UK exporters.7

CESCE (Spain)

Turning to Spain, Pablo De Ramon-Laca Clausen, Chair and CEO of the Spanish ECA CESCE reflected on how ECAs have been evolving as a powerful tool for governments to “help our countries grow and internationalise”. He said that CESCE had seen increased demand for flexibility in untied and domestic programmes focused on supply chains. The Spanish government has upped CESCE’s underwriting capacity from €9bn to €15bn in response to “a huge expansion of the [transaction] pipelines – by the end of May 2025, the ECA had already covered transactions at 80% of the 2024 entire full year total”. 2025 is expected to be “a record year”.

De Ramon-Laca Clausen also set how the ECA has weighted its activity more towards green eligible transactions. Demand for this is coming from Spanish firms that “want to be aligned with Taxonomy8 or the Annex I of the OECD Arrangement”.9

Pablo De Ramon-Laca Clausen, Chair and CEO of CESCE reports on how activity has been weighted more towards ‘green’ deals

By way of background, Banco de España (the Spanish central bank) had reported in September 2024 that between 2008 and 2023, Spanish exports grew as a share of GDP from 26% to 39%. This jump was broad-based across products and destinations with goods exports forming 68% of total sales abroad.10

Euler Hermes (Germany)

As for Germany, Edna Schöne, CEO of ECA Business at Euler Hermes confirmed that although the German ECA had supported various defence projects in the past, these were specific to the maritime sector. This year, however, the Federal Government had decided to “give defence projects a real push with export credit financing.”

As reported in flow, the German “debt brake” made way for a €500bn fund to restore the country’s infrastructure (roads, bridges and schools), out of which €100bn is dedicated to climate-related projects and an open-ended borrowing leeway for defence. Schöne went on to explain that while the ECA has had to be more conservative – ensuring there was at least 51% of German content (or at most 49% foreign content) in the exports to qualify for ECA – the February’s launch of the Euler Hermes ‘flex&cover’11 strategy overhauling national content rules allows a more flexible approach when assessing applications for export credit. An intense examination of the exporter for their broader footprint in Germany allows that exporter to continue with covered exports without having each individual transaction referred. By mid-June the ECA had issued ten of these “passports”, a figure that Schöne expects to grow.

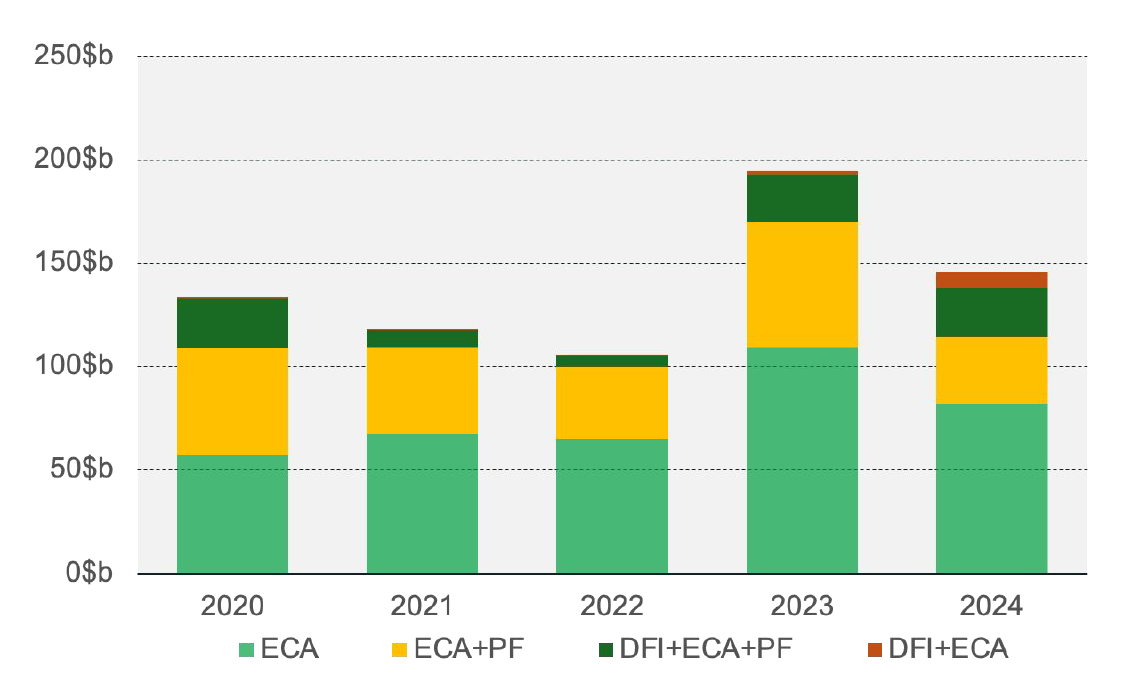

She then went on to explain how political backing is needed to “do a better job” of aligning ECA and development finance, not least because each has very different mandates – the former to maximise German content exports and the latter being the interest of the developing economy. “How do we bring that together?” she asked. According to the Export Finance Research Report 2025 this alignment did get underway in 2024 among some ECAs and looks set to continue. See Figure 2.

Figure 2: Breakdown of area of finance in the ECA market

Source: TXF Global trends in export and project finance

Lender perspective

The Global Head panel dived deeper into the earlier discussion on how export finance had evolved and changed. Deutsche Bank’s Global Co-Head of Structured Trade & Export Finance, Werner Schmidt, praised government institutions for increased flexibility and how ECAs have “moved more quickly than ever before to tackle the challenges we have in the market.

Werner Schmidt, Global Co-Head of Structured Trade & Export Finance at Deutsche Bank celebrates increased ECA flexibility

The past restrictions in terms of traditional tied export finance in emerging markets was, he said, “exciting from a cultural and counterparty perspective – you could learn a lot about different regions”. However, the emergence of project finance deals and export finance blended with corporate finance in developed markets has made the business “more interesting and exciting than it ever was before”.

In particular, he added, several ‘huge ticket’ offshore wind park financings combining project and ECA finance are good examples of how export finance has become “more innovative and complex”.

Concluding in the flow perspectives video, ‘Defence and a changed ECA landscape at TXF Global 2025 in Copenhagen’ at the end of the conference, Moritz Doernemann – the other Deutsche Bank Global Co-Head of Structured Trade & Export Finance – agreed that defence and energy transition were big parts of the 2026 transactions that were underway at this event. “This is where it is happening – I am excited for the remainder of this year and 2026,” he said.

Global 2025, Export, Agency and Project Finance took place from 10–12 June at the Tivoli Hotel & Congress Centre, Copenhagen, Denmark

Sources

1 See nato.int

2 See oecd.org

3 Deutsche Bank is one of these international banks. See the flow article, "Project finance explained"

4 See trevisobellunosystem.com

5 See sace.it

6 See export.org.uk

7 See assets.publishing.service.gov.uk

8 See spglobal.com

9 See oecd.org

10 See bde.es

11 See exportkreditgarantien.de